Cryptocurrencies vs gold

Article after article there are authors pointing how crypto currencies and gold are very similar assets, either bulking them together as similar investment asset, or looking for differences between them to point which one is better.

The reality is that those two assets should never be compared because they are far too different assets to begin with, one is on the forefront of human science and technology and the other one has not changed much over past few thousand years in terms of use. Its like comparing a car with bridge, two different functionalities of objects, that do share few similarities like many other objects, but in the end have very different use. But then again, its possible to point out differences, just to show how different those two assets are in the specifics and variables that they do not share. Usually austrian economists will point to Bitcoin and gold as equally worthy investment as they share similar variables, the reality is majority of market in crypto currencies is not sitting there due to those variables, but completely different uses that crypto currencies provide.

Transaction use and cost

Transaction costs of those two assets are very different, especially when comparing low fee crypto currencies like certain alternative cryptos which allow fees to stay within range of 0.1%-0.5% of transaction fees.

Transaction fees of gold (buying and selling, or use of certain credit cards that are linked to gold deposits) are far larger, usually well above 2%, and buy premiums ranging even up to 10% in some countries.

Liquidity

When it comes to actually liquidating assets, those two cannot be compared, since selling gold can often be long process, which is reliant on physical travel to store or person, while on other hand crypto currencies that are sold over decentralized exchanges can be sold efficiently within seconds or minutes.

Chances are that you might not be able to sell gold to store or person if there is no agreement on price/premium/fee, or if there is weekend coming around which leaves many stores closed, another example might be financial crisis, where stores could be closed, go bankrupt or simply not willing to sell any due to holding for higher price.

Decentralized exchange of cryptos allow trader/investor/user to always have chance to liquidate position when he or she wants.

Trust and reliability on third party

Putting gold in safe deposit of company, bank or any other individual always comes with risk of trust. Company can go bust or there are many other reasons why it could harm the potential holder of assets that trusted it to that company. While it is true that centralized crypto exchange can go bust too leading to loss of assets for holder, it is not the way crypto environment was meant to be set up. Each holder should take care of his / her holdings on personally controlled wallet, which prevents third party risk. As long as this is done, third party risk is decreased down to 1% (leaving only theft and hacking as possibility, or loss of password).

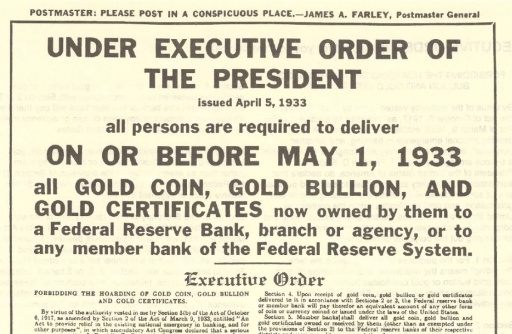

Risk of confiscation

Simply there is no way preventing goverment to confiscate gold holding of any asset holder in the world, it has happened many times before in history that confiscation took place, mainly due to fact that goverment had insufficient funds to further fund the operations. Its an external risk that gold asset holder can never be fully protected against.

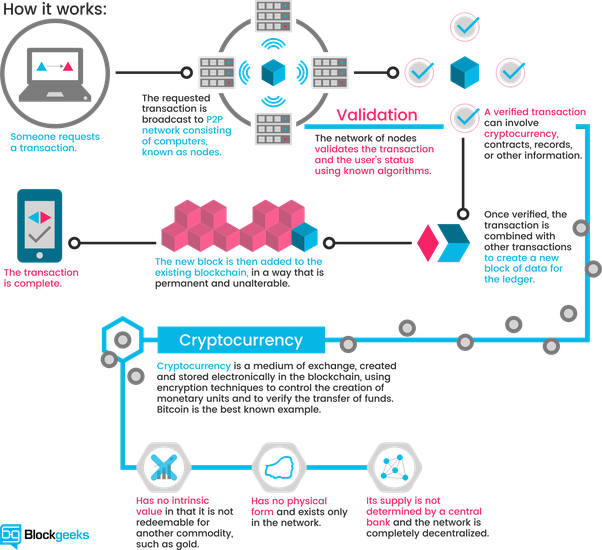

Crypto currencies are distributed on decentralized protocol, which means that for goverment to confiscate it would be very difficult and un-practical process, it would be just as difficult as shutting down crypto currency, its doable theoretically but practically not really. Shutting down internet and seizing every computer in existance would cause unimaginable cost to worlds economy, and it would just never happen. Without doing both of those actions it is not possible to force confiscation or destruction of crypto assets.

