Steemit Crypto Academy Contest /S1W2 Reviewing Centralized Exchanges By @azamrai

Difference between centralized and decentralized exchanges:

Centralized exchanges are the most popular exchanges in the world. They are centralized because they have a controller, which is usually a company. This company is responsible for all the operations of the exchange: from handling customer funds to matching buyers and sellers. Centralized exchanges are faster and more reliable than decentralized exchanges.

Decentralized exchanges are becoming more popular, as people become more aware of the risks associated with using centralized exchanges. With a decentralized exchange, there is no central controller. This means that there is no one person or company who is responsible for the security of your funds. Decentralized exchanges also tend to be slower and less reliable than centralized exchanges.

Let's move to main topic that is discussed in following words!

Discuss briefly Centralized exchanges and its Benefits to crypto users.

Centralized exchanges have been a staple in the traditional financial world for quite some time. These exchanges allow investors to buy and sell securities in a centralized location. Centralized exchanges provide a few key benefits to crypto users, which are security, trust, and liquidity.

Security is one of the main benefits of using centralized exchanges. These exchanges are heavily regulated and often have multiple layers of security. This makes it difficult for hackers to penetrate the exchange and steal user funds.

Trust is another key benefit of centralized exchanges. Users can trust that their funds will be safely stored on the exchange and that they will be able to access them when they need them. Centralized exchanges also offer liquidity, which means users can quickly buy and sell cryptocurrencies without having to wait for a buyer or seller to be found.

What do you look out for when choosing an exchange to trade your crypto assest?

When looking for a crypto exchange, it’s important to do your research to ensure you are choosing a reputable and reliable platform. Here are some key things to look out for:

The reputation of the exchange:

This is arguably the most important factor, as you want to be sure that your funds are safe and that the exchange will be around for the long haul. Do some online research to see what others have had to say about the exchange.

The security of the exchange:

Make sure that the exchange has implemented robust security measures, such as two-factor authentication and encryption.

The fees charged by the exchange:

Compare the fees charged by different exchanges to find one that offers competitive rates.

Review your favorite centralized exchange and explain its unique features

There are a variety of centralized exchanges that investors can use to buy and sell cryptocurrencies. Each exchange has unique features that distinguish it from the others.

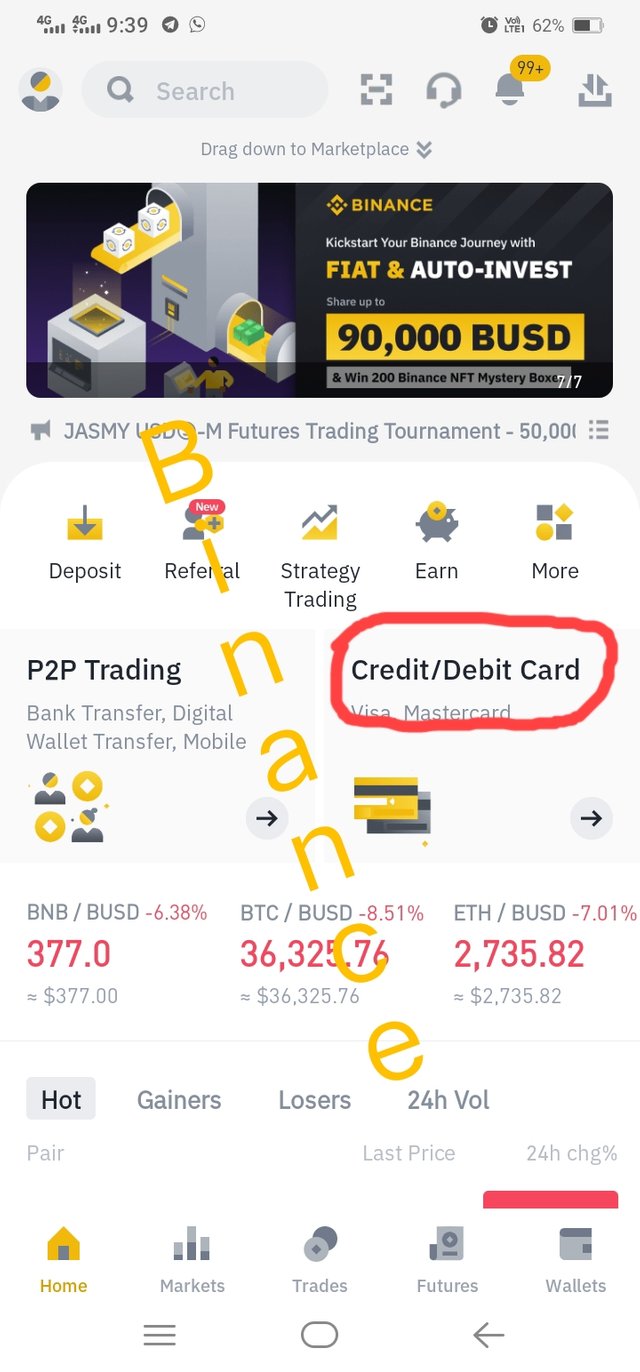

Binance is a popular exchange that offers users a wide variety of cryptocurrencies to trade.

Binance also offers a very user-friendly interface, which makes it easy for beginners to get started.

A large variety of cryptocurrencies to choose from, including Bitcoin, Ethereum, Litecoin and more.

Fast and easy registration process that only requires an email address and a password.

High security standards that include 2-factor authentication and a host of other measures. 24/7 customer support via email, chat or phone.

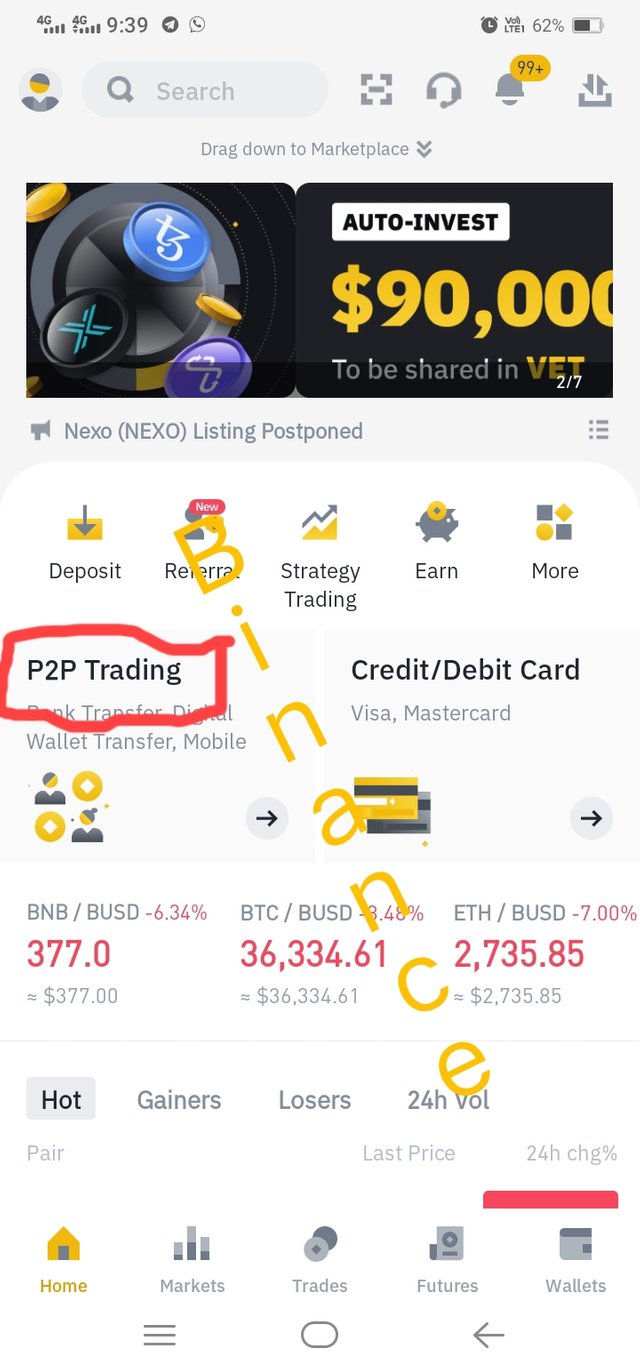

P2P

Binance, one of the world's largest cryptocurrency exchanges by trading volume, has announced the launch of its new peer-to-peer (P2P) trading feature. The new P2P trading platform will allow users to trade cryptocurrencies directly with each other without the need for a third party.

The launch of the Binance P2P trading platform comes as a response to increasing demand from users for a more decentralized exchange platform. According to Changpeng Zhao, CEO of Binance, "Peer-to-peer trading is one of the most requested features from our user base and we are pleased to finally launch it."

The Binance P2P trading platform is currently in beta and will be available to all users in the near future.

Coinbase is another popular centralized exchange. Coinbase is known for its security measures, which make it a safe place to store your cryptocurrencies. Coinbase also offers a built-in wallet feature, which allows you to store your cryptocurrencies in one place.

Is there anything about your favorite exchange you will like to be changed? Discuss.

There are a few things about centralized exchanges that I would like to see changed. For one, I would like to see more trustless exchanges emerge. These exchanges would allow users to trade their tokens without having to trust the exchange with their funds. This would be accomplished by using a smart contract that automatically executes the trade once both parties have agreed to the terms. Another change I would like to see is increased security measures. Many centralized exchanges have been hacked in the past, and users have lost millions of dollars worth of cryptocurrency. I would like to see exchanges implement better security measures such as two-factor authentication and multi-signature wallets.

What shortcomings do you see on centralized exchanges and how do you think user funds can be protected since we don’t have access to our wallet private keys?

Centralized exchanges have come under scrutiny in the past year due to security breaches that have resulted in the loss of user funds. For example, in January 2018, Coincheck lost $532 million worth of NEM tokens. In June 2018, Bithumb lost $30 million worth of cryptocurrencies. These are just a few examples of the many security breaches that have occurred on centralized exchanges.

One of the main shortcomings of centralized exchanges is that users do not have access to their wallet private keys. This means that users cannot withdraw their funds from the exchange if they choose to do so. In the event of a security breach, users are at risk of losing their funds.

Another shortcoming of centralized exchanges is that they are often slow to add new cryptocurrencies to their platforms. This means that users cannot trade some of the most popular cryptocurrencies on these exchanges.

Conclusion:

In conclusion, centralized exchanges are not perfect, but they offer a number of advantages that decentralized exchanges cannot. They are more user-friendly and have a larger selection of coins. Centralized exchanges are also faster and more secure than decentralized exchanges. While decentralized exchanges may eventually overtake centralized exchanges, for now, centralized exchanges are the better option for most users.

Great write-up! One of the risk (disadvantage) of centralized exchange is when they go broke, you will lose it all!

Yes, it is therefore as there is a control of a company or team that's why this risk is found in centralized exchange, in spite of this risk, people love to use centralized exchange just because of low fee and quick response.