Steemit Crypto Academy [Beginners' Level] | Season 4 Week 5 | Stability In Digital Currencies

Hello and welcome to yet another week of the Steemit Crypto Academy. In the last weeks, we properly looked into the topic of the Bid-Ask Spread. The topic seemed simple enough and most of you did pretty good. That's awesome!

This week, I am going to introduce something new and quite interesting. I wish for every student to carefully go through the lesson and gain the experience. Come with me as we look into the issue of Volatility and possible Stability in digital currencies.

Cryptocurrencies and Volatility

We always come across the warning of cryptocurrencies being very risky. "Invest what you can afford to lose", they say and for good reason too. Cryptocurrencies are very risky because of the uncertainties that surround them. There is no way to be 100% sure of the outcome of any cryptocurrency, not even Bitcoin. Although, these assets have proved to be very successful for the past decade, there is no way to know for sure if they are really the future of finance.

Crypto coins are normally decentralized meaning there is no central authority controlling them. The value of a coin is mostly what the public makes it out to be. The prevalent emotional state of investors moves the market and so we expect these coins to be a lot more volatile than fiat currencies. Think about it, if these coins are decentralized and the markets are open 24/7, it means that people can easily perform activities in the market. When more people buy a coin, the demand and use increase and so does the price. Similarly, when more people sell a coin, the demand and use reduce and so does the price.

A store of Value

There are arguments that cryptocurrencies cannot be a store of value because of their volatile nature. Even though they are easily tradeable these days and can increase massively in value, they can still lose their worth very easily. What you put in might be lower than what you get and that is a problem. For cryptocurrencies to be considered a proper store of value, they need to be stable.

For an asset to be stable, it has to show very little or no fluctuations in price. Cryptocurrencies are generally not known to have this attribute. However, there are digital currencies that have been developed with the stability attribute and we would be talking about them below.

Stablecoins

In an initial attempt to create stable digital currencies, stablecoins were developed. Stablecoins are cryptocurrencies that have their prices pegged to a real-world asset. These currencies are backed by real-world assets or another cryptocurrency which serve as their reserves. Stablecoins have become extremely popular over the years as the crypto space expands. Taking the types of Stablecoins, we have;

1. Fiat-Backed Stablecoins: These types of stablecoins are backed by fiat currencies. Most of the stablecoins under this category are backed by the US Dollar. This means that the coins are collateralized by the US dollar which serves as their reserve.

Very popular examples of this category are Tether (USDT), TrueUSD, Binance USD (BUSD) and USD Coin (Coin).

2. Commodity-Backed Stablecoins: These types of stablecoins are backed by commodities or assets like Gold, silver or even real estate and pegged to its price. Digix is a very popular example of this type of stablecoin with its price pegged to 1 gram of Gold.

3: Crypto-Backed Stablecoins: This category is very special. Crypto-Backed Stablecoins use other cryptocurrencies as collateral to achieve stability. Stablecoins such as DAI use Smart Contracts to over-collateralize the currency with an Ether reserve. That way, the volatility of Ether does not affect the pegged price of DAI.

Central Bank Digital Currencies (CBDCs)

A Central Bank Digital Currency is a digital representation of a country's currency. It is a digital currency with the same value as the currency of the country that issues it. The concept of CBDCs is still new however it is certain that they would be issued by the central bank of a particular country. This means that this type of currency, unlike cryptocurrencies, would be centralized.

My country, Nigeria, for example is developing her digital currency called eNaira. The currency would have the same value as the Naira.

Pros of CBDCs

1. Including the Unbanked: Someone might say that CBDCs are similar with the regular electronic banking but it really is not. Electronic banking is still banking. You need to have to have a bank account with a physical bank most times. However, in the case of CBDCs, a bank is not necessary because citizens can easily receive money to their wallets. This type of system would really help to include the unbanked.

2. Legally Backed: I feel like this ought to be the biggest advantage of these currencies. Since they are issued by the Central Government, they are clearly backed by the law and would be recognized as a proper medium of exchange.

Cons of CBDCs

1. Centralized: Like I said earlier, CBDCs would be issued by the Central bank and this means that they would be centralized. The element of trust comes in here. Users would not have full control of their assets. Not just that, they would be affected by policies of the Government. Bad policies cause inflation and devaluation of currencies.

2. Lack of Privacy: Unlike cryptocurrencies, CBDCs would lack the privacy element in the sense that the central authority would be able to monitor the users and their account activities.

