Nothing wrong with gold in backwardation.

For many years there are stories making rounds in the blogosphere that whenever gold is in backwardation "this is not supposed to happen" because it opens up a "risk-free arbitrage". In a market that is not manipulated, the arbitrage would be jumped immediately and so backwardation is a signal of manipulation (or lack of trust in futures markets) and shortages in the physical market - or so the story goes. I won't address all theories by the story tellers related to price manipulation in this micro-blog, but let's have a look at the alleged "risk-free arbitrage" and see why this argument is false.

Backwardation means that futures price are lower than the spot price. In such a scenario, traders can sell spot and buy it back through a futures contract to make a profit. Sounds logical doesn't it? Alas, there is more to it.

As we know (or read this if you don't know https://www.bullionstar.com/blogs/koos-jansen/gofo-and-the-gold-wholesale-market/) the forward curve of a currency is a reflection of interest rates. For gold, denominated in USD, the forward curve is determined by gold's interest rate (the gold lease rate, GLR) and the US dollar interest rate (LIBOR). The formula is:

Gold forward rate ≈ LIBOR - GLR

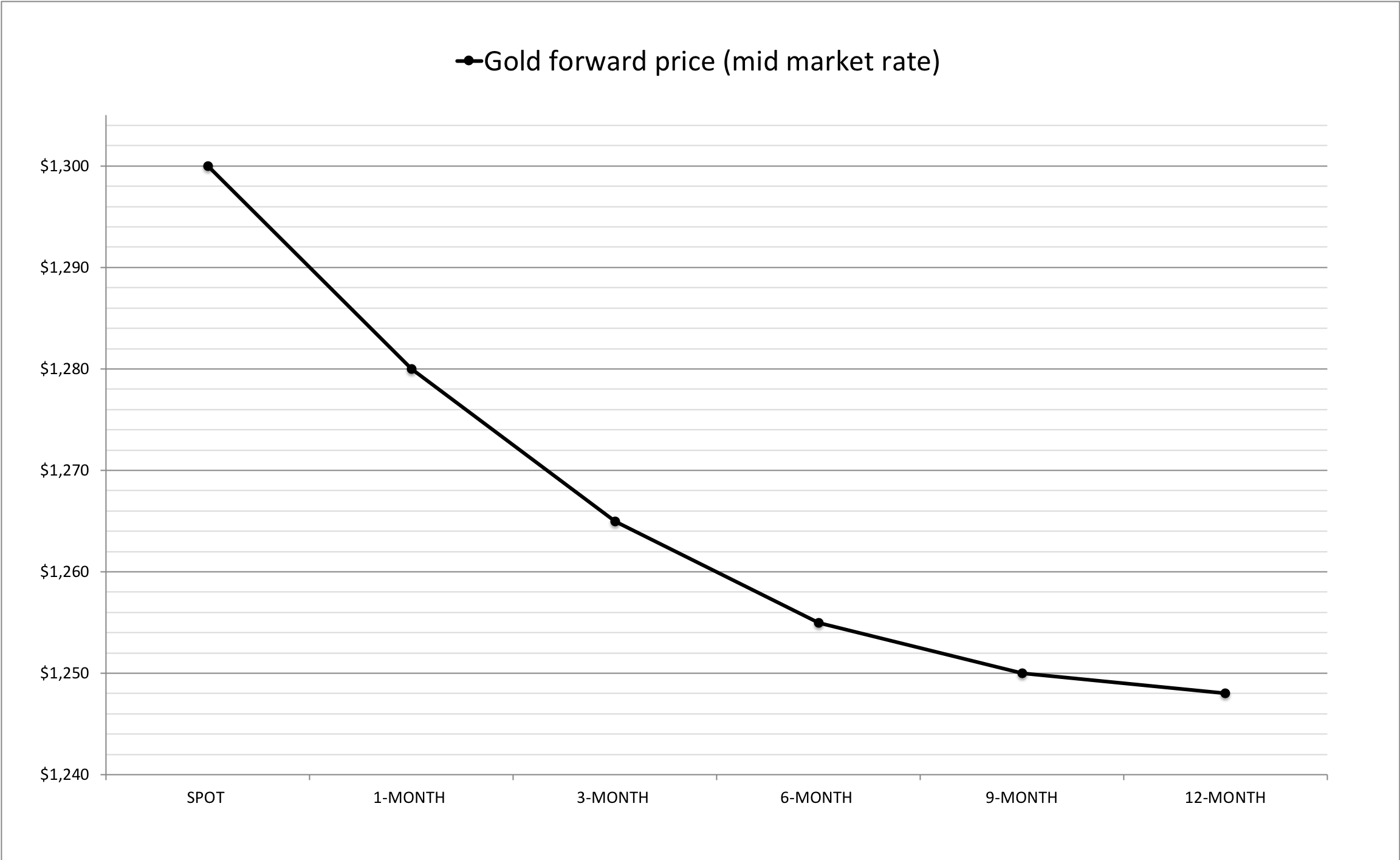

In the example gold futures curve above we can see spot gold is $1,300 per troy ounce and gold 12-months out is $1,248 per troy ounce. The curve is obviously in backwardation. The 12-months forward rate (the forward price relative to spot in percentages) in this example is - 4 %, LIBOR is 2 %, and GLR is 6 %.

In the formula it looks like this: - 4 % = 2 % - 6 %

According to some analyst gold backwardation opens a "riks free arbitrage" possibility by selling spot and buying forward. Suppose we want to execute this trade within our example.

- We borrow 100 ounces of gold at 6 % (GLR). In 12-months we need to repay the principal plus interest which is 106 ounces.

- We sell spot 100 ounces of gold for $130,000 and deposit the dollar proceeds at 2 %.

- We buy a futures (/forward) contract for 106 ounces 12-months out.

12-months later…

- Our dollar deposit has grown into $132,600 (1.02 * $130,000).

- With our USD funds we can take delivery of 106 ounces. The total price to pay is,

106 * 1,248 = $132,500

What?! There's nearly no profit? Only $100 which can be neglected if you add in transaction costs etcetera. How is this possible? The simple explanation is that my example is a no-arbitrage condition. If the formula "gold forward rate ≈ LIBOR - GLR", more or less holds there can be no profit.

