Terra (LUNA) Blockchain - Crypto Academy / S5W4 - Homework post for @pelon53

Hello friends, I welcome you all to my blog this new week as I participate in the week4 season5 of the steemitcryptoacademy lessons. Hope to make my submissions on lessons presented by professor @pelon53 on Terra (LUNA) Blockchain.

(designed in canva)

Question 1: What is Terra Station? Explore the application, Download the wallet and connect the wallet to Terra Station. Screenshots required.

What is Terra Station

The Terra Station is an official wallet of the Terra assets which serves as a bridge connecting the mobile services and the decentralized applications which are built on its ecosystem. This shows that not only that the Terra Station serves as a wallet for all assets and tokens in the Terra network but also a good user-friendly application that connects with the mobile websites through the WalletConnect.

In the Terra Station, all activities from its merchant and customer clients can access the terra network en route it with supports given to its utility coins the LUNA, and any other Tera stablecoins in the network. Also are the Anchor protocol (ANC) and the Mirror Protocol (MIR) tokens which are supported by the Terra station. This in extension helps in the smoother management of the $LUNA, swap option as well as the Stake option "on the go".

The Terra Station can either be downloaded via the Android version or the IOS. There is also the web extension which provides more adoption and usability rate amongst interested participants. Users of this platform can engage in trade, send and receive tokens from exchanges, Swap their coins, Stake Luna, Withdraw staking rewards, and as well connect with other dApps.

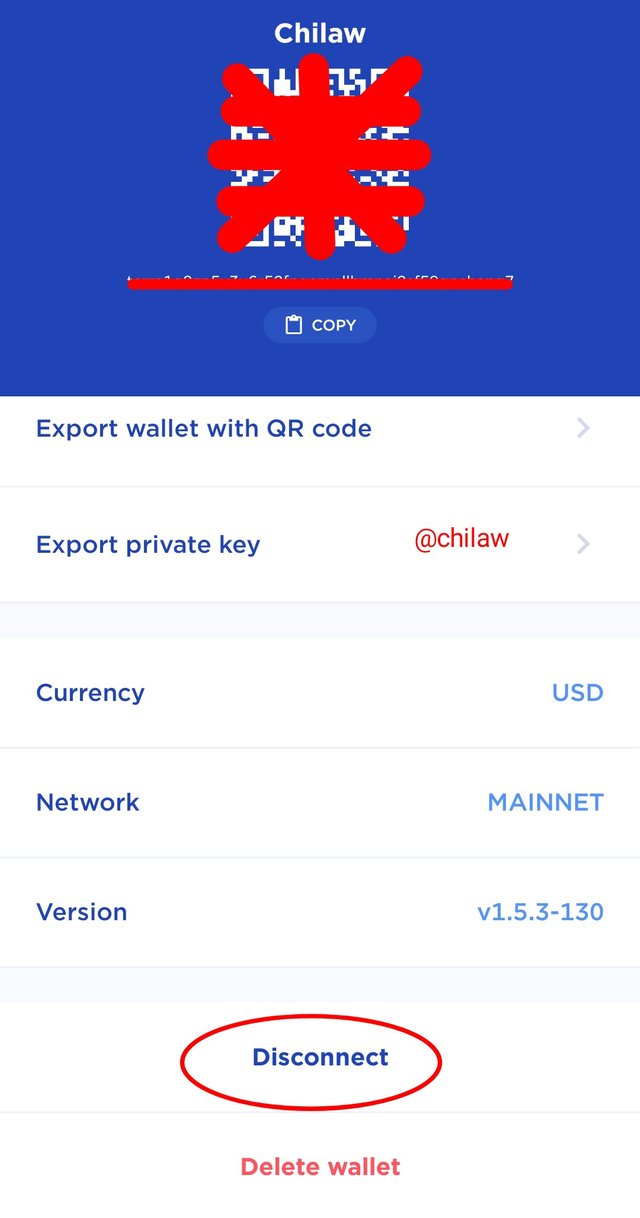

Downloading & Connecting the Terra Station

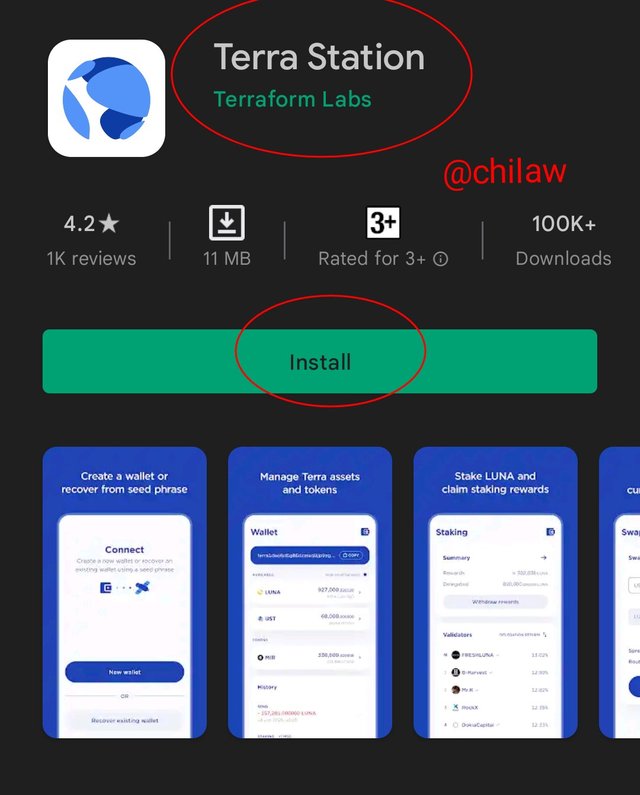

- I will be demonstrating this process using the Android Playstore. So I will quickly visit the Playstore and search for the word "Terra Station".

