What is Sensex? How it is calculated?

Sensex is one of the most important market indices in India. We hear in News / TV / Radio that the Sensex's rating has gone up or down. But what is actually the Sensex?, how is it constituted ?, how is it calculated? Many people do not know so we will discuss this in this article.

#What is the Sensex

People are happy when the Sensex increases, and when it goes down, people become upset. So let's know what the hell is it?

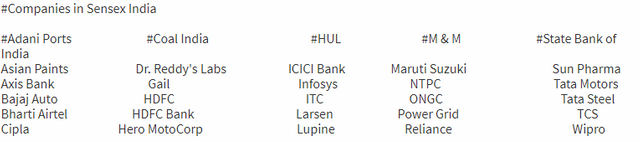

SENSEX is a short form of Sensitive Index, it is also known as BSE-30 because it represents the top 30 companies of Bombay Stock Exchange (BSE). These 30 companies represent different areas and are selected on the basis of various parameters in which market capitalization is given importance. There are currently companies like Bajaj Auto, Coal India, HDFC Bank, TCS, Reliance Industries, Maruti etc. in the Sensex.

It was first compiled on January 1, 1986, and it was taken on the basis of "Market-Capitalization Weighted" method. From 1 September 2003, the Sensex is calculated on the free-float market capitalization method, on which most global indices are based, such as Dow Jones, FTSE etc.

#Meaning of Sensex?

It is the market-weighted stock index of 30 companies that have been selected on the basis of financial soundness and performance. Typically, large and well-established companies, which are representative of various industrial areas, are chosen.

It was first published in 1986. The base price of the Sensex is 100 and the base year is 1978-79.

Let us look at some numbers.

Number of shares in the Sensex - 30

By March 15, 2017, the full market capitalization of the Sensex was Rs 4,986,299 crores and free float market capitalization was Rs 2,687,777 crores. Was there.

#How did the Sensex perform for years?

Here is a graph that shows the value of the Sense since the beginning -

#How the Sensex is calculated?

The Sensex is calculated using the free-float Market Capitalization method. In this method, the index shows the free-float market value of 30 constituent shares according to the base period.

#What does the free float market capitalization mean?

Free float is for those shares which are open for trading. All shares can not be free floating. Some may be mortgages, in the hands of individuals or entities controlled by some interests / promoters, some shares may be government holdings, etc. Such locked-in shares are not considered free floating.

#What is market capitalization?

The market capitalization is the combined value of all the shares of various companies in the stock exchange.

The market capitalization of the company is based on the price of shares of the company and the number of shares issued by the company.

This figure is multiplied by the free float factor to determine free-float market capitalization. Every company has to give information on the quarterly basis in the format given by BSE.

Free float market capitalization is divided by the index divisor to get the Sensex value. This separator adjusts for changes in stocks and other corporate functions. The value of the Sensex index is in the Separator base year.

#How Sensex Works - Example

Suppose the index has two companies - X (Y) and Y (Y).

Company X (X) has 500 shares, out of which 300 free-floating or available to buy and sell the general public. The price of each stock is 80 rupees.

The company has 1,000 shares of Y (Y), 700 of which are free floating. The price of each stock is 100 rupees.

Company X (X) market capitalization = 40000

Company Y (Y) market capitalization = 100000

Free Float Factor for Company X (X) = 0.60

Free float factor for company Y (Y) = 0.70

Total free float market capitalization of the index = (40000 * 0.60) + (100000 * 0.70) = 94000

Suppose that the base year index was 5000.

Value of index = (94000 x 100) / 5000 = 1880

So the value of the index would be 1880.

What are the high and low points of the Sensex in the last 10 years?

Market affected by various political, social and economic factors worldwide. In 2008, the Sensex reached the lowest point, when US stock markets started to crash and the U.S. There was a big drop in

The Sensex also had a major fall in 2015.

The Sensex reached its highest point in August 2015 and March 2017.

#How do I use SENSEX for my investment?

You can invest in a Sensex based fund to take advantage of the rising value.

If the market fluctuates, then the Sensex has been swinging in different values, so it is better to wait for the instability in the index to decrease. (Better you invest through SIP)

The stock is the financial term in the Sensex; most of them are blue-chip companies. You can invest in equity funds which invest in these stocks.

It acts as an indicator that how the economy is working and how companies are performing will help to make a judicious decision in your finances.

We hope that what is Sensex? How is this calculated? Through this article, you might have got the answer to the questions related to the Sensex, if you still have any questions then you can ask us through comment. And if you liked this article, please share it.

Plzz Share your thought on this post, you like this post or not?