Hello everyone, hope you are all doing great. I welcome you all to my second homework task provided by

@yohan2on. Thanks to

@steemitblog for this awesome initiative.

source

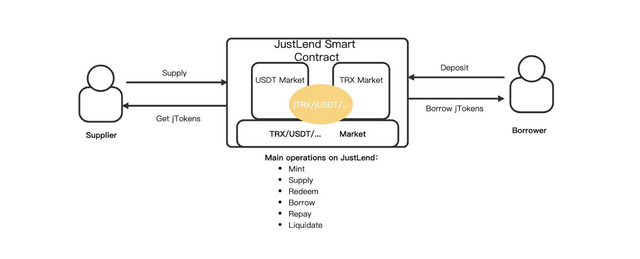

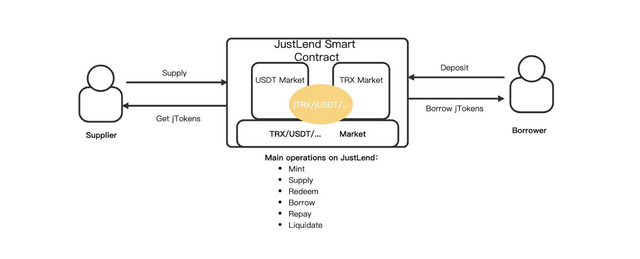

What is JustLend

JustLend is a TRON-based currency market convention pointed toward building up asset pools whose loan fees are controlled by a calculation dependent on the market interest of TRON resources. There are two parts inside the convention, specifically providers and borrowers. The two of them communicate straightforwardly with the convention to acquire or pay a drifting loan fee. On JustLend, every currency market compares to a remarkable TRON resource, for example, TRX, TRC20 stable coin (for example USDT), or other TRC20-based tokens, and involves an open and straightforward record that records all exchanges and verifiable loan fees.

Supplying assets on JustLend

On peer-to-peer platforms where borrowers are coordinated with loan specialists, a client's resource is straightforwardly loaned to another. Paradoxically, the JustLend convention pools the inventory of every client, which drives up liquidity and finds some kind of harmony. Providers can pull out their resources whenever without trusting that a particular advance will terminate, permitting JustLend a lot higher liquidity than their shared partners. Resources provided to a market are indicated as jToken (a TRC-20 symbolic equilibrium). Token holders can secure comparing jToken by providing and keep important standards to acquire interest.

Borrowing assets on JustLend

If clients (borrowers) wish to borrow assets on JustLend, they need to initially procure jTokens as insurance through saving tokens, and afterward obtain any accessible resource on the stage. Dissimilar to shared conventions, JustLend just requests that borrowers indicate the acquiring resource with no different prerequisites, for example, the expiry date. Acquiring is executed ongoing, and its loan fee will be naturally changed dependent available's organic market. Here's a model: the loan fees for getting TRX and TRC20-USDT maybe 2% and 5% separately. Various resources have fluctuating financing costs, which are naturally determined by the market's demand.

Primary Use Cases

- Clients can pledge different TRC20 tokens in their ownership in return for other TRC20 tokens.

- We can short a specific token: get the symbolic we wish to short from JustLend and sell on the trade preceding its fall. This permits us to benefit from the symbolic's misfortune.

Features of JustLend Protocol

● Fund supply: JustLend adopts the idea of money market fund pools, with different underlying assets corresponding to their own markets.

● Matching: Orders are matched by smart contracts automatically. There is no need for suppliers and borrowers to negotiate interest rates, loan terms, etc.

● Interest accrual: Interest accrues as each block is generated on TRON (which takes around 3 seconds).

● Lending: Lending is executed in real-time. Suppliers can enjoy interest without any action as long as they hold jToken.

● Repayment: Borrow and repay as you go. Borrowing can be done as long as the collateral value * collateral factor > loan value + accumulated interest.

● Supplying/borrowing interest rate: The floating interest rate is automatically calculated by JustLend smart contracts based on market supply and demand.

● Liquidation: If the borrower's collateral value falls below the liquidation threshold, JustLend smart contracts will automatically trigger liquidation.

Source:Justlend paper

Governance

The governance of JustLend is implemented through voting for proposals. JST can be used for community governance of JustLend and its holders may submit proposals on the JustLend protocol or vote for them.JustLend will begin with centralized control and over time transition into a fully community-led platform. The following rights in the protocol are controlled by the admin:

● The ability to open/close/enable a money market

● The ability to update the interest rate model for each market

● The ability to update the oracle address"

Source:Justlend paper

Summary

JustLend, the main TRON-powered lending platform, is the response to that demand.JustLend devises an exceptional strategy to give extensive, simple to-utilize, and decentralized advanced resource monetary administrations where trust is not, at this point an issue. Please be careful not to enter websites with similar domain names since they are phishing sites all around out there. There is always a risk when investing in smart contracts due to hack angles and possible loss of APY for the long term.

Reference:

Regards:

@yohan2on

@steemitblog

Cc:

@steemcurator01

@steemcurator02

https://twitter.com/boss7514/status/1361248486105096192

JOIN WITH US ON DISCORD SERVER:

Hi @boss75. Thanks for submitting your homework.

Unfortunately, 40% of your article is plagiarised content.

You need to research, read carefully, and digest the information then present it in a unique way according to what you have understood. Just Copying and pasting some else's work won't be tolerated.

Kindly do your corrections. Respond back to this comment when you are done rectifying your article then I will come back and re-cross check your work to see whether you have really accomplished your homework.

@yohan2on, Thanks for your feedback. I tried smallseotools to check and It showed the original source is this one. Can you please provide me the proper content post you have got ??? And I have also mentioned the proper information source and reference in the protocol, governance, and reference section. Isn't it enough???

Thank You.

Yes, you did well to provide the references to your content but some of it you directly just copied and pasted from the Justlend whitepaper pdf document

It's preferable and okay to just quote and reference any directly copied and pasted content like this;

All those pointed out words in your article are not yours. Please rectify that in your article. Respond to this comment and I come back to check.

@yohan2on,

I have already mentioned the proper sources in the last point of every section. Do I need to mention the source in every point???

Thank You.

Your referencing is okay but the way you have presented your original work mixed with plagiarised content is a wrong one. As it is right now, it seems like this is your entire work yet it's not.

Kindly present every copied and pasted work in quotation format like this;

Source

Justlend white paper

Then attach the reference at the end of the article like the way you did in your article.

You should also understand that when I am weighing your content words used in your article, I exclude those quoted words just because they are someone else's words.

@yohan2on,

I have rectified my post as per your instruction. Is It okay now??

Thank You.

Great! It's now okay.

Justlend is one of the great financial Dapps built on the Tron blockchain. Crypto traders can make the best use of this dapp by acquiring crypto loans for investing in other cryptos that are likely to make them some profits depending on their analysis and investment decisions.

You have successfully completed your homework.

Thanks a lot @yohan2on. Your post was really helpful. I have contacted you on Twitter and discord. Hopefully, you will reply to me there soon.