13 reasons why to own gold after breaking above $1300

Gold is showing decent strength going into the end of summer breaking above strong psychological and technical level of $1300 per ounce which can finally confirm the beginning of long-term bull market. At the same time, gold reached new highs for 2017.

There is no lack of fundamentals supporting the move upwards. But as gold traders got used to during recent years, the "fat fingers" smashing gold to the downside during ridiculous trading hours in low liquidity markets has no limits. So I always remember the old saying used by many long time traders, "Markets have the ability to stay irrational longer than our accounts solvent".

Following are 13 main drivers of the coming long term precious metals bull cycle:

- Unlimited quantitative easing by all major central banks with no end in sight.

- Bond market long term bubble supported by artificially suppressed interest rates.

- Stock market bubble supported by easy money and stock buybacks.

- Geopolitical risks at the record high and still growing.

- Algorithmic trading systems accounting for the majority of liquidity in many important markets.

- Fake accounting of real losses in the banking system.

- Housing market bubble re-created by long-term interest rate suppression.

- The bankruptcy of many countries and states worldwide is slowed down only by central bank interventions in many markets.

- Central banks propping up the stock markets.

- Derivatives markets risk not addressed by any monetary institution.

- Lack of responsible behavior by many major world leaders.

- Media outlets spilling propaganda about the real state of affairs and economy.

- Crypto currency fans have the same motivations as precious metals investors.

The list can continue, but is sufficient to understand why many smart investors and families continually invest in precious metals for wealth preservation. With more debt and debased currency you can create nominal growth you like for a very long time but you just can’t replace wealth generation. This realization is probably the strongest factor that will be supporting the gold success story in the future.

But the shocking part is that I can't see any real and honest efforts to resolve the above mentioned issues. So every year that we witness postponement of dealing with it, helps accumulate more pressure in the gold market. And we all know when the pendulum starts to move from one extreme, it almost never makes a stop in the middle but swings to another extreme. In western world, the wealth holders of today didn't witness this situation for several decades.

Gold price technical picture

Gold is looking technically well positioned, having tried to break above the 200-day moving average 4 times this year. For the past 30 days, we were moving above all of the commonly watched averages, 50, 100 and 200-day moving average.

Also, we can see some most basic long term buy signals like the crossing of the 50 and 100 day moving averages above 200 MA. All of the averages were retested several times in the past few month so gold is free to move up.

$1300 level in gold marks the April and June top of the market and it is the price where we oscillated right before Donald Trump was elected in November 2016.

On 28th of April gold broke this important barrier. What is more important gold was able to reach $1325 and close the session above $1300 and hold there two consecutive session what may be a confirmation of true break-out. It is expected that there will be at least one if not more attempts to retest this level from above.

Interesting news for gold investors from around the world

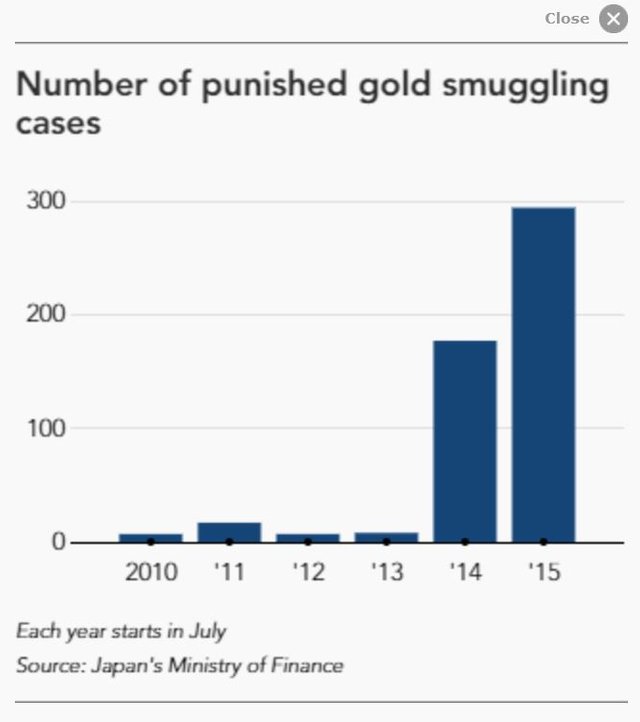

Gold smuggling into Japan rising exponentially!

Suddenly there was a need to publicly present that gold is still in Fort Knox.

The American public is so lucky it can take the word of a former Goldman partner who would be only the third secretary of the Treasury to go inside the Fort Knox vault since it was created in 1936 by President Franklin Delano Roosevelt.

Germany repatriated gold from US ahead of schedule!

Why such a rush to make it 3 years ahead of schedule?

Germany's repatriation of 674 tonnes of gold - or 53,780 bars of gold - is complete, lifting the amount of gold held domestically to 1,710 tonnes or 50.6% of the total. Going forward, Germany will still have 1,236 tonnes held at the NY Fed, and another 432 tonnes of gold at the Bank of England.

