Investment through Private and Public Sales - Crypto Academy / S4W6 - Homework Post for @fredquantum

Image edited by me in Powerpoint

1.What can you say about Crypto Investment and how to properly utilize the investment tools available to make the right decisions?

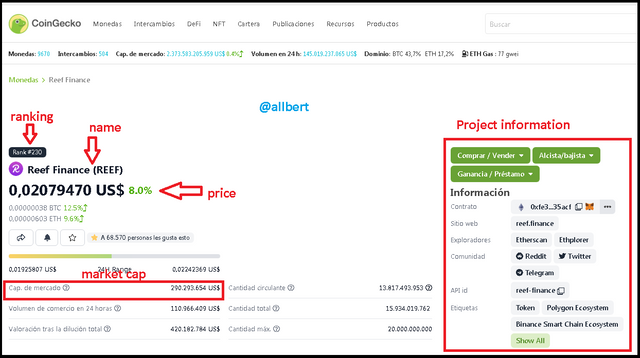

1-Platforms like Coingecko, Coinmarket cap: They are designed to display all the information regarding a project, from the price of the coin, project foundation, developer team, usually always show the link and social networks so that we can verify for ourselves that a project is real.

Image taken from: Source

If it is not listed on either of these two sites... the project is probably a scam or might not exist.

2-Project web page: On this page, there should be information about the function of a project and its token. It should also contain information from the white paper and the road map.

3-Developer team: Researching this is of the utmost importance, as it is the people who give veracity and support to a project. A cryptocurrency will generally rise or fall depending on the people working to develop it.

Cardano Founders. Image taken from: Source

It doesn't matter if you are going to do Holding, or participate in a yield farm or Pre-Sale. It is always necessary to review the people who make up the development team... if they are real people if they are responsible and capable of the development of a project.

2.1 Private Sale in Cryptocurrency.

Benefits

1-The token is sold at a much lower price than it will be when it goes to market.

2-If the project turns out as expected, it can produce great profits for the investor since he/she would be buying a token at a very low cost.

3- The attention is personalized. You have the opportunity to meet the developers directly.

Risks

1- At this stage, the project is more vulnerable and constitutes a great risk for investors to never see their investment return.

2- These sales are not regulated by any agency, so in case of a scam or failure to meet the terms of the agreement there are no authorities to turn to.

3- There is no clear time of return on investment, as it depends on how good the following phases are.

4-No liquidity to cash out.

2.2 Presale in Cryptocurrency.

Benefits

1-The token is again offered at a price lower than the final market price.

2-The pre-sale also constitutes an opportunity for long-term profit.

3- More tokens are offered than in the private sale.

4- The project enjoys a little more solidity.

Risks

1-If the next phase is not good, may not see returns on investment.

2-There is not as much token supply as in the next phase.

3-The project is still relatively unknown, so few things support the project.

4-In this phase you don't get to know the developers as much as in the first phase.

5-Tokens can be locked up for a long time before they can be cashed out.

2.3 Public Sale in Cryptocurrency.

Benefits

1-Lower risk since at this stage the project is more consolidated.

2-More liquidity of the token and more possibility to exchange it.

3-Less uncertainty about the future of the project, since judging by the private sale and pre-sale it is possible to foresee how strong the project will be.

Risks

1-The token would be purchased at a higher price compared to the presale and private sale.

2-There is still volatility in the price of the token, as if it is suddenly sold by the vast majority of upstream investors, the coin could lose value.

3-There may be much less profit than expected.

4-The supply is not unlimited, as it depends on the ICO goal being met.

