READ NEW INSTRUCTIONS! | Steemit Crypto Academy Season 2 Week 3: Trading and Holding - Two Sides of a Coin

.png)

Introduction

Good day and welcome again to my class. Last class, majority of us understood the concept of blockchain, and successfully completed the task. There were some plagiarized content, half-baked content, and derails from the topic too. I know we have all learnt and will strive to be more focused on this week’s lecture and task. Today, I want to talk to us about the two major methods of investing/profiting from cryptocurrencies, Hodling and trading, the two sides of a coin, literally😏. We will learn what it means to buy and hold, spot trade coins, leveraging and its children cross, isolated and futures trading.

So John, 15 years away from his retirement as a banker decides to make other retirement plans. He had options like real estate but that was too complex and would take him a lot to know what to do. He wanted to just trust the insurance company but John has heard some really nasty stories and he didn’t want to stake his future on the integrity of someone else, then at work the next day, he saw his dear old friend, Maxwell arrive in a Lamborghini.

What?! How? Maxwell was his colleague and they both earned equally, and he wasn’t from a buoyant family, when he

finally got the chance to talk with Maxwell, he found out that Maxwell had come across a hardware ledger from his college days when he got about a thousand bitcoins for almost nothing. That moment it struck him! Why not use crypto? After surfing the net for days, watching youtube video after youtube video, he found out there were two ways people made money from crypto, Holding, which his friend did, and trading.

His mind was made up, it was now a case of; WHAT TO DO?

.png)

Buying and Holding (HODL)

Newbie or not, you most probably have heard the term HODL. This slang is a misspelling of the world hold, although some people believe it to be an acronym meaning “Hold On for Dear Life”. Whatever the origin, this simply means acquiring cryptocurrency through buying, exchange, mining or any other source, and leaving it in your wallet for as long as you have set or till a target price. This requires a lot of patience and fortitude because you will ride heavy bumps along the way, there will be fear, dips, downtrends, and paranoia. The pressure to sell builds with each hurdle, and most people end up selling with less profit, or even at a loss, or before the stipulated time. However, as the saying goes, “The hodlers always win”.

How To Hold

A lot of people do not know that wallets do not actually hold any cryptocurrencies, rather they are properly equipped to access the blockchain and perform transactions. There are many ypes of wallet to hold your coins. Different types of wallet and what you can do with them. Let’s see:

Cold Wallets

These are wallets that are not connected to the internet. They are stressful to use, but recommended to hodlers because they cannot be hacked and generally safer than hot wallets. There are of several types

Paper Wallets

This is a document that has the private and public including QR codes of your wallet printed on it. These wallets are ususally printed from an online source. They are used to make transactions, although I have not used or seen one, claims are that paper wallets only allow movement of the entire portfolio and not parts. I do not need to tell you, or John what would happen to his funds if this paper was destroyed and no copies were made, or if the paper got into the wrong hands.Hardware wallets

Not so easy to use, but hardware wallets are considered very good options. The funds are not easily accessible, but that can be remedied using platforms like Binance Dex. hardware wallets use an offline device or to create and store private keys. An example of hardware wallets is the Ledger USB. This is basically a USB built to store private keys, and they require a computer to be accessed. I do not need to tell John or you what would happen if the USB isn’t kept safe. Examples of ledger wallets are Trezor One, Ledger Nano X and Keepkey.Offline Software Wallets

This type of wallet divides itself into an offline wallet securing the private keys and an online wallet with public key. The online half initiates transactions, which are unsigned, the unsigned transaction is forwarded to the offline half to sign it with the private key, then send it back to the online half which then sends it to the blockchain. This method ensures the private key remains intact at all times. Examples of offline software wallets are armoury and electrum.

