Capital Management and Trading Plan - Crypto Academy / S4W8 - Homework post for @lenonmc21

1. Define and Explain in detail in your own words, what is a "Trading Plan"?

When we talk of "Trading Pan", we simply mean that it's a strategy or technique that a trader developed in order to gain profit during trading periods because all traders are aimed at making profit instead of losses by properly planning how they can do their trading through a good plan

We can therefore say that a good trading plans will enable a trader to be persistent and consistent in his results by producing a better out put when he/she puts up a good strategy that will be able to suit and affect him positively because when ever a trader makes a trading plan and then enter the market, if he/she discover that his plans are working as predicted, he can now place a buy or sell order with the aim of making profit in return.

But if he/she discover that the market is not moving as he earlier predicted by his plan strategy, then he/she will no need to place any buy or sell order in order to avoid unnecessary losses. We see here that the plans had work since he didn't buy or sell any crypto coins In order to avoid unwanted loses and hence enabling him to be persistent in his plans

2. Explain in your own words why it is essential in this profession to have a "Trading Plan"

Before explaining the importance of doing trading plan, I would love to say this;, Before succeeding in life, one have to seat down and do proper planning of his/her life before he can ever be successful in life because there is no food for a lazy man who will one to become successful without planning and shaping his life.

Back to our question, becoming successful in trading through proper planning is what ever trader will wish. So traders need to plan a technique that he/she will best follow up and become successful because if they trade without planning, they may have unwanted loses that could be figure out if they sat down and did their trading planning. Trader's aim at trading with a consistent with a plan that should always give a positive out put of interest but doesn't guarantee that all out out results should always be positive.

What traders should do here when their results were negative with little losses is that they will still need Seat and rethink to carry out another trading plan that will give them a positive out put because a good trader with a good trading plan can experience loses at times but still be encouraged by adjusting their trading plans so ad to now gain profit

So we have to know that trading plans usually enables traders to monitor and view their trading performance by checking and adjusting the place they went wrong as they will now keep following the right trend in trading for both risk and capital management

We should also known that a good trading plan usually helps to forget the rate of greed and fear of emotions in the aspect of taking decisions during trades

Trading plans can render a trader a good and profitable trading plans when ever they plan and predict the prices in the market before entering to place a buy or sell option which will inturn favours them

3. Explain and define in detail each of the fundamental elements of a "Trading Plan"

They are four main fundamental elements of trading plans namely Risk management, Capital management, trading psychology and Control over trading account which traders can use in order to carry out their trading plan effectively. Below I will detailed them.

Risk Management

Before carrying out a trading plan, a trader needs to take into account the risk he could endure because I'm the world of trading, there can never be a guarantee of one trading 100% accurate because we are bound to do mistakes at times since we all are human beings.

So at times, a trader will definitely get losses despite his planning In the trading, so what a trader can do during those losses period is that he/she will definitely need to into consideration the risk management inorder to minimize all his losses by limiting the losses that he initially got. With this, we see how the risk management will enable the trader's losses to be much more smaller than his gain profits.

Capital Managementanagement

When making a trading plan, one has to take seriously into consideration his capital so as to know exactly what amount he can put in trading in a way it shouldn't affect him too much if he losses because as I earlier said we humans are not God, so we got to do mistakes at times Since we can be 100% accurate all the times, so our capital management here is determined as a percentage of our total capital which is closely related to risk management since it's determine as the percentage of the risk losses that we can take before increasing our profit.

So now our percentage gain of profit will definitely be greater than our losses. So we see here that all our losses will be recovered and we can't think about it any longer because the capital management takes into account all our capital that we can place a trade with in order to get profits In return

Trading Psychology

This aspect is extremely very important because it deals with our thoughts and emotions which can enable us gain or loss depending on the State of our minds and emotions. So in order to always acquire much profits, all traders will need to limit the level of their psychology because every trader's purpose is aimed at making consistent profit.

A good example of psychology in trading is when If a trader doesn't makes his trading plan and eventually don't limit all his profits obtain when ever the trend of prices of assets rises, most traders that didn't Carry out their trading plans will definitely take hold of their coins that they had for sale simply because they will be thinking that the price will still go up which will in turn enable them to experience a lot of losses due to this notion. I have been a victim of circumstance some times ago 🤣 and I had to loss so much since I didn't Carry out my trading plans because at times when I ever I enter the market and see how how the price chart is rising, I will eventually think that it will continue rising by taking hold of my coins that I had for sale but to my greatest disappointment, the price chart instead reverses back and drop drastically making me to experience some losses.

Since I started making trading plans, I started being consistent in my plans by making much profits from it since I had to put emotions aside and follow all the rules of my trading e

Control over Trading Account

This is another vital step in effectively carrying out a trading plan because controlling over our trading account is usually obtain taking into consideration our profits obtain. So taking Into consideration controlling our account simply means that we can definitely obtain a lot of profits by calculating all our losses and profits because this is where a good trading plan will enable us to get profits by effectively following our trading strategies

We see here that this method is use to maximize the traders capital on daily basis depending on the trader's trading days because traders uses this method to build their account just from their initial capital they started with in order to gain high

Practice (Remember to use your own images and put your username)

1. Build a "Trading Plan" and cover all the basics discussed in class. For this, you should NOT take the examples that I put in my class (Including the example amounts), use your own examples and your own images to make said plan, you must also base this "Trading Plan" as if you were operating on the platform of " Binance ”, taking into account that the minimum amount of exchange or investment is $ 10.

