Homework-Task 2 || Cryptocurrency Exchanges and Cryptocurrency Market Capitalization by @gbenga

"Crypto Wallet"

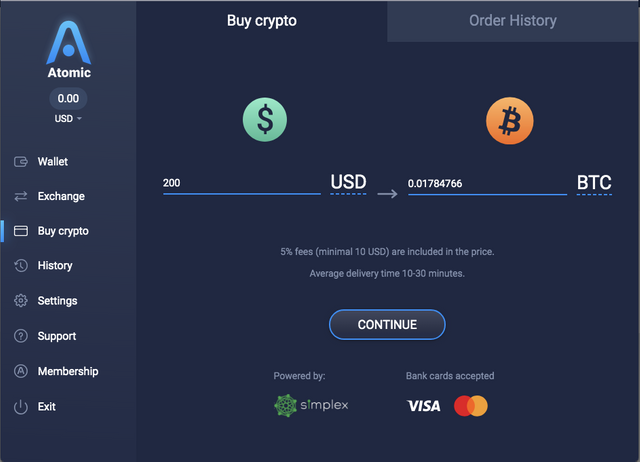

Defination: A cryptocurrency wallet is a piece of software that keeps track of the secret keys used to digitally sign cryptocurrency transactions for distributed ledgers. Because those keys are the only way to prove ownership of digital assets – and to execute transactions that transfer them or change them in some way – they are a critical piece of the cryptocurrency ecosystem. Better known as "crypto wallets," they are like the keys to the blockchain car. Without those keys, the car won't run. And without them, there would be no way to prove ownership of a digital asset - anything from a bitcoin to a token representing some kind of asset. 1 There are 5 types of wallet available.

Pros:

- Easy to use; good for on-the-go transacting.

- Convenient if you trade on your computer; safer than online or mobile wallets.

- Not susceptible to hackers; you control your keys.

- Very secure; cold storage; good for storing large amounts of cryptocurrency.

Cons:

- Least secure method of storing cryptocurrency.

- Risk of downloading viruses.

- If you don’t back up your computer and it dies, you lose your cryptos.

"Crypto Exchange"

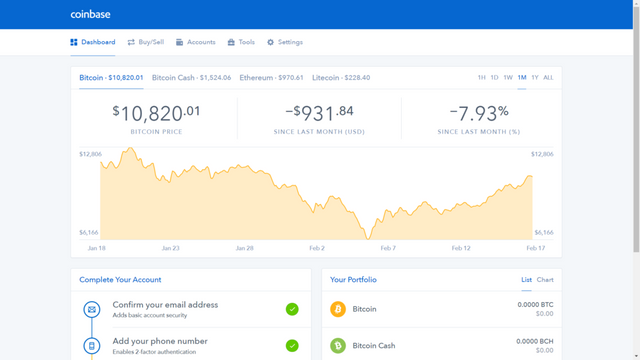

Defination: Cryptocurrency exchanges are online platforms in which you can exchange one kind of digital asset for another based on the market value of the given assets. The most popular exchanges are currently Binance and Bittrex. It is important not to confuse cryptocurrency exchanges for cryptocurrency wallets or wallet brokerages. Cryptocurrency wallets and wallet brokerages generally allow you to buy and sell a small range of popular digital assets (Bitcoin and Ethereum), which you can then send to a different exchange to trade for other digital assets like altcoins. This statement is not entirely exclusive though; most cryptocurrency exchanges will usually limit their users to only trade digital assets for digital assets, but a few allow trades of fiat currencies such as U.S. Dollars for cryptocurrencies.2 I personally prefer Binance and Poloniex.

Pros:

- Decent exchange rates.

- Low transaction fees.

- Minimal deposit fees.

- Dozens of Crypto’s available for exchange.

Cons:

- Sometimes slow customer service.

- Some exchanges need KYC.

- Limited payment options.

Q. Will You Keep Your Crypto Assets in a Wallet or on an Exchange??

Answer: I think Cryptocurrency exchanges are the most ideal approach to get some cryptos as a result of the prizes or airdropped however don't store the entirety of your coins in trade alone, you should utilize a crypto wallet too.

Q. Will You Keep Your Crypto Assets in a Wallet or on an Exchange??

Answer: I think An exchange is essentially a bank, with the added feature of real-time exchange. But there’s a difference: if the bank gets hacked, your personal data get stolen, but your funds are protected by insurance and transactions can be reversed. If an exchange gets hacked you not only give away your personal data, but you lose also all your Bitcoins, and Bitcoin transactions can’t be reversed. Bitcoin exchanges hacking happens quite often nowadays, it’s still a pioneering environment, and many people without experience have joined the banking sector. 3 I’ve never heard of any being hacked before. They do feel magic because I don’t know how they are programmed. But I never meant to say that it’s unsafe to store your crypto assets in an exchange like kucoin or binance, In fact, there many reasons why traders should store their assets on them. When trading cryptocurrency between wallets outside of the exchange service, there are always fees and gas prices associated that take a cut each time you send some coins.

So, if traders were to play it safe and do this each time they make a trade, the returns would be much less. While this method of storing crypto in more secure wallets outside of the exchange is much safer, it is simply not realistic for higher frequency traders who make multiple transactions daily. The main advantage of exchange wallets is their convenience and, sometimes, the incentives that exchanges offer for using their wallet. It is just easier to leave money in the wallet attached to the exchange so that you can instantly exchange your held coins for another. You have to find a balance between guarding your profits and protecting your coins from hackers or exchange failures.

Regards:

Cc:

@steemcurator01

@steemcurator02

https://twitter.com/boss7514/status/1361231448183767042

JOIN WITH US ON DISCORD SERVER: