Making sense of the FUDs and where does it go from here..

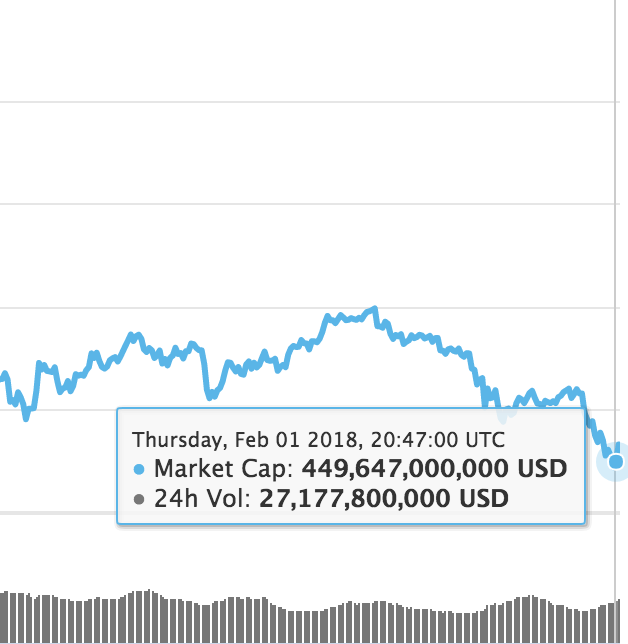

Some of you know who I work for and this week was a bit busy.. Checking after each day of learning sessions and workshops, I see some anomalies and weird patterns. I am trying to decipher why these past several weeks and especially this week means.. Also, today on Feb 1, the market hit another cliff and went down.. To update, I guess CND AI bot was much more accurate than me... I was good until the evening... CND AI is a great token...

To start out, let's look at where we had a significant dips in the overall market caps

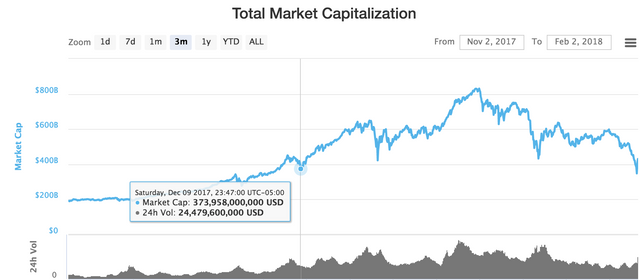

First one is on 1/11/2018 since it was the lowest drop level (628 billion) after market cap hit 800+ billion.. (Keep in mind of note on 1/4/2018 for Tether)

Second was on 1/17/2018 where the market cap was at 428 billion (after another run up)

Third happens to be a volatility period where it is limbo and just falls off the cliff today with 449 billion

Let's look back on what happened on those dates:

1/11/2018: South Korea to ban cryptocurrency

Reference: https://blog.svkcrypto.com/2018/01/11/top-crypto-news-11-01-2018/

1/17/2018: Asia sell-off (and no known reason with most pointing to the Lunar New Year calendar) and remember the BitConnect saga (and the platform closing that day)

Reference: https://techcrunch.com/2018/01/16/bitcoin-crypto-crashed-hard-part-deux/

Side note: 1/20/2018 was India cracking down on India cryptocurrency exchanges for tax money

https://www.coindesk.com/bitconnect-shutters-crypto-exchange-site-regulator-warnings/

2/1/2018: SEC involve on a closure of a crytoproject and broader concerns of cryptocurrency (and regulation)

Reference: https://arstechnica.com/tech-policy/2018/02/bitcoin-drops-below-9000-in-continued-cryptocurrency-slide/

You could see some news are more pervasive and most publicized are on the negative perspective and light of cryptocurrency. We call them FUDs but how much they impact could be seen and heard on activities.. Though I do not believe in Tether (and the validation of 1 token: $1US backing, scaling issue, and how it will handle of "running to the cryptobank"), the principle on how it works and why people would buy Tether does show telling signs.... Tether sole purpose is to retain the US$ value of investor's crypto portfolio and remove the volatility aspect of the coins (until the investors are ready to buy back into the market). Hence, to remove the negative impact of FUDs on the portfolio.

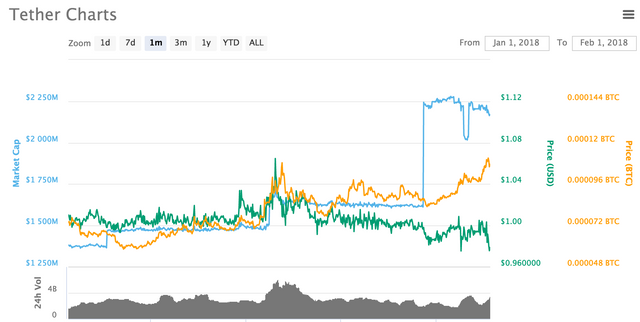

Let's look at US Tether at Jan 11, 2018 (0.2382% of global market cap)

You see that the market cap on Tether did not see a significant spike. Why? The news was coming out of Asia. The overall market cap drop shows Asia was significantly impacted (which we know in retrospect was market manipulation by Korean ministry of finance). So why wasn't there a spike in Tether? If you can check (using current information since I could not find historical data on that date with volumes), you see most and majority of percentage of the UST holdings are in Western nations' exchanges and not Asian exchanges. Side note, this was the whole discussion about Tether and Bitfinex "scam"(though I do not agree completely with story).

