Ford Motor Company (F) Stock Analysis

Ford Motor Company(F)

Company Description

Ford Motor Company designs, manufactures, markets, and services a range of Ford cars, trucks, sport utility vehicles, and electrified vehicles; and Lincoln luxury vehicles worldwide. Its Automotive segment sells Ford and Lincoln vehicles, service parts, and accessories through distributors and dealers, as well as through dealerships to fleet customers, including commercial fleet customers, daily rental car companies, and governments. The company's Financial Services segment offers various automotive financing products to and through automotive dealers. Its financing products comprise retail installment sale contracts for new and used vehicles; and direct financing leases for new vehicles to retail and commercial customers, such as leasing companies, government entities, daily rental companies, and fleet customers. This segment also offers wholesale loans to dealers to finance the purchase of vehicle inventory; and loans to dealers to finance working capital and improvement of dealership facilities, purchase dealership real estate, and other dealer vehicle programs. The company has a strategic collaboration with Panasonic Corporation of North America and Qualcomm Technologies. Ford Motor Company was founded in 1903 and is based in Dearborn, Michigan.

| Valuation Metrics | Ford Motor Company |

|---|---|

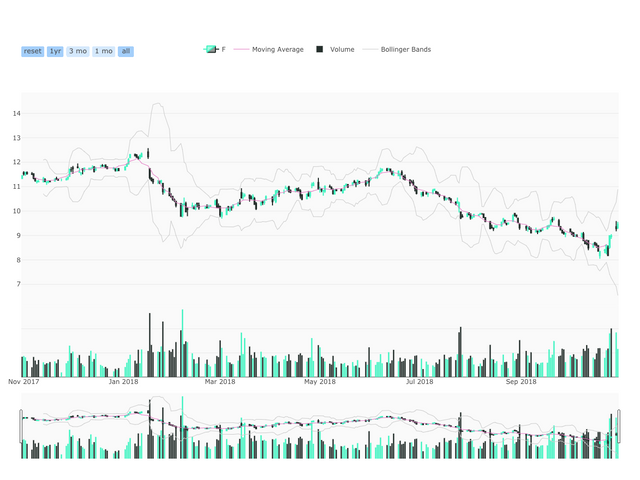

| Price | $9.46 |

| Daily Range | -1.66% |

| Opening Price | $9.62 |

| Daily Price Range | $9.43 - 9.67 |

| Bid | 9.54 x 3100 |

| Ask | 9.55 x 2900 |

| Fifty-Two Week Range | $8.17 - 13.48 |

| Trading Volume | 68,431,156 |

| Average Trading Volume | 45,108,421 |

| Market Capitalization | 37.989B |

| Beta | 0.74 |

| P/E Ratio (TTM) | 5.65 |

| EPS (TTM) | 1.69 |

| Earnings Date | Jan 22, 2019 - Jan 28, 2019 |

| Forward Dividend & Yield | 0.60 (6.47%) |

| Ex-Dividend Date | 2018-10-22 |

| Target Price | $9.89 |

| Sharpe Ratio | -1.34 |

Summary Statement:

Ford Motor Company currently trades at a spot price of $9.46 with a one-year expected target price of $9.89 meaning an expected forward return over the next year of 4.55%. Some important measures to look at are the company's beta of 0.74 the company's Sharpe ratio of -1.34.

Disclaimer: This article is not investment advice. As with any investment, investing in stocks is risky and can result in a loss including principal. For advice consult your licensed financial advisor or broker.

Data provided in this article was brought to you in part from Yahoo Finance, Robinhood (using Pandas data reader web API), and Quandl. If there is a stock that you would like to see analyzed and posted please comment below and tell me which company you would like to see. All company suggestions will get an up vote from me. Thanks for reading.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=106335