Bitcoin survives the Economic Collapse, proving it has staying power (2020)

If Bitcoin was Human, you could think of it as maybe having entered preschool. The recent stock market plunge was like it's first test. And according to JP Morgan, it got an A+.

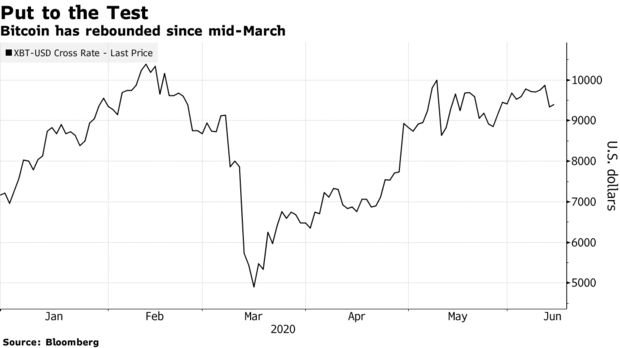

In March, Bitcoin, like the legacy market, went through a stretch of relentless testing as the Global Economy shut down and investors fled from risky assets due to the COVID-19 outbreak. But amazingly, Bitcoin emerged relatively unharmed, and according to a report from JPMorgan

“Cryptocurrency takes its first stress test: Digital gold, pyrite, or something in between?”

What's interesting to me is that more and more billionaires seemed to be flocking to Bitcoin over the last few months, amid the economic tornado that has savaged the world's economy.

Nikolaos Panigirtzoglou of JPMorgan had this to say about bitcoins resilience: “price action points to their continued use more as a vehicle for speculation than a medium of exchange or store of value.”

Many experts had predicted a doomsday scenario from Bitcoin if stocks collapsed. But Instead, Bitcoin has become much more correlated to riskier assets like equities.

It seems that this Thursday has proven that theory to be correct when the Bitcoin fell as much as 7.8% amid the worst Dow Jones slump in 12 weeks. On Friday however, it bounced back, retracing about 1/3 of the previous day’s loss. Bitcoin is now trading at around $9,500. Still, though, It’s gained almost 80% since mid-March and looks like it has its eyes set on it's old all-time high of $20,000.

A bullish sign for Bitcoin

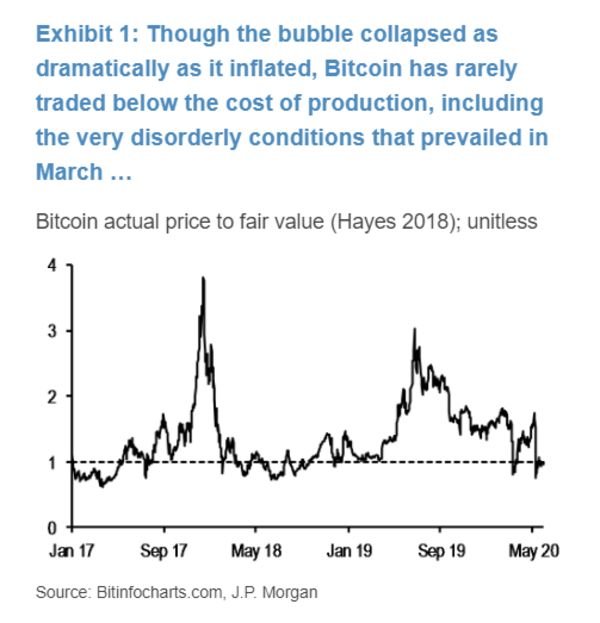

During the depth of the march catastrophic collapse, Bitcoins valuation did not diverge much from its intrinsic value, meaning that Bitcoins value only dipped below mining costs for a short time even as volatility spiked.

In addition, there were very few holders selling off their positions during the crash. In other words, during panic periods like the one we experienced cause by COVID-19, traders typically rush for safety causing a rush for the exit. But instead, most coins fell at the same rate and time period, and that correlation continues to rise.

“That suggests that there is little evidence of run dynamics,

or even material quality tiering among cryptocurrencies, even during

the throws of the crisis in March,” JP Morgan wrote.

Finally, Bitcoin's market has proved to be more resilient than many thought. Holding up even better than the safe-haven assets like Treasuries and Gold. Though Bitcoin suffered a big drop in liquidity during the peak of the crisis, that disruption rebounded itself much faster than most asset classes.