Also, there was an increased spike on Jan 4. You see that Tether added $100 million in market cap (0.1953% of global market cap - where prior to the spike was 0.1824%) There were news and concerns about cryptocurrency (China pushing out bitcoin miners and Visa cracking down on Bitcoin debit card in Europe). Note that 1/4/2018 was the beginning of this extreme volatility and anomaly of coin market cap.

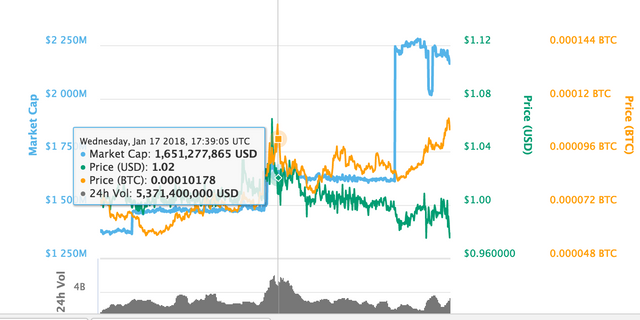

Let's look at Jan. 17. If this was a panic sell on FUDs, I would deduct that Tether would have a bump.. As you could see, you do not see that day but shows up day prior (1/16/2018 with .2768% global market cap prior to the bump). Tether has a nice bump up (+ 170 million in market cap and 0.3853% global market cap). With the date being on UTC, and events written being any part of that day afterward, I consider the events show volatility and shift with investors. Either case, you could see that more people did get into UST. Was Lunar New Year a factor? I do not know since I do not know the exposure of UST in Asian exchanges. What I do know is the down market did increase UST and its % to global market cap.

Lastly, Feb 1 and the sell off... You see more of the Tether having more uptick on the global market cap (.4811%) with spike happening on 1/28/2018. That spike brought +500 million with .3836% global market cap. Why higher % (global market cap kept dropping as well as people trying to profit on the $.0x since Tether will eventually go back to 1:1 ratio and where would people place in crypto besides cashing out).

What could we conclude? FUDs are happening! No surprise there... UST kept growing in percentage to the coin market cap and shows people are heavily concerned about FUDs... But what is surprising is why are FUDs impacting the investors? I could understand some of the events but you can't make that case for all (e.g. UST has issues but are still in it as we speak for some investors)... Could be correction with the crypto bubble as some stated? One thing I keep asking myself if no propaganda was done, would the market correct itself like this? I do not believe it would. Also, if you look the trend that our market cap value is about where we were before the run up and eventual drop (373 billion to 348 -400 billion)

So what is the issue? I think most of the issue is education...

Market changes are not based on fundamentals but on very emotional and poor decisions from those information (propaganda in my view). The problem with the market is most people do not understand the fundamentals.. They did not get educated or even weed out of information that are not accurate.. Either case, what I want people to realize is FUDs are big variables and that we should discern and ensure the information is accurate before taking actions. FUDs in my view are almost truth (e.g. India propaganda that they are banning crypto was never stated but were spinned on social media)..

Now back to a question that will need to address: How do we get back to the upswing?

- Education... If you go by hype (like running on fumes), you are the first one to go out when some minute thing happens... If you know the value of the crypto, this would become easier to HODL

- We need to clear the FUDs and make them what they are... Propaganda and manipulation of the market for personal gains for select few. Those who need to lie so you could get a profit, then you do not help the market (Bitconnect anyone?)

- More people need to get involve in community for the value that this market will provide and deliver (more people buying in, the more likelihood the market recovers). Again, removing barriers would help (more exchanges and fiats actually support crypto publicly).

At the end, I believe we need a critical mass of investors who will see the value of crypto (and even HODL) for the market to recover and jump... At the end, Jan is a lost month of FUDs and reverse PnD (sell off at the top and trash the coin and buy it low... Futures hello?)... I think we need to clear the nonsense out and get people to understand the basic.. Need to ask if you are really researching the information and confirming the info be truth or not...

Side note, DigixDAO should tell you something (it is like Tether but with commodities in my view)

Really enjoyed reading this. Very detailed and again I completely agree. The Cindicator bot absolutely amazes me in regards to accuracy. I often wonder is it because of the strenght of the AI or is it the strength of the collective data it gathers from the people.