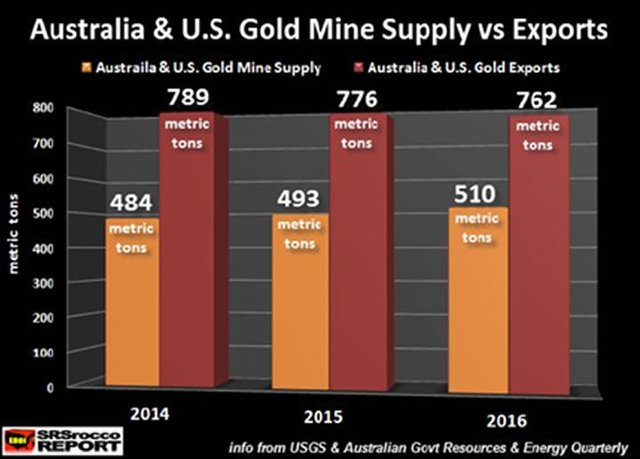

Gold production has fallen 2 percent in the first five months of 2017 from the same period a year ago, Hynes added, citing data from the World Bureau of Metal Statistics. Production in the month of May alone was down 3.1 percent from a year ago.

Which is lowest mark for global gold production since the financial crisis of 2008.

According to the World Gold Council, total bar and coin demand grew 13 percent in the second quarter of 2017, driven by a strong 56 percent increase in Chinese demand.

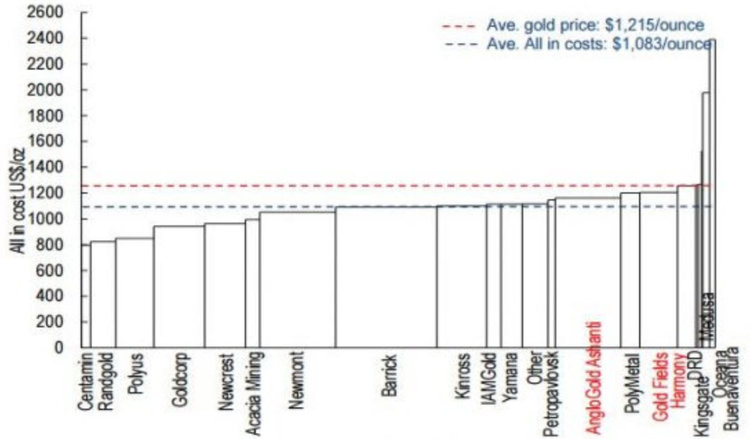

Gold production costs not attractive for new mine development!

Today’s prices (red dotted line below) are not much above production costs for a majority of mines. The average mine pays $1,083 to pump out an ounce of gold, leaving a couple hundred dollars of profit at current rates.

The chart below shows the global cost curve for gold mining — in terms of all-in costs. That includes operating costs, sustaining capital at mines, and development costs to bring new ounces of production online.

That equates to under a 20% profit margin. Not terrible, but not likely to spur a lot of new mine development.

Commitment of Traders (COT) Reports Now Fairly Bearish For Gold And Silver!

In gold especially, speculators (always wrong at big turning points) have loaded up on long futures contracts while closing out their short positions. The commercials (always right at big turning points) have done the opposite, closing out long positions and going aggressively short.

Another point that bears repeating is the temporary nature of this indicator. Eventually, fundamentals in the form of surging demand for physical precious metals will swamp the paper market. Gold and silver will soar regardless of which futures players are long or short.

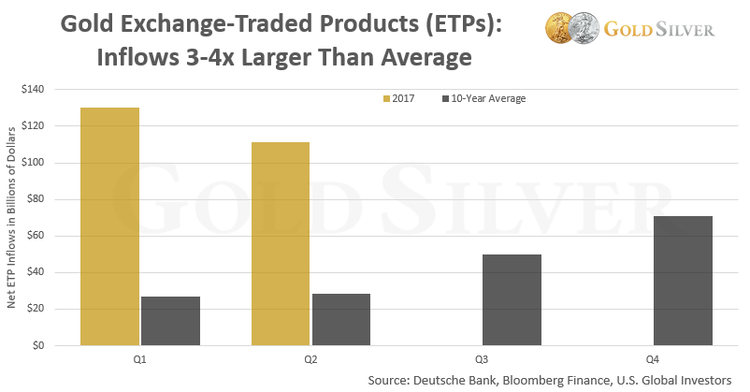

This clearly signals that institutional investors—the primary buyers of gold ETPs—see a crucial need to have exposure to gold.

Will the world awaken to gold this winter?

We are coming close to the end of summer and with the break above $1300 level, we put the first dent in the 6 months sideways movement of gold. I expect gold to continue in an upward trend from here and hold above $1300.

Not because the negative trends in economy and world society are new to anyone interested in gold, but other investment opportunities are getting so limited and crowded that even gold can become a savior for masses looking for wealth preservation and profit. Everyone needs to remember that gold market is so small that even small money relative to bond and stock market can move it up pretty quickly.

Holding physical gold, high-quality gold junior miners, or mineral banks is a way how I prepare myself to profit from current market situation.

Still what surprises me most is that I often find recommendations even from gold bugs to hold around 5-10% in gold exposure. I don't really understand why would I hold such a small exposure considering the issues facing the world. Facts supporting reasons why people invest in gold mentioned in the beginning threaten the stability of almost every major market. So why would I want to be exposed to these other markets more than to gold?

Let me close with the legendary mining investor, Eric Sprott.

To find the value you have to look where other people aren’t looking.

Congratulations @chartist! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @chartist! You received a personal award!

Click here to view your Board of Honor

Do not miss the last post from @steemitboard:

Congratulations @chartist! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!