Elon Musk Bitcoin Price Driver, Is It True?

Thousands of BTC or Bitcoin investors got rich suddenly because of Elon Musk's post a few moments later fell into poverty because of Elon Musk's next post after that he was rich again after that he was poor again, now the question arises

“How can Elon Musk play with the Bitcoin price?

“What Does Bitcoin Really Work Like?

“And has Bitcoin started to become unstable and its price is going to drop drastically?

The answer lies in narrative economic theory and irrational preoccupation.

In January 2021 Elon Musk changed his twitter bio to #bitcoin in just 30 minutes the price of Bitcoin rose by 6.31% and in 1 Hour the price of Bitcoin rose to 13.19% and peaked in 7 hours the price rose to 18.99% .

In February Elon Musk announced that he had bought Bitcoin worth $1.5bn and Tesla would accept Bitcoin as a means of payment and the Bitcoin price immediately rose 17% and the next few days Bitcoin continued to rise and then in May Elon Musk announced for environmental reasons Tesla would not accept Bitcoin as a means of payment, the value of Bitcoin immediately fell by 12% because the Tesla investors thought that they would sell all of their Bitcoin assets and make the price of Bitcoin go down.

After that Elon Musk made a post that he would not sell the Bitcoin assets that he owns, the Bitcoin price moved up again and at the time this article was made the Bitcoin price rose 0.85 % at the price of $ 36913.87 , now the question arises "how can Elon Musk get Set the Bitcoin market value?”

To understand this phenomenon we must first understand memahami

What is BTC or Bitcoin?

How does it work?

The irrational theory of market economy?

and important lessons that we can take?

I. What is Cryptocurrency

Cryptocurrencies are digital assets designed to function as a medium of exchange where records of individual coin holdings are stored in a digital ledger that exists in the form of a computerized database using strong cryptography.

This cryptography serves as to secure transactions and control for the creation of additional coins as well as to verify the transfer of coin ownership. According to investopedia there are around 4000 cryptocurrencies worldwide and Bitcoin is the first cryptocurrency.

Unlike the paper money circulating at this time, crypto money is not issued by the government and there is not even any institution that controls the circulation and value of the cryptocurrency.

Crypto money was created by a person or group of people who are great at digital cryptography and bitcoin itself was created by Satoshi Nakamoto who until now still doesn't know who he really is.

The computer program they created was made to control the mechanism for circulating crypto money, this process is called mining. Meanwhile, the value of crypto money itself that determines is purely a market mechanism and no party can even control the price of crypto money. And even the creators themselves can't interfere with the price of the money.

If people believe that a certain cryptocurrency will increase in price then people will flock to buy it and make the price of that currency go up. Meanwhile, if people are worried about the future of the cryptocurrency, people will sell it and so the price of the money will go down. so basically it is market sentiment that determines the ups and downs of the price of the cryptocurrency.

II. Why do people like Crypto money

Secure

It is safe because until now the blockchain technology used to run crypto money cannot be hacked and the government cannot check and track our crypto money.Privacy

Because no one, including the government, can know how much cryptocurrency you have and what has been transacted for anythingEasy

Because we can transfer crypto money to each other and to anyone in an instant. Because there are almost no fees you have to spend for transactions or transfers of crypto money.

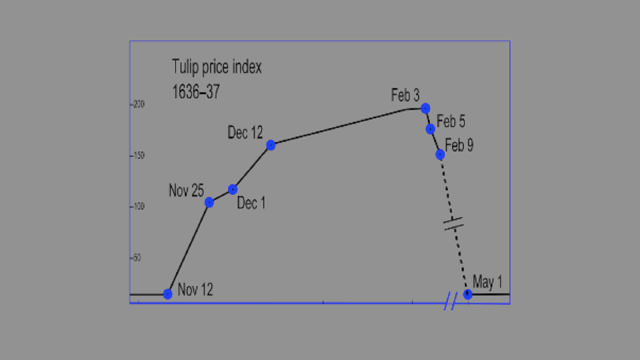

Then back to the previous question “How can an Elon Musk regulate the market value of Bitcoin? "The answer lies in the Economic Theory of Narrative, Narrative economy is seb uah theories about how the story is popular emerging in communities S a t able to drive the economy . For example, in the early 17th century Tulips became so popular as exotic flowers and were hunted by collectors in a short time the demand for Tulips was very high and exceeded their availability so that the price went up. .

After that, in the community, a narrative emerged about people who became rich suddenly because they sold Tulips. Finally, everyone started selling and growing Tulips. This higher demand made the price of Tulips go crazy.

In 1637 people started to lose faith in the Tulip flower. The Tulip story changed and the businessmen who owned the tulip fields panicked because people had bought few tulips while production was still going on. Tulips prices fell freely while bringing millions of people bankrupt with him .

From the example above, Bitcoin is actually the narrative that makes the price what it is today, Bitcoin is a hope to carry out economic activities without being shackled from the ancient financial system. Bitcoin is the promise of the future and that is clearly a very interesting narrative. Investors who have bought Bitcoin feel themselves part of a group of enlightened and technologically savvy people. And these investors told of their success in Bitcoin so that their friends also jumped in to invest and increase the popularity of Bitcoin to rise again.

Another narrative that makes the price of Bitcoin rise is the existence of credibility where Bitcoin can be a medium of exchange to buy a Tesla car as soon as the level of public trust in Bitcoin becomes high and makes Bitcoin prices soar. and assurances from Elon Musk, Mark Cuban and other prominent influencers guarantee the credibility of Bitcoin.

So basically Elon Musk does not control the price of Bitcoin but Elon Musk only controls the narrative and influences the behavior of investors. Investo moves the market, and it is the market that determines the price of Bitcoin.

III. We can learn a lesson from this incident

Build a compelling narrative for the business we run

To build a narrative, don't look at what business we are running, but look at what we are fighting for.Take advantage of people who have influence over the market segment we are working on.

Ride Popular Narrative.

If we are not able to create our own narrative, the solution is to just ride the existing narrative.