The Future of Real Estate and You

This week several articles popped up about a company that was able to generate a 3D printed home in less than 24 hours for about $10,000 USD. The authors rightly noted that this could resolve housing crises in developing countries where many currently reside in urban slums or substandard housing (see https://steemit.com/technology/@loku/3d-printed-home-that-can-be-built-for-less-than-rs-2-6-lakhs-envisioned-for-developing-world and https://steemit.com/science/@fatkat/usd10k-home-built-in-under-24-hours-using-3d-printing-vulcan-printer).

Less discussed was the potential impact 3D printed homes could have on real estate in general. 3D printed home construction could rapidly increase supply and put downward pressure on the overheated housing markets in many advanced industrial nations. What is truly compelling is that the 3D printer house is not the only potential big disrupter that real estate faces. Several technologies could significantly drive down the costs of real estate in major cities.

In this post, I analyze four weak signals that could potentially see major urban cities shed some of their value to rural communities. I finish by offering four broad strategies you can take to avoid being unduly impacted by this shift.

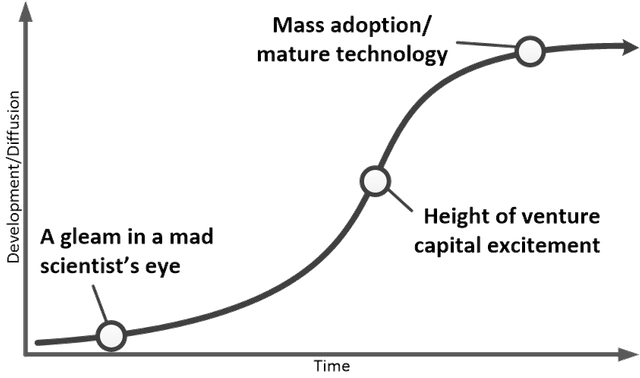

First, though, a little on nomenclature. What are weak signals? Part of my commitment to sharing what I know about the study of the future involves introducing the concepts and methods I use. Weak signals are events, developments, or practices that have yet to hit mainstream adoption or take off but if they did could have a significant impact on our world.

It is a tough art to do well. The closer you are to the far left of the graph the farther ahead you can potentially see; however, the uncertainty here is high. Many techs and practices fizzle out before they go anywhere. For this post most of the weak signals we are dealing with are pretty close, if not on, to the point marked height of venture capital excitement. This gives us better plausibility but also places us fairly close to the "present."

So what are the weak signals that could upend urban real estate current premium over the next 15 years? Autonomous cars, the growth of internet based employment, 3D printing, and Superbugs could all put significant downward pressure on urban real estate.

Autonomous Cars

Of the weak signals that could disrupt traditional real estate markets, autonomous vehicles are perhaps the most intuitive. At present, urban real estate commands three decisive advantages over rural property.

First, as workforces in many developed nations have become more specialized and educated they are more dependent on vibrant and high tech job centers. At present, densely populated, cosmopolitan cities hold a near monopoly on these types of job. Specialized labour is highly dependent on cities and this dependence puts upward pressure on urban real estate prices.

Second, cities command the advantage of convenience. Commuting can add several hours of essential “dead” time during a workday. Living in a city allows people to save time and cuts associated costs with a long commute, it is also significantly better for their health.

Third, as wages are squeezed and pension plans continue to erode, more and more people buy real estate as both a home and an investment. Historically, real estate in urban centers has offered a higher rate of return and this logic becomes quickly self-reinforcing.

Autonomous cars have the potential to erode many of these advantages. Autonomous cars will eventually be outfitted with interiors radically different from today's cars. These interiors will probably support a variety of behaviors such as sleep, work, recreation and potentially even exercise. This will transform the commuting experience and ensure that time spent driving is not lost time. This will make a 2 hour commute more palpable and could see more people move to rural areas (countries that experience heavy winters will see a slower growth in this trend but the trend will accelerate as the climate changes). Moreover, more effective and efficient driving will allow commuters to cover more ground more quickly extending the distance away one can live.

However, the autonomous car could also put additional downward pressure on the premium urban space commands. Commercial shops have already come under pressure from the digital economy. Currently Toys are Us, Sears, JC Penney, Barnes and Noble, Payless have either died or on death row. The effect online shopping has had on the high street could be significanly compounded by autonomous cars. Potentially, autonomous cars could be used to drive to an outlet store or warehouse, be loaded, and return home to you. Retailers that wish to survive will invest less in downtown physical store fronts and instead will increase their online presence and develop outlet stores with lower overhead costs. Foot traffic downtown will fall. The stores likely to survive in downtown spaces will be part an experiential economy the vanguard of which has already materialized in the form of escape rooms, virtual reality arcades, and board-game stores. As commercial stores die and fewer workers are required, this will have a knock on effect on urban real estate prices.

