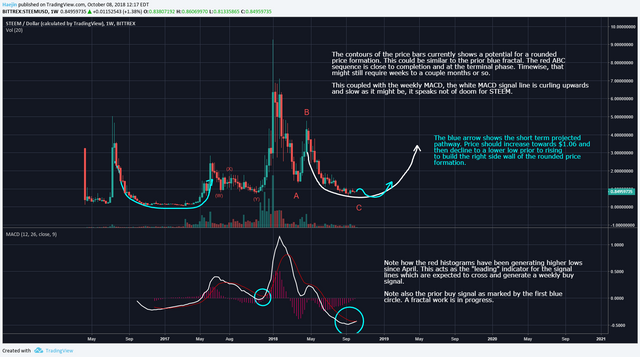

STEEM Analysis

SUMMARY

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

https://steemit.com/bitcoin/@haejin/elliott-wave-tutorial-1-by-haejin

https://steemit.com/bitcoin/@haejin/elliott-wave-tutorial-video-2-zig-zag-and-flat-corrections-how-to-recognize-and-label-corrective-waves

https://steemit.com/bitcoin/@haejin/elliott-wave-tutorial-iii-how-to-label-and-apply-triangle-price-corrections

https://steemit.com/bitcoin/@haejin/tutorial-on-the-use-of-fibonacci-ratio-and-elliott-waves

https://steemit.com/bitcoin/@haejin/when-to-buy-and-sell-using-elliott-waves-a-tutorial

Hey, thank you for your analysis. I do share the same view of you towards Steem.

Yes, in the long run, like 2-3 years; STEEM should be at double or triple digits. Regardless of the exact price, long term greed is the best mode to be in and so, accumulation is the key.

I am looking forward to a new low in STEEM.

I will buy 10,000 STEEM if price drops below .50 cents

thanks haejin.

There are no guarantees in any trades or analysis. However, here is my updated Bitcoin chart which projects $5,700 so a bit higher than the previous $5,200. Basically, the triple combination WXYXZ has it so that the Z is an ABCDE triangle.

This a wonderful analysis.. Not only me... Everyone is waiting for steem growth....

The growth is likely to come in quick and strong spurts followed by corrections. This is how the sentiment that drives prices ebs and flows.

Thank you Haejin. Good post. This crypto correction in general has been much longer than I thought. When Bakkt launches and/or and ETF we should get the next uptrend.

That's what EVERYONE is expecting and often, the herd is wrong. So, while I agree that the new bull market will start (Dec?), the news or events that trigger it might not exactly be what we expect.

Good day! Tell, please, what tools do you rely on in your analysis?

Posted using Partiko iOS

I use tradingview.com for the charting. My methods are based on the Elliott Wave analysis and Chart Pattern recognition. The books that might be helpful are: The Elliott Wave Principle by Frosst & Prechter; Technical Analysis of Stock Trends by Edwards & Maggee

Thank you for reply

Posted using Partiko iOS

I'm sorry, I have also been analyzing financial markets for 18 years, so I was interested about your methods of analysis.

Thanks again @haejin