CMPP, DILD, JSMR, KAEF, PTPP Read This And You Will Earn A Lot Today.

CMPP - Backdoor listing

Disclosure of PT Rimau Multi Putra Pratama (CMPP) discloses rights issue plan and inbreng with PT Indonesia Airasia (IA). The plan is part of the IA backdoor listing scheme through CMPP where CMPP will conduct a rights issue with a target of Rp 3.41 trillion through the issuance of 13.65 billion new shares at Rp 250 per share. Around 76 percent of the rights issue proceeds will be used to take over Rp2.6 trillion of perpetual securities to be converted into IA's new shares. About 24% of CMPP's rights issue funds will be allocated for working capital. The plan is pending approval of EGMS on October 6, 2017.

DILD - Marketing sales

PT Intiland Development (DILD) posted a marketing sales of Rp 2.7 trillion to 28 August 2017. The acquisition exceeded the company's target of Rp 2.3 trillion for 2017. The Company has successfully launched a mixed use and high rise development project called Fifty Seven Promenade by acquiring marketing sales of the project amounting to Rp 1.6 trillion, well above the company target of Rp 520 billion from the Fifty Seven Promenade project. Meanwhile, by the end of 1H 2017, the company's total marketing sales were recorded at Rp 1.1 trillion. So after the launching Fifty Seven Promenade total sales of the company's marketing achievement mencapi Rp 2.7 Trillion above the initial target of Rp 2.3 trillion.

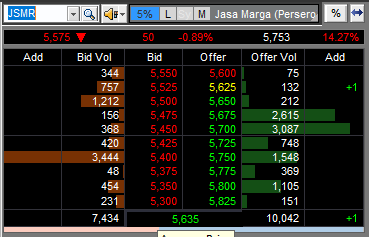

JSMR - Offering KIK-EBA

PT Jasa Marga (JSMR) completes the offer of asset-backed collective investment contracts (KIK-EBA) on the revenues of class A and B toll roads worth Rp 2 trillion. The Company registers EBA assets of Mandiri JSMR01 securities rights over Jagorawi Class A tariff revenue with due date 30 August 2022 and has a coupon rate of 8.4% per annum and for EBA class B is offered on a limited basis. The Company has appointed underwriters, PT Mandiri Sekuritas, PT Danareksa Sekuritas, PT Securities Materials, PT BNI Sekuritas, PT BCA Sekuritas and PT CIMB Sekuritas Indonesia. In addition to funding Through EBA JSMR also issues global rupiah-denominated bonds with a target fund of US $ 200 million to US $ 300 million.

KAEF - Drug raw material factory

PT Kimia Farma (KAEF) will operate a raw material manufacturing plant in 1H 2018. KAEF and South Korean pharmaceutical company, Sungwun Pharmacopia Co Ltd, have established a joint venture, PT Kimia Farma Sungwun Pharmacopia that will mengepepasikan raw material factory in Cikarang ( West Java). Currently the physical construction of the raw materials factory is 100% complete and the first phase of the machine has arrived at Tanjung Priok. This factory has a capacity of 15 tons-30 tons per year. This plant will help KAEF reduce the import of raw materials of the drug.

PTPP - New contract 7M 2017

PT Pembangunan Perumahan (PTPP) booked a new contract worth Rp 21.8 trillion in 7M 2017, approximately 53.7% of new contract target of Rp 40.6 trillion this year. Of the achievement value, the contribution of BUMN contract is 56.8%, private sector is 28.9%, and the contract from the Government is 14.3%. From these achievements, management estimates a net profit of Rp 732 billion in 7M 2017. PTPP posted a net profit of Rp 572.6 billion in 6M 2017.