The Bid Ask Spread (Part II)- Steemit Crypto Academy- S4W3- Homework Post for @awesononso

QUESTION 1: Define the Order Book and explain its components with Screenshots from Binance.

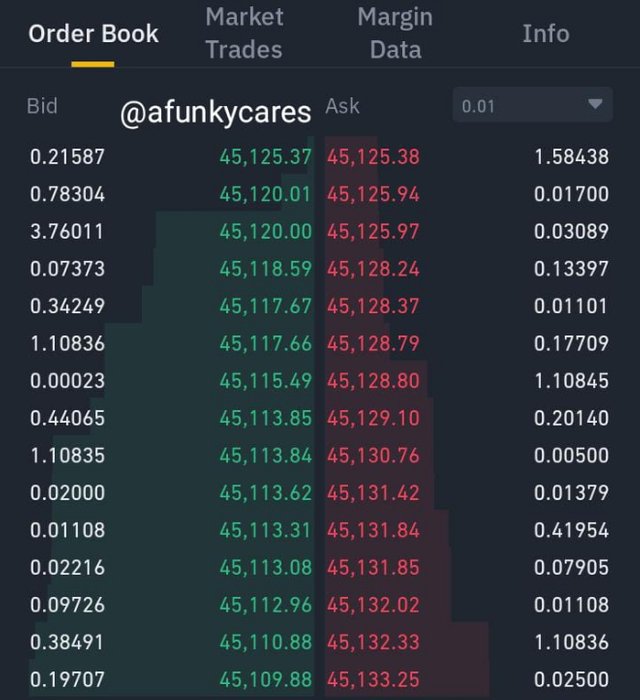

BTC/USDT Order Book from Chart

The order book is a record of the prices set by traders for a particular asset either to buy or sell it. It is a list of orders that are yet to be executed in a particular crypto asset. The order book is different for every asset. This means that for each asset there is an order book. It can been seen on the trade zone in few as displayed in the screenshot below and below the chart as displayed above.

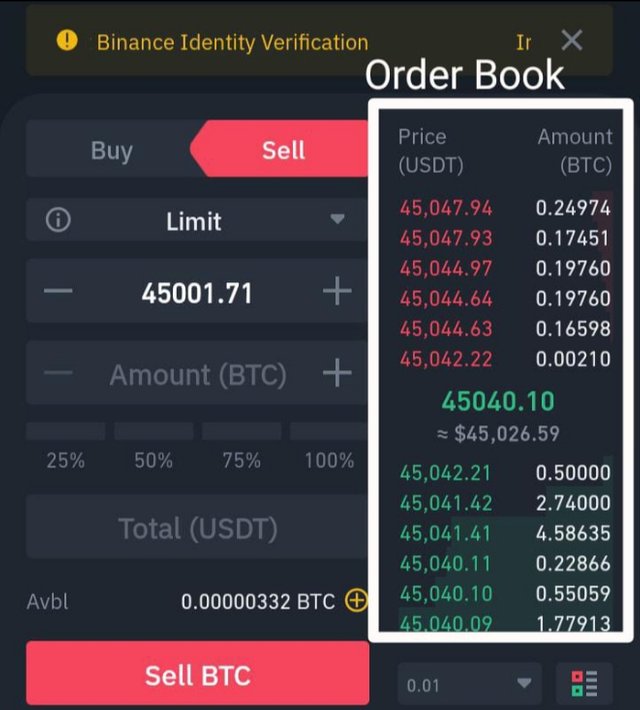

BTC/USDT Order Book from trading page

The order book is made up of three different components which are, the ask prices, the market price, and bid price.

The ask prices of the order book are the prices written in red colour at the top. These are the prices that have been set to sell an asset. The asks prices are usually displayed few but they move with the current price of the market therefore they change in between a second. We have the highest ask price at the base of the ask price and the lowest ask price at the top. An ask price is executed when it becomes the lowest ask price.

