Must know TIPS for landlords!!! This could save you millions!!!

Hi steemers, we are qualified insurance advisors who have recently joined Steemit to offer insurance tips to fellow Steemers. We can cover all aspects of commercial insurance and our aim is to ensure our followers do not get caught up in the insurance trap or jargon.

How does the fire at Grenfell affect your insurance as a Landlord?

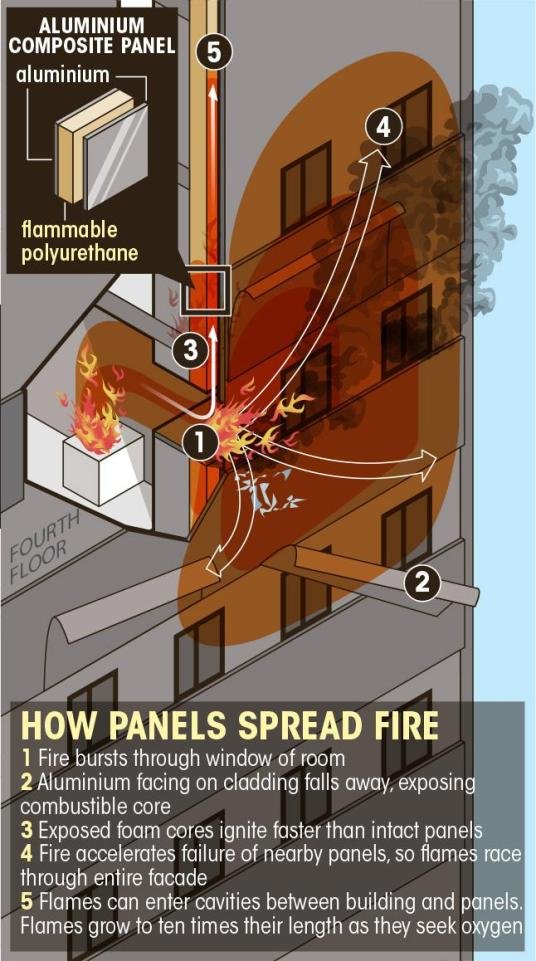

The fire at Grenfell was reported to be started on the 14th June 2017, on the 4th floor of the 220ft, 22 storey high rise block of flats. The incident was thought to have been casused by a Hotpoint Fridge Freezer, this in turn caused the external cladding to ignite and rapidly spread.

How does this affect me?

For most Commercial and Residential landlords policies Fire is always an automatic cover, even if your building is unoccupied an insurer will restrict this cover to FLEA, otherwise known as Fire, Lighting, Earthquake and explosion.

A fire is usually a peril that is covered under most circumstances unless it can be proven by fire experts it was started deliberatley for financial gain.

The key thing here to remember is Insurance is for reimbursement not betterment and most of time people will get the two confused.

In compliance it is the Policyholders responsability to ensure they disclose all the material facts to their insurer, as an example: if you contact your insurer for a Quotation for a property and they do not ask you the construction, my advice would be not to do any business via them.

When declaring the construction ALL insuers or brokers will ask you to confirm if the property is deemed standard construction? most people will assume standard construction would be brick or stone with a slate or tiled roof, however it must be disclosed by the policyholder that the property might have panelling on the exterior, if such panelling is present on the building it would need to be investigated further of its material, here is where in event of a claim the onous would be the Insurer/Broker if this is not investigated correctly.

The combustibility of insulation material, even when not part of panel system when disclosed by the policyholder should ALWAYS be investigated and carefully considered, Insulation and insulation with combustible materials can generally be reguarded under the following accending catergories :

- Combustible

- Fire Retardant

- Approved Fire Retardant

- Fire Resistant

- Incombustible

Ideally an insuer will want the materials to be Fire Resistant or Incombustible, further information on this can be found by refering to the Fire Service or DCLG.

What about the tenants who lived in Grenfell or my tenants?

If you have a large claim and your property is deemed in-habitable by the insuers , they will indemnify (reimbursement to the amount owed) you for Loss of Rent:

- Loss of Rent - Loss of rent is included within MOST residential Property Owners Policies upto 20% of the total rebuild cost. - As an example if your property is insured for £500,000 your loss of rent should be £100,000 per annum - here's the catch, having Loss of Rent cover over a 12 month indemnity period would not be beneifical to a Policyholder insuring a property the same size as Grenfell, why? because in event of a claim the same size as Grenfell there could be a number of different reasons as to why the building works might not be started staight away, e.g, Enquiry into cause of the fire, palnning permission, inquest into deaths, lack or sorce of materials or labour, thus meaning if you are only covered for 12 months, and six months after the event you still have not started to rebuild the insurers will only pay you the rent you could of received for the 12 months, anything after this the landlord would be responsible for.