- Search and install this App as seen from Playstore

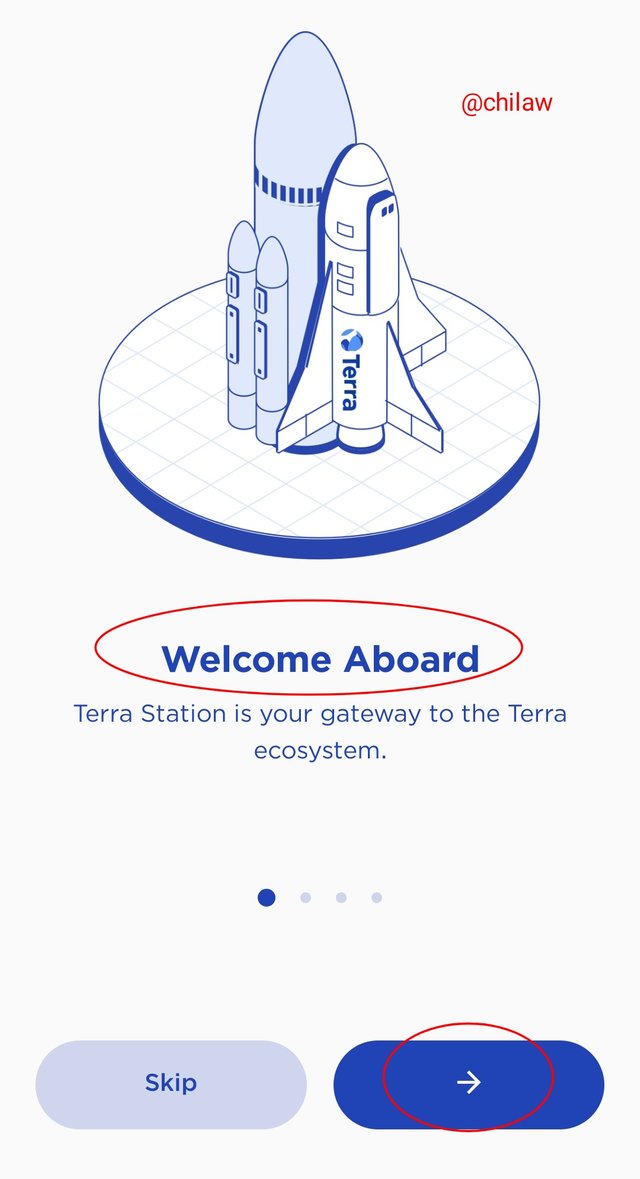

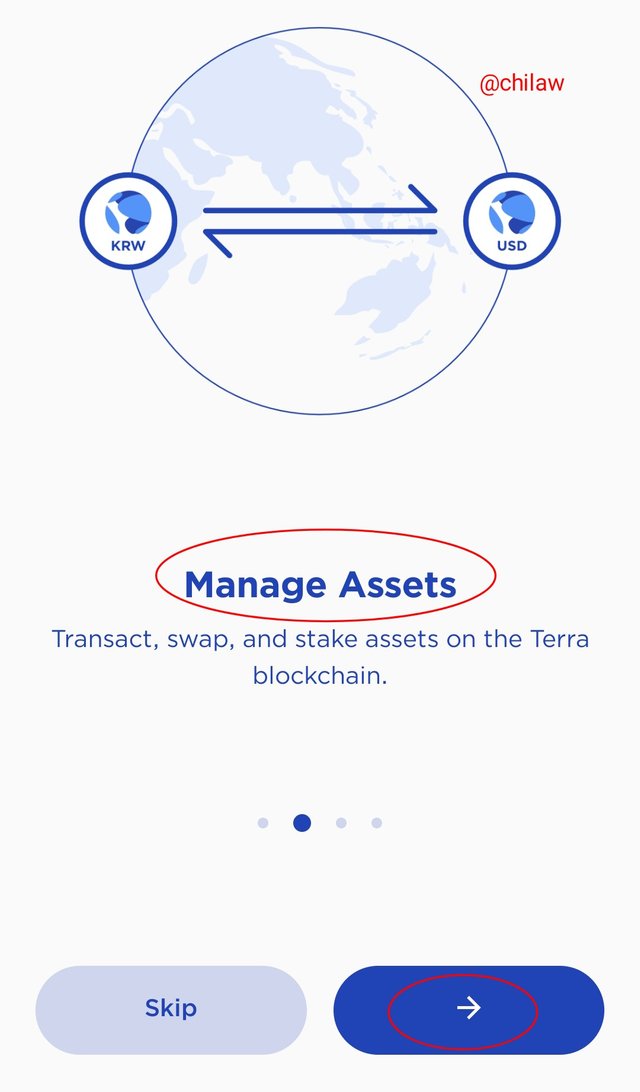

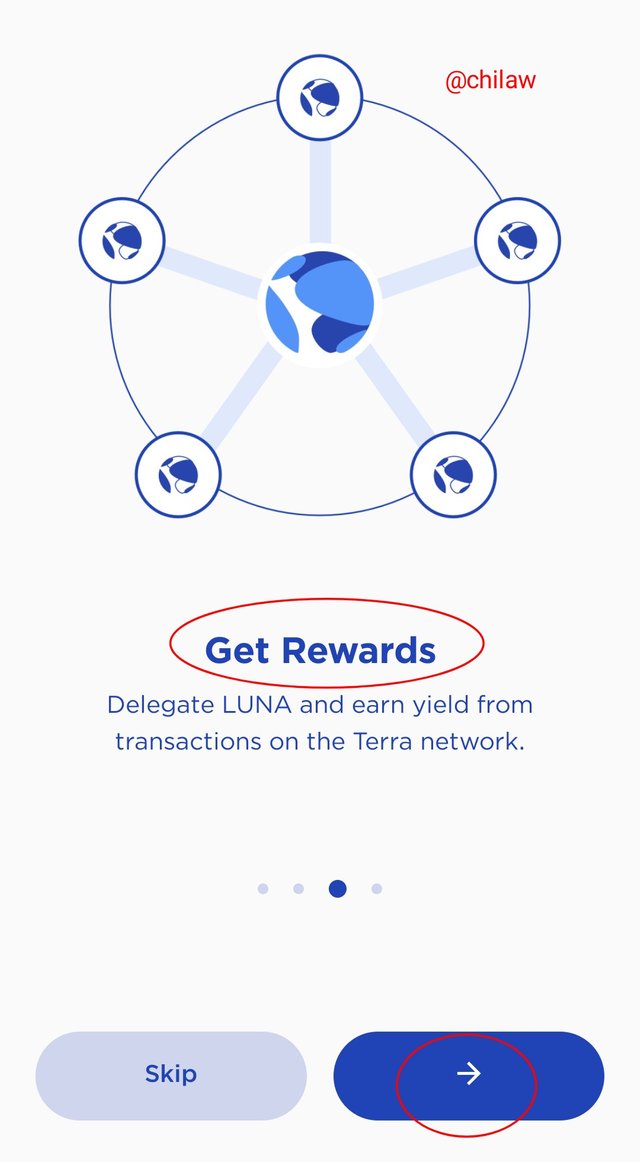

- Click on the arrow button till the end to see all the features inherent in the App which include; The welcome Onboard option, Manage Assets, Get rewards, Exploring Terra