The Market Price is the current price for which an asset is sold. It is price for which an asset is available to be sold in the market. They is found between the ask prices and the bid prices in the order book. This are the prices that have been set to buy an asset. They are also displayed few but moves with the market price. Among the bid prices, we have the highest bid price at the top of the bid prices and the lowest at the base. A bid price is executed when it becomes the highest bid price.

The Bid Prices are the prices are the prices written in green colour at the base of the order book. These are the prices that have been set to buy an asset. They are also displayed few but moves with the market price. Among the bid prices, we have the highest bid price at the top of the bid prices and the lowest at the base. An bid price is executed when it becomes the highest bid price.

QUESTION 2: Who are Market Makers and Market Takers?

Market Makers: These are crypto traders who make an order to buy or sell at their convenient bid or ask price respectively. They use the limit order in executing their trades. Their order forms part of the bid and ask prices.

Market Takers: This are traders who buy or sell at the market price price they meet. They do not bargain for bid or ask price but rather, they use the current price in the market. They do this by using the market order to make their others.

QUESTION 3: What is a Market Order and a Limit order?

Market Order: This is the type of order that is executed immediately. When trades have been set to this order, the order executes at the current price or highest bid or highest ask price. Often times, they are executed at the highest bid or highest ask price. The traders that trade with this type of order are called the market takers.

Limit Order: This is the type of order that is set to be executed in the future. It is the the type of order that allows for bidding or asking for price in the market. Some of this orders take hours, days or weeks (as the case may be) to execute. The traders who trades with this type of order are called market makers.

QUESTION 4:Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

The relationship between market makers and traders with the order types and liquidity is that;

Market makers sets prices for which they are to trade their assets. These prices set by the market makers make the limit orders which are the bid and ask prices. Because their are always limit orders in the market, a lot of buy and selling goes on. This makes the market liquid, that is the presence of enough buyers and sells in the market that leads to the quick execution of orders. Traders who which to trade at the current price of the market always have traders with because the price fluctuates and once the market order reads a limit order, the price is filled and a market order set by a market taker is executed instantly.

QUESTION 5: Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

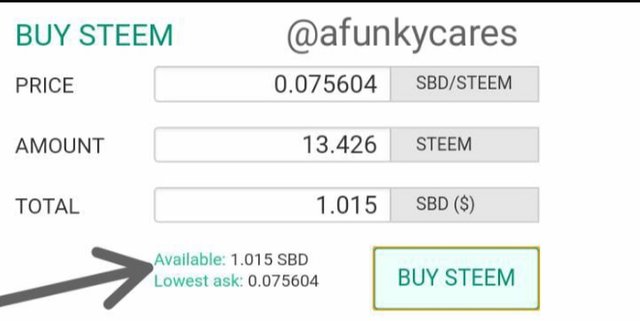

To attempt this question, I logged unto my steemit wallet. From the market in the drop down arrow for SBD, I accessed the Order book.

(a) I made a buy entry of 1.015SBD for 13.426STEEM by accepting the lowest ask price of 0.075604

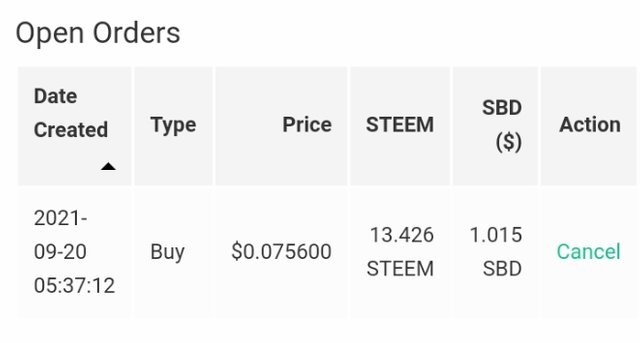

The order was created but because it was

set at the lowest ask price, it executed in less than seconds. What I also happen that is recorded in the open order is that the price set for my order is 0.000004 below the lowest ask.

(b) Here, I made a buy entry of 1SBD for 13.332 STEEM at my price of 0.075613.

The order was created but because it was below the ask price, it wasn't executed. It is just going to be registered until the lowest ask price comes down.Also the price set in my open order is 0.000005 lower than my price.

