Price Action Trading Module 3 continues

LESSON: Identifying Trend Changes

The main two ways to tell if a trend has changed is or whether we want to be long or short are:

1,2,3 reversal pattern

A key support or resistance being broken – this is a powerful method and can be used for very short term changes.

This is the best method for putting traders on the right side of the market when it has broken a key level and made a very quick shift of trend. This is when the rest of the market will often be faked out and be looking at other long term trends and other rubbish like moving averages etc, but for traders that understand these key levels they can position themselves in just the right spots.

Price Forming Base / Top Reversal

Price action is great for reading reversals because nothing else gives as an advanced clue to where price is going as price action. Every indicator, and every system is built from price.

The other reversal pattern we use is when price forms a base at the low or a top at the high.

Make a note of this; after price has been trending or moving strongly in a direction either higher or lower, it very rarely will just turn around after one candle.

Price nearly always needs to pause, or move sideways, but rarely will it move and turn around in only one candle.

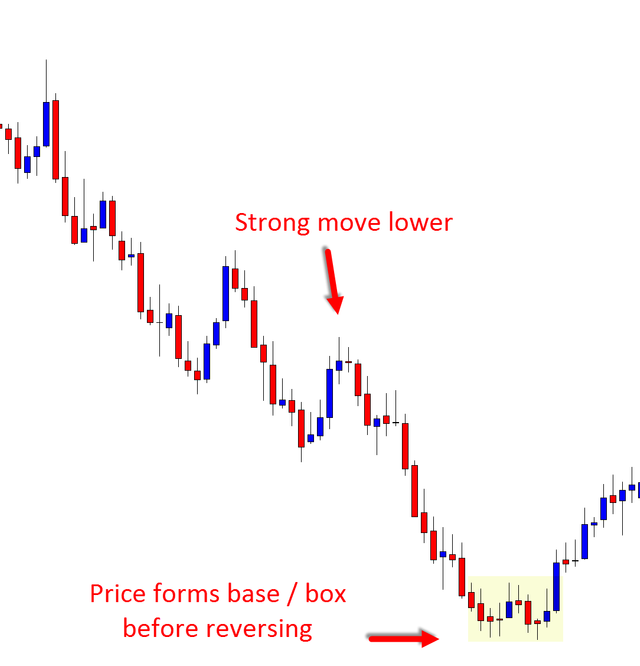

Like in the chart example I have added for you below; price makes the strong trend lower, but price does not just form one candle and turn and reverse higher. It forms a base at the low. Buyers at the low push back against the sellers and form a bit of a tug of war because this trend has been going on for some time.

When price tries to move higher, the sellers / bears jump back in again and push price back lower and that is the exact reason why price rarely turns around the first attempt. There is a constant tug of war between buyers sellers and supply demand going on.

Module Three

Duration: 2 mins

Module Progress:

50% Complete

Next Lesson »

« Previous Lesson