Delusional Bitcoin Vs Fool’s Gold

Warren Buffett says bitcoin is a ‘delusion’ and ‘attracts charlatans’

Billionaire investor Warren Buffett says he sees “no unique value” in the world’s largest cryptocurrency.

“It is a delusion, basically,” Buffett tells CNBC’s Becky Quick.

The Berkshire Hathaway CEO has been a long-time critic of crypto currencies. He called bitcoin “probably rat poison squared,” ahead of the 2018 Berkshire Hathaway annual shareholder meeting.

So, as a hedge to the dollar and other (FIAT) currencies collapsing, everyone always says buy gold, buy gold (and silver).. this sounds like a sound strategy until one considers Warren Buffet’s take on the total amount of the World’s gold — a single cube with 20 meter / 67 foot sides:

Total amount of the World’s gold — a single cube with 20m / 67 foot sides

The plan for an inevitable, mathematically certain FIAT currency (s) collapse is to return to the Gold Standard which would re-invoke the golden rule…

Max Keiser on Warren Buffet's take on Bitcoin // bubbles: "the dollar is doomed. Gold, Bitcoin will benefit tremendously": https://blocktv.com/watch/2019-02-27/5c76a340cf571-crypto-crunch-one-on-one-with-max-keiser

The proverbial plot thickens with the Supreme’s Court Alice Corp VS CLS Bank ruling that holds “claims may not be directed towards abstract ideas”. The opposite of abstract is physical — like a physical cube of gold for example:

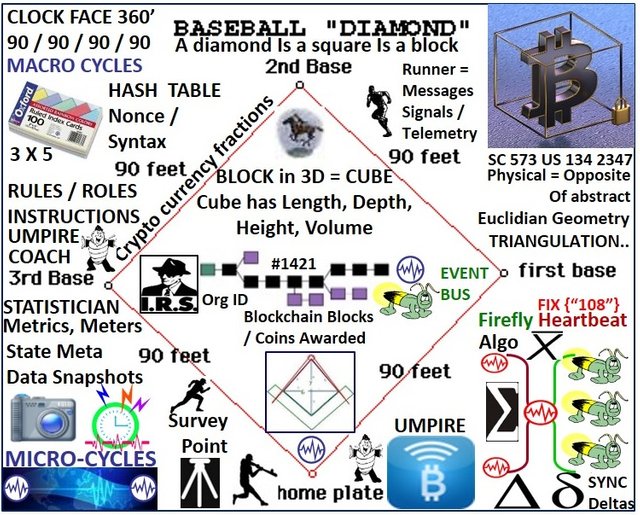

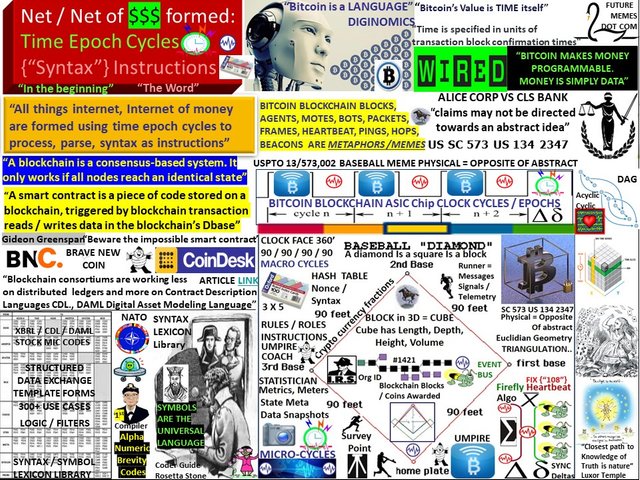

Bitcoin Crypto-currency value is stored as blocks on the "blockchain" - a metaphor / meme for time cycles - syntax

Speaking of physical value, Speaking of Alice through the looking glass and Wonderland… “It’s a new world order in the aftermath of Alice,” says Dale S. Lazar, a partner in DLA Piper’s Reston, Virginia, office. LINK http://www.abajournal.com/magazine/article/business_method_and_software_patents_may_go_through_the_looking_glass_after/

Bitcoin blockchain blocks, agents, motes, bots, heartbeat, beacon are metaphors for intervals, time cycles available to process / not process SYNTAX. The internet is coded, programmed using time cycles to process instructions, commands etc. It follows that the key to achieving consistency, interoperability among myriad memes and establishing a consistent, systemic one world economic system of systems is to focus on two main common building blocks — time cycles and syntax. USPTO applications leading up to and including application 13/573,002 establish these facts in my opinion.