3. What are the mediums used for Public/Pre/Public Sales in Cryptocurrency?

Websites:

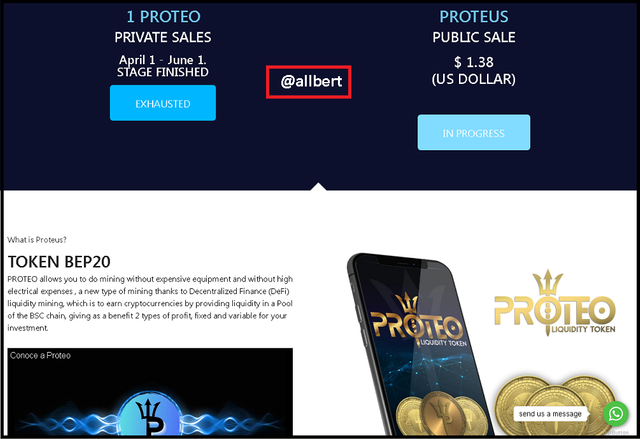

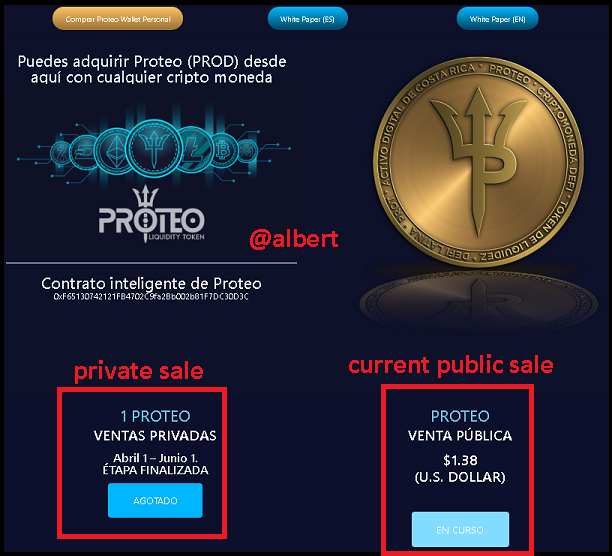

I think that universally it is the most common media, since creating a website is not expensive and gives a kind of formality to the pre-project. Through the website, you can find all kinds of information about the project, such as white paper, road map, contact with the developers, dates, etc.

Proteo website. Image taken from: Source

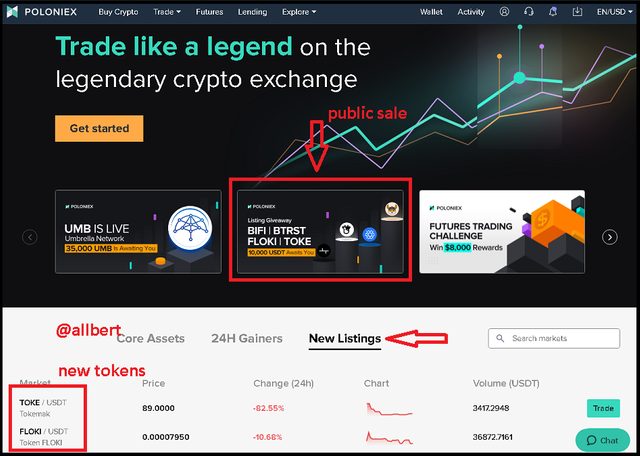

Exchanges:

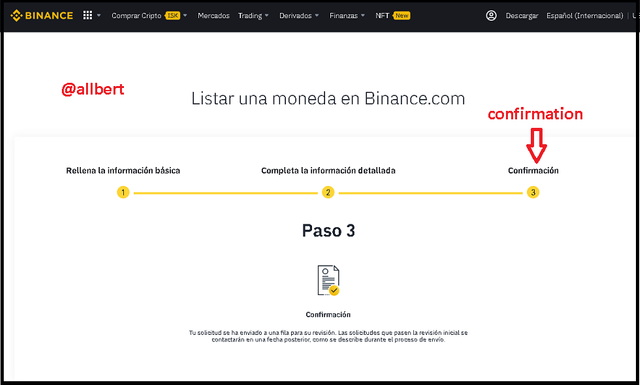

As I said before, exchanges also offer their service to promote the sales of a new project. Naturally, it is more expensive and demands more requirements to make a public sale through an Exchange, but for investors, it is safer.

