Steemit Crypto Academy [Beginners' Level] | Season 4 Week 1 | The Bid-Ask Spread | Homework post for professor @awesononso by @alihussain07

1 Properly explain the Bid-Ask Spread.

2 Why is the Bid-Ask Spread important in a market?

3 If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

4 If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

5 In one statement, which of the assets above has the higher liquidity and why?

6 Explain Slippage.

7 Explain Positive Slippage and Negative slippage with price illustrations for each.

Q1 Properly explain the Bid-Ask Spread?

Bid-Ask Spread

Working of Bid-Ask Spread System

On the Cryptocurrency exchange platform, sellers have placed their ask price for a specific currency. The buyers explore the required fields and tell how much they want to pay for a specific currency. In this way bid price is established by the different buyers. The trade is the dependent on the difference in the Bid-Ask Spread.The Bid price and the Ask price are not always the same. We can see on the exchange platforms that the ask price will be a bit higher than the bid prices. Large company holders which are known as the “Market Makers” offer prices to both buyer and the seller. Then these market makers enable themselves to control the Bid-Ask Spread of the market. For Example, Market Maker set a price of $30.30/30.90. So, $30.30 will represent the Bid price while the $30.90 represents the Ask price for the market. This gives a large amount of profit to the market makers because they are controlling the customers accordingly.

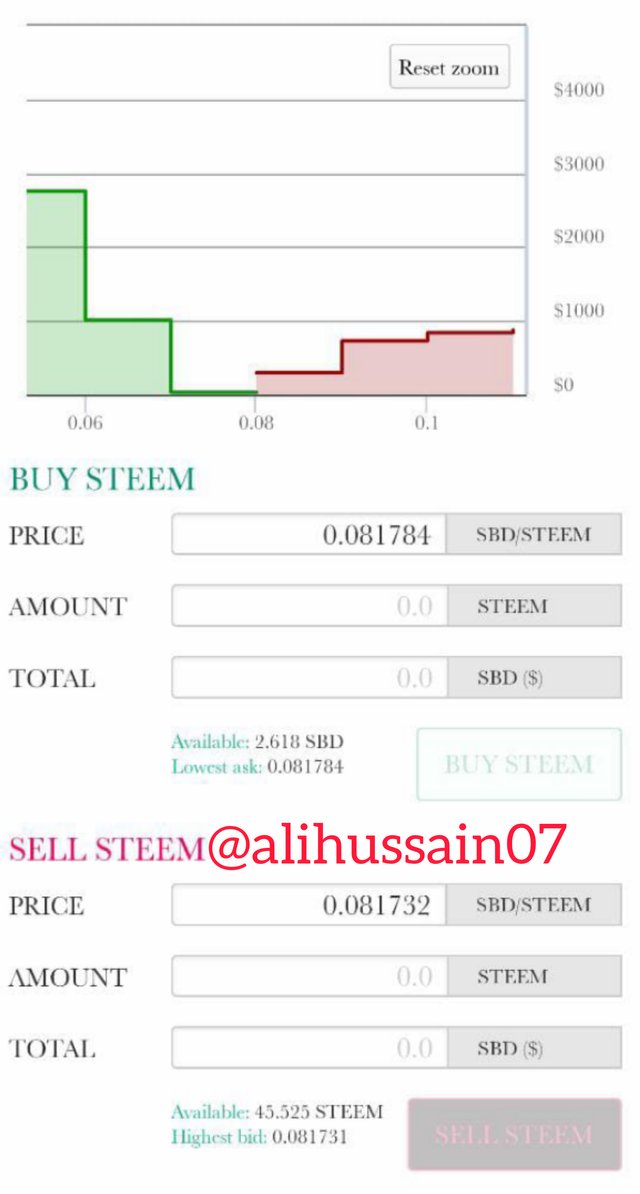

- Ask price 0.81784

- Bid price 0.81732

- so bid-ask spread price is 0.81784-0.81732= 0.00056

Placing Order in a Market

If we are a buyer or a seller, we will not be able to know the trading signals in the market. We have to use the specific “Market Orders” while trading the Cryptocurrency. The pricing of the digital assets are changing continuously. If we want to gain profit in a short amount of time, then market order will benefit us. There are both aspects of using the market order. A lowest buying price is received if one place a market sell order and highest selling price is obtained on submitting a market sell order.

Q2 Why is the Bid-Ask Spread important in a market?

Importance of Bid-Ask Spread

As mentioned earlier, Bid-Ask Spread is the difference between the seller’s price and the buyer’s price. In some cases It is also called as“Price Spread”. It is considered very valuable in the digital currency market. Many traders trade depending on the difference in the price spread of the market.

Importance in the Market

In the market, it is very important for the liquidity to take place. For that, Bid-Ask Spread plays a vital role. If the buyers and the sellers prices are very close to each other it means that there is a mutual understanding for a respective amount of digital asset and market is growing efficiently. If the spread is wider than the usual, it means there is a difference in the opinion of the customers and market is greatly influenced by it.

