Demystifying the newest "coin listing" of Grayscale Investment: with "private goods", it's truly the currency control by the founding father of the parent company

According to the filing website of the Delaware company in the United States, Grayscale has established a new trust company. In addition to the first exposed Grayscale Chainlink (LINK) trust, there are five currencies, namely XTZ, MANA, and FIL. , LPT, BAT.

Under the strong influence of Grayscale, these six currencies broke out in the current wailing and bleak market.

MANA rebounded 40%, LPT rose more than 140%...

It’s not surprising that mainstream currencies such as LINK, XTZ, FIL, etc. were selected, but it’s surprising that altcoins such as MANA, LPT, and BAT were selected, especially Livepeer (LPT), which is based on the Ethereum area. Blockchain's open source video live broadcast platform service, Coinmarketcap data shows that its market capitalization ranks 236, only two small exchanges such as Poloniex are listed, and transactions are concentrated in Balancer and Uniswap.

How can such a small altcoin get into the shadow of gray investment?

The answer is simple. This is the investment project of Grayscale Investment's parent company, Digital Currency Group (DCG). More directly, this is the currency held by DCG founder Barry Silbert.

In 2019, Barry Silbert announced on Twitter that DCG has invested in Livepeer.

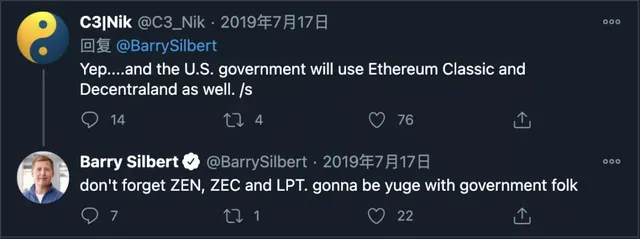

Since then, Barry Silbert has repeatedly called for LPT on social media.

In addition to LPT, the other two small altcoins Decentraland (MANA), Attention Coin (BAT) and Filecoin (FIL) are also in DCG's portfolio.

Since the beginning of 2018, Barry Silbert has been screaming for MANA. Recently, ZEN and ZEC, which he actively called for, are also DCG investment projects.

Here is a detail. Before Grayscale Investment embarked on the altar in the second half of 2020, Barry Silbert honestly listed his position portfolio in his Twitter profile, namely BTC, ETC, ZEC, MANA, ZEN, LPT... This is also the currency that he calls the most frequently on Twitter.

Some Twitter netizens once pointed out in the comment area that the reason why Barry actively called for orders was because his positions such as ZEN and ZEC had fallen sharply in the bear market, and also suffered losses in the secondary market. (Note: not confirmed)

At the end of 2020, when more and more people pay attention to Grayscale Investment, the description of the position portfolio was also deleted, but the cache mark was still left.

Grayscale Investment’s trust and DCG’s portfolio, or Barry Silbert’s positions, seem to form a perfect linkage.

The profit model of Grayscale Investment mainly comes from the collection of management fees, but with the current influence of Grayscale Investment, any cryptocurrency listed in the trust may be sought after and a premium, which in disguise has helped DCG greatly increase its investment income.

The investment trends of DCG and Barry Silbert have also become the vane of the entire industry.

An crypto blogger once wrote in his investment experience: Buying anything Barry Silbert bets on his reputation is almost certain that he will redouble his efforts to save his self-esteem.

In the world of decentralized cryptocurrency, both public opinion and capital are moving towards the head: Big money control everything!

In January 2021, Barry Silbert resigned as CEO of Grayscale Investment. He stated that he wanted to focus on other cryptocurrency projects.

Barry Silbert's goal is obviously not a big gray scale, but a huge DCG group.

Today, the Digital Currency Group (DCG for short) almost controls "half of the country" of cryptocurrency. In addition to Grayscale, DCG owns or invests in more than 180 well-known blockchain and Bitcoin companies including Coindesk, Gensis, Coinbase, Ripple, Bitpay, Blockstream, etc.

Barry Silbert has publicly stated that he hopes to build DCG into Berkshire Hathaway in the cryptocurrency field , a diversified group that integrates holding and investment, and on the one hand, builds a leading company in the industry through self-construction and acquisitions. ; On the other hand, through investment in the layout of high-quality enterprises in the industry, enjoy the benefits of long-term value investment,

"What I really want is flexibility. I want to start a new business, have the ability to acquire companies, and have the ability to buy coins, but any traditional fund model is not suitable for my desire."

It seems that the "trust" of the blockchain industry is gradually taking shape. The road and pits that the financial and Internet industries have traveled, the block chain has a high probability of going through again.

(Note: Trust refers to a form of monopoly in an industry (commodity field) where a company merges, accommodates, and controls a large number of companies in the same industry through acquisitions, mergers, and trusteeships among production companies. Through this form, trust companies can achieve a monopoly on the industry market, and through the establishment of a unified price within the company, etc., make the company dominate the market and maximize profits.)

Not surprisingly, you can see Barry Silbert invest and promote more cryptocurrencies in the future.

This reminds me that Barry Silbert once said in 2018 that 99% of cryptocurrencies are worthless. I wonder if this 99% includes the projects he has invested in?