PLASTIC FINANCE BLOCKCHAIN CONTRIBUTE IN RECYCLING SECTOR

Wondering how blockchain can contribute to the recycling sector? If yes, you have landed at the right place. This article explains why companies need blockchain and what is the role of blockchain in bringing transparency.

Blockchain Not Just for Finance Anymore

Why Blockchain is Needed in Recycle Domain

Blockchain Platform to Bring Transparency

Startups Leveraging Blockchain

Conclusion

Blockchain Not Just for Finance Anymore

Gone are the days when blockchain was majorly known to transform the financial sector by fastening cross-border transactions with accurate recording capabilities without involving third-party intermediaries. Blockchain is a peer-to-peer, decentralized, distributed ledger technology that promises to eliminate the need for trusted centralized agencies. As the field of blockchain is soaring, at present, it has its footprints in almost all industries, be it supply chain, digital identity management, eCommerce, healthcare, and others. With increased adoption and repeatable use cases, recycling is another significant domain that has the potential to lessen the burden of waste and recycling. Leveraging blockchain may not eliminate the root cause in a day, but it could help ease and make the process much more transparent.

Want to gain an in-depth understanding of blockchain technologies and its use-cases? Check out- Blockchain Council.

Why Blockchain is Needed in Recycle Domain

Nowadays, waste management is in critical shape. According to Statistics, the global recycling market is foreseen to reach $377 billion by 2024. Plastic waste management is another severe issue impacting today’s environment. Since recycling systems are rather insufficient, blockchain can bring greater supply chain visibility in the recycling sector for better decision-making capabilities. The purpose of introducing blockchain is to fit everyone in the value chain, with accurately detailed and trustworthy data about recycled products.

Due to its high potential, companies are successfully trialing this new technology to alleviate the planet’s waste problems.

Blockchain Platform to Bring Transparency

Due to its increased burden of regulations and for accurate record information, blockchain is crucial in the recycling domain. The recycling process has to pass through several entities before reaching its final destination. Thus, to track goods in order to ensure its quality and provenance, blockchain provides complete transparency. In complicated supply chains, blockchain lets everyone, right from port authorities to manufacturers, track the journey of recycled goods from source to its final destination.

Blockchain technology and stable currencies can play essential roles in encouraging every home and MRF to simplify plastic recycling sector funding. Using a smart contract, Plastic Finance can tokenize each sort of plastic regrinds and pellets and build an internal exchanger, allowing people and businesses to monetize plastic waste easily. Blockchain also adds transparency to each plastic industry supply chain. Furthermore, Plastic Finance may develop DeFi Dapps (decentralized finance, decentralized application) to allow trash to be collateralized as assets.

About The Project

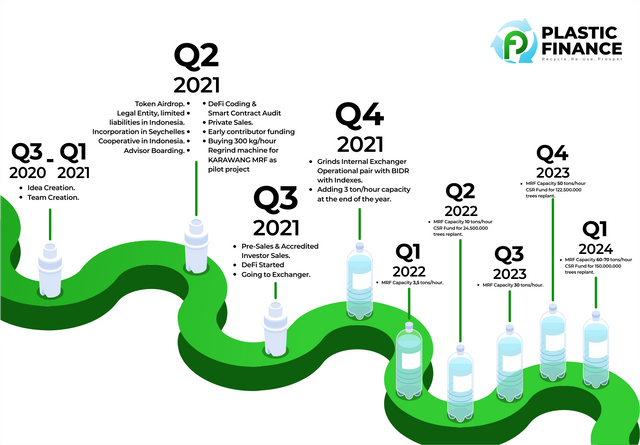

Plastic Finance focuses on boosting the productivity of garbage pickers to increase plastic recycling. Plastic Finance is not disrupting the waste value chain; instead, Plastic Finance adds value to the value chain, benefiting all stakeholders. Furthermore, Plastic Finance supports the tree replanting initiative to reduce CO2 emissions, demonstrating Plastic Finance's dedication to the circular economy. Plastic Finance empowers plastic trash collectors through cooperatives and DeFi by providing them with financial inclusion and educational opportunities. It takes 50 workers in the supply chain to recycle 50 tons every hour. By the end of 2023, Plastic Finance hopes to recycle 80,000 to 2,16,000 tonnes of plastic grinds every year.

What Exactly is the PLAS Token?