.png)

Hot Wallets

These are basically wallets that are connected to the internet. There are numerous types but I will talk about three:

Exchange Wallets

This is basically wallets on cryptocurrency exchanges like binance, huobi, etc that can hold your coins. These type of wallets are usually used by traders or people who use their crypto as an exchange medium regularly. These exchanges actually store the crypto in their own wallets, but give you a medium to access. This means the private key is in their possession and not yoursMobile and desktop Wallets

These are normal wallets, apps you download on your phone or computer and store your cryptocurrencies. You can send from or receive coins with them using QR codes or addresses. They can be hacked and are prone to malware, so be careful. Trust Wallet is a very popular example.Web Wallets

In simple terms, wallets that can be accessed through a browser. They could be through exhanges or the browser directly. Some give you the private keys and others hold onto it, and your portfolio safety rests on their integrity, John thinks this is too risky.

Now that John knows all the ways he could hold his crypto, he decides to delve into the world of trading and know what

opportunities await.

Strategic and Panic Selling, the difference

Selling crypto currencies means exchanging them for another cryptocurrency or fiat. There are so many reasons to sell, some people sell because they have emergencies and need the money, some people sell because they have reached target profit levels, but holders sell for only 2 reasons

Panic and Strategy. We all have heard the regular “buy low, sell high”. Some holders use this to increase their portfolio size. Take for example, Jude and Michael buy 1000 TRX each at $0.1. TRX goes on a bull run and hits $1, and there is a resistance level there, Jude sells at $1, has $1000, price drops to $0.5 and Jude buys again, with the money, this time 2000TRX, Michael on the other hand watched it fall to $0.8, $0.6, at $0.5, he decides to sell out of fear of losing more, at least he is still in $400 profit.

Two weeks later, TRX breaks the resistance and hits $2, Jude is smiling, he has made $4000 from his $100, Michael realizes this and FOMOs in, but he is already late and would have to hold longer.

The difference between these two men was, one sold with a plan, one sold out of fear. What makes you sell? John has learned a lesson from the story of these men, I hope you did too.

Trading

This is where I love exchange wallets, They make trading easy by pairing up crypto with crypto and other fiat and fiat-backed crypto. Trading, as simply as the name implies means exchanging a coin for fiat or other coins, in other to make profits from flunctuations in price. Take for example, while John was learning, he discovered that if he has $10, and he buys bitcoin with it at $10,000 per BTC. BTC then proceeds to do a 20% move and goes to $12000 a few hours later, John sells and makes $2 from that. A thought occurred to him, what if the coin did a -20% move, what happens?

Well at that point, if he decides to sell, he makes loss worth $2. This is called spot trading.

.png)

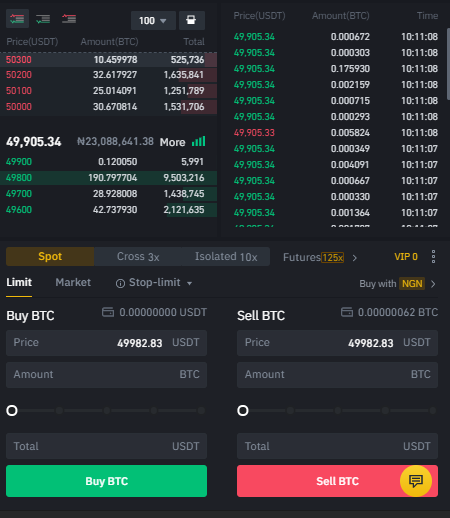

Spot Trading

This is the exchange of one crypto or fiat in exchange for a coin you believe will grow in price. This is usually done in pairs, and most coins are paired against the stable USDT for example BTC/USDT, ETH/USDT. You can decide to use 50usdt to buy ETH, if the price of ethereum goes up or down by 15%, you make or lose exactly 15% of the capital used to buy. On Binance, to place a spot trade:

Open the pair(BTC/USDT) you want to trade, ensure your spot wallet is funded with the currency you want to use to buy (usually USDT)

select limit if you want to buy when it gets to a certain price before buying, or select market to buy at the current market price.

input the amount you want to buy, and click on buy BTC.

