Kingsway Financial - Bright Management and Cheap

Kingsway is a holding company functioning as a merchant bank with a focus on long-term value-creation through strategic investments, acquisitions and financings.

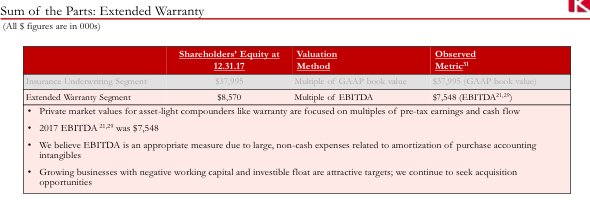

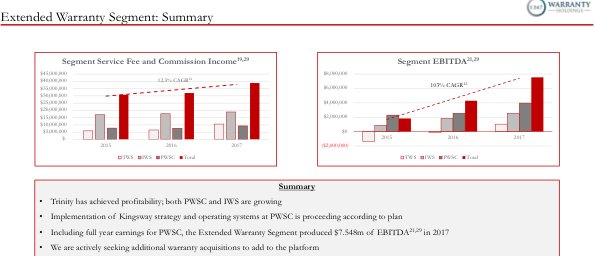

The company owns a couple warranty businesses that produce almost $8M a year in free cash flow (FCF). The company is currently selling for $66M on the stock market. Which gives this company an EBITA multiple of 8. This doesn’t include the equity interest in some solid companies such as Limbach Holdings and PIH Insurance.

Lately they have decided to sell their non standard auto insurance business. Which looks like a positive since they can focus on more profitable options such as the warranty business and more merchant banking deals. The stock has lost half of its value since the announcement.

Let’s see if the sum of the parts justifies a $66M market capitalization.

Let’s give the above EBITA a multiple of 5 to be conservative.

$7,548 x 5 = $37,740

A ~$38M valuation for the warranty business is very conservative when considering the growth and profitability.

Now let’s look at the merchant banking.

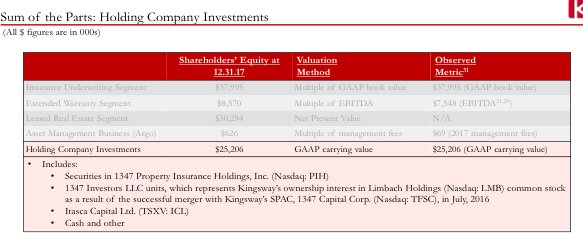

Both PIH and Limbach are growing companies with extraordinary leaders and valuing Kingsway equity ownership in these companies and their other investments at $25M is fair.

That gives the company a $63M valuation not including the smaller business they are developing such as their leaseback deals and asset management company.

If you think the warranty business justifies an 8x EBITA multiplier then you are basically getting these solid companies with extraordinary management for free.

Looks like their chairman thinks the company is cheap also buying 69k shares on September 12th for 2.78 per share.

Turn arounds usually take a long time to develop but it looks like this company is making the right decisions and allocating some capital here might have a nice margin of safety for the value investor.