Poloniex. Image taken from: Source

Social networks:

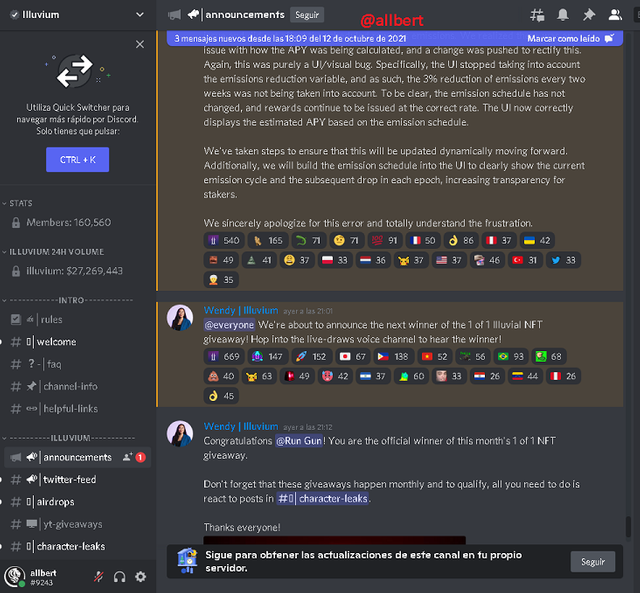

Various social networking platforms such as Discord and telegram have become very common lately for pre-sales of new tokens and new projects. The positive factor of these mediums is that they are a very inexpensive way for developers to maintain constant communication with investors and the general public.

Illuvium Discord channel. Image taken from: Source

Business lunch or other types of social meeting

In my case, I once attended one. It was in a very luxurious hotel in the city where a talk was given about cryptocurrency (I don't remember its name). Although at that time I knew absolutely nothing about cryptocurrencies, today I understand that I was at a private sale, since in total there were about 20 people at that meeting, and it had been the same developers of the project who invited us. Usually, these types of meetings tend to be very exclusive, and not just anyone is allowed in. On the other hand, I suppose that if a large company wants to create a blockchain project they could have other means to push their project such as advertising on TV, newspapers, radio, internet, cinema, billboards, etc. 4. Research about any recent (2021) successful ICO or IEO and give detailed information about the project. (Note: BETA token is excluded).