Relation with Liquidity

To increase the liquidity, it is necessary that the spread in minimize to a greater extent. For that, market makers have appointed various people in this respective post to recognize and maintain a Bid-Ask Spread in the market according to their consumers. Market makers captures the both sellers and the buyers and set a target value to pursue the deal. When he is able to get attention of a lot of customers, profit is shared with the company and liquidity is maintained.

Importance in Consumer Market

Sometimes margins in the amount given by the market placers can be ignored if we directly purchase from the consumer market. As mentioned above, market is influenced by the buyer and seller and they are gathered by the market place holders. If they make a deal outside of the market place holders, they will be able to attain profit. It will be enough to satisfy both the persons. But place holders also play an important role in the market as they are a source and they greatly give ratings to their customers. So, if we want to establish a connection it is recommended to contact a place holder.

Q3 If Crypto X has a bid price of $5 and an ask price of $5.20,

Calculate the Bid-Ask spread

As we know that,

Ask Price – Bid Price=Bid-Ask Spread

Bid-Ask Spread = $5.20 - $5.00

Bid-Ask Spread = $0.2

Calculate the Bid-Ask spread in percentage

% Spread = (Spread/Ask Price) x 100

% Spread = ($0.2/$5.20) x 100

% Spread = 3.846%

Q4 If Crypto Y has a bid price of $8.40 and an ask price of $8.80:

Calculate the Bid-Ask spread

Bid-Ask Spread = Ask price - Bid price

Bid-Ask Spread = $8.8 - $8.4

Bid-Ask Spread = $0.4

Calculate the Bid-Ask spread in percentage

% Spread = (Spread/Ask Price) x 100

% Spread = ($0.4/ $8.80) x 100

% Spread = 4.54%

Q5 In one statement, which of the assets above has the higher liquidity and why?

Crypto X has high liquidity. It can be explained on the basis of the spread. As the spread of the Crypto X (X = $0.2) is smaller as compared to the Crypto Y(Y = $0.4), so we can say that the crypto X has higher liquidity. I also learn that the high liquidity will cause buying and selling price to be closer to each other which benefits the market.

Q6 Explain Slippage?

Due to the sudden changes in the digital currency market, the placed order price can be fluctuated very easily. This can be understood by explaining the term slippage. Slippage occurs when traders have to accept the changed price except for the original one they have decided due to fluctuation in the price. The order is then completed with a different price then what was expected. This phenomenon can be observed in any market currently operating around the world.

Slippage cannot be avoided but it can be reduced in different ways. The traders have set a specific percentage window of fluctuation. If the changing exceeds beyond that limit, there orders can be cancelled depending upon the situation. On the viewpoint of the Slippage, there are two main categories in which it has been divided. These are Positive Slippage and Negative Slippage respectively.

Q7 Explain Positive Slippage and Negative slippage with price illustrations for each?

Positive Slippage

Positive Slippage usually occurs if the price of the Cryptocurrency falls, so that the purchasing power or the selling power of the trader is enhanced. For Example, if we purchase 100 units of a digital asset at a price of $10 ($1000). By the time of completion of all the orders, slippage occurs and price suddenly drops to $9.50.

We can also observe the positive slippage in selling a digital asset. For Example, we want to sell 100 units at a price of $10 ($1000). The final price after slippage comes out to be $10.5 unit each. As a result, the trader will obtain a profit of $50. This is known as Positive Slippage.

Negative Slippage

In Negative Slippage, the pricing of the Crypto currencies are enhanced from the known value. In this way, the buying power of the trader is reduced. For Example, if we want to buy 100 units at $10 (1000). Due to slippage, the spread is enhanced and the final price would be $10.50 resulting in the negative slippage.

In another scenario, if we want to sell digital asset for example we have 100 units to sell at a price of $10 (1000). After negative slippage, the final prize comes out to be $9.50. The results would be worse than the expected if we invest in a large amount of units.

Normally acceptable Slippage by the traders are between 0.5% - 1%. Any value above it is considered as a loss by the traders. It is neglected if we are dealing a small amount but if we are dealing in thousands of dollars, then it can cause serious issues in the market.

Conclusion

In this assignment, I explained various terms related to the Cryptocurrency market including Bid-Ask spread and spillage, Bid-Ask Spread is important to maintain the liquidity in the market and also to engage the customers effectively. The higher difference between the bid price and the ask price will ultimately lead to a decrease in the digital assets in the market. Spillage is also important term to be remembered when trading. Sudden change in the bid price is known as spillage. Positive and negative spillage is observed in the market by the traders. It usually occurs unexpectedly. The traders have to set a target to avoid the negative spillage

Very good explanation from you. Keep it up!

Hello @alihussain07,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Thanks again as we anticipate your participation in the next class.