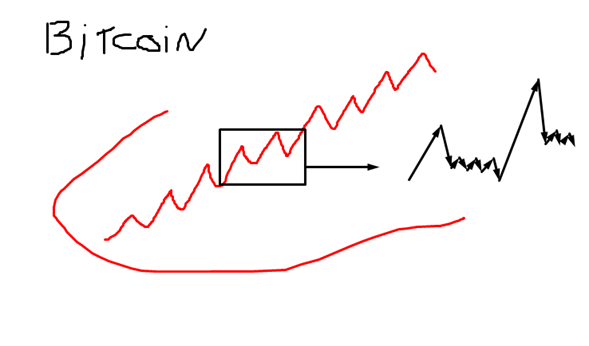

CHAPTER 1 THE BITCOIN HAS CROCODILE TEETH (eats inflation)

Today I start with a series of posts that will be numbered by chapters, which seek to explain and tell in its totality what is happening in the world today, and how the great masses of money, and therefore societies, are moving.

CHAPTER 1 THE BITCOIN HAS CROCODILE TEETH (eats inflation)

Little by little I begin to accept that bitcoin is the revolution of our time, perhaps more even the same internet. Its future value may be unimaginable, just thinking that China uses it as a common currency leaves us out of range.

It could be worth US $ 100,000, or 1 million, because it is unthinkable and we can not predict it today.

I recommend you to watch this video of CLIFT HIG, it may be one of the most understood in cryptoneses and therefore the one that can best understand its future development.

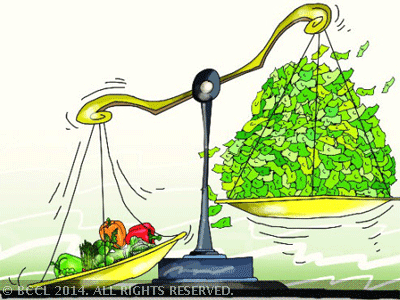

Hyperinflation, which has already begun, will be the main problem in the world in the coming years, and along with that, companies and people will seek refuge, take care of their money and their assets.

For this reason, gold and silver have always been the best and easiest safeguards, however, for the globalization of the world today, it is very unlikely and difficult to make transactions with these physical metals. Creation of BITCOIN solves all those problems, as it manages to be divided and easy to transfer.

But let's get back to inflation, what happened in the world, if prices have gone down, for example oil, went from being worth $ 125 a barrel, to only 25-30 at its lowest point and today walks by 45-50. Prices are generated by supply and demand, the latter has not changed many years ago, that is, the nations, companies and citizens of each country do not consume more oil than before, we spend the same as always.

But then why does its price change in the market?

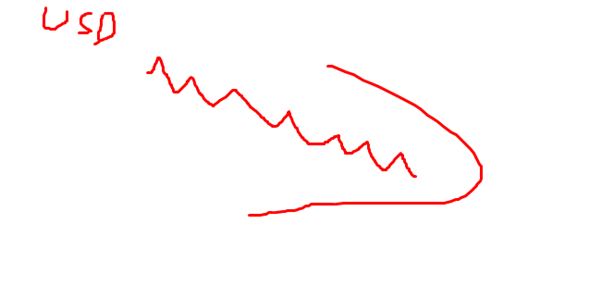

Simple because its counterpart, which is the USD (US dollar) has changed a lot, in recent years has become more expensive compared to other currencies, but this increase in the value of the dollar occurred despite the fact that the Fed lowered the interest rate To 0, which only indicates to us that the value of the dollar was based on what the market considered, they had the belief that its US owner would be sustainable in the time and gave sufficient support to the currency.

In the last 8 years we have seen how the FED uses its money-making machine constantly and continues to make dollars to the market, as this has flooded with dollars all over the world, and in the last FED meeting, when they decided to raise another 0.25 Its interest rate, we not only saw the dollar rise, but fall sharply. This is a clear sign that the market no longer wants more dollars and what is worse still has lost confidence in the Fed, and in the United States.

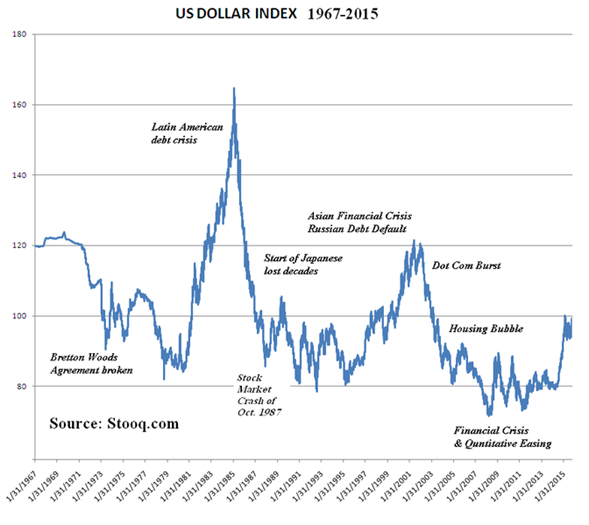

Let us broaden the image of the dollar index a little,

This is the value of the dollar over time since 1967, the day of the Bretton Woods agreement, that day changed the world by removing the gold standard of the dollar, and since then the dollar touched its highest ceiling along with the last great expansion of The American economy, then only to mark downs with which the pattern of the crocodile teeth appears again but in reverse.

Finally all this is to indicate that I consider that BITCOIN, came to stay, I consider that it is not a bubble (probably will be in many years more), I consider that it is a good method to cover the next period of Hyper inflation, I recommend as an asset to do trading, even more if you do not have expertise in that, if you want to buy bitcoin and save them until you count 10 thousand, 100 thousand or millions.

Greetings and until the next chapter.

Great metaphor!)

I think that since December 2016 with the Fed's first rate hike, and the market's null reaction to that, the dollar went into a spiral, which will not end until we reach the bottom of the canal.

The market, people, traders, have lost confidence in the actions of the Fed and the US government, this week when the Fed announces a new rise, if it is only 0.25% more, the market will react Again punishing the dollar to more falls

The only way this changes is that the Fed will rise from 0.5 to 1% in a single blow. But that would be like shooting a bomb on Wall Street and on the same American debt.

That was a good post. Seems like you put some work into this bitch!

Looking forward to reading your next chapter...Have a good weekend!

You get my vote , which is worth....0 cents at this point! ha..brutal.

thanks, don't worry for the money your comments are more important.

Great info. thanks for posting - Voted & Following!