Gold – A Commodity, Currency, or Pet Rock? by Roy Sebag

It is common for financial pundits to categorize gold as just a commodity. It is not. Commodities generally have value only to the extent that they are effectively consumed either directly, or indirectly via various industrial processes. This is largely the case even with gold's sister silver, which does tarnish and, in modern times, has found numerous major industrial applications that place it beyond practical recycling. Industrial metal stockpiles generally can be expensive to maintain and the costs of recycling metal scrap can be prohibitive. Agricultural and other 'soft' commodities are consumed essentially entirely as food.

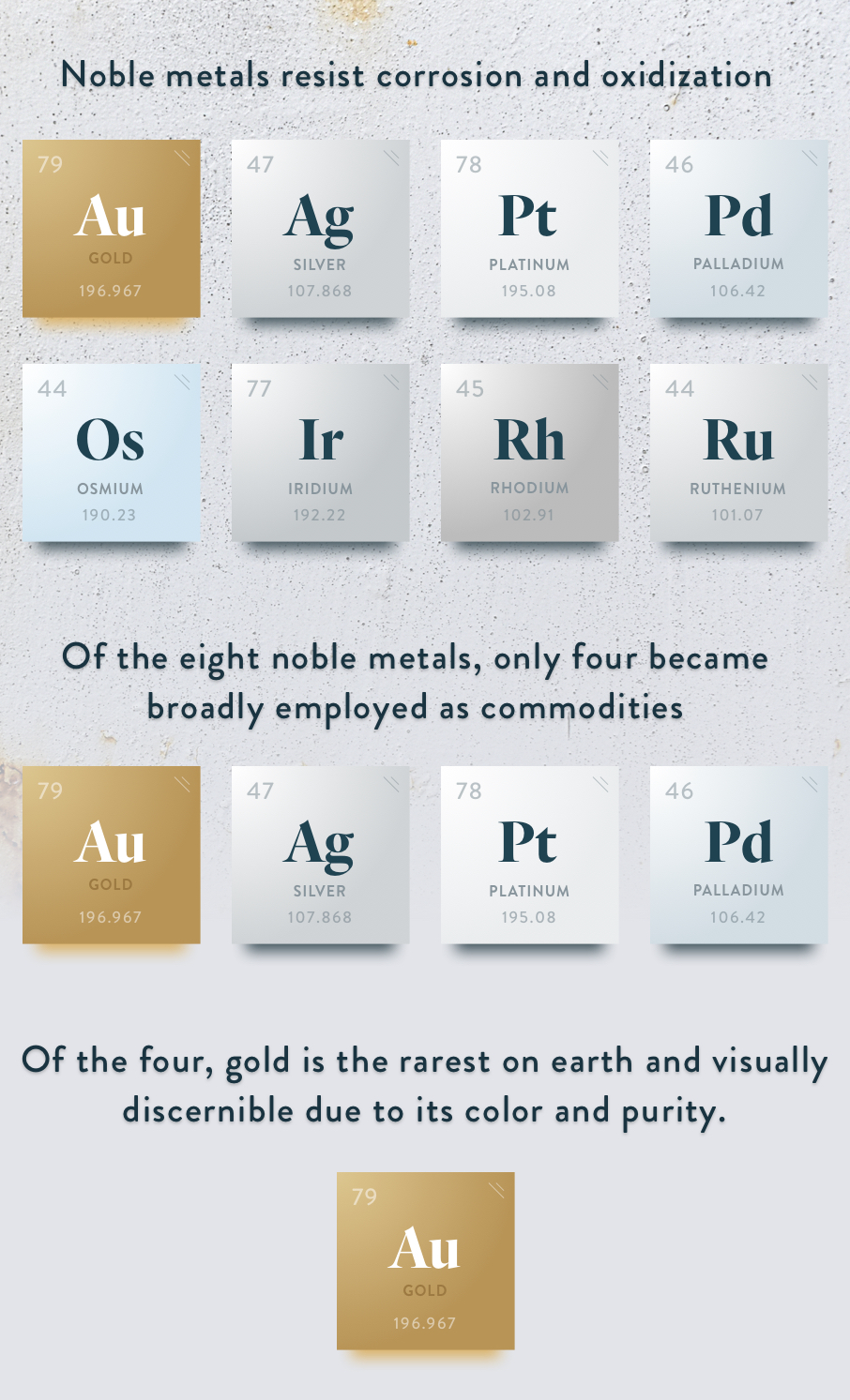

By contrast, gold is gold. It stands alone as the only non-reactive element excepting a few noble gases and poisonous substances. Yes, gold can be fashioned into jewellery, or into myriad other objects of beauty. But the marginal cost of melting it right back into generic bars or coins is small, hence the ubiquitous market for even tiny amounts of scrap jewellery.

