Will gold go up further?

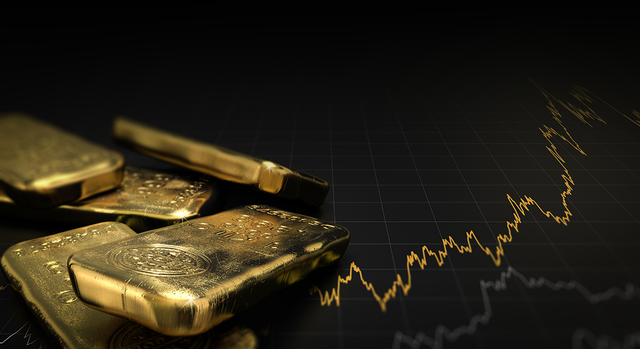

On September 13, gold prices exceeded $2,600 for the first time in history: on the Chicago Mercantile Exchange (CME), quotes for the December futures contract rose by 0.79%, reaching $2,600.9 per troy ounce. Since the beginning of the year, driven by growing expectations of an imminent cycle of rate cuts by the Federal Reserve, the price of the main precious metal has already increased by more than 23%.

A second driver of the gold market rally is the increasing demand from global central banks. According to the Gold Return Attribution Model (GRAM), gold has risen due to a significant drop in the US dollar and, to a lesser extent, due to the decrease in yields on 10-year Treasury bonds, as the Federal Reserve hinted that the time for rate cuts had come.

It is also worth noting that in August, India's import duty on gold was significantly reduced, following a change at the end of July, which spurred a revival in gold demand in the country. There is speculation that this reduction led to strong buying interest from jewelry retailers and consumers.

Outlook

The current macroeconomic situation is difficult to assess due to the flow of conflicting economic data. The results of the upcoming US elections are adding significant uncertainty, likely leading to more investors expressing their views through the options markets.

Globally, the top-line data still looks quite good. GDP growth is at 2.5%, and composite PMI indices remain positive. However, the services sector, which accounts for the majority of output, supports these figures, masking the fact that manufacturing remains in some decline, particularly in Europe and China.

A soft landing for the US economy still appears to be the most likely scenario, especially considering that Federal Reserve Chairman Jerome Powell, in his annual speech at Jackson Hole, laid the groundwork for a series of rate cuts.

It's only speculation how broader macroeconomic data might affect market reactions, but it seems likely that both the dynamics of the US elections and expectations of Fed rate cuts have increased activity in the gold market. Under such circumstances, it is reasonable that investors are more focused on short-term prospects. Their behavior suggests they view gold as the primary hedge asset against immediate event risks, while also positioning it as a beneficiary of lower interest rates.

Outside the US, the ongoing slowdown in China is likely to impact consumers' ability and willingness to buy gold—especially when it comes to jewelry. But even Chinese gold ETFs faced outflows last month, unlike the growing demand for Indian ETFs and the much-anticipated return of inflows into Western ETFs.

Nonetheless, most market participants expect further growth in gold prices. For example, analysts at Goldman Sachs (NYSE: GS) expect gold to rise to $2,700 by the end of this year, while strategists at Bank of America (NYSE: BAC) predict gold prices could reach $3,000 per ounce. In their view, the price of the precious metal could reach this level within the next 12–18 months. This could happen if US interest rates decline and demand from large institutional investors increases.

In the short term, the target for price growth now seems to be the $2,640–2,660 range, although an unexpected obstacle could be the start of profit-taking after years of growth, which has been supported by expectations of a Fed rate cut.

Website : https://gold.storage/

Whitepaper: https://gold.storage/wp.pdf

Follow us on social media:

Telegram: https://t.me/digitalgoldcoin

Steemit: https://steemit.com/@digitalgoldcoin