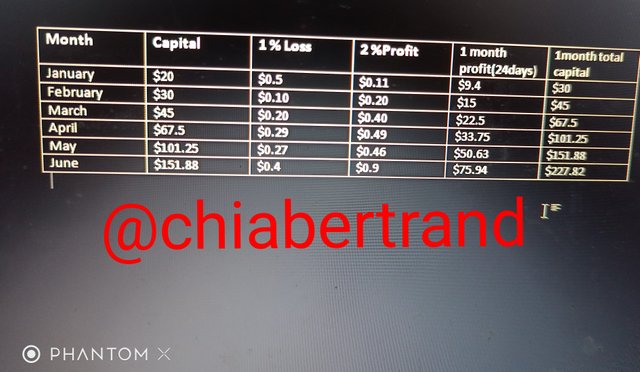

I will be using my verified Binance account in carrying out this plan with a pair of cryptocurrency MATIC/USDT as I will be assuming to start up with an initial amount of $20. This strategy is assumed to be a 6 months strategy

my trading plan which I use Microsoft excel to work it

I will be explaining the table below

Column 1:this depicts my first month of trading

Column 2: It depicts my initial capital I use in order to start up my trading and at the beginning of each month, I will start trading with my my new initial capital obtain from the previous month

Column 3: this depicts my 1% losses and indicates the amount of % I can risk depending on my capital

Column 4: it depicts my expected daily profit I obtain from trading simply by using my initial capital

Column 5: It depicts the results I got after trading for 24days and it's base mainly on my 2% profit I'm always expecting day to day

Column 6: It shows my final capital which I got after trading for 24 days by gaining profit including my initial capital and I got my final capital simply by adding my 24 days of profit with that of my initial capital which is $20 + $10 = $30 which is just for the first month

You have seen how my initial capital for the first month was $20 but at the end of my trading, I made a profit of $10 which accumulates the initial capital I had making it a total of $30. I will now be using this $30 as my start up capital for the next month. That is what I will be doing for my trading period of 6 months

Now below I I be discussing my trading plan base on the 4 basic elements of a trading plan

What was my Risk Management?

My Risk Management here was to ensure that I check out all my results be it loss or profit so as to make sure that I obtain more profit than losses. That is why I made my risk management in the ratio 1:2 where I had to go away from the market emmidiately gaining 2% profits and then leave the market emmidiately after making just 1% losses

What was my Capital Management?

My capital management for my percentage (%) loss per day is 1% of my capital which is $20, so I had to risk it for $0.1.

Then my percentage for my percentage (%) capital per day is 2% of my capital which is $20, so I will have to get a $0.2 profit

I use to trade 6 days in a week, that is from Mondays to Sartudays then have a resting day on Sunday since I have a lot of work to do on Sundays

My rules and Psychology that I use now

Ad I earlier explain how I got a lot of losses when I never had a good trading plan, so my psychology use to over come me and my emotions too at times will only make me have great losses some times so since I set up my trading plan and kept my emotions aside, I have been able to have a lot of profits. So what I do now is that:,

First thing first is that I can never borrow capital and use it to carry out trading because my mind will extremely be worried that the capital might loss and the person start requesting for his money back. So just by borrowing money will enable me nor to carry out trade effectively due to fear of loses. So by doing this, I will always avoid panic and tension by over coming my emotions during trading when I use but my own capital

I always make sure that the capital I use in starting up my trading is not all of my earnings because even if I eventually experience loses, I might be able to use another capital to start up another trading because we all are humans and make mistakes at times even if we are ancient in what we do.

I make sure I control my mind and emotions in a way that I have no doubts in anything especially when I'm studying fundamental analysis of trading before entering the market to carry out a trade

When ever I'm about to start trading, I make sure everything about me is okay, I pray to God for a steady mindset and calmed mind

What is my capital planning

I had earlier explain my capital planning in Column 6 of my trading planning capital as I always do my trading for a period of 6days which I began with an initial income of $20 and got my daily profit at a % of 2% and my daily losses at a % of 1% . I think everything is explain in detail from the table above in column 6

So far we have studied this lessons, we have seen it clearly that if a trader doesn't make a trading plan for himself, he may eventually get losses on daily basis but if he put a trading plan and follow it up effectively, he/she will get a lot of profit from it.

I'm a living example of this circumstance because I had once had a lot of losses since I never carried out trading plan but ever since I knew of trading plans and kept my own trading plan, I have been able to over come my emotions during trading and I don't longer do over trading as a result of losses in order to gain. Instead, when ever I experience a loss, I will instead calculate my percentage of risk lost in and use it to make profit instead.

Thanks so much Professor @lenonmc21 for this beautiful lessons for It has really widen my knowledge on trading the more

Thanks for the review and feedback professor. I will definitely do much better in your next class

#club5050 😀