1933 confiscation is often used as primary case example, but the fact is that there were many more confescations done in much higher frequency in history, especially looking at era between 500 BC to 1000 AD. This historical pattern still exists, and it could just as well happen in near future without anyone guaranteeing against it.

Transparency of transactions

Crypto currencies allow for great transparency of transactions that any user can access very easily. And on other hand also allowing market of currencies that have intentionally very hidden transactions allowing for specific market to access them.

Gold is however not 100% in either of those two extremes which means that transactions cannot be completely hidden nor can they be completely transparent to fresh user of monetary system (takes a use of banking functions or check of balance sheet of company to fully track the transaction).

Division into small parts

From business perspective it is very practical to give consumer or product provider ability to buy or sell as low quantity of products as possible, and to cut currency into small pieces with little problems as possible. It is no surprise that the number of new small business that are created each year are 100 times higher in use of crypto currencies than use of gold as mean of payment. While gold can be splitt into small parts, its simply not practical. Creating 1 mm pieces of gold to pay for single product is simply not a fashion that any business wants to adopt in 21st century, it was used centuries ago simply due to having no alternative better way to do it, but with age of technology its far more efficient to use digital currency that can be divided into far smaller pieces, and the most important point...without creating large negatives by doing that.

One can still use fiat currency or gold to handle small transaction, but nobody likes to carry around 10 kilograms of coins in order to settle all needed transactions. And let me not even get started on new 3 EURO coin and its size....

Most crypto currencies can be divided into parts far smaller than 1 cent of fiat coin, and tousand times smaller than smallest useful chip of gold, making it very efficient to handle low transactions and to handle very small purchases and micro transactions in general. Micro transactions are very underrated concept in economic system and yet extremely powerful if done correctly. 100.000 people contributing 0.0001 USD equals can pay for quick small loan or service to some person, the costs of donation or payment are tiny to sender, but they mean a lot to reciever. With current fiat currencies it is simply not possible to send such small payment, let alone gold. I believe micro or nano transactions will be the future of economic system allowing for very fast liquid investments and startups, or simply donations. Crypto currencies are moving towards it extremely fast, no other asset really can grasp that area simply due to unability to split it into low required parts.

Main differences, the use cases

Now while i did do some quick points to compare both assets, really the main point of this article is to point how use cases actually separate those two assets on completely different ground, and point that the use case for each is different.

In general often those two assets are compared due to austrian economists that are generally interested in both of them due to certain shared charasteristics (limited supply, no control of central goverment over assets, ...), but what really separates them is the majority of market use, not specific minority of people pointing out the common shared variables. The reality is that majority of market that uses cryptos are not interested or invested in gold at all, nor interested in the positive variables of it, this is the fact that currently is forming larger portion of 100 billion crypto market.

Traditionally gold was used as inflation hedge, in past few decades the use of gold is mainly coming down to hedge against heavy risk events such as spikes in probability of financial crisis or war. Big players in financial markets are especially buying gold when it comes to strong risk events, which leads to strongest moves.

Chart bellow shows pretty strong move initiated in gold from risk events that happened in last few days in Middle East.

Use cases for generally the largest move in crypto currencies come from technological use, and not hedges against any risk on or risk off events. Updates to technology of coins, general improvement of use is what creates the largest surges of price, which makes those two assets perform best on two completly different basis of events.

Chart bellow shows crypto asset that performed with strong surge due to updates it had released for its technology and general use.

Crypto currencies can be effectively used to hide transaction completly, using liquid currency to hide transactions such as Monero coin, or on completly oposite side providing very easy to see completely transparent transaction overview on blockchain. This opens the use of two completely different markets to crypto currencies, the ones who want strong privacy on transactions and those who are looking for complete transparency.

