Focus Shifts to USD/CAD

My focus has shifted to USD/CAD this week, as almost everything depends on their inclusion in any NAFTA deal. As we've discussed on the blog already, the level of uncertainty is very high and the pair rallied to end the week as a result.

The question I find myself asking however, is whether this is all political bravado before a deal between strong allies will be reached, or if hostilities are for real. Going by how we've seen Trump conduct foreign policy before, I'm leaning toward option A) as you can see from my weekend thoughts below:

This one is going to drag on, but ultimately Canada will surely become a part of any trade deal in the end and CAD will likely see some relief.

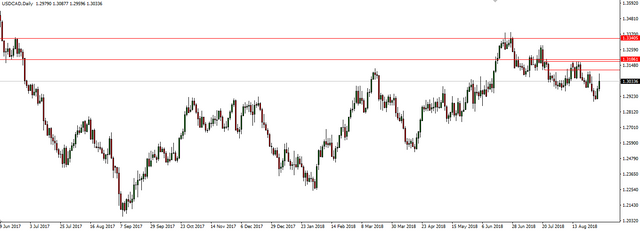

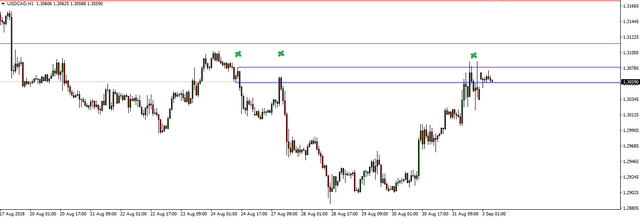

With USD/CAD coming off higher time frame resistance...

...I see a repricing to the short side being where the biggest move could come.

Monday sees the US and Canada off for Labor Day, so volumes and movement is expected to be muted. With price sitting at higher time frame resistance, can you really see any major levels being destroyed early in the week?

The other fundamental aspect to keep in mind is the poor Canadian GDP print that we saw last week, essentially pushing back expectations of a September rate hike from the BoC. This has been the driving factor in Barclays' trade recommendation of a USD/CAD long, but I'm not sure how you can take that at resistance, with so much uncertainty around NAFTA.

With price opening up within the following zone, USD/CAD is certainly in play:

We're back retesting this zone for a third time which depending on how you look at it can mean it's both strong or weak. People laugh at me for saying that resistance is resistance until it's not, but it's true.

If we get below it, we're going to sell retests of previous short term support as resistance. It's the same as the Aussie shorts last week. Just be patient and let the trades come to you.

Best of probabilities to you.

@danewilliams | Steemit Blog

Market Analysis

Twitter: @danewilliamsau