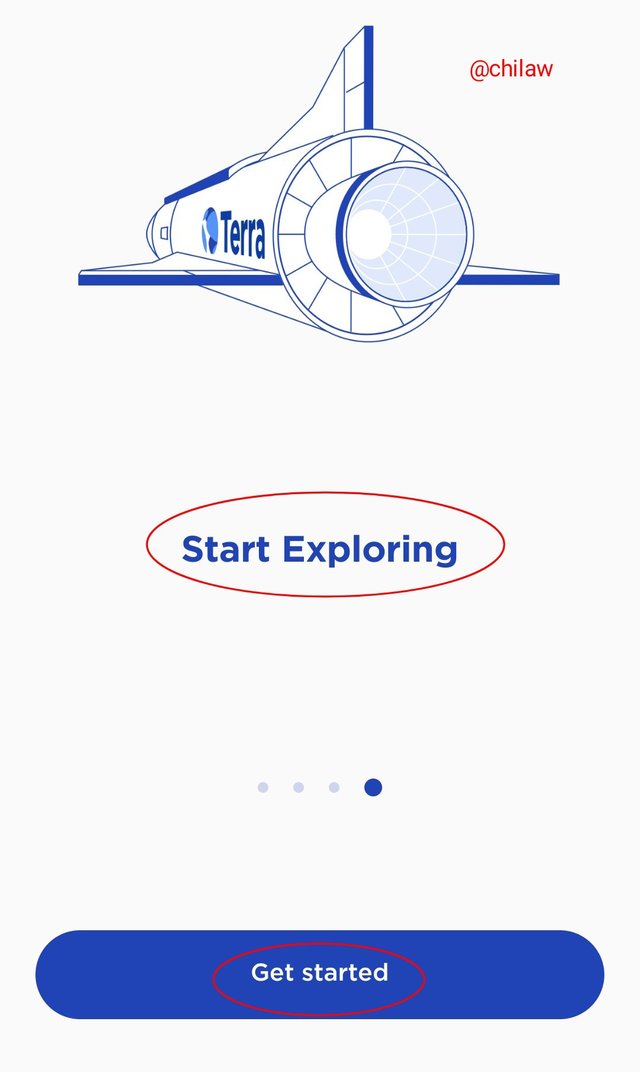

- Click on the "Get Started" button to continue

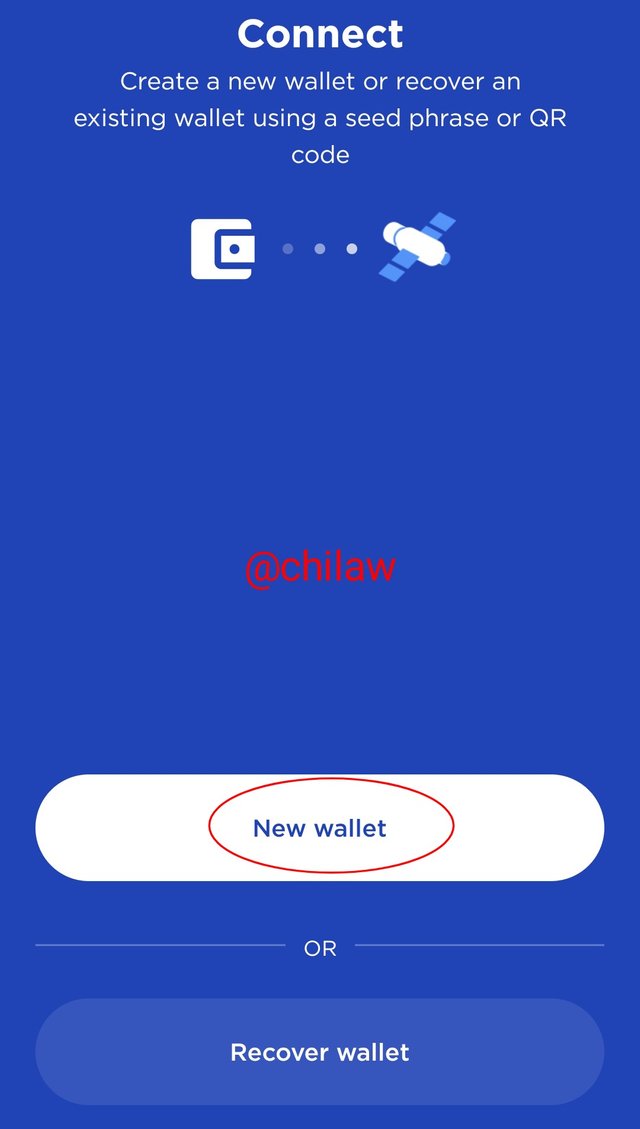

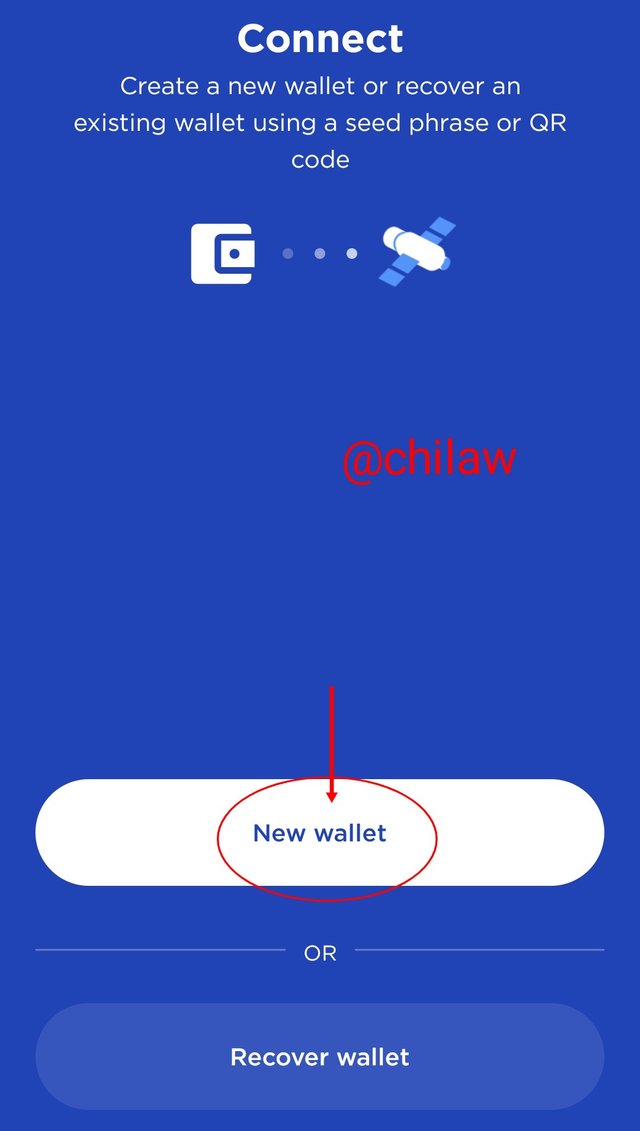

- Click on the "New Wallet" button

- Enter your Wallet name and Password (Confirmation) and click on the Next button

- Write down your seed keys and reconfirm my entering some specified words. then click on the "confirm and finish" Button to set up an account.