Congratulations you have spot traded BTC. If it gets to the profit levels you deem fit, sell, by following the above instructions on the sell side.

John likes the idea of spot trading, but started thinking, he doesn’t have so much in terms of capital, and he doesn’t think $2 is worth the stress, in comes LEVERAGING.

Leveraging; The Double-edged Sword

Leveraging is in simple terms borrowing to increase units. Think of it as borrowing capital to do business so as to increase your profits. Remember if the business ends up in a loss, you alone carry it, the lender has no share of the losses. Same way, leverage trading works when the exchange lends you money to buy coins, so you can open a larger position.

On Binance, there are 3 ways to take advantage of leveraging;

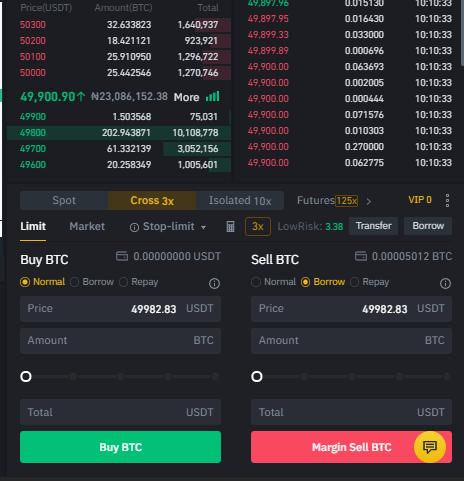

Cross Margin

This is a leveraged type of trading where unrealized PNL is drawn from the whole cross margin balance, including open trades. This means if you have a trade open from ETH/USDT in $3000 profit, and a trade on BTC/USDT in $2500 loss, the profits from the first trade will hold the second. To cross-margin trade;

Transfer the amount you want to use for trading from your spot to your cross margin account

Open the pair(BTC/USDT) you want to trade

select limit if you want to buy when it gets to a certain price before buying, or select market to buy at the current market price.

Select “Borrow”

input the amount you want to buy, and click on buy BTC.

To close the trade, on the sell side change “borrow” to “repay”, and follow the above instructions too.

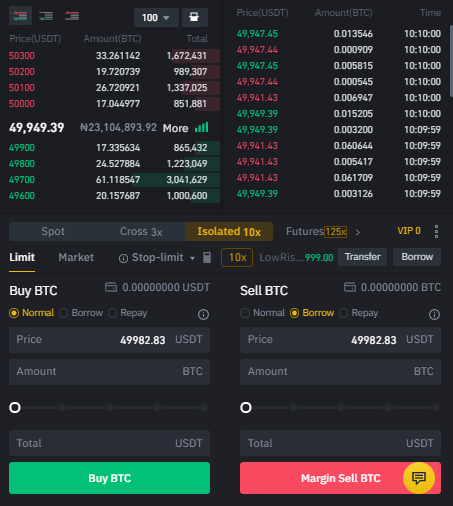

Isolated Margin

This type of leveraging isolates pairs, meaning losses from trading another pair cannot the be drawn from the balance of another pair. Each pair’s balance has to be self sufficient, or it could get margin called.

To isolated margin trade;

Transfer the amount you want to use for trading from your spot to the exact isolated margin account, e.g BTC/USDT.

Open the pair(BTC/USDT) you want to trade

select limit if you want to buy when it gets to a certain price before buying, or select market to buy at the current market price.

Select “Borrow”

input the amount you want to buy, and click on buy BTC.

To close the trade, on the sell side change “borrow” to “repay”, and follow the above instructions too.

Futures Trading

Although if you ask, you are told futures is an agreement to buy or sell a coin/token at an agreed rate, in a time to come, it doesn’t feel much like it. This type of trading is like forex trading, if you have ever tried it, in that it allows for the option of stoploss and take profit, and you can also place a sell.