Internet Based Employment

The shift to gig-based employment is already in full swing. By 2020, 42% of Canadians will be employed as Gig workers and by 2025, 70% of the American workforce will be classified as gig workers. At present, when we think about gig jobs our attention turns to Uber, Task-Rabbit, and other forms of work that still require the worker to be physical present. However, many new online freelance work platforms have sprouted over the last decade (Freelancer, Fiverr, Upwork, Toptal, to name but a few) that could sever the assumption that specialized labour and urban centers go hand in hand. These platforms allow workers to complete hour to month long projects for an employer located anywhere in the world. There is no need to suit up or drive in. Its a flexible work schedule and in some cases is very well remunerated. As more workers find themselves working on exclusively online contracts the need to be in a city will decline and many might look to rural communities to lower their living costs, especially as gig work will increase household income precarity.

Increasingly, where we work could be restricted only by the quality of the available internet connection. This effectively levels the economic playing field between cities and rural communities. Many rural communities will require a significant internet infrastructure upgrades to make this viable and this could occur unevenly. However, as many rural communities face aging population and loss of talent, the leadership of these communities could seek internet improvements as part of revitalization project. Consequently, fewer people would need to leave their homes, let alone purchase expensive urban real estate.

SuperBugs

The plague has never been good for cities and historically sparks a mass exodus to the countryside where lower population density protects against transmission. (If you haven’t already, check out Daniel Defoe’s Journal of the Plague Year, it’s a fascinating account of the plague in London told retroactively). For the latter half of the twentieth century to present, largely thanks to antibiotics, bacteria related fatalities have not had a huge impact on where we choose to live. However, overuse and improper use of antibiotics are allowing many forms of bacteria to gain resistance to antibiotics.

Recently both the G20 and WHO warned of the threat posed by antibiotic resistant strains of bacteria and stated that the production of new antibiotics was “a critical priority.” If you question the impact of this consider this, before antibiotics five women out of every 1,000 died in childbirth, 1 of every 9 skin infections, from causes as benign as scrapes and insect bites, proved fatal. Pneumonia had a 30% fatality rate. Already, the impact of failing antibiotics is being realized. In the US, alone, recorded deaths from drug-resistant bacteria have doubled from 2003 to 2014. If viable new antibiotics are not created within the next five years, the World Bank forecasts that superbugs could kill 10 million people annually and cost five trillion dollars pushing 28 Million people into poverty by 2050.

It is not hard to imagine that under these conditions many people would take precautions to avoid contact with incurable forms of bacteria. One plausible outcome is that areas with lower population densities become favored places to live. This trend would see those with means moving out of urban cities and into rural settings where they could more effectively pursue a “bio-secure” life. Under these conditions, urban real estate would realize a significant decline in value and face numerous infrastructure challenges in managing care and effective quarantines.

3D Printing

There are two implications on how 3D printing could affect urban housing prices. The first, is rather obvious and should need no elaboration. 3D printed house can be erected cheaply and rapidly. As with any market, a rapid increase in supply comes with an associated decline in price. Initially builders will probably target urban space that is utilized poorly or in need of restoration. However, as autonomous vehicles hit the market builders with foresight will likely begin to buy-up disused farmland on the cheap in anticipation of buyers willing to commute to work or able to spend most of their time outside cities.

However, the other potential driver is that as 3D printers become more sophisticated and cheaper they may be able to produce a range of consumer goods. If rural communities gain a greater share of high income workers, these communities could install 3D printers and localize consumption, which again would chip away at the historical advantage cities have had on meeting consumer demand.

Coping Strategies

Before I type another word to page, I want to underscore the number one caveat of future oriented analyses: this analysis is not a prediction. Nobody can predict the future. What I am offering here are plausible futures that could unfold if these weak signals were to become more significant over time. As such, these implication and strategies are useful in helping us prepare for these potential outcomes. There are certainly plausible futures that would render these strategies ineffective or irrelevant. With this said, the following might be good forward-looking approaches to urban real estate and city life:

First, if you are landlord or aspire to be one, the most durable type of urban real estate investment is likely to be on the lower or higher end of the cost spectrum. The middle class is in its death throes (stay tuned for my post on seven theses for a post-middle class society) and with it goes most of its institutions, the single-family detached home being most at risk. The demand for apartments, condos, and cheap housing is unlikely to fall tremendously as low skilled workers and students will probably both end up in urban centers (the former eventually being priced out of suburbs and rural communities as urban and rural property reach a new equilibrium).

Second, if you are thinking of working for an urban municipality you may want to consider the steps the city has taken to protect its revenue streams. Not only will autonomous cars put property taxes under pressure but they don't need to park. In the next decade we may witness a transition from a world of parking space scarcity to parking space surplus. Cities could see significant revenue shortfalls as parking meters become irrelevant and traffic fines become harder to issue. Reductions in staff and benefits are plausible outcomes.

Third, related to the above point, if you are looking for a potential revenue opportunity start developing solutions that will help cities recapture revenue. They will be hungry for this as revenue streams come under pressure and climate change related impacts raise the costs of maintaining essential infrastructures.

Fourth, companies that specialize in providing and improving infrastructure of all types (roads, sewers, internet, and lighting) could see significant windfalls as rural communities will need to improve all of these if their populations increase.

Stay tuned for my next post, "Autonomous Cars and the Politics of Security"

Sources:

https://www.fool.com/slideshow/17-retailers-2018-death-watch/

https://medium.com/@fernnews/imagining-the-post-antibiotics-future-892b57499e77

https://www.reuters.com/investigates/special-report/usa-uncounted-surveillance/