SuperEx丨Interpretation: Forbes’ Predictions for the Cryptocurrency Market in 2025

#SuperEx #Cryptocurrency #Forbes

Today, Forbes released seven predictions for the cryptocurrency market in 2025, covering various areas such as national cryptocurrency reserves, stablecoins, BTC/Defi, ETFs, tech giants, cryptocurrency market capitalization, and cryptocurrency companies. The Forbes report states that 2024 marked a historic turning point for Bitcoin and the cryptocurrency ecosystem. This year witnessed the successful launch of the first Bitcoin and Ethereum ETFs, marking the real entry of institutions into the cryptocurrency field. Bitcoin surpassed $100,000 for the first time, and stablecoins continued to solidify the global dominance of the US dollar. In addition, the winning US presidential candidate included support for Bitcoin as one of the core campaign promises during the election. These milestone events together established 2024 as a significant year for the cryptocurrency industry to step onto the global stage.

This Article will provide a detailed interpretation of Forbes’ seven predictions for the cryptocurrency market in 2025.

- The Rise of National Crypto Reserves

Forbes’ first prediction is that several nations will begin to build their own crypto reserves by 2025, with Bitcoin being a significant part of these reserves. As Bitcoin gradually earns recognition as “digital gold,” more countries are likely to hold Bitcoin as part of their foreign exchange reserves. This trend is expected to propel Bitcoin toward becoming a global reserve asset.

For emerging market countries, holding Bitcoin can provide a hedge against domestic currency devaluation. El Salvador made history as the first country to adopt Bitcoin as legal tender, and others may follow suit, gradually increasing their holdings in Bitcoin and other cryptocurrencies. This shift indicates that Bitcoin is becoming more than just an investment vehicle; it may also become an integral part of the global financial system.

- The Continued Growth of Stablecoins

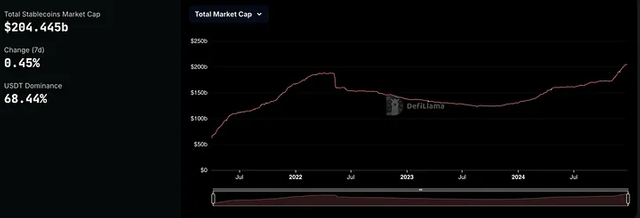

Forbes’ second prediction is that stablecoins will continue to reinforce the U.S. dollar’s dominance in global financial markets. With the rise of digital currencies, stablecoins have become a popular alternative to traditional fiat currencies due to their stability and low volatility, making them the preferred choice for cross-border payments and digital asset transactions.

Currently, stablecoins such as Tether (USDT) and USD Coin (USDC) are widely used, and more institutions and businesses are accepting them as a means of payment. Forbes predicts that the market capitalization of stablecoins will double by 2025, reaching $400 billion. This growth will further solidify the dollar’s position in global markets, particularly in international settlements and financial innovations.

As regulatory frameworks continue to evolve, stablecoins will also benefit from greater clarity and compliance, enhancing their legitimacy and stability within the global financial system. By 2025, stablecoins will not only be a payment tool but also one of the most important digital assets in the global financial market.

- The Rise of Bitcoin’s DeFi Ecosystem

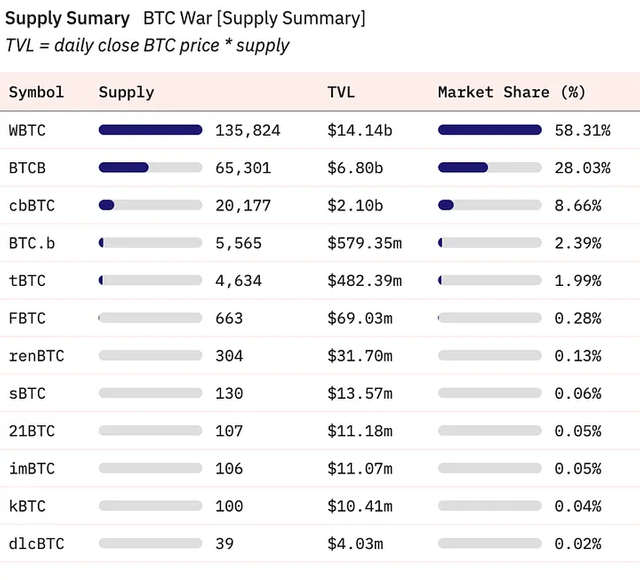

Forbes’ third prediction is that Bitcoin’s DeFi ecosystem will experience explosive growth by 2025. Traditionally, Bitcoin has been viewed as a store of value, while Ethereum has dominated the decentralized finance (DeFi) space. However, with the continuous development of Bitcoin’s Layer 2 solutions, such as Stacks, BOB, and Babylon, Bitcoin’s DeFi ecosystem is beginning to take shape. These Layer 2 networks enable Bitcoin to provide more efficient transactions and smart contract capabilities, allowing it to move beyond being just a store of value and to play a significant role in DeFi.