The story tellers say that backwardation still shouldn't occur because if someone already owns gold (instead of having to borrow it) he could make a profit. Let's go through the math. Suppose I own 100 ounces of gold and want to execute the trade.

- We sell my 100 ounces at $1,300, pocketing $130,000 and deposit the proceeds at 2 %.

- We buy a futures contract for 100 ounces 12-months out.

12-months later…

- Our dollar deposit has grown into $132,600 (1.02*$130,000).

- With the USD funds we can take delivery to buy back my 100 ounces. The total price to pay is,

100 * 1,248 = $124,800

Now we have some profit,

$132,600 - $124,800 = $7,800

So, did we really make a "risk-free" profit? If you think about it, what we did is sell gold and buy it back after 12 months. From another angle, we lend it out for 12 months and made $7,800. But if we had lend gold out directly in the lease market at the prevailing rate (6 %) we would have made exactly the same amount of dollars.

Often gold loans are settled in dollars. At the start of the loan the amount of dollars agreed as interest is the gold interest multiplied by the spot price. If we had lend out 100 ounces at 6 % the gold interest would be 6 ounces times $1,300 is $7,800.

100 * 0.06 * 1300 = $7,800

If one owns gold and the gold futures curve is in backwardation, the profit to be made by selling spot and buying forward will be exactly the same as leasing one's gold out directly. Both trades boil down to the same time thing: lending gold out. We know that lending out money comes with the risk of default for which the lender is compensated with interest. In this post we've seen that it doesn't make a difference if one lends out money (gold) directly through the lease market or indirectly through the futures market.

The argument that gold backwardation shouldn't happen because it should be arbitraged (risk-free) away is not true, because the futures curve simply reflects interest rates.

If you look at the futures curve of the Indian Rupee, denominated in USD, http://www.cmegroup.com/trading/fx/emerging-market/indian-rupee.html you'll see backwardation simply because the Indian Rupee interest rate is higher than LIBOR.

In conclusion, there's nothing unusual about currencies in backwardation in my opinion.

nice article, Thank you!

koosjansen looks like you copy / pasted some content of this post from this article:

seven day black and white challenge day 2 - @annadeda

Please consider to avoid plagiarism!

Congratulations @koosjansen! You received a personal award!

Click here to view your Board

Congratulations @koosjansen! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!