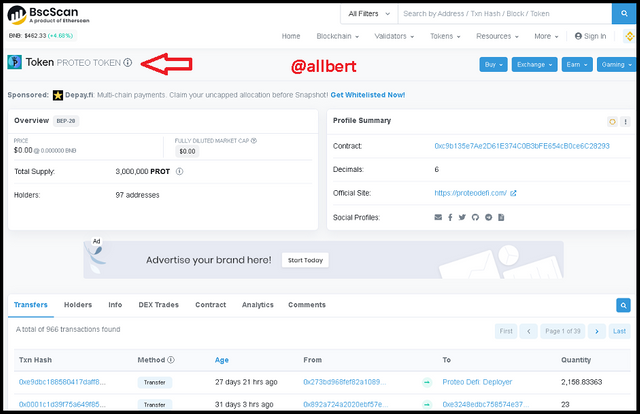

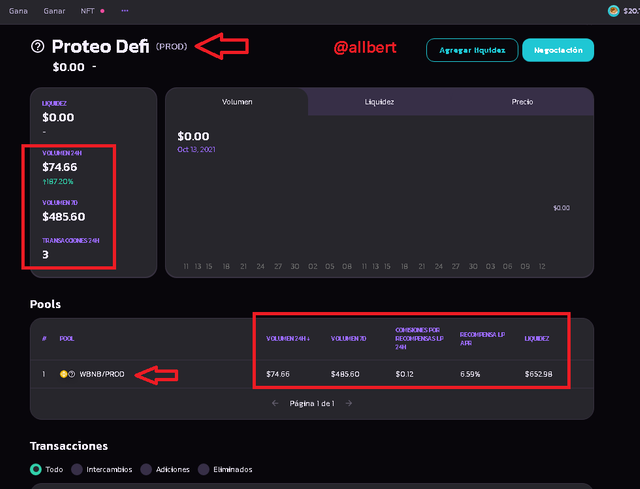

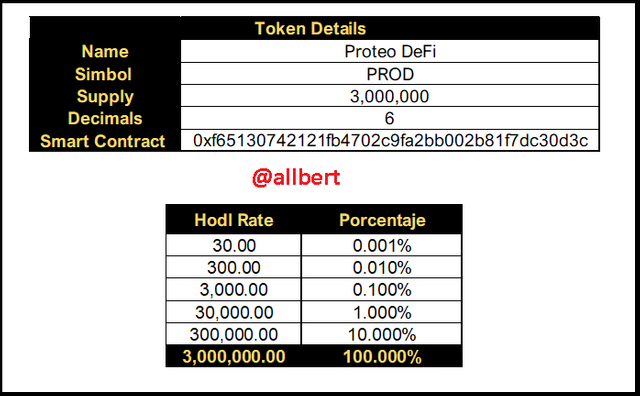

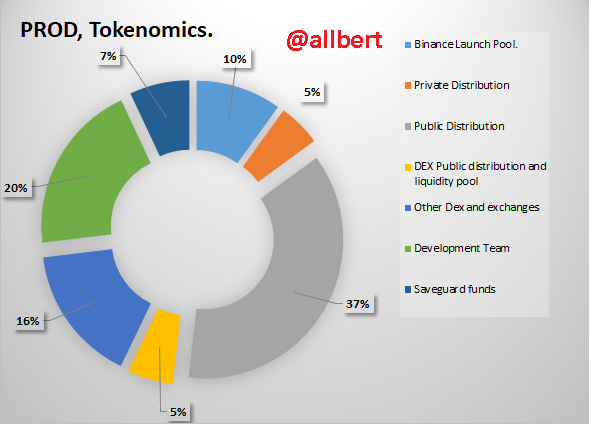

PROTEO

Proteo website. Image taken from: Source

Image taken from: Source

Image taken from: Source

According to its roadmap, the public sale will be until November 1st, which will be the day of the official launch of the platform and the token. It is in November 2021 that it is planned to be listed on coinmarket cap.

Proteo Roadmap. Image taken from: Source

Proteo Roadmap. Image taken from: Source

Proteo Roadmap. Image taken from: Source

5.Create an imaginary token. Write about the project including its use case. Develop an ICO which includes Private sales (3 stages) and Public sales (1). Note that: You are expected to explain what the funds are intended to be used for, your Private sale should have 3 stages, and specify the initial supply available, and the price you are issuing the token in each stage. Also, specify the price you are issuing the token at the Public sale phase (including the supply).

GANDALF

Gandalf. Image taken from: Source

The platform's algorithm will be in charge of matching two customers who upload opposite bets, from a catalog of options that will vary depending on the match or sport selected.

Gandalf will be developed on the Ethereum blockchain and its bets will work through smart contracts, which will ensure that the winning party receives its winnings.

In other words, When uploading a bet a customer will select a sport and match, being able to bet on results, amount of points scored, etc. Each bet will be uploaded separately and matched with other customers on the platform who have uploaded a bet on the same line but with opposite or different outcomes.

ICO

___________________________________________

First Private Sale:

The first private sale will be held at the Hilton Hotel in the city, inviting some well-known investors in the field such as athletes, coaches, broadcasters, team owners.Date: October 30, 2021

Supply: 1,000,000 GDF

Price:0.3 USD

Total raised: 300,000 USD

Use of funds: Payment for developer team, office and IT equipment rent and expenses for the next 3 months.

Then the next two private sales will be conducted with two online bookmakers interested in investing in the project.

___________________________________________

Second Private Sale:

It will be held at the offices of the online bookmaker Bwin.Date: 15 November 2021.

Supply: 1,000,000 GDF

Price:0.75 USD

Total raised: 750,000 USD

Use of funds: Payment of new equipment, payment of image rights of sports teams and famous athletes. Expansion of the current Gandalf Sports headquarters.

___________________________________________

Third private sale:

It will be held at the offices of the online bookmaker Betcris.net.Date: 28 November 2021.

Supply: 1,000,000 GDF

Price:0.9 USD

Total raised: 900,000 USD

Use of funds: Payment of requirements for listing on Exchanges, closing of Beta development, and payment of advertising campaign.