Forbes notes that as more DeFi protocols and applications are built, the total Bitcoin locked in DeFi protocols is expected to surpass $24 billion, which is the current amount of Bitcoin wrapped on other blockchains. This suggests that Bitcoin will not only be an asset for investors seeking a safe haven but will also become a vital part of the decentralized financial system, allowing for a wide range of applications, including lending, trading, and asset management.

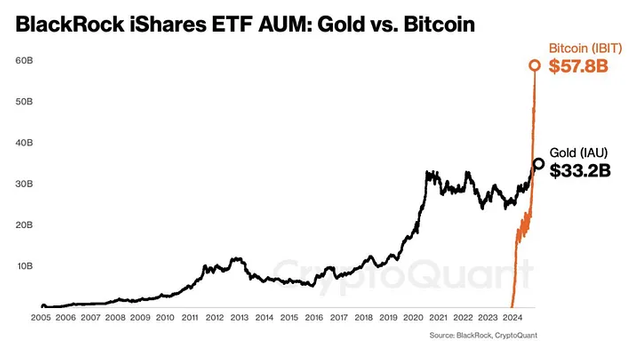

- The Diversification of Crypto ETFs

Forbes’ fourth prediction is that crypto exchange-traded funds (ETFs) will diversify significantly by 2025. Since the launch of Bitcoin and Ethereum ETFs in 2024, crypto ETFs have gradually gained recognition, attracting significant attention from institutional investors. However, Forbes predicts that, as the market matures, ETFs will no longer be limited to Bitcoin and Ethereum but will expand to include other cryptocurrencies, particularly Ethereum staking ETFs and those tracking Solana and other emerging blockchain ecosystems.

As the crypto market evolves, ETFs will become a convenient entry point for more investors. Through ETFs, investors can easily gain exposure to the crypto market while enjoying lower transaction costs and higher liquidity. This will further accelerate the mainstream adoption of crypto assets and attract more traditional financial institutions into the space.

- Tech Giants’ Increased Involvement in Crypto

Forbes’ fifth prediction is that tech giants will ramp up their involvement in the crypto market. In 2024, Tesla became the first major tech company to purchase Bitcoin in large quantities, and Forbes believes other tech giants, such as Apple and Microsoft, will follow suit by increasing their holdings of Bitcoin and other cryptocurrencies.

The involvement of these tech giants will have a profound impact on the crypto market. On one hand, their participation will increase liquidity and market depth. On the other hand, their expertise in technology, payments, and blockchain applications will help push forward the development of the crypto space. In the future, tech giants may establish their own blockchain networks, launch crypto payment systems, or even introduce their own digital currencies, further driving the growth of the crypto industry.

- Crypto Market Capitalization to Surpass $8 Trillion

Forbes’ sixth prediction is that the global cryptocurrency market capitalization will surpass $8 trillion by 2025. This forecast reflects the tremendous potential of the crypto market and the increasing importance of digital assets within the global financial system.

With the continued rise in the prices of major cryptocurrencies like Bitcoin and Ethereum, the emergence of DeFi and NFTs, and the growing involvement of institutional investors, the total value of the crypto market is set to expand. Additionally, as the market matures and becomes more widely adopted, crypto assets are likely to surpass many traditional asset classes, making crypto one of the most significant investment sectors in the world.

- The Revival of U.S. Crypto Startups

Finally, Forbes’ seventh prediction is that U.S.-based crypto startups will experience a revival. In recent years, U.S. crypto startups have faced challenges due to regulatory uncertainty and policy barriers. However, with the gradual improvement of the regulatory environment — especially as clarity around cryptocurrency compliance continues to grow — U.S. crypto startups will experience a resurgence.

The United States, as a global hub for technological innovation, will see its crypto startups play a crucial role in advancing blockchain technology across a variety of sectors, including finance, healthcare, and supply chain management. As more crypto startups emerge, they will drive further innovation and add momentum to the growth of the crypto industry.

Conclusion

Forbes’ seven predictions for the crypto market in 2025 present an exciting and transformative future. From the rise of national crypto reserves and the continued growth of stablecoins to the expansion of Bitcoin’s DeFi ecosystem and the diversification of crypto ETFs, the crypto market is poised for a revolutionary change across multiple dimensions. These predictions not only offer a glimpse into the future of the crypto industry but also provide valuable insights for investors, entrepreneurs, and policymakers alike.

As institutional investments pour into the market, technological advancements continue to unfold, and regulatory frameworks become clearer, 2025 is set to be a pivotal year for the crypto industry. It’s a time of opportunity, but also a time of challenge. For those looking to capitalize on the growing crypto market, staying informed and adaptable will be key to success in this rapidly evolving landscape.