Changing How We Live With The Blockchain Series: Towards A Better Way of Raising and Accessing Fund

Businesses, the backbone of any society, are powered by transactions. Which is why it’s important that we consistently find better ways of accessing funds. Over the years, the power to provide these funds have moved from one class of the society to the other.

The Guardians of Innovation

We’ve witnessed tremendous technological innovation over the past few decades. And the Silicon Valley which has in it leading tech companies like Google, Apple, Facebook etc has been at the forefront of this new world innovation. From smart sensors to automated coffee makers, Silicon Valley has radically changed how we live and interact with one another.

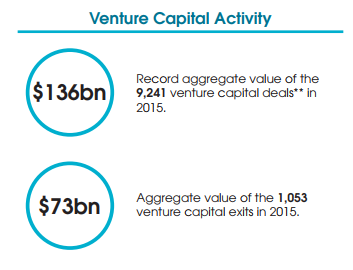

Until recently, the immense contributions of the venture capitalists to the technological advancements has received little attention.. These contributions – seed round, Series A, B, C et al to innovation have been fundamental to the recent data age.

Basically, VCs were able to push fantastic R &D designs out to the world. From garages of nerds to the living rooms of millions of people around the world.

However, this superpower to fund an idea to life also brought attendant disadvantages. Venture capitalists became the gatekeepers of ideas. They had the veto power to kill an idea. All it took was for a VC to dislike the founder for his idea to be killed. In fact, many of the biggest tech companies like Google and Whatsapp were initially passed over by Venture capitalists. The oxygen to fuel an innovation became suddenly tightly controlled.

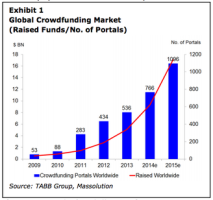

In an attempt to give the power back to the people, crowdfunding sites came to life. Companies like Kickstarter, GoFundMe, IndieGoGo and others. The public massively received this and recent estimates showed that crowd-funded funds surpassed that invested by VCs. Sadly, this model, like that of the VC is not without its own shortcomings.

The New Age of FundRaising

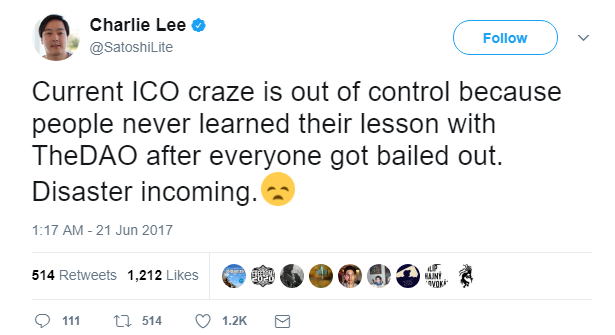

This year ushered in a new way of raising funds: Initial Coin Offerings (ICOs). Like stock IPOs but without its' stringent regulations, ICOs became avenues of raising funds in a decentralized manner directly from the public. The ability to grow or kill an idea rested solely in the hands of the public. And like a lot of new innovations, the public opinion has been swooned by a lot of enterprising minds: dubious and sincere.

2 days ago, the ICO Market reportedly crossed the $1billion mark. A figure larger the total market cap of Bitcoin a few quarters ago. It’s been one shattered record after the other and the nascent market rode the euphoria to the peak.

- EOS shattered all records by raising $185million in first 5 days.

-Bancor Raised $153million in 3 hours

-Status raised $102m

-IOTA reached $1.8billion market cap within a few hours of joining BitFinex exchange

-CoFound.it completed biggest presale of $15m.

-BAT raised $36m in 24 seconds.

These and many more astonishing events happened over the past few weeks demonstrating the arrival of a new way of powering new ideas.

Old Wine in A New Bottle: Decentralized VCs

Due to the existing benefits in the present VC model, a couple of initiatives have sprung up to adapt the model in a decentralized manner.

Last week, Starta, an Eastern Europe startup accelerator opened its ICO raising about $1.5m to refinance the 21 tech startups in its portfolio. They also laid plans for using extra funds to fund even more startups.

Raising $15m in 60 hours last month, Cofound.it also planned to launch a decentralized VC fund that will help create a bridge between exceptional experts/investors and needy startup ideas owners. The video below gives an overview on how CoFound.it aim to revolutionize the present VC model.

Other decentralized models of managing funds of recent are Salus and Numeraire – an AI-powered hedge fund.

