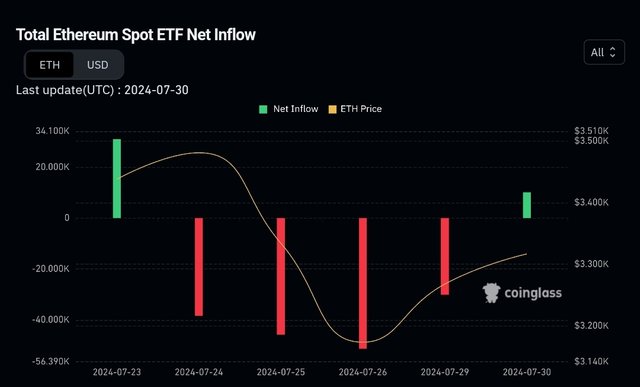

Total net spot ETH ETFs inflows shows plus again 🥳

After spot ETH(Ethereum) ETFs begun trading July 23rd, it turns out plus again.

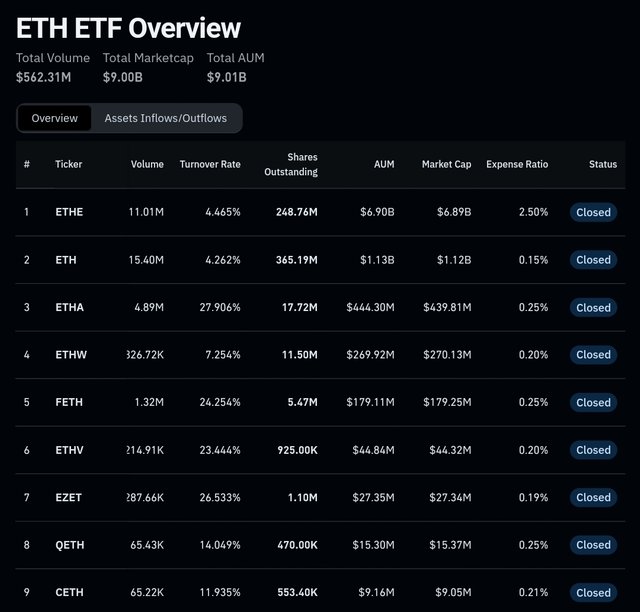

As I previously said, the fee of ETHE by Grayscale is 2.5%. So, compared to other spot ETH ETFs, it's much higher. There is no reason to keep holding their funds into the ETHE.

Therefore, it seems that money movement is progressing from the ETHE to other spot ETH ETFs.

Alright, let's take a look at the ETHE's ETH holdings. They hold more than $6.80b ETH. It's around 2.1m ETH.

During the last week, the net inflows of the ETHE indicates $-1.84b. So, if this trend stays for 3 weeks, the market cap of the ETHE will be $1.28b.

But, the actual figure will be definitely different to the forecast. Anyways, we can expect that the ETH sell pressure by the ETHE won't likely exceed four weeks.

Therefore, I expect the ETH price and altcoin marketcap will recover this late summer or autumn.

This comment is for rewarding my analysis activities. Upvotings will be proceeded by @h4lab and @upex

Upvoted! Thank you for supporting witness @jswit.