5 steps to trade on Forex for Beginners

Forex is one of the most volatile type of investment markets and one of the most exhilarating experiences in the world. Forex, in it’s nebulous form, is simply trading currencies-buying and selling, betting for and against the various currencies of nations. With great liquidity and immense margins, it is one of the most effective ways to make money in a market, and easily the quickest way to throw money away. In this article we will show you 5 steps to trade on Forex for Beginners.

1. Start Forex trading with Forex education

It may sound boring, but Forex begins with education and It's an important step in 5 steps to trade on Forex for Beginners. Trading requires minimal understanding of the market functioning mechanisms. Novices often omit this step, relying only on their success and intuition. But Forex is not gambling, it has own laws. Success is possible when trading blindly, however it is short-time.

You can learn how to trade on Forex in different ways: paid and free, in-class and online or you can Click Here to download Free Guiding Ebook to learn how to trade on Forex Market and Tips you should know.

How to learn Forex trading individually and free

You can learn Forex basics individually – assiduity, patience and time are required. Books, thematic resources, blogs of the successful traders, forums, video tutorials and webinars are the main educational materials. It is important to find easy-to-understand source that will not confuse even more.

The following books are considered classical:

- Alexander Elder “Trading for a Living: Psychology, Trading Tactics, Money Management”;

- George Soros “The Alchemy of Finance”;

- Warren Buffett “The Essays of Warren Buffett: Lessons for Corporate America”;

- Erik Nayman “The Small Encyclopedia for Trader”;

- Jack D. Schwager “Market Wizards”.

- Miracle Forex Secrets

Books form a certain knowledge base, but do not teach successful deals. Reading of specialized literature is useful along with video tutorials, webinars and demo accounts. Look for applied information from insiders at Forex resources: thematic sites, forums, blogs, communities.

Authoritative Forex resources are listed below:

Books form a certain knowledge base, but do not teach successful deals. Reading of specialized literature is useful along with video tutorials, webinars and demo accounts. Look for applied information from insiders at Forex resources: thematic sites, forums, blogs, communities.

Authoritative Forex resources are listed below:

|

Investing |

|

Investopedia |

|

Dailyfx |

|

Babypips |

|

Digitalcashpalace |

|

Earnforex |

|

Forextips |

|

Donnaforex |

Online courses from brokers

Distance learning gains popularity. Forex brokers use online courses, webinars and mentors` services to teach their clients. The most available form of learning are webinars, i.e. online seminars. Any trader with Internet can take part in such online events. Webinars are popular due to:- Simplicity and availability;

- Opportunity to put questions to the webinar presenter via chat;

- Visual materials – video, screenshots, presentations, screen sharing;

- Participating is usually free.

Forex courses – in-class learning

Forex brokers often hold learning courses locally. Classes are led by professional traders. The course usually consists of lectures and practical training. Forex-coach shares his experience, gives advice, analyzes trades. Forex courses are considered to be very effective teaching method, assuming a real professional teaches you. High cost and location dependence are its main disadvantages.

2. Choosing a broker

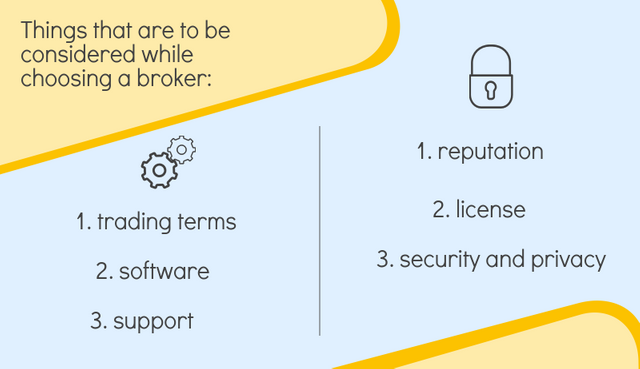

Brokers are intermediaries between a trader and market. Unfortunately, you cannot start Forex trading without them. Therefore, try to choose a reliable and honest company. How to do it? Look for independent ratings of Forex companies, read reviews on forums. Be careful – reviews and ratings are often made-to-order. Moreover, both positive (bought by broker) and negative (paid by competitor). Do not trust only one source. The following parameters tell about the broker more objectively:- Reputation. The experience of the Forex broker demonstrates its stability and reliability. But do not write off young companies – their trading terms are often more loyal.

- License. Any company, providing financial services, should be certificated. If the broker is not subjected to one of the regulators, think carefully before signing up.

- Trading terms. Look what trading accounts and terms are offered: leverage, spread, commission and initial deposit.

- Software. Which trading platforms can be used in the company. Do they have mobile and browser versions? Are they easy-to-understand for beginner?

- Support. Contact support team via chat or email to make sure of their courtesy, competence and awareness. Multilingual and around-the-clock support is always a priority.

- Security and reliability. How to check it by yourself? Look at the URL address in your browser: HTTPS protocol is a good sign. If you use Chrome or Mozilla, the green lock to the left of the address bar is a proof of secure connection with the site (the site has a valid TLS/SSL certificate). This requirement is obligatory both for password entry and payment pages etc. Of course, it doesn't guarantee broker's integrity, but at least no one will intercept your data. It would be great, if the financial operations and password reset are supported by two-step authentication. Ask the support team to provide you with information about another client, as if he is your friend or relative – what will they answer?