PLAS is the Plastic Finance ecosystem's native coin. PLAS was developed to support recycling initiatives and serve as a governance and ownership token to receive periodic dividends or profit-sharing from recycling and DeFi transactions and internal exchange margins. Plastic Finance will charge a 5% fee on the internal exchanger spread price of plastic regrinds and a 0.175 percent fee on saving withdrawal or loan payment transactions in the DeFi platform. All of these fees will be collected in a wallet and regularly dispersed via a smart contract. Plastic Finance receives 60% of the net profit from the cooperative recycling company each year. In turn, Plastic Finance will pay the fees and profit-sharing to PLAS investors as dividends.

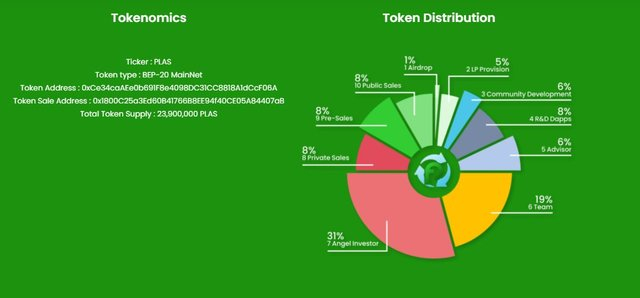

Tokenomics

Ticker : PLAS

Token type : BEP-20 MainNet

Token Address : 0xCe34caAEe0b691F8e4098DC31CC8818A1dCcF06A

Token Sale Address : 0x1800C25a3Ed60B41766B8EE94f40CE05A84407aB

Total Token Supply : 23,900,000 PLAS

Public sales

If the pre-sales target is below expectation, there is an option to offer internal staking & DeFi at the same time in June 2021.

Blockchain: BSC BEP-20

Governance token Ticker: PLAS

Total supply: 23.900.000 PLAS

Public sales total :2.000.000 PLAS @ USD1

Early contributors: 7.300.000 PLAS locked up to 27 months

Accredited investor sales: 2.000.000 PLAS @ USD 0,375 minimum USD20.000,-

Pre-Sales: 2.000.000 PLAS@ USD 0,6

Airdrop or Community Grant : 1000.000 PLAS

Hardcap Pre Sales + Accredited Sales = $1.950.000,-

Hardcap Public Sales Total = $ 2.000.000,- (can be planned into IFO if pre sales and private sales succeed)

Total Hardcap : $ 3.950.000,- PLAS price calculation is pegged to USD value.

Roadmap

Plastic Finance's ESG Investment Access

With the support of the investing community, Plastic Finance can sustain and grow Plastic Finance's efforts to enrich the recycling system and empower the trash community. Plastic Finance is democratizing access for everyone to participate in the global purpose of recycling and empowering people with DApps and DeFi.

Plastic Finance focuses on boosting the productivity of garbage pickers to increase plastic recycling. Plastic Finance does not disrupt the waste value chain; instead, it adds value to the value chain, benefiting all parties. Furthermore, Plastic Finance supports the tree replanting initiative to reduce CO2 emissions, demonstrating Plastic Finance's dedication to the circular economy. Plastic Finance can make the recycling system more contemporary, inventive, and beneficial for all stakeholders, encouraging more individuals to recycle plastic.

Startups Utilizing Blockchain

A Plastic Finance startup that collects and recycles plastic utilizing blockchain technology. Plastic Bank offers incentives issued via digital tokens. When the plastic waste reaches the Plastic Finance center, digital tokens are distributed via smart contacts, and each transaction is then recorded on the Plastic Finance platform.

Conclusion

From the discussion above, it is clear that blockchain has entered the recycling domain once and for all, and how it works is very simple. Blockchain-enabled smart contracts can help help streamline the recycling process without compromising security. Blockchain, by its decentralized and tamper-proof nature, will create a level of responsibility in every member of the recycling cycle.

Read More Here:

Website: https://plastic.finance

Official Twiter: @Plastic_Finance

Whitepaper: https://plastic.finance/whitepaper.pdf

Official Telegram: https://t.me/plasticfinance

Facebook: https://www.facebook.com/plastic.finance/

Linkedin: https://www.linkedin.com/company/plastic-finance

Youtube: https://www.youtube.com/channel/UCxZvaGVdcOJ-_SnGaEn4kew

Author

User Name : ahabite

BTT profile : https://bitcointalk.org/index.php?action=profile;u=2620198

ETH Wallet : 0xBfd9e86cc70Fd032Da8a125c79e2982C4839e76e

The purpose of introducing blockchain is to fit everyone in the value chain!