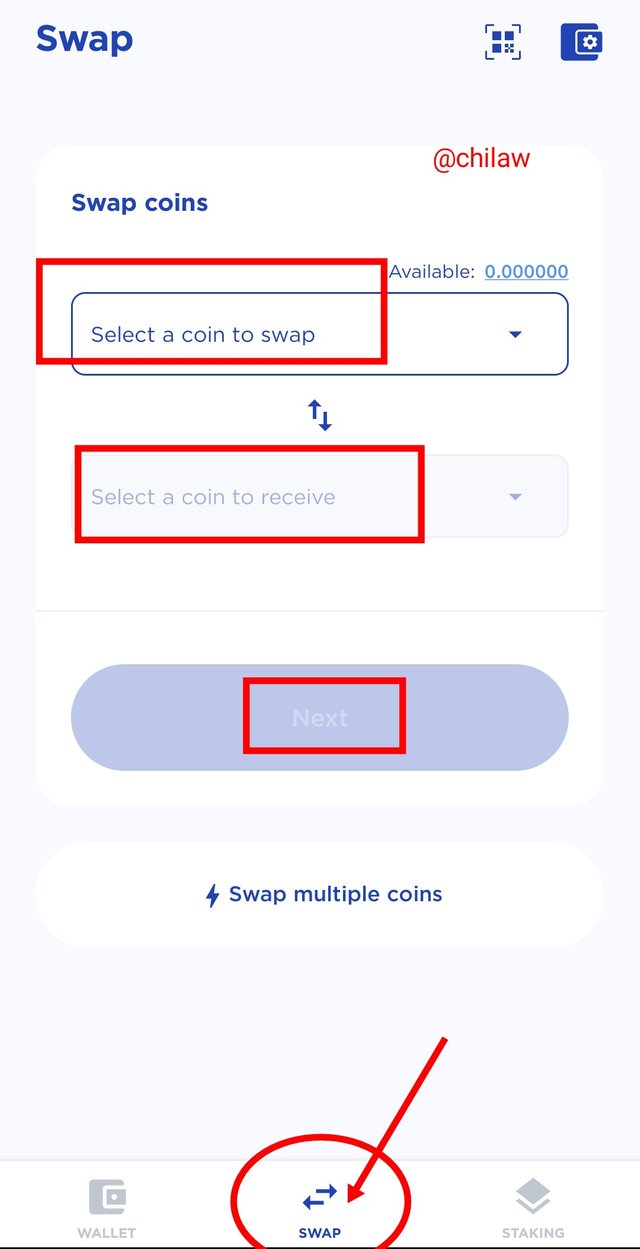

Swap Feature in the Terra Station

- From the landing page, click on the swap button below the scene

- We have box areas to enter the preferred coin to be swapped as well the box to select the requested token to be received.