QUESTION 6: Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

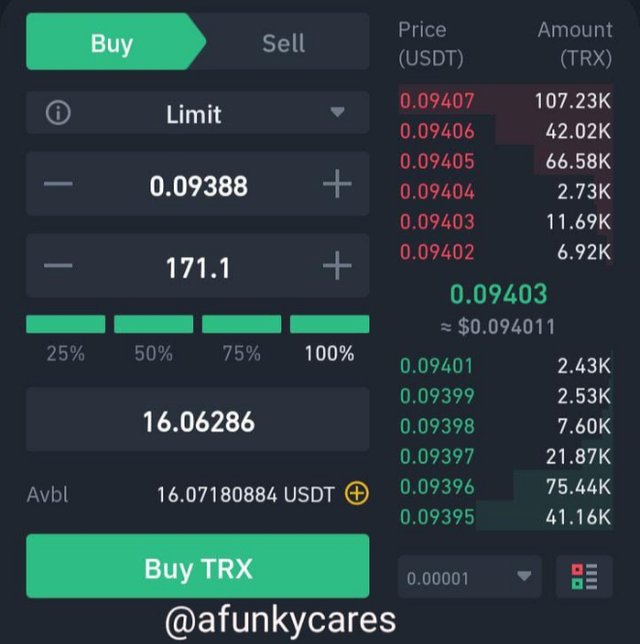

Placing a Limit buy Order

Open Buy Limit Order

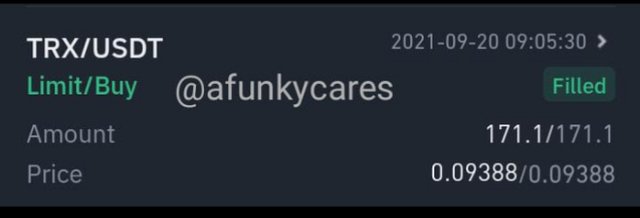

Limit Order History

Before I carried out this trade, I change the order type to limit.

I carried out the above trade by inserting the price I wanted in the price box. My price fell among the bid prices at the moment, I clicked 100% and lastly clicked buy. So an order was opened for it. It was also marked among the bid prices. The order was executed when the market price and the highest bid price were same.

By placing this buyer limit order, I became one of market makers at that time. My order my order impacted the market by becoming one of the bid prices at the market at that time.

QUESTION 7: Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

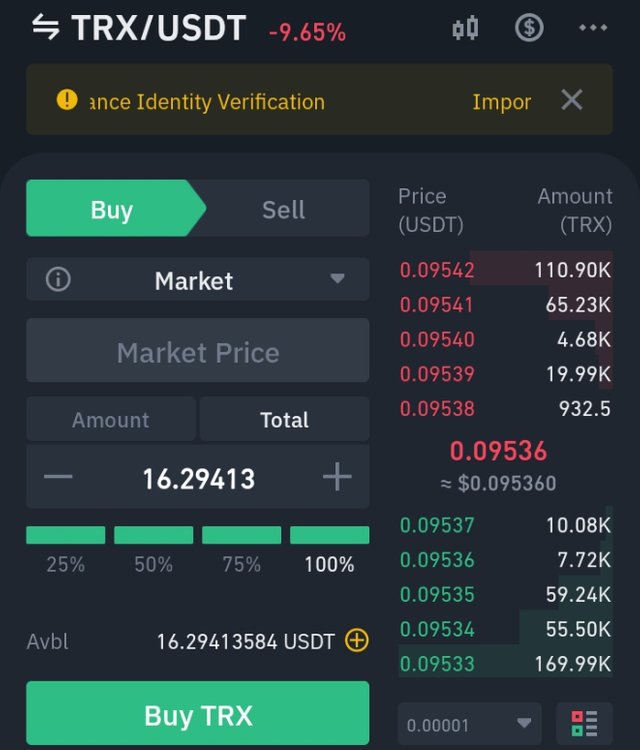

Placing a Buy Market Order

Buy Market Order

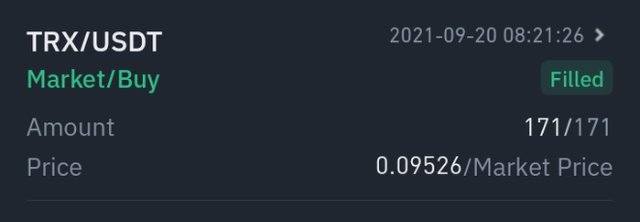

Details of the Buy Market Order

I changed the order type from limit to market before carrying out this trade.