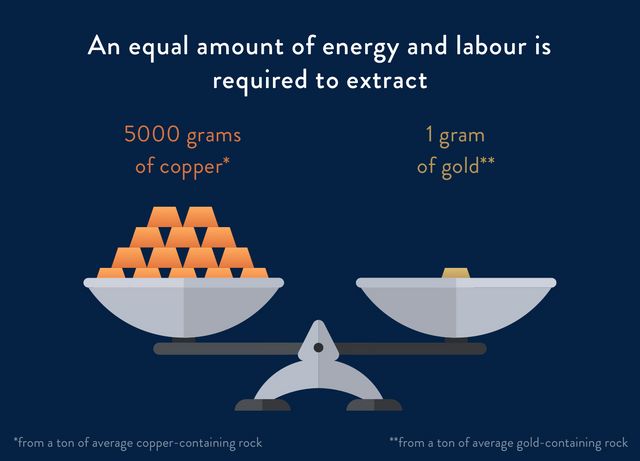

Gold production is highly energy-intensive and also requires labor and capital input. But gold, once produced, is eternal. Hence gold is the only substance known to man that functions as stored energy, labor and capital, and hence of stored value. This is the best explanation for why gold has been used as money across all major civilisations over time and is still used as a de facto money in India and much of Asia.

That gold does not circulate as a legal-tender currency does not make gold a commodity either. Fiat currencies require third parties to enforce their acceptance and regulate their supply. Here, too, gold is gold. No government is required to enforce its acceptance. Nor is any government able to print it excessively or otherwise devalue it. This is also what makes gold a truly international and multicultural money, unlike fiat currencies with fundamentally political characteristics, their values thus subject to political expedience.

As Lord Acton once observed, power tends to corrupt and absolute power corrupts absolutely. By corollary, monetary power tends to corrupt and absolute monetary power corrupts absolutely. This has become highly evident through the quantitative easing and zero or negative interest rate policies of many central banks since 2008.

Money itself is a technology. As contemporary information theorist George Gilder explains, prices are information and money is the conduit. Economist Ludwig von Mises made the point already in the 1920s that communism would fail because without market-determined price information, economic resources could not be efficiently allocated. Actively managing fiat currencies distorts vital information such as interest rates and risk premia and so undermines economic health. There is also mounting evidence that it exacerbates inequality by elevating the prices of those assets held by the wealthiest households. Gold cannot be manipulated by a single issuer as there is no issuer. It cannot be printed so as to inflate asset prices and exacerbate inequality.

Advocates of bitcoin frequently cite these above points when arguing that it, too, is superior to government-issued fiat currency. However, they also sometimes claim that by contrast to bitcoin, gold is a 'barbarous relic' from a time long ago, before computers and the internet ruled global commerce. As with the claim that gold is a commodity, this is also incorrect. There is no practical reason why blockchain technology--the engine behind bitcoin or other competing digital currencies--cannot be applied to gold itself. The only difference is that unlike blockchains, which can be replicated into a potentially infinite number of competing currencies with similar characteristics, there is no replicating gold. Alchemists have tried to be sure but have always failed and the laws of physics and chemistry explain why.

Hence the efficiencies of blockchain can be combined with the unique, eternal store of value benefits of gold, demonstrating that gold is not only not just a commodity but also the ultimate store of value, entirely as suitable for the future as it was for the ancient world and all of those in between. Applying blockchain technology to enable the frictionless exchange of title to gold is thus the single most significant innovation in monetary technology since the advent of standardized coinage in the 1st millennium BC. That is the real scoop here which the mainstream financial media have completely missed so far.

Reintroducing gold as a commodity money using innovation and technology has been my personal mission since 2008. My two primary businesses: Goldmoney and Mene 24K Investment Jewelry illustrate gold's versatility as both a currency and exemplary natural element.

Great post @roseybag! In my opinion, gold is more of a commodity than anything else, but it could also be viewed as some form of non-government backed currency.

The real value of gold is yet to be fully explored. For instance, the precious metal can be applied in healthcare as a mono-atomic gold Ormus to deal with several health issues. It also has applications in technology since it is a powerful superconductor.

More and more use cases of gold are being discovered, and I think that it may increase the demand for the precious metal in the future.