Futures comes in two types;

USDT Margined futures

Here the base currency is USDT and that is the deposit currency. Your profits and losses are calculated in USDT, and so is your balane. You can place a buy trade on BTC/USDT at $49,000, set the leverage level you want, which could be up to x125, aand take profit at $50,000.Coin Margined futures

COIN-margined futures have its PNL and balance calculated with the coin itself. This means deposits are made according to the base coin, e.g BTC and profits and losses are calculated within, and the coin is paired against fiat, e.g USD.

We will elaborate more on futures and Its complexities in our next lecture. john still to satisfied, asks; "What if the loss is bigger than my deposit?", then he learned about margin calls

Margin Call

This is the liquidation of a position when its floating PNL is lower than 80-100% of the initial deposit. Fior example, you have $2000, opened a cross margin buy of x5 on btc, and the floating PNL drops to up to -$1600 , the exchange automatically closes the trade in loss, takes bak their loan to you, and whatever is left($400) becomes your balance. Margin levels are different, some exchanges offer 60% some allow up to 80%. This is what people refer to as REKT because the money is totally lost and fluctuations in price does not affect your portfolio again.

Conclusion

.png)

John realizes that while trading is riskier, it is more rewarding, but all he wants to do is invest, so he invites his brother Joseph, who he knows will be interested in trading and introduces him to trading, while he sticks to putting his savings into crypto.

This is what we should understand, holders and traders can all be profitable, you should know whether to trade or invest based on what your plan and skill level is.

Homework

- Do you hold any coins? Talk about the wallet type you prefer/would prefer holding in

- With screenshots, show how to perform spot trading on any pair of your choice.

- Holding or trading, which do you prefer and why?

Rules

Post Homeworks in in the community Steemit Crypto Academy.

For Homework Task, add tag #holdingvstrading, #alphafx-s2week3, and #cryptoacademy in the first 3 tags. Also, tag me as @alphafx somewhere in the post.

PLAGIARISM is not right, ensure to avoid it. make sure images are copyright free, original images are better.

Post Requires a minimum of 300 words.

Submit Homework task on or before 1st may 2021.

make sure to use #alphafx-s2week3

Users who are powering down will not be voted, take note!

@steemcurator02 will only consider voting homework posts from users with reputation 50 or above

Thank You.

unless otherwise stated, all images are designed by me or personal screenshots

Good day Prof @alphafx.

Thanks for the well delivered class. You really explained in details. This time, I understood 90% of your explanations nevertheless, I have a question.

You gave us the steps in carrying out cross margin and isolated margin trades. You said we should transfer the money we want to trade with to margin trade but in your explanations, you said we should still select borrow. Do we have to select borrow when we have money to trade on margin trades?

What is it the percentage of profit or loss on Binance margin trade? How is it calculated for traders?

There have been up to two times I had borrowed given USDT of 500 with 0% by binance in the reward center. In one of those times, I claimed it but could not see it any where in my margin wallet, so I didn't do anything with. Though I didn't know how to trade there. When next I am given, how do claim it successfully to see it for trades?

According to my experience in margin, the house always wins, since I use margin on several occasions to experiment and end up losing 90% of my capital, what I did realize is that binance keeps a large part of the profit, BECAUSE DO I BELIEVE THIS? I put $ 200 in margin and at the exchange they lent me 2000 usdt plus the $ 200 that is my capital was a total of $ 2200, my investment put it in the BNB / USDT pair I bought the BNB at $ 512 and sold at 522 $.

This means that I bought 2,200 / 512 = 4,296 BNB and I sold at 522 * 4,296 = 2,242.96, which in theory gave me a profit of $ 42, but the reality is that, when I paid the loan, I had only earned $ 4.2.

Then I made another loan I had the same $ 2,200 again and bought BNB at $ 518 but the currency had a sudden drop and reached $ 497 I received a message first on the phone saying that the losses in margin were high, but instantly it came to me Another message that they had canceled my orders to prevent me from going bankrupt.