3. Technology gap: The goal is to reach the unbanked population but the problem is that a major part of this population do not have access to mobile phones and other basic devices. This Technology gap, otherwise known as the Digital Divide, is something that needs to be addressed if CBDCs are to be successful.

Rebase Tokens

Rebase Tokens are a very special type of cryptocurrencies. They achieve stability in a very different way entirely.

A Rebase token has what is called a Rebase Mechanism that adjusts its circulating supply when its price changes. Because the supply of these tokens change with price, they are also called Elastic Supply Tokens.

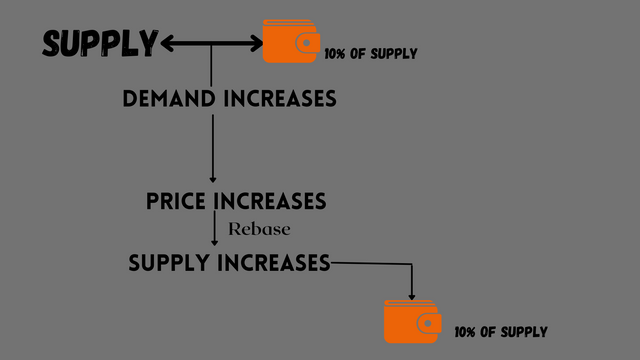

How Rebase Tokens work

Rebase tokens, just like regular Stablecoins, are designed to have a particular value. Let us go back to basic supply and demand and understand how rebase tokens work...

When there is so much demand for a token, its price would increase as it should. For a rebase token, when the price increases, the supply would increase accordingly as well. This increase in the supply would cause the price of the coin to return to its intended value or at least closer to it because as the law of supply states, The more the supply, the less the value.

The same thing happens when demand falls and the price suffers. The rebase mechanism would adjust the supply so that there are less tokens in circulation. This would in turn cause the price to increase.

Now, people that hold rebase tokens would notice that instead of the price of their holdings to change, the number of tokens they have will instead. The number of rebase coins in a wallet increases or reduces accordingly after every periodical rebase. Still, holders would still own the same percentage of the network because the whole supply adjusts accordingly.

Ampleforth

A very popular example of a rebase token is Ampleforth represented as AMPL. It has a peg value of $1 and a rebase schedule of 24 hours at 2:00 UTC. When the price of AMPL goes above $1, a positive rebase would occur and the supply would increase. Similarly, when the price goes below $1, a negative rebase would occur and the supply would reduce.

AMPL's rebases can be calculated with the formula;

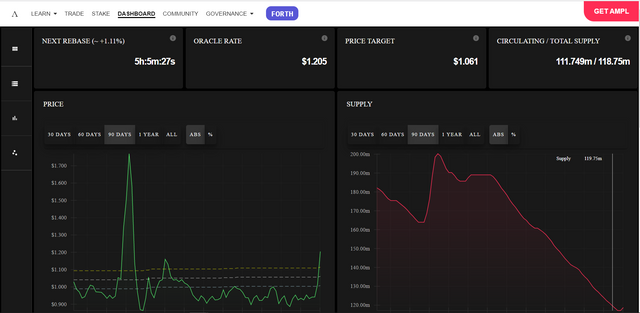

The necessary values can be extracted from the website. Just visit https://www.ampleforth.org/dashboard/

From the image above, we can extract the Oracle Rate and Price Target.

To calculate the Rebase%;

Oracle Rate = $1.205

Price Target = $1.061

Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

={[(1.205 - 1.061) / 1.061] x 100} / 10

= [(0.144/1.061) x 100] / 10

= (0.13572 x 100) / 10

= 13.572 / 10

= 1.3572%

The same answer can be gotten using this calculator

Stability in your portfolio

It is important to have some units of stablecoins in your crypto portfolio. The coins are easily tradeable and cost less than fiat during transfers. The good thing about having sablecoins is that you can withdraw or sell them anytime without worry of selling at a loss. Also, they can be used to enter quick positions when trading.

