Long Term Care Awareness Month: 3 Long Term Care Planning Tips That Work

The best time to start the conversation with your family about future plans concerning your health and assets is this November, which is Long Term Care Awareness Month.

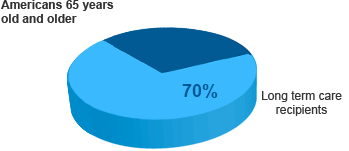

Long term care is a truth that everyone needs to be addressed as early as possible to avoid financial woes and becoming a burden to your family. Around 70% of Americans 65 and up will require long term care at some point in their lives. The cost of care is expensive so it’s imperative to prepare for future care expenses.

Make the most of Long Term Care Awareness Month by reaching out to your loved ones to begin the conversation and start planning for long term care. For starters, answer this short quiz to find out how much you know about long term care. From there you can take the next step of planning by following these long term care planning tips.

1. Discussing Long Term Care with Family

Initiating the talk with your family about their future plans for their health is quite challenging. Most older adults aren’t comfortable in sharing their finances with their loved ones. But delaying the conversation will just make things worse. So it’s best to face the inevitable truth that your aging parents are at risk of requiring any form of long term care.

Here are some tips to help you initiate the long term care talk with your loved ones:

• Start early – Don’t wait until your loved one requires long term care. Start as early as you can so you have enough time to explore and evaluate options together.

• Introduce long term care slowly – As soon as your loved one shows signs of difficulty in doing everyday tasks such as doing household chores, walking, bathing and other tasks concerning the personal care, start asking questions whether she needs help in carrying out these activities.

• Explain the importance of care – Explain to your loved one the need for. It would help to make them realize that planning for long term care reduces the risk of becoming a financial and emotional burden to their adult children. Aging parents don’t want to become a burden to anyone so this type of conversation can persuade them to get help.

• Consider your loved one’s preference – Your loved one has the right to make decisions so make sure to consider his or her concerns and preferences when planning for care.

• Ask help from siblings – Asking help from other people is not a sign of weakness. It simply means you want the best for your loved one. Involve other people such as your siblings if your aging loved one doesn’t respond well to your long term care conversation.

2. Understanding Long Term Care

Long term care is described as different types of services and support that a person might need due to old age, illness, disability or injury that he or she would need in order to maintain his or her quality of life. Ltc provides assistance in carrying out Activities of Daily Living (ADLs) such as eating, bathing, dressing, toileting, continence and transferring.

Who Needs Long Term Care

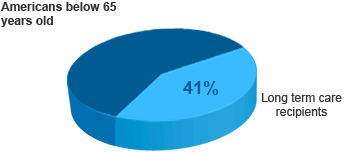

According to a study, 70% of Americans 65 and above will require long term care. But, long term care is not just exclusive to aging individuals. In fact, 41% of long term care recipients are 65 years old and below.

On average, women would need long term care for 3.7 years while men would need care for 2.2 years.

Check out this 50 Long Term Care Statistics Everyone Should Know this 2018 that can help you understand long term care more and can help you with planning.

Long Term Care Facilities

There are different types of long term care facilities and services available today. To avoid confusion and to make sure that you’re choosing the right ltc setting and service to your loved one, here are the different types of long term care settings and services that can help individuals with their care needs.

• Home Care – A type of unpaid care that is usually provided by family members or friends or paid care provided by professional caregivers. Home care includes assistance in ADLs, prescription management, physical therapy, and others.

• Adult Day Care – This type of care help family members take care of their loved one without sacrificing their daily activities and other responsibilities. It is designed to take care of aging individuals during the day while their families are at work.

• Assisted Living Facility – This is perfect for older adults who prefer to maintain some of their independence while receiving care. It provides 24-hour supervision, personalized care, housekeeping services, medication management and recreational activities.

• Nursing Home – These licensed facilities offer 24-hour supervision and comprehensive long term care services perfect for individuals who are chronically ill and can’t receive care at home or in other communities. It is the most expensive care facility. But you can cover its cost through a long term care insurance coverage.

3. Choosing the Right Long Term Care Payment Option

There are several ways you can pay for long term care such as government programs like Medicaid or private insurance like long term care insurance and others.

Here’s a list of long term care payment options that can help you find the most fitting option for your loved one.

• Medicaid– This government program is actually the default payment method for long term care. However, you can only qualify for benefits if your income is $2000 or below. Read this article to find out how Medicaid can pay for long term care.

• Long term care insurance – This is a type of insurance that helps Americans fund long term care expenses that they might need due to old age, chronic illness, injury or accident. It helps pay for different types of long term care support and services such as home care, adult day care, assisted living and nursing home.

• Life Insurance with LTC Rider – It is a type of life insurance that provides long term care and death benefit. This is perfect for people who have been turned down for traditional long term care insurance since it has a loose underwriting. However, it is more expensive and has limited benefits.

• Short Term Care Insurance - As the name implies, it is a type of insurance that pays for long term care for a short time – for a few days up to 365 days. It is more affordable compared to traditional long term care policy but it’s limited coverage is risky considering that aging individuals usually receive long term care around 2 to 3 years.

• Group Long Term Care Insurance – It also referred to as employer-sponsored long term care insurance. It is offered by employers that help Americans pay for their care needs. It has a simple underwriting, which makes it perfect for individuals who have health conditions or too old to buy traditional long term care policy. However, it provides limited coverage. It pays for 50% or 75% of home care unlike individual long term care insurance that covers 100% of home care.

• Self-Insuring – It means funding your long term care expenses by means of your assets or other financial resources you have. This is only recommended for individuals with assets that are worth $2.5 million. It is known to be very effective if you live in states with cheap long term care facilities and services.

Conclusion

Long term care is a truth you can never run away from because it will eventually catch up on you. Instead of putting of long term care planning, make the most of Long Term Care Awareness Month this November to help your loved ones plan for their future care needs and avoid putting their savings at risk and becoming a burden to the family by using this guide.