Why I HODL GME and You Should Too

Right now on my Crypto Blog many people are searching for information about the DGAZF short squeeze. I believe they are doing so to find a case study of how GameStop (GME) could play out. You are probably wondering what are the catalysts for price growth of GME?

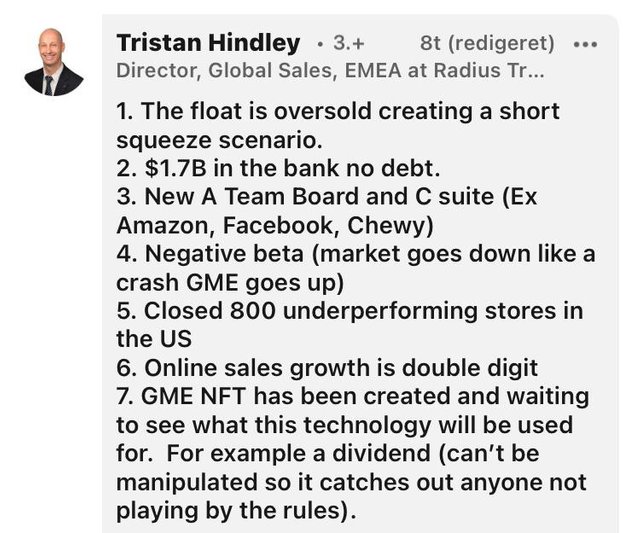

Firstly, here is a summary of my investment thesis as highlighted by Tristan Hindley on Linkedin.

In short form, this sums it up. Now I will get into more details for you:

Short Squeeze Opportunity

Hedge Against Stock Market Crash

Better Fundamentals

1. Short Squeeze Opportunity

There has been tons of talk about the short squeeze on Reddit. I suggest you do your own research and search for some of these articles yourself. The short squeeze also known as the (MOASS) mother of all short squeezes, will cause many short hedge funds to get margin called. These hedge funds are completely self serving and do little to contribute to humanity. I consider GME to be a weapon to take back some of the $4 Trillion that was stolen by big business during the 2020 lockdown. Many small businesses had to close permanently because they were deemed “non-essential”.

The number of shares short on GME isn't known precisely but may be 1000%+. This squeeze is a one time opportunity that will never be allowed to happen again by the people in control. I compare GME today to buying Bitcoin in 2014. When the shorts do cover, you can anticipate a rocket to the moon unlike anything before it. I am convinced that the shorts never covered and they have been delaying the inevitable through put options, futures and swaps. Look at the censorship by MSM regarding GME coverage. If the squeeze were not real then MSM would not be on the attack.

I have discussed the VW short squeeze and DGAZF short squeeze in another blog post. You can read about it here.

2. Hedge Against A Stock Market Crash

If you haven't noticed, commercial real estate is in big trouble because of remote workers. No one wants to work right now. This and other factors will contribute to a crash. If you stay away from MSM, many alternative media sources are suggesting a market crash. The bigger the bubble, the bigger the crash. It's hard to say exactly when this crash may occur but you can think of GME as your crash insurance. GME has a negative Beta which means GME will go up during a crash while the markets go down.

Some warning signs of a market crash are:

High P/E Ratios

Elevated Shiller CAPE Ratio

Buffett Indicator

High Leverage

Also, Wall St. has waited 13 years for retail to go all in. Meaning, this is the perfect time for the street to yank the rug out from under retail investors. Covid should have crashed the markets if they weren't so heavily manipulated by the FED. Despite the high valuations some hedge funds are going bankrupt such as Archegos Capital.

3. Better Fundamentals

If you haven't noticed, the GameStop website is being quickly transformed into a high ranking powerhouse. Seriously, as a web marketer I know that their website is improving every day. Because of their focus on the customer experience, they are delighting people with every purchase. Consumers are much happier buying from GameStop than Amazon. They also treat their employees much better than Amazon. You can expect GME to steal market capitalization from Amazon over time.

Keep in mind that I like GME when compared to other meme stocks because it's fundamentals are way better than MovieStock and others. The meme stocks are all correlated but I believe GME will come out on top. Even if the short squeeze doesn't happen exactly as planned, at today's GME price of $158.50, I don't think you can lose in the long term based on the business transformation from a retailer into a tech company. Tech companies have a much higher multiple than retailers due to network effects and other factors.

In my opinion, GameStop will become a trillion dollar tech company on par with Apple and Google. At that market capitalization, shares will cost $13K+ each. If you look at the GameStop careers page, they are hiring for many high profile roles. Not to mention the number of Amazon, Facebook and Chewy executives that have moved to GameStop. The Internet always wins and I think hedge funds will learn this hard lesson.

Some other business transformation tools to look forward to. A possible special dividend and non-fungible token (NFT) on the blockchain. The shorts will have to pay for the dividend. GME has $1.7 Billion in the bank with no debt. They have closed 800 under performing stores in the US alone which will save on rent expense. Also, online sales are growing in double digits.

In conclusion, I have included a Tweet for comic relief. Thanks for reading. Please share this post on your social media channels.

I own GME and like the stock. This crypto blog is my opinion and should not be construed as financial advice.