The countries where people pay the most tax and the least tax

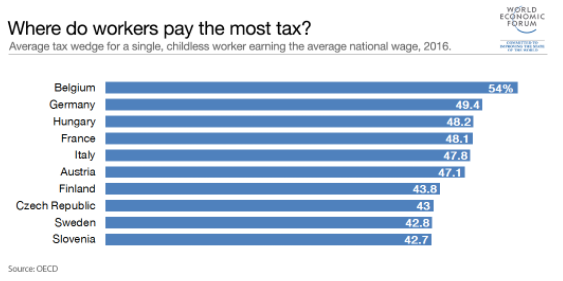

There is a common theme among the 10 OECD countries in which workers pay the most tax: every single one of them is in Europe.

Sitting comfortably ahead of the rest of the pack is Belgium, where workers pay more than half the money they earn in tax in the form of income tax and social security contributions.

This puts Belgium nearly five percentage points ahead of the next highest taxing nation, Germany, in the recently published list of tax rates in OECD countries.

According to data in the Taxing Wages 2017 report, the average across all 35 OECD member countries is for an individual to contribute just over a third of their pay packet to income tax and social security.

However, workers in the top 10 nations in this list all pay significantly higher than this.

After Belgians paying 54%, second and third place in the list belong to Germany and Hungary, where workers pay 49.4% and 48.2% respectively.

The OECD Taxing Wages 2017 report measures the level of personal income tax and social security contributions in each OECD country by calculating the "tax wedge" - personal income tax, employer and employee social security contributions, minus family benefits received as a proportion of total employer labour costs.

Belgium, Germany and Austria come top on the data when considering the average wages of single, childless workers receiving no family benefits.

However, this tool created by the report’s authors shows that when it comes to families with children, France tops the list with an average tax rate of 40%.

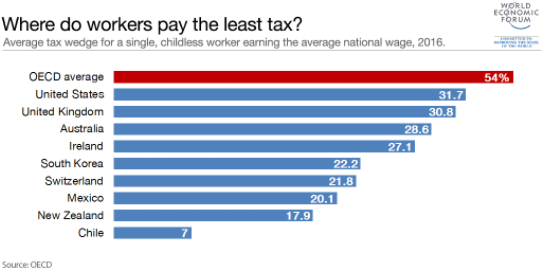

Low tax nations

While European nations have the highest tax rates for both individuals and families, there are a few low-tax European countries too.

Countries with tax wedges for single childless workers that fall below the OECD average of 36% include: Poland at 35.8%; the UK at 30.8%; Ireland at 27.1%; and Switzerland at 21.8%.

These lower-tax countries belong to a group of 14 OECD member states where the tax wedge is below average.

Among these is the US at 31.7%, Australia at 28.6% and Israel at 22.1%.

The lowest taxed OECD nations are Mexico at 20.1%, New Zealand at 17.9% and Chile at 7%.

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.weforum.org/agenda/2017/07/countries-where-people-pay-most-tax