My advice would be to have a 36 months indemnity limit meaning you are covered for three years predicted rent in event of a total or big loss (this will be the same scenario in most circumstances, from flood claims to escape of water claims etc..

Property Owners Policies are on a Claims Occuring Baisis - This means that the claim would have to have occured or happened during the period of insurance, the other type of policy would be on a Claims made Basis meaning the claim would have to have been made during the period, this can be found on more complex polcies like Professional Indenity, Contractors.

The other key thing to remember is Alternative Accomodation, this will cover the tenants to be re housed in event of the block becoming un-inhabitable, again most insurance polcies should cover this automatically usually upto 30% of the rebuild sum insured. However in some cause the landlord may wish to choose more and therefore Loss of Rent or Alternative Accomodation can be adjusted to the policyholders requirements, again Alternative Accomodation will also have an idemnity limit and tends to follow the same indennity period as the Loss of Rent.

Property Owners Liabilty is another Key thing to consider when insuring a large block of flats, most insuers will offer you £2,000,000 as standard, Property Owners liabiliity is designed to cover the property owner for slips, trips or bodily injury gained whilst at the property, it is also important to note the parimeters of the property and Property Owners Liability will extend to the car park and communal hallways unless the exterior land is owned by local authority. Private land insurance is different to property and the two should not be confused. On a property the size of Grenfell it would be a good idea to insure the property upto £5,000,000 or more.

I heard rumours Grenfell could of been caused by terrorism?

Terrrorism is a seperate Policy and NO Insurer or broker can include this cover standard, properties in a higher risk postcode like London should consider terrorism as an optional extra as it could cover them if such a disaster should happen, without this the freeholder would be responsible for paying for the damage.

What about if my contents was inside the property?

A Property owners policy would not cover you for the tenants contents as a landlord you cannot insure something that does not belong to you (insurable interest) as you have no insurable interest in it, however most insurance property policies cover you for landlords contents usually upto the sum insured of £5,000 or £10,000 on a higher net worth policy, it would be important to rememeber that this is the amount for the total property not per flat.

What if I am under insured?

Under insurance is a widley common spoke about subject, you often hear people say "insurance is a scam I had a claim and they didnt pay out", the key thing to understand is an Insruer or broker should always take the time to explain the condition of AVERAGE, this is a small clause within your policy that in event of a claim could jeopardise you, basically AVERAGE means the insurer will deduct the amount you are under insured by this is why its never a good idea to under insure yourself to save on the premium/price, example: if you insure your property for £250,000 and you have a fire claim the surveyor or loss adjuster would look at the current rebuild cost, so if your property is worth £500,000 and you are insured for £250,000 you are 50% under insured, but.... as you only paid the premium on £250,000 the insurers will only pay you £125,000 thats 50% of what you insured yourself for. My advice would be anyone insuring a purpose built block of flats or a HMO (Housing Multiple occupants) is to have the property surveyed by a qualified surveyor.

There are some ways however that this can also be avoided, an insurer can offer to cover you on an index linked basis or a day one uplift basis, day one uplift usually come in the following percentages 15%, 30% and 50% the higher the uplift the higher the rate/charge will be. Day one uplift basically means: when you insure the building the Insurers know or expect the value of the property to increase therefore the uplift would indemnify you for the amount (like safety net), for the difference in value from inception to renewal. Index Linked means the cost of the property will go up with inflation which is usually around 3% maximum per annum, overall an indexed linked policy would be cheaper than a Day One Uplift Policy.

All Property Owners Policies should include cover for Accidental Damage, although the premium can be cheaper without it, my advice would always be to include it, just like subsidence which will protect the building against landslip or heave, any previous property that has had subsidence should ALWAYS disclose it to their Insurer/Broker as more than likely the cover would have to be obtained via a specialist provider.