During the entire private sales process, a total of 3 million GDF was sold and a total of 1,950,000 USD was raised, almost half of the expected capital to finance the entire project. Due to the great receptivity of the project, we will move to the public sale phase.___________________________________________

Public sale:

With the money raised in the last private sale, we will start an advertising campaign in sports media, such as ESPN, Fox Sports (now Star channel), etc. It is stipulated that the public sale period will be between January 15, 2022, until March 1, 2022, and the purchase of the token will be made through the Gandalf Sports website.Date: January 15, 2022 - March 1, 2022.

Supply: 3,000,000 GDF.

Price:1.3 USD.

Total raised: 3,900,000 USD.

Use of funds: Final payment of sports branding requirements as well as the final launch of Gandalf's platform.

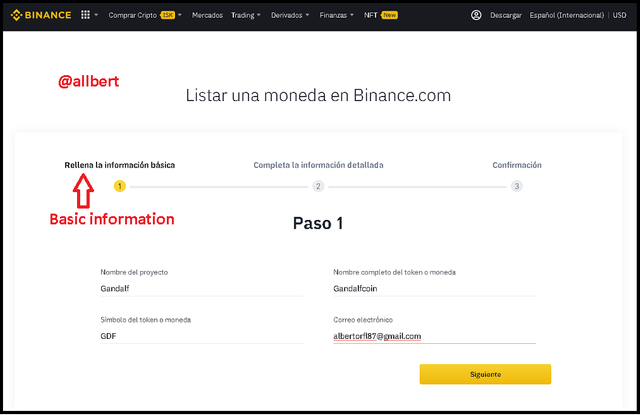

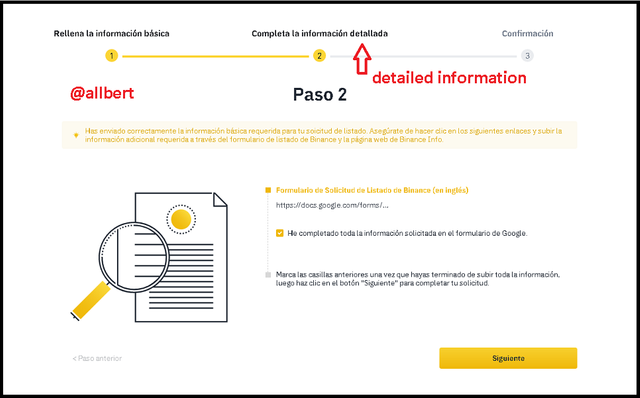

I can say that before the deadline the minimum required for funding could be reached, exactly on February 1. In total 6,000,000 GDF were sold between all sales phases, reaching an amount of 5,850,000 USD of funding.6. What are the criteria required for listing a token on CoinMarketCap. Is there a criteria for listing an asset on a Centralized Exchange? If Yes, use an exchange for your explanation in response to the question.

CoinMarketCap

To know the listing criteria of Coinmarket cap we can go to the FAQ of the platform and there we can find the Criteria which are the following:

1-Fill out the Online application form.2-Tracklisting Guidelines. Within which are the following requirements for new tokens:

-Leverage cryptography, consensus algorithms, peer-to-peer technology, smart contracts.

-Have a website and a block explorer.

-Must be exchanged on at least one exchange.

- Have a legal representative through whom Coinmarket cap can be addressed.

3-Evaluation Framework

In this phase coinmkarket cap evaluates the exchange volume of the token, the peers offered, the team, and the community that makes up the project. They actually evaluate the project in general.

4-House Rules Something that caught my attention in the house rules, is that the Coinmarket cap listing is free, and project developers are exhorted not to fall victim to scams or scams. 5-Delist policies It consists of the causes that may cause Coinmarket cap to remove the token from your listing, such as:-Low liquidity.

-Lying in the information provided to Coinmarket cap.

-That the project is under investigation.

-Low receptivity of the community.

All these requirements were taken from the Coinmarket cap website: https://support.coinmarketcap.com/hc/en-us/articles/360043659351-Listings-Criteria

Centralized Exchange

Image taken from: Source

Image taken from: Source

Image taken from: Source