Financial Education - Achieving business objectives through the planning process

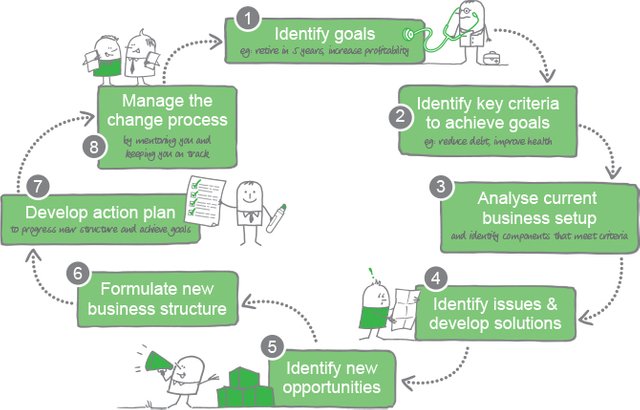

For any company, regardless of the sector it belongs to, planning means the process where the company starts by defining the objectives and plans to achieve them, the starting point of planning is the establishment of the objectives to be achieved, the setting of objectives is the first activity that must be fulfilled: to know where it is intended to get to in order to know exactly how to get there.

Objectives are the future results you hope to achieve. They are the selected goals that are intended to be achieved in a certain period of time with certain available or possible resources. Thus, objectives are future pretensions that, once achieved, cease to be objectives and become reality.

All the above described, leads to define what the Tax Strategy is, it is the action plan established, after the analysis of the tax environment of the company, for the achievement of objectives.

The achievement of such objectives may be the maximum use of the tax incentives granted by law, the lowest payment in the amount of taxes allowed by law, payment on the most convenient dates for the company within the margins set by law.

On the other hand, the action plan may include and coordinate aspects such as deferral in the payment of taxes, inventory valuation, depreciation, normal depreciation, amortization of losses, system for the determination of taxable income (accrued or received), and tax incentives.