The value of each asset is the community that is willing to use it and agrees on the use. It is very commonly misunderstood where the value of assets such as gold comes from. Just becouse some asset has limited supply it doesnt mean that its price is set in stone to go higher every year, nor does its quallity of being shiny determines its whole value. In general is if community agrees that certain variables of asset are useful and solve problems it has value.

Gold has limited supply with very low increasing supply from mining, and pretty decent demand year on year. It has shiny look with nice colors which creates demand from the use of jewelry or items in architecture, it also provides far better store of value than holding large warehouse of assets since gold material does not age. There are many other variables that simply solve problems to part of community, which is why gold still has value today.

The values and problem solving of crypto currencies are however by majority very different to the ones of gold, which drives to the point on start of article that this long term values is what separates the use and increase of values of this two assets very differently.

Future possibility of price increase of whole crypto currency market is far higher than gold simply due to the fact that crypto currencies solve much more problems for society than gold does.

Blockchain and new upcoming technologies that solve further problems

The possibilies of blockchain are massive. Thousands of systems that currently operate on centralized workflow could be much easier and far more sufficiently distributed and shared on blockchain technology, solving massive amount of problems to humans that are willing or need to use them. This basically leaves gold miles and centuries ago in terms of problem solving, since there is very few new problems that are solved around gold use every year. The main problem solving does not come from each crypto currency itself, but the blockchain that really has potential that cannot be compared by any technology that exist at the moment.

Lets list some problems that blockchain protocol and certain crypto currencies around it solve, opening 1000 times larger capital influx and problem solving potential comparing to gold. Those are fact based, gold as asset simply does not allow technology or system in order to solve those problem on its own:

-99% profit distribution to content creators, artists especially (Musicoin, SNGLS), touching industry of many billions of USD in yearly value

-prediction markets, distribution of decent statistical reliability of questions of future events (Augur, Gnosis), opening gates of massive market from betting side, from information side, hedging etc

-decentralized distribution and exchanges (DCOPR, Bancro, NEM), including all current major centralized exchanges such as Nasdaq, all major crypto exchanges, all major FX brokers, this opens gates towards hundreds of billions of capital, and milions of people looking for higher liquidity, lower fees and better executions, solving many problems at once.

-Computer power sharing (SONM, Golem), solving problems of milions of people not being able to play demanding games, rendering heavy output from GPU, doing demanding CPU research for science, plenty of capital, plenty of problems solved, plenty of users

This list could go on and on, and this is the point where it comes absolutely needles to compare asset of crypto currency to gold, simply gold has no mean or technology behind it to solve the mass of problems that crypto currencies and blockchain actually can solve.

Lets count some variables that solve and help problems of society that crypto currencies do compared to gold, giving it far higher value.

-speed of transactions

-safety, no need for third party thrust, additional strong password protection of assets

-providing technological advances

-decentralized market places

-micro transactions

-low cost of transactions

-24/7 market, no down times

-massive amount of capital in online business ready to use cryptocurrencies to use all above advantages in their business

-no need for banking or any storage account

-being active member of economy, use of user to user lending, complete control over interest rates, routing transactions over different users to decrease costs

Its always important to remember the value of each asset comes from community using it and agreeing that there is actual good case of use. No specific variable alone can set the value of asset high, if community and users dont find that particularly useful. And every asset on planet is in direct competition to other asset that holds similar valuables. Historical use is not guarantee for future, especially not when technology is around, technology is one of the largest trend distrubters in human history, changing trends of historical use faster than anything before.

Both are similar assets in that they represent an asset held outside the beaurocracy. However, currently gold in not outside of beaurocratic and central bank influence as cryptocurrencies are (but don't be surprised to see central banks beginning to acquire cryptocurrencies so that they may attempt to control it as well). One main difference for me is that it is probably dangerous to have gold in your possession in the wold we live in today. Also, ease of use and fractionality, as you suggested, are huge advantages for cryptocurrencies.

older generations definitely prefer gold over crytocurrency lol

Well it doesnt come from rational perspective of comparing those two assets, generally older generations prefer them becouse they do very little research on technology, and assume that main advantage of crypto currencies are the shared variables they have with gold, which is exactly what i pointed in article is what one should NOT do.