Roy, this is an amazing piece! I can’t tell you how thrilled I am to see you on Steemit. Steemians should consider themselves lucky to have you involved here! I have resteemed this and written a piece in your honor!! https://steemit.com/steemit/@goldmatters/goldmatters-asks-steemians-for-a-favor

@goldmatters - You have been an incredible friend and supporter. I am thankful to have you in my corner. Thank You for all you do for Goldmoney and our mission of broadening access to physical precious metals.

Welcome to Steemit @roysebag! We are lucky to have someone of your knowledge, expertise, and business prowess here on the platform! This article was a great read, and I can’t wait to see more of your content!

I have to tell you, @goldmatters is probably the best evangelist of Goldmoney and Mene you could ask for! He is constantly sharing knowledge and giving back to the community.

Thank You. I am excited to learn more about this innovative new platform!

Welcome aboard Roy!

Goldmatters has been instrumental in educating me about Menē and Goldmoney, and others too! All across the Steemit platform — and especially in #steemsilvergold. Moreover, he has been a delightful and witty friend to interact with: he won a very special 2017 Steem round from my stash, and paid it forward by sending me a goldmoney t-shirt. He is a super generous guy and has supported this community big time — all the while getting more and more people on this decentralized band-wagon and interested in the Au projects he supports.

I have opened a Menē account (got some others to join too) and already have the brushed Verona Cuff in ny cart — just figuring out the exact payment date and method (that your company accepts cryptos is a major boon).

So, thank you! All too often genius is overlooked!

Welcome aboard Matey — gold times await!

Cheers! from @thedamus

What do you mean? Like somebody stores the gold, and you transact in blockchain tokens?

You don't need a blockchain for this. It would actually be less efficient, as far as I can tell. You'd needlessly be adding a layer of mining and decentralized confirmation, when we're still trusting the centralized gold source. It's better to just have a centralized ledger.

There might be a role for these, but you could never have one that's ubiquitous. You can trust centralized storage of gold when it's small, but you wouldn't want to trust a big piece of the world's wealth in one party's hands.

You can ask yourself why Bitcoin Cash (the exact same thing!) only has 12% the marketcap of Bitcoin and Bitcoin Gold about 1% and all others even less.

I've heard there's even a website or some sort of tool out there that streamlines the process of cloning Bitcoin and allows anyone without coding skills to do it with a few clicks.

The network effect is a real thing.

Bitcoin is not a physical object, so it's not meaningful at all that physically it can be cloned. (This is basically just an assertion that being a physical object would be better.)

Bitcoin is a network of people more than it's the protocol itself. The protocol enables this network to be a thing, but what has value is the network.

Hi @roysebag , and welcome to steemit! My most favorite talented and all-around awesome guy @goldmatters sent me over to check out your blog, it is great to have someone with your knowledge and expertise join this platform. I'm already a huge fan of Gold money and I'm ready to sign up with Mene. Cheers and you have a new follower!

Welcome to SteemIt @roysebag we are all looking forward to reading your thoughts and learning more about Mene and Goldmoney. I've had a Goldmoney account for years, back when it went by the name of BitGold. @goldmatters has done a great job here on Steemit and even got me into Mene24K recently. My 2nd order should be arriving tomorrow for my wife's birthday celebration this weekend...its an amazing business concept...well done.

@roysebag Wow! This has made my day :) Thrilled to see you on Steemit! I'm proud to say that I have a Goldmoney account and have since it was BitGold and thought then what a brilliant concept that was, although there is nothing like holding Gold in your hand, I do like the security of having some tucked away in various faults throughout the world...

Then enter #Mene24K another brilliant concept which has been fantastically publicized by @goldmatters and I'm delighted to say that I received my first pierce of #Mene24K last week and I'm in love thanks to my wonderful hubby @matthewwarn - who's post you actually tweeted :)

So, a big, heartfelt welcome and I look forward to reading more of your posts very soon :)

Fellow Goldmoney Network member! So happy we have our own community here @redwellies

@par-ee Yes, isn't it wonderful :) Love being around like-minded individuals :)

Welcome Roy! I have been learning so much about gold the last couple of weeks thanks to @goldmatters. I didn't realize how important it really was, and I am as excited about it now as I am about Steemit! There are a lot of precious metals enthusiasts on here, so you will definitely find a welcoming home on Steemit! :)

Welcome to steemit. Our Goldmoney expert @goldmatters directed me here, and I'm glad he did. Its nice to have someone like yourself here and you'll find most of the precious metal stacker community here on Steemit already appreciate and understand the value of gold. A few of us are even members of goldmoney.