Origins of the Manipulation of Gold and Silver Prices

Much has been said about the current manipulation of Gold and Silver prices today by the big bank like JP Morgan and HSBC, as well as by the LBMA and Comex. In this article, we would like to demonstrate that the manipulation of these prices is nothing new. The greed of the rich know no bounds.

Gold and Silver have been a store of wealth throughout history. As far back as around 2000 BC, these precious metals were a prominent form of wealth (Genesis 13:2). Around 650 BC gold and silver were first minted into coins of equal weights in Lydia (in Western Turkey). Each coin looked the same and was interchangeable.

Not long after, in the free market of Athens, Greece, the use of gold coins exploded. For over 100 years, this worked great. Athens monetary problems began when they went to war against Sparta in 431 BC. First they lost access to their gold and silver mines. Also, they were paying armies on foot, many miles from home. Athens found themselves running out of money. To increase the coin supply received from taxes, the government melted down the coins and mixed in 50% copper into a new coinage. This doubled the amount of coins. However, over time, people held on to the older 100% gold coins and only spent the cheaper coins mixed with copper. Eventually these coins became 100% copper and lost value through inflation. Because of this currency manipulation, the Greek money lost value and in 404 B.C. Athens surrendered to Sparta and became a satellite of Rome.

Ever heard of the story of Jesus overturning the tables of the money changers? The Jewish religious leaders levied a Temple tax levied, which had to be paid in a particular kind of money called the "shekel of the sanctuary." Last coined in 140 B.C., it was quite scarce at that time and sold at a premium. Through currency manipulations these corrupt leaders were swindling the people. With righteous indignation, Jesus overturned their money changing tables and exposed them as “a den of thieves.” (Matthew 21:12-13)

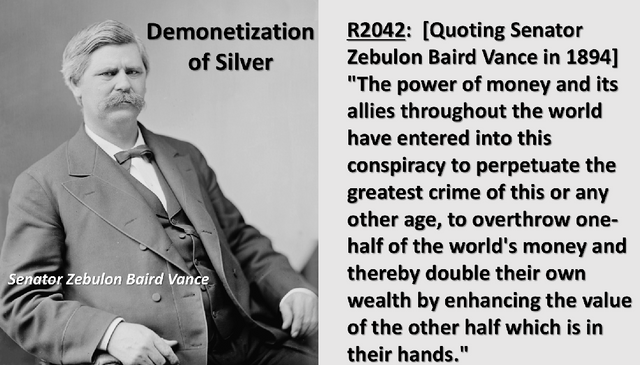

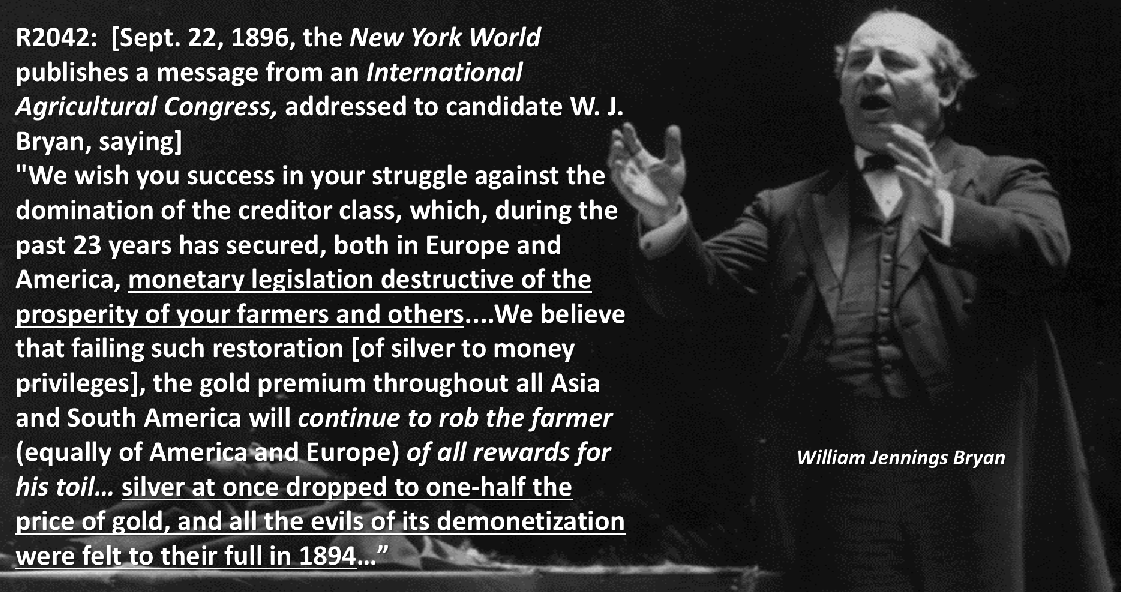

The bankers deceived legislators around the world to demonetize silver and thereby double their wealth.

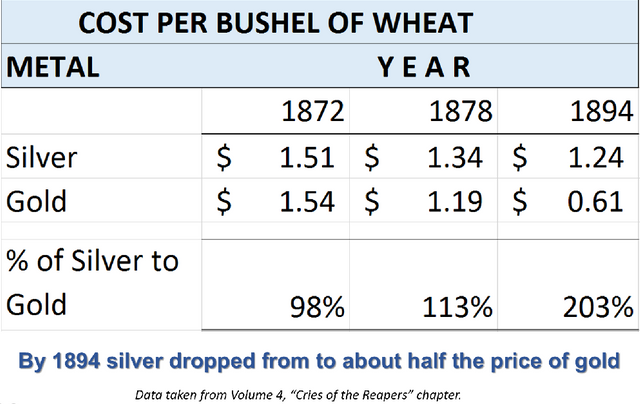

Russell continued to say, “Philosophers, statesmen and scientists have… very generally have hastily come to the conclusion that every fall in price of wheat is wholly the result of "overproduction." Next Russell cites statistics showing that production declined over a ten year period, hence the real cause was the demonetization of silver in 1872. We have compiled this data into a chart for ease of understanding.

.

.

Farmers worldwide were suffering the consequences of the demonetization of silver, which made the wealthy and the bankers who held gold twice as rich, but as for the farmers and many others, their wealth was cut in half. So the conventional wisdom of “over production” was not the truth and mislead the public.

The next chart shows that in 1872 it was cheaper to buy wheat with silver. You could buy that bushel with silver for only 98% of what it would cost you to buy it with gold. By 1894 it cost twice as much to purchase wheat with silver, meaning the value of silver was cut in half. You could only buy that bushel with silver for 203% of what it would cost you to buy it with gold.

Today, through fraud, the banking systems (JP Morgan, HSBC) sells hundreds of paper stock all representing the same one ounces of silver or gold. This is all done to suppress the price of silver and gold so that people will stay in the depreciating paper currencies. The LBMA and Comex fraudulently accept this scam and arrive at low prices for these precious metals. If true price discovery were allowed in a real free market, the value of gold and silver would shoot to the moon while the currency values of paper currencies around the world would crash. If there is enough interest, we would consider doing a part 2 showing the the more current history of manipulating the price of silver and gold and why we are nearing the end of this scam.

For Part 2 on the Manipulation of Gold and Silver Prices today, go to this link: https://steemit.com/gold/@nicodemus/bankers-suppress-the-prices-of-gold-and-silver-in-the-futures-markets

good read awaiting part 2, thanks

Cryptowizard,

Thanks. If I can find the time, I will do a part 2. Thanks for the encouragement.