Computer ASIC chips create time cycles to process syntax as instructions — period. See Supreme Court Alice Corp Vs CLS Bank “a claim may not be directed towards an abstract idea”. Alice Corp Vs CLS Bank would be turning internet and internet of money patent claims upside down — if industry started taking this precedent seriously which probably won’t happen until the Bitcoin Blockchain wars begin — in my opinion. Until then, you may want to be thinking about what physical meme you will select given physical is the opposite of abstract. Then again, the first filed physical meme isn’t as important as the most useful. The meme should have a clock convention as well as a method and means to measure and meter the Bitcoin Blockchain and therefore, survey points are necessary since the IRS has stated that Bitcoin is “akin to property” see IRS memo #1421

Speaking of tangible goods to secure the value of a currency, Thomas Edison and Henry Ford re-stated a late 1890’s proposal by economists to establish a national currency based on the value of crop commodities. In 1991, an Economist from Belgium Bernard Lietaer restated the previous Economist and Edison and Ford’s proposal calling it the TRC Trade Reference Currency

TERRA TRC Trade Reference Currency

Nobel Prize winning Economist Milton Friedman described using an index of tangibles to include gold and silver, commodities to base issuing currency in his K% Rule which should have been called an Economic Heartbeat imo

Milton Friedman’s K% Rule

Economist Milton Friedman predicted the rise of a computer capable of automatically adjusting the inflation rate of money, and this is precisely what we see in the case of bitcoin, as a regulatory algorithm intelligently adjusts the mining difficulty to make the issuance of blocks more or less easy depending on the demand for network hashing power. No money system we have seen to date can claim it is chronologically regulated. The universal construct of time is the backbone of the cryptocurrency digital economy. Investopedia K % Rule Source: https://investopedia.com/terms/k/k-percent-rule.asp

Friedman’s k-percent rule: American economist, statistician and writer Milton Friedman once posed the idea of replacing central banking institutions with a computer capable of mechanically managing the supply of money. He proposed a fixed monetary rule, called Friedman’s k-percent rule, where money supply would be calculated by known macroeconomic and financial factors, targeting a specific level or range of inflation. Under this rule, a central reserve bank would have no leeway as money supply increases could be determined by a computer and the market (and its citizens) could then anticipate all monetary policy decisions. Will we ever see Friedman’s computerized banking institution put into action? Considering the mining network is the closest thing to an authority within bitcoin, and mining will only get more specialized and thus centralized in the future, we may well already be on the path towards it.

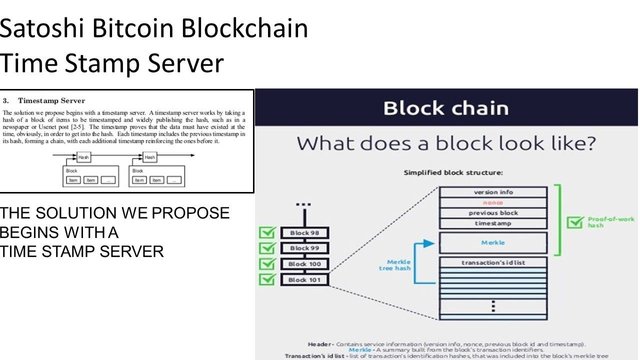

Satoshi Nakamoto’s Bitcoin key building block is a time stamp server. Satoshi Nakamoto: “Bitcoin is intended to be paired with the market place” “the blockchain stores references to market indexes” Globalization involves multi-national corporate entities vying for control of regional resources. It follows that a proven strategy to identify, track, and monitor resources in the global economic matrix is needed.

Bitcoin cryptocurrencies as programmable money and the internet’s heartbeat, heartbeat messages timed to harvest data during micro economic cycles then aggregated into a composite economic heartbeat pulse as Economist Milton Friedman’s K% rule is a clear and present opportunity for trade equity and economic system of systems stability.

Ecologically sustainable Economic Heartbeat

J.P. Morgan to Tesla “Where do I put the meter”?

BBC Article Buffet on world’d gold supply LINK https://www.bbc.com/news/magazine-21969100

CNBC Article Buffet opinion on Bitcoin: LINK https://cnbc.com/2019/02/25/warren-buffett-says-bitcoin-is-a-delusion.html

MEDIUM ARTICLE: Delusional Bitcoin Vs Fool's Gold: https://bit.ly/2Xp3aAl

https://medium.com/@heart.beacon.cycle/delusional-bitcoin-vs-fools-gold-e4bea26afba8

Congratulations @beaconheart! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Enjoy the free vote! I hope you continue to enjoy your time here in this wonderful community we call Steemit!