So my question is:

When I invested the first time in the BNB / USDT pair, the BNB went up $ 20 and my profit in theory was 42 but I received only $ 4.2 when I paid off the loan; So where is the remaining $ 37.8?

My second investment I invested in the BNB / USDT pair and the currency had a fall of $ 21 and automatically binance canceled my orders and I lost half of my money only reflected $ 100 in my balance, now I ask myself another question; When I win the 42 and received only $ 4.2 it is not supposed that if the coin goes under $ 21 it should not lose $ 4.5; So where is my other $ 95.5?

The reward that binance gives to use it in margin will never be reflected in the balance since the function of that reward is to pay commissions that each operation you do in magin carries, which means that each operation that binance makes charges you 0.01 % of the amount you are trading. With the 500 USDT you will pay those commissions that will not be deducted from your real balance.

NOTE: Operating in margín is risky, you have 80% of losing your money if you do not know how it works since I made the mistake of operating there without knowing much about magín loans.

In conclusion, in margín binance operates with your money they will never have a loss with your operations, the loss will come out of your pocket, but binance if it takes a large part of your profits, advice do not use margín.

@ruzmaira... Thanks so much for the enlightenment.

I think this is enough for my questions.

On the other hand, I think with proper understanding, one can really gain from it. I am not planning on trading on margin though.

Good idea, it is not recommended to trade margin call, if you want to trade on margin, I recommend the bot of future on Binance. This bot is more profitable than operating on our own account. I have seen how some users have taken a large profit in the future through bots.

The advantage of the bot is that you can adjust the loss margin you are allowed to lose.

I am just seeing this, well explained. @tmighty do you have anymore questions?

No Prof

My submission

https://steemit.com/hive-108451/@tomlee/homework-post-for-alphafx-hodling-versus-trading

An interesting lecture @alphafx

Hello prof here is my assignment

STEEMIT CRYTO ACADEMY: SEASON 2 WEEK 3 - TRADING AND HOLDING BY @alphafx

Professor @alphafx

https://steemit.com/hive-108451/@sayaalan/steemit-crypto-academy-week-11-homework-post-for-professor-alphafx-about-trading-and-holding-two-sides-of-a-coin

Professor @alphafx, this hasn't been reviewed yet

Profesor espero este muy bien aqui esta mi TAREA.

https://steemit.com/hive-108451/@arriechek/4itnqg-or-steemit-crypto-academy-or-temporada-2-semana-3-comercio-y-tenencia-dos-caras-de-una-moneda-or-tarea-para-alphafx-or

Hello Professor @alphafx this is the link to my assignment for your remark. Thanks i appreciate your effort.STEEMIT CRYPTO ACADEMY SESSION 2 WEEK 3|| HOME WORK TASK FOR @alphafx ON HOLDING AND TRADING

Hello Professor @alphafx. Here is my Homework Post submission:

https://steemit.com/hive-108451/@manuelgil64/steemit-crypto-academy-season-2-week-3-or-or-trading-and-holding-two-sides-of-a-coin-by-alphafx

Hi professor this is homework

https://steemit.com/hive-108451/@prosperamente/crypto-academy-week-11-homework-post-for-alphafx-trading-y-holding-las-dos-caras-de-una-moneda

Thank you very much!

https://steemit.com/hive-108451/@wonderbowy/home-work-by-wonderbowy-for-alphafx-steemit-crypto-academy-season-2-week-3-trading-and-holding-two-sides-of-a-coin

Hello @alphafx,

please my home work submission for this week kindly go through and mark it.

Hello Professor @alphafx

my homework this week.

https://steemit.com/hive-108451/@adamsmoke/steemit-crypto-academy-season-2-week-3-trading-and-holding-two-sides-of-a-coin-homework-post-for-alphafx-by-adamsmoke