The Big Boys Are Getting Interested

Last month, on the cover of Forbes’ July issue was the owner of Polychain Capital. Since the beginning of the year, mainstream media’s attention has been continuously spiked by the several rumors of quick wealth people make from crypto. Columns after columns are being dedicated in pages to cover these stories. And with such massive growth, it was no gainsaying that Wall Street wants a share in it.

While Polychain capital was reporting a 3000% returns on crypto-investments in just a few months, new Wall Street funds were flowing in with Pantera capital raising $100m in June to run an ICO-only hedge fund.

And it’s not only the finance guys in suits that are interested, reputable firms like Deloitte, IBM and a host of other international firms are jumping in on the blockchain /cryptocurrencies bubble. Recently, Deloitte and Waves announced a strategic partnership on ICO related services.

Issues:

The recent Cryptocurrencies ICO funding craze has not been without its own attendant challenges. The biggest of them of all has been allegations of scam and lack of solid projects.

While these allegations have been mostly true, an in-depth research will reveal the same issues also plague other traditional means of raising funds.

Age-Old Problems

Take the video below for example. It describes the 5 Biggest Crowd Funding Scams ( Kickstarter Scams, Indiegogo Scams) -

In fact, dedicated websites like Gofraudme.com have been created to warn the public on crowdfunding projects with little or no value.

The Venture Capital model is also not left out. This week, released reports estimated the total amount of VC funds lost to dead startups amounted to $1.48 billion. And we’re just halfway through the year.

ConclusionEasing the processes involved in raising funds is an essential part of encouraging innovation. Over the years, Man has consistently evolved new ways of exchanging funds with one another. Still, at its early stage, Cryptocurrencies bring a new way of raising, accessing and managing transactions in a decentralized manner.

And it is hoped that just like previous means were given several benefits of doubt even after mass market failures, cryptocurrencies should be allowed to blossom into the beauty they are.

Very inspirating to me as a newbie

You are so on point @infovore. I am actually funding a start-up with rewards from Steemit.. I give it like a loan to the start-up. This is good stuff bro!

Wow. Thats interesting. I'm planning on doing the same.

All I can say is that I bought some EOS too! Was it worth it? I guess I'll have to wait and see. Very detailed account, great writing skills.

Glad to support the winning team! 100% here!

Thanks so much for dropping by. I haven't laid my hand on any EOS yet. Probably, maybe when the hype dies down. So many promising coins and so little BTC ;)

Hi @infovore well written. In the last few days we have seen a lot of uneducated crypto peoples getting out of the market when the best was to keep it all and add some new asset at incredible price. But it is good for us in some ways. Thank you ^ and follow you

Well written post! People without any knowledge just throwing money into the market is not helping anyone. They will get burned though.

This technology is definitely the future of thing. About time the big boys noticed.

Possibly one of the benefits of companies like Google being originally passed over by VCs meant they needed to (1) improve their business model and/or (2) improve how they communicated their value proposition.

As we're now seeing with some ICOs, with minimal barriers to entry and minimal infrastructure, the opportunity to (relatively) easily raise money with good communications and little else may have us reconsidering the value of VCs (or better screening tools) for Pre-ICO.

I do agree with you. And it will be interesting to see what lies in store for ICOs in the future.

"blockchain /cryptocurrencies bubble". Fiat currency bubble. Fixed it for u. ;)

Haha. Thanks.

Great article, once more. Personal & family fudning, bank loan, VC funding, crowd funding to decentralized funding (ICO): Evolution of (start-up) Funding.

It will be interesting to see Blockchain apps get to that stage. Thanks for dropping by.

So I'm relatively new to all this. With that in mind, I've only recently begun to understand how ethereum works, and now I'm here on steemit and it's even more confusing, but I know that this stuff is the future so I'm trying to understand as best and as quickly as possible. I still feel I'm on the outside of the loop when it comes to ICOs. I have no idea how I invest in one, much less EFFICIENTLY find the needed information so that I can make an informed decision with my money. Any suggestions? I find myself wading through articles that are either way beyond me or just plain worthless.

I feel you. I've been in crypto for over a year and there are still tons of stuff I'm confused about. I will advice you to accept the fact that you cant know all while still spending time to learn new stuff daily.

Thanks for dropping by btw.

they're too slow

But they've got the big money to push BTC to 5 figures :)

they do - its a fact

some of them are in isn't it?