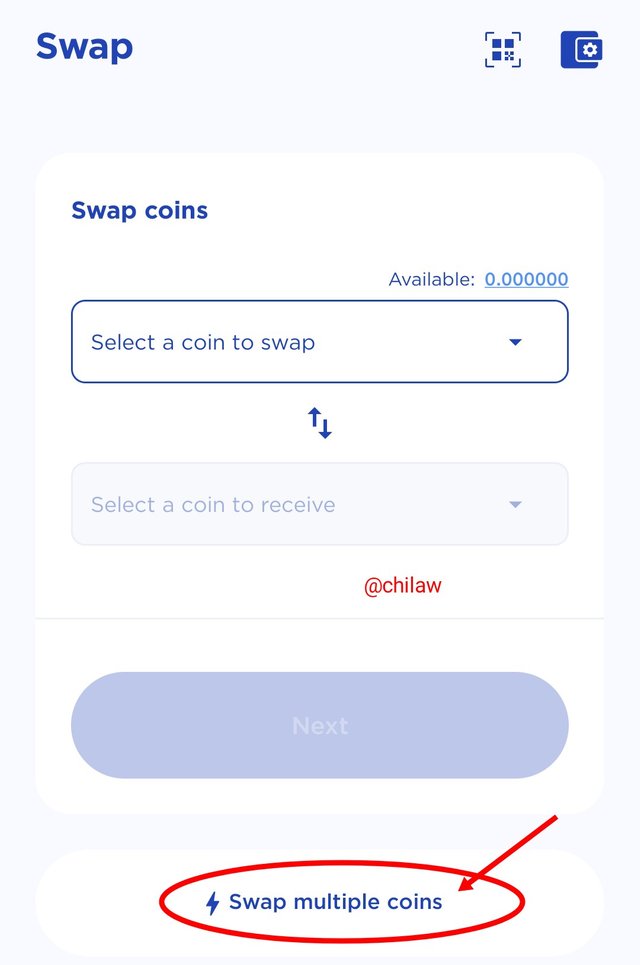

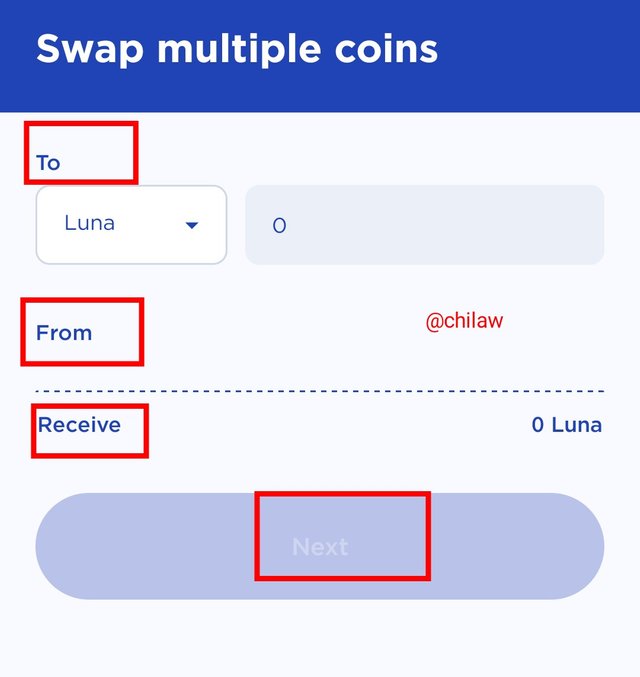

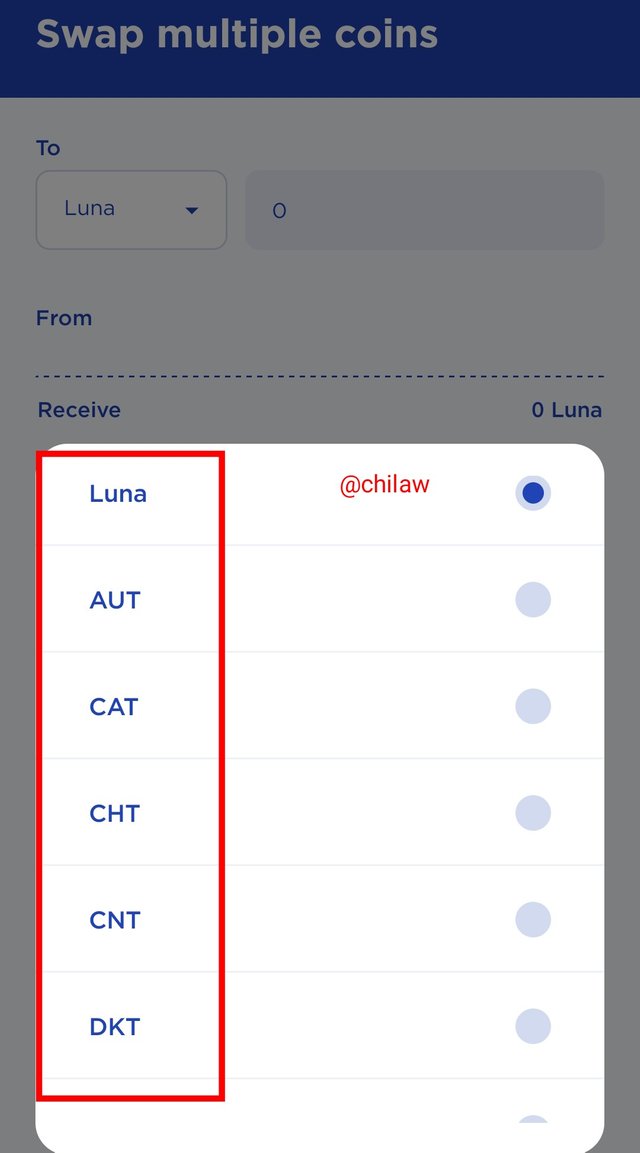

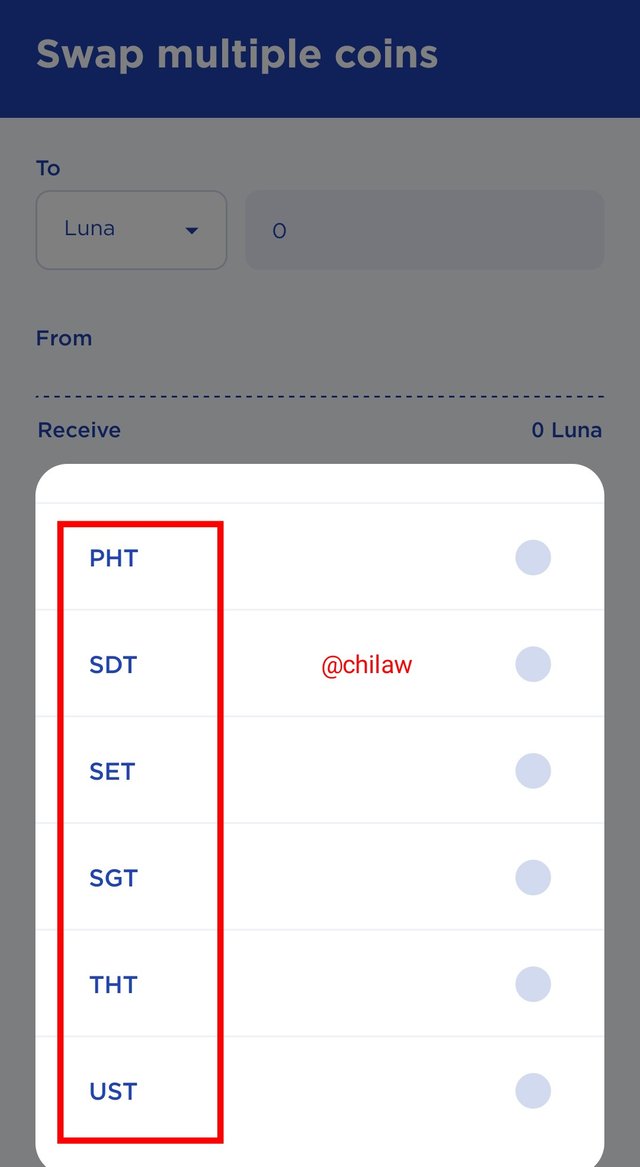

- We also have an option for "Multiple Coin Swap". Click on it to load the interface

- We have the three options; too, FROM & RECEIVE

- We also have a number of coins to select aside from the Luna coun which includes the following: AUT, CAT. CHT, CNT, DKT, EUT, GBT, HKT, IDT, INT, JPT, KRT, MNT, PHT, SDT, SET, SGT, THT, and UST.