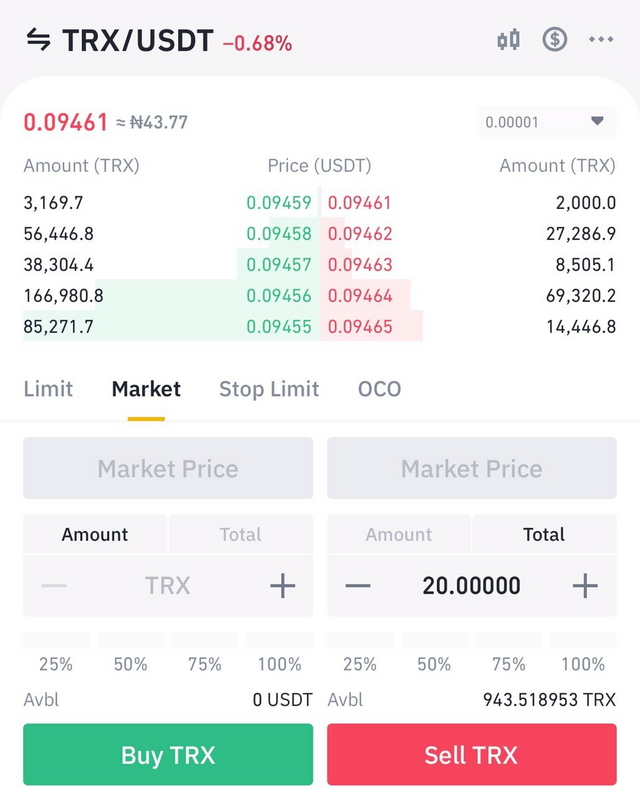

In the images below, I sold some TRX for $20 worth of USDT on Binance.

The downside

Your portfolio worth will not increase so much when the prices of coins begin to rise.

Conclusion

Cryptocurrencies are very volatile indeed. With this fact, it is necessary that there is some extent of stability in virtual currencies just like in fiat. The movement started with Stablecoins which have seen some success and then rebase tokens which proved to be quite an innovation. Now, we are looking forward to CBDCs to become a proper legal tender in the digital space. The success of these coins can have a great positive effect in the crypto space. Well, let's just wait and see.

Homework

Explain why Stability is important in Digital currencies.

Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

Explain in your own words how Rebase Tokens work. Give an illustration.

Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

Rules/Guidelines

- This Task will run until 9th October 23:59 UTC.

- Your article should be at least 300 words long.

- Make sure your username is on the screenshots provided.

- Please try and understand the topic before performing the task.

- Make sure you post this assignment in the Steemit Crypto Academy Community.

- Use the hashtags #awesononso-s4week5 and #cryptoacademy among your first 5 hashtags and tag me @awesononso.

- Plagiarism and content spinning is not tolerated in the Academy. Repeat offenders will be blacklisted and banned from the academy.

- All outsourced images should be copyright free and properly referenced.

- Only students with a minimum of 200SP and a reputation of 55 are eligible to participate. You should also not be powering down.

- Your homework title should be Stability in Digital Currencies- Steemit Crypto Academy- S4W5- Homework Post for @awesononso

My Comment section is open for any questions or suggestions.

Thank you.

Well detailed professor, will be sure to participate

Hello Prof, here’s my homework post!

Stability in Digital Currencies- Steemit Crypto Academy- S4W5- Homework Post for @awesononso

Very interesting and detailed lecture

@awesononso prof,good day to you.

Please can I participate in this task with a reputation of #14 and so of 93?

I really want to be explore my knowledge on cryptocurrency with all the lectures provided by all professor so far.

I really wish I can?.

Best regards

@gracellagift

You have the required Reputation but you still need to reach the SP level. The required SP is 200 but yours is 93.

It is 134,I powered it up to that @awesononso

Thank you

@awesononso The number 6 is too complicated! I don't have another wallet apart from Binance. What should I do?

You can transfer to someone else just for the assignment.

Won't there be charges that will be incurred for the transfer?

Here is my homework post

https://steemit.com/hive-108451/@wireless07/stability-in-digital-currencies-steemit-crypto-academy-s4w5-homework-post-for-awesononso

Hello prof. @awesononso

My homework post link;

https://steemit.com/hive-108451/@ladyofpolicy/steemit-cryptoacademy-beginners-level-season-4-week-5-stability-in-digital-currencies-for-prof-awesononso-by-ladyofpolicy

Hello prof @awesononso this is the link to my homework post

https://steemit.com/hive-108451/@noskiart/crypto-academy-beginner-s-level-week-4-task-5-stability-in-digital-currencies

Good day professor @awesonoso, this is the link to my homework post. https://steemit.com/hive-108451/@srrebullient/steemit-cryptoacademy-beginners-level-season-4-week-5-stability-in-digital-currencies-for-prof-awesononso-by-srrebullient.

Thank you.