Geico Insurance Buffalo, NY

Geico Insurance Buffalo, NY

Get to know Geico insurance agent in Buffalo.

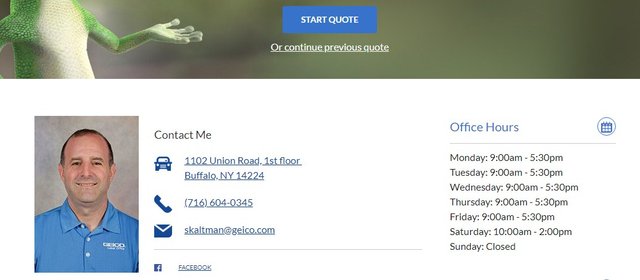

Hi, I'm Scott Kaltman. Before opening my GEICO Insurance Institute in Buffalo in 2013, I worked in the company's GEICO office in car sales, automatic claims, and home sales and services for about 10 years. Being a GEICO Buffalo Insurance Agent has enabled me to be more active in my community. My office recently worked with Crusade Against Impaired Driving, Inc. In addition, I am a member of Orchard Park and the Hamburg Chamber of Commerce. Look for me at the Hamburg Hamburger Festival, the World's Largest Sale Yard, Cystic Fibrosis kickball tournament, Buffalo Bisons baseball game and Taste of Buffalo. Like us on Facebook for updates and find out where you can go out and meet Gecko!

Scott's team will help you to find the best car insurance

We offer spectacular rates at home and insurance tenants in Western New York. Stop by or contact us and see how we can help you save by packaging your residential and car insurance coverage.

Visit us at Buffalo.

You can find the Scoot on the first floor of 1102 Union Road. We want to meet you!

Geico is the second largest car insurance company in the country with many interesting things on offer. Yes, this company is known for low rates, big discounts and easy access by all Geico customers. This company offers online access via a smartphone or by phone. So, Geico is an insurance company that is perfect for those of you who like cheap policies and you can easily manage your policies online when the agent is not near you.

There are several reasons we recommend Geico for those of you who are still confused to make choices:

Complaints about Geico are lower compared to other companies and this is evident from the median industry.

Higher levels of customer satisfaction with fast and easy claim services.

Easy access via websites and mobile applications, you don't have to bother managing policies or making claims if you understand technology.

Geico Auto Insurance Rating

Many ranked this company and Geico was ranked 13th out of 23 insurance companies included in the USA Insurance Review List as the best car insurance company with 4 stars out of 5 for satisfaction, performance and all.

We give this rating based on:

J.D. Power that provides ratings for customer service, access services, claim satisfaction and shopping satisfaction.

The report we received regarding complaints to this company was less, meaning that there were many customers who were satisfied with Geico Insurance.

The data we get from the National Association of Insurance Associations regarding consumer complaints about this insurance company is valid.

Geico Customer Satisfaction

As we said earlier, Geico has a place "above average" for the overall purchasing experience (of course car insurance) data from the J.S Insurance Shopping Study. Power’s United States 2017. This proves that the company is very consistent with the best service to its customers so that the level of customer satisfaction can remain high. Even the ranking "better than most other companies" was also obtained by Geico through the J.D. Auto Claim Satisfaction Study. Power 2017.

Geico's complaint

All insurance companies certainly have problems and complaints raised by customers who are not satisfied. Geico Insurance has "fewer" complaints regarding car insurance this year and according to the latest data from the National Association of Insurance Associations.

GEICO Financial Strength

Geico is more confident with excellent financial strength. According to the rating agency A.M Best, Geico has "superior" or A ++ financial strength and this is also evidence that the company is very good at handling claims and providing excellent claims services. So, if you want to see how far the company is able to pay the claims submitted by customers, at least you have to look at the financial strength of a company and then you can make the right decision.

Geico Car Insurance

Besides offering special car insurance, Geico also offers several coverage that you can choose, including:

Mechanical damage coverage: this means that your car will get repairs for all mechanical parts of the new car with a requirement of less than 15,000 miles and within 15 months. This coverage can be updated up to seven years or around 100,000 miles.

Roadside emergency assistance: You can add $ 14 per year to get this important coverage. Yes, it is very important because you will get roadside emergency assistance if your car experiences sudden damage such as a dead battery, requires a crane, requires gas and so on.

Auto Xpress Repair is also offered by this company to make you easier. Why? Because the claim manager will meet you in the workshop, explain in detail the repairs and will answer all your questions. If you previously had a rental reimbursement policy, Geico Insurance will pay for your rental car, always your car is repaired and this coverage is not yet available for all states.

Bottom Line About Geico

You can easily access policies through the technology offered by the company. Yes, you can do many things through a website such as making a claim or making a payment. You can also do this through a mobile application that helps you to check your policies and billing details, access your car insurance card and more.

The mobile application also allows you to do live chat with agents or request roadside assistance.

Geico's telephone number is 800-207-7847 and you can also do various things by contacting the company's telephone number. Thanks

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.nerdwallet.com/blog/insurance/geico-insurance-review/

I upvoted your post.

Best regards,

@Council

Posted using https://Steeming.com condenser site.

Congratulations @ariee! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!