Overall Property Owners is a relatively simple policy to provide from an Insurers/Brokers perspective, our advice is just purely based on our knowledge of over 12 years in this industry we are both Qualified Insurance Advisors holding ACII qualifications and we have both spent many years studying this complex market, if you would like us to do any more blogs on any type of commercial insurance including but not limited to the following:

Property Owners

Construction

Marine/Transit

Cargo

Medical Malpractice

SME (Small to medium enterprises) Shops, offices, hotels etc

Professional Indemnity (miss advice)

Directors and Officers

Right to Light

Land Liability

Public Liability

Employers Liability

Cyber Insurance

Travel Insurance

Household

Manufacturing Risks

Products Liability

Commercial Combined

Disclaimer: Please be advised we can only offer you general advice regarding specific types of policies, as we are sure you can appreciate most insurance policies have terms and conditions/policy limitations and exclusions in order for us to give you specific insurance advice please comment particular queries or questions in order for us to give you to correct advice for your specific requirements.

您好,我们是合格的保险顾问,他们最近加入了Steemit,为Steemers提供保险提示。我们可以涵盖商业保险的所有方面,我们的目标是确保我们的追随者不被陷入保险陷阱或行话。

Grenfell的火灾如何影响您作为业主的保险?

据报,Grenfell的火灾将于二零一七年六月十四日,二十二层,二十二层高层单位的四楼开始。这个事件被认为是被Hotpoint冰箱冷藏室所吸引,这反过来又导致外部包层点燃并迅速蔓延。 )

这对我有什么影响?

对于大多数商业和住宅业主政策消防总是自动覆盖,即使您的建筑物空闲,保险公司也将限制该保护范围到FLEA,否则被称为火灾,照明,地震和爆炸。

火灾通常是大多数情况下的危险,除非能够被火灾专家证明是为了获得经济利益而开始的。

这里要记住的关键在于保险是为了报销而不是改善,大多数时候人们会让这两个人混淆。

在遵守情况下,保单持有人应承担责任,确保他们向保险公司披露所有重大事实,例如:如果您联系您的保险公司进行财产报价,并且不要求您进行施工,我的建议不会通过他们的任何业务。

在申报建筑物时,所有人或经纪人将要求您确认该物业是否被视为标准施工。大多数人会认为,标准建筑将是砖石或石头与石板或平铺的屋顶,但是必须由投保人披露,如果这种镶板存在于建筑物上,则需要对其进行调查进一步的材料,如果没有正确调查,这里是发生索赔的地方是保险公司/经纪人。

绝缘材料的可燃性,即使不是投保人披露的面板系统的一部分,应始终进行调查和仔细考虑,可燃材料的绝缘和绝缘通常可以在以下的配套设备下进行调节:

- 可燃

- 阻燃剂

- 批准的阻燃剂

- 耐火

- 不燃

)

理想情况下,这些材料将要防火或不燃,材料可以参考消防局或DCLG。

居住在格伦费尔或租客的租户呢?

如果你有一个大的索赔,你的财产被认为是居住者,他们将赔偿(欠您欠的金额)你失去的租金:

- 租金损失 - MOST住宅物业业主政策中的租金损失高达总重建成本的20%。 - 作为一个例子,如果你的财产被保险50万英镑,你的租金损失应该是每年10万英镑 - 这里是捕获,在12个月的赔偿期内,租金损失不会对保证财产保险的投保人是有利的尺寸为Grenfell,为什么?因为如果索赔与格伦费尔的索赔大小相同,原因可能有很多,为什么建筑工程可能不会立即开始,例如:调查火灾原因,嘱咐许可,研究死亡,缺乏或索赔材料或劳工,这意味着如果您只能享受12个月的时间,而事件发生后的六个月您仍然没有开始重建,保险公司只会向您支付12个月内收到的租金,房东将负责。

我的建议是要有一个36个月的赔偿限额,这意味着你在三年内预计租金总额或大量损失(这在大多数情况下是相同的情况,从洪水索赔到逃税等等)。

财产所有者的政策是发生Baisis的索赔 - 这意味着索赔必须在保险期间发生或发生,另一种类型的政策将以索赔为依据,这意味着索赔必须在这个时期,这可以发现在更复杂的政治,如专业创业,承包商。

另一个需要记住的重要事情是“替代住宿”,这将涵盖租户在住房不安的情况下,再次,大多数保险监管机构通常应该自动覆盖重建保险金额的30%。不过,在某些情况下,房东可能希望选择更多,因此可以选择租金或替代住宿