3. Trading on a demo account – virtual Forex

Educated trader is good, but isn't enough It's only one step in 5 steps to trade on Forex for Beginners. You need practical experience. Where to get it for free? Open a demo account – Forex trading simulator. You choose a broker, open a demo/practice account, install trading platform and start Forex trading with virtual money. Demo trading is similar to the real. You trade under broker`s trading terms, make deals for the same quotations, learn the platform without investing your own funds. There are 2 ways to open a practice account:- With registration – you open a demo account on the main page of the broker`s official website only after registration.

- Without registration – you open a demo account directly from the trading platform, or on the official website without registration.

Open several demo accounts and compare trading terms of different brokers to be sure you find the right one.

Open several demo accounts and compare trading terms of different brokers to be sure you find the right one.

The reverse side of a demo account

Many traders don't recommend demo trading. What are their arguments? The trader does not accept virtual money seriously and does not feel the emotions appropriate for the real trading. Imagine: you trade on a demo account, trade with profit, a large sum of money is already on your account. Go to a real account and all is lost – instead of profit you have a loss, instead of the deposit – big fat nothing. The fact is that the price of virtual money is low, so we bear losses easily. The trader keeps calm and continues to trade even at unprofitable transactions. When real money is at stake, such emotions as greed, fear and excitement take place. In most cases, it is the reason why trader fails. How to reduce the risks?- Trade on a demo with a sum, which you will trade on a real account;

- Use the same trading terms;

- Make deals reasonably;

- Keep trading journal, correct mistakes;

- Do not stay on a demo account for a long time;

- Do not make trades of high volume on real accounts, even if you trade on the demo successfully;

- Follow money management rules.

Step 4. Opening a trading account

When beginner`s training is behind, it’s time to start Forex trading in real mode. To do this, you need to open a trading account on the broker’s website. The buttons and links for account opening are usually located in the most conspicuous places. The account opening procedure is often combined with the registration. At this stage, the future customer should provide personal information. At least – name, email, phone number, address. Some serious companies may require even income level information. On one site you should provide minimum data, so you can start trading immediately. On the other site account should not be opened until you do not send a copy of the identity card and deposit your account with a certain amount.

The account opening procedure is often combined with the registration. At this stage, the future customer should provide personal information. At least – name, email, phone number, address. Some serious companies may require even income level information. On one site you should provide minimum data, so you can start trading immediately. On the other site account should not be opened until you do not send a copy of the identity card and deposit your account with a certain amount.

If you are ready for serious trading – indicate correct personal information. The confirmation code/link may come to the email address or phone. Brokers do not process the withdrawal without the documents confirming person`s identity and place of residence.

You will understand the procedure in the course of registration. Everything should be intuitive. If not – write to the support desk. Trading account should be deposited, otherwise you can`t trade. The only exception is a non deposit bonus, which is regularly given by brokers in order to attract new customers.

If you are ready for serious trading – indicate correct personal information. The confirmation code/link may come to the email address or phone. Brokers do not process the withdrawal without the documents confirming person`s identity and place of residence.

You will understand the procedure in the course of registration. Everything should be intuitive. If not – write to the support desk. Trading account should be deposited, otherwise you can`t trade. The only exception is a non deposit bonus, which is regularly given by brokers in order to attract new customers.

5. Installing the platform

You need a trading platform to start Forex trading – software that connects trader with exchange market. If you have been trading on a demo, you have already installed it. Forex offers a variety of terminals. There are most popular: |

Exness |

|

IC Markets |

|

FX Pro |

- Multi-functionality – analytical tools, indicators; the possibility of algorithmic trading;

- Security – protection from unauthorized access;

- Availability – compatibility with operating systems and browsers;

- Mobility – mobile applications and browser-based versions of the platform;

- Speed;

- User-friendly interface.

All trading terminals can be divided into 3 groups:

Traditional desktop platform – the most convenient and functional. A trader downloads terminal and installs it on the computer. But you may have difficulties with some operating systems. Traditional desktop platform – the most convenient and functional. A trader downloads terminal and installs it on the computer. But you may have difficulties with some operating systems. |

Mobile applications – a stripped-down functionality on the screen of the smartphone or tablet. The main advantage is mobility. Mobile applications – a stripped-down functionality on the screen of the smartphone or tablet. The main advantage is mobility. |

Browser version of the platform (Web platform) – the most unpretentious variant. You can trade directly in the browser without installing any software. Nevertheless functionality is limited. Browser version of the platform (Web platform) – the most unpretentious variant. You can trade directly in the browser without installing any software. Nevertheless functionality is limited. |

1. Learn Forex theory: read books and articles on the Forex resources, communicate on forums, watch video tutorials and webinars, visit Forex courses; 1. Learn Forex theory: read books and articles on the Forex resources, communicate on forums, watch video tutorials and webinars, visit Forex courses; |

2. Choose a reliable broker: make personal ranking of brokers and compare their trading terms; 2. Choose a reliable broker: make personal ranking of brokers and compare their trading terms; |

3. Practice on a demo account: virtual trading will help to learn platform's functionality, test trading terms of each account type; 3. Practice on a demo account: virtual trading will help to learn platform's functionality, test trading terms of each account type; |

4. Open and deposit a trading account; 4. Open and deposit a trading account; |

5. Install the platform and start Forex trading. 5. Install the platform and start Forex trading. |