Monday London Session USD Musings

The US Dollar traded initially higher during Asia, as markets remained risk averse thanks to a potential escalation in the China/US trade war. A theme that also led to treasury yields edging lower.

President Donald Trump was on the wires Friday, saying that he was ready to tariff virtually all Chinese imported goods into the United States. Stepping up his rhetoric with just a potential lazy $267 billion worth of more goods. This is in addition to the already $200 billion spoken about previously.

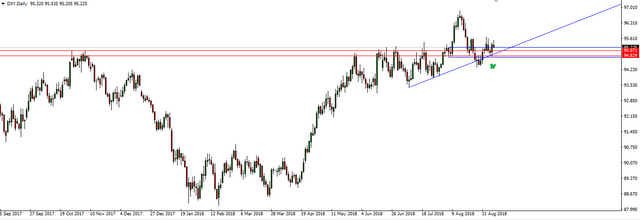

But with markets not fully pricing in the impact of US tariffs on... well, pretty much everything Chinese, sentiment seems to have shifted throughout the trading day and the DXY is starting to come off now.

From this, it looks like markets are going to remain risk-off. It doesn't look like there's going to be any public concessions from either side in the near term and risk is set to suffer as a result.

Best of probabilities to you.

@danewilliams | Steemit Blog

Market Analysis

Twitter: @danewilliamsau