So I clicked on buy from the top because my layout. Then I click 100% and click on buy. The order was executed immediately at the highest ask price.

By placing this buyer market order, I became one of market takers. My order order impacted the market by becoming the highest asked price.

QUESTION 8: Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

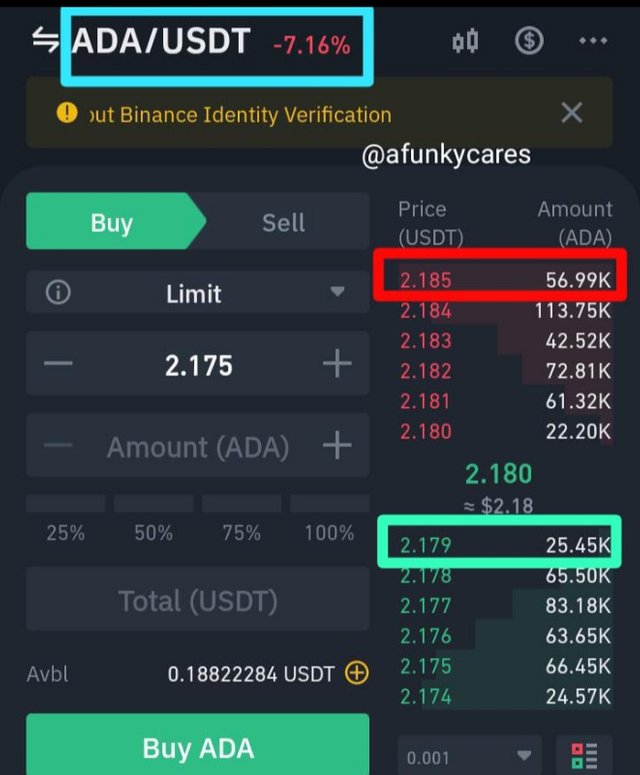

SCREENSHOT OF ADA/USDT pair from Binance.

The above screenshot was taken from the trading page. So I used the order book in the trading page for that this calculation.

Highest Bid Price: $2.179

Lowest Ask Price: $ 2.185

(a) Bid-Ask Spread

Bid-Ask Spread = Ask Price - Bid Price

= 2.185 - 2.179

= $0.006

(b) Mid Market Price

Mid Market Price = (Bid Price + Ask Price)/2

= (2.179 + 2.185)/2

= 4.364/2

= $2.182

I am go into take another screenshot of the order book from the chart section and use it to calculate.

I will use a screenshot of the order book of ADA/USDT from the chart section also for this calculations.

ADA/USDT Order Book from Chart.

Highest Bid Price: $2.061

Lowest Ask Price: $2.076

(a) Bid- Ask Spread = Ask Price - Bid Price

= 2.076 -2.061

= 0.015

(b) Mid Market Price = (Bid Price + Ask Price)/2

= (2.061+2.076)/2

= 4.123/2

= 2.069

I made the second calculation when the price of the asset has fallen from where it was in the first calculation.

Conclusion

The order book is a long list of prices written in green and red colour depicting buy and sell orders respectively. It is made up of three components which are bid, market and ask prices. Both limit orders and market orders can be made on this book. While limit orders take time to execute, market orders execute instantly.

@tipu curate

Upvoted 👌 (Mana: 1/5) Get profit votes with @tipU :)

Thank you.

hello friend, i have followed you on steemit, please be kind enough to follow me as well. lets make steemit a great community together. thanks & regards