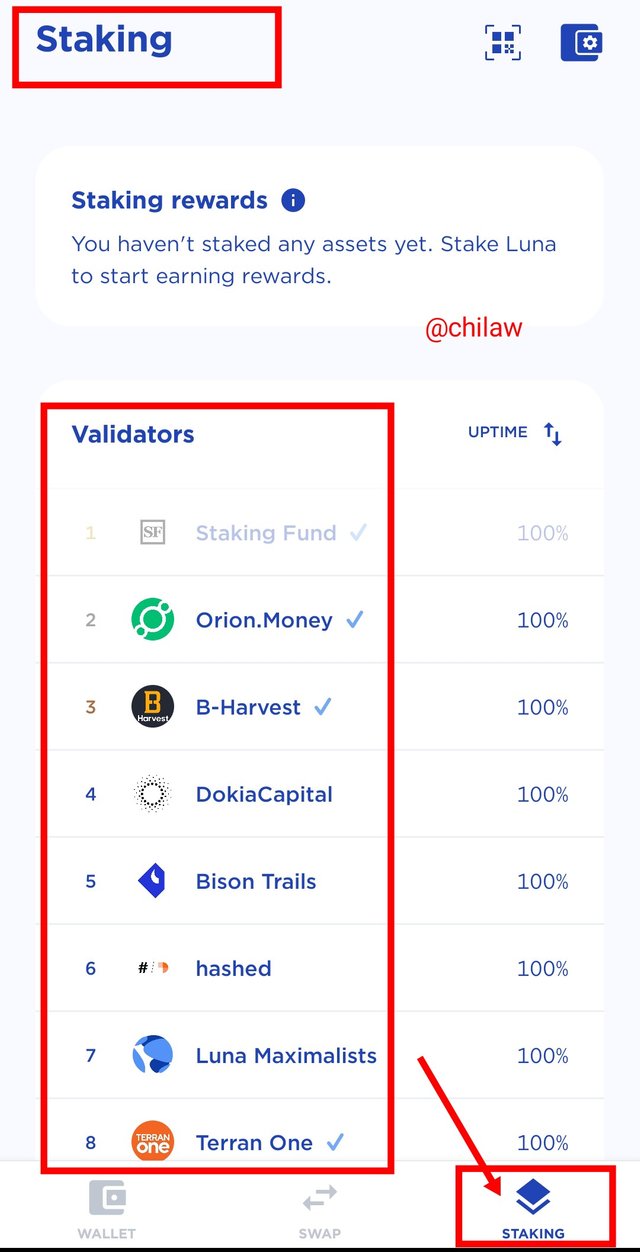

STAKING Feature in the Terra Station

- From the landing page, click on the STAKING button below the scene

- There are about 190 listed validators to stake

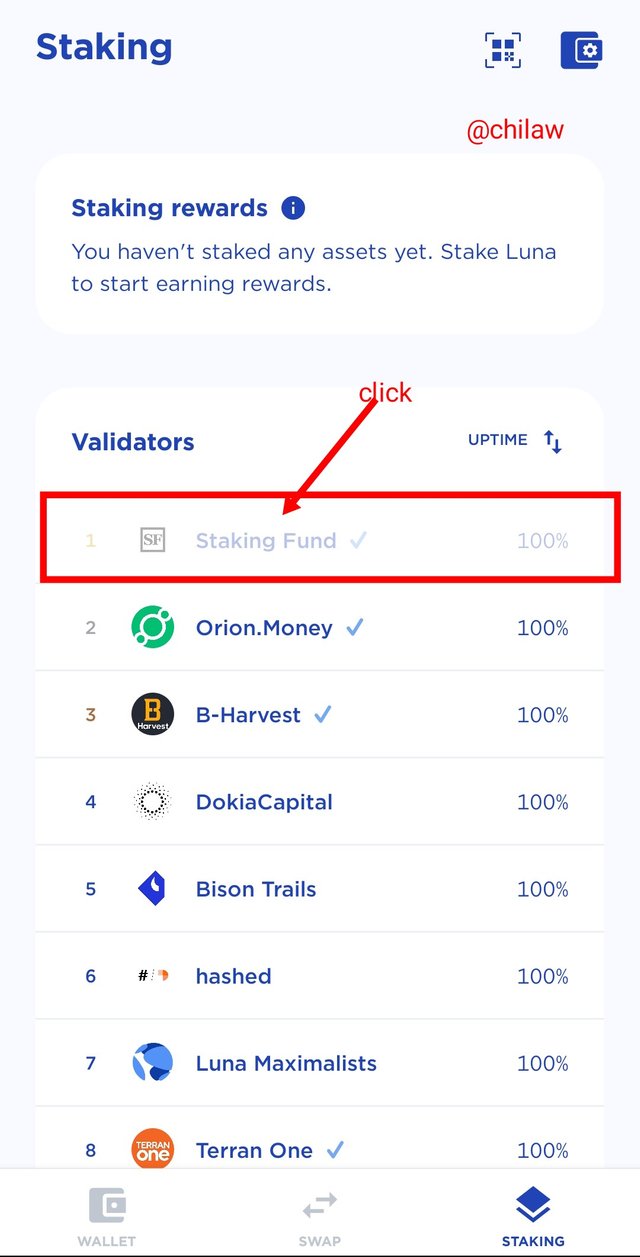

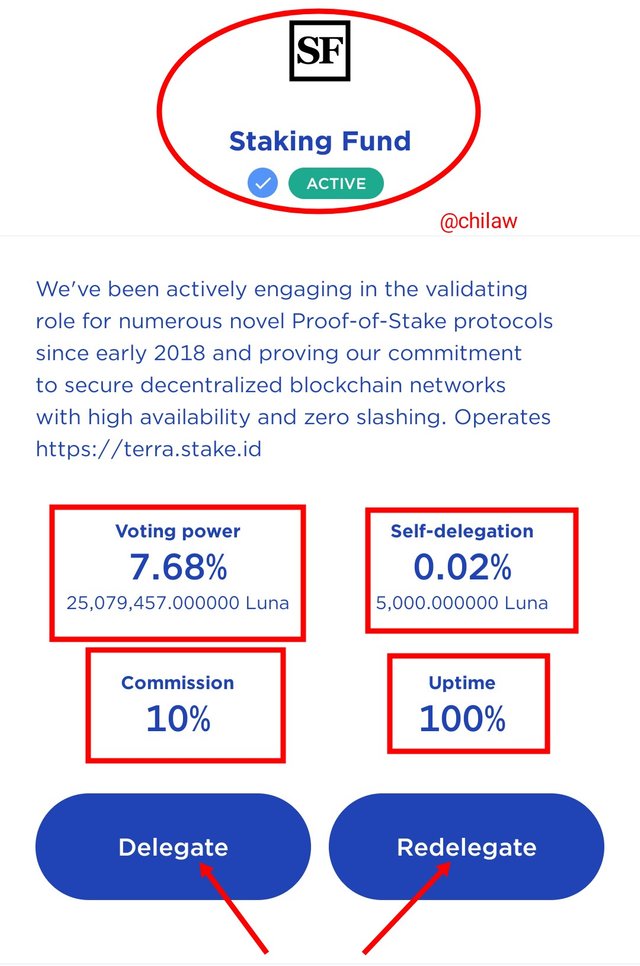

- For any of these validators of interest, you can click on it. Let's click on the Staking Fund (SF) and explore further

- We can see the different options there. Voting Power (7.68%), Self Delegation (0.02%), Commission (10%) and Uptime (100%).

- With the Delegate and Redelegate buttons, we can stake our coins and as well re-stake them to a validator

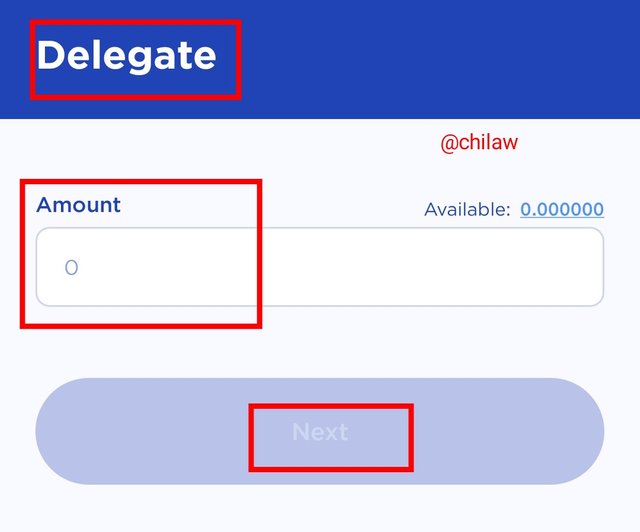

- Click on the Delegate button to see the updated interface.

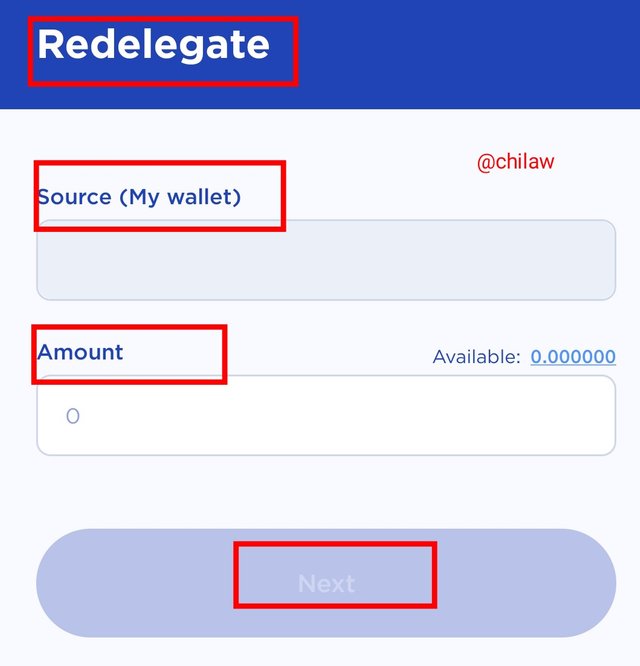

- Click on the Re-Delegate button to see the updated interface.

Question 2: Explain Anchor Protocol, explore the app, and connect the Terra Station wallet. Show screenshots.

The Anchor Protocol

This is a dApp that is built on the Terra Network. Anchor Protocol is a savings protocol that is powered by the Terra e-commerce payment system with guaranteed Terra Stablecoin execution. Participants of this system especially the liquidity providers earn yields by lending their terra assets which in turn are used by borrowers but are observed to collateralize their asset through a smart contract powered by the PoS mechanism.

This protocol like every other decentralized dApp does not have a minimum deposit condition, account centrality or ambiguous sign-up processes rather interested participants can have access to this protocol irrespective of region or race. In its operation, the Anchor Protocol uses its main utility token which is the ANC, and any other supported token in the Terra network relative to its DeFi ecosystem.

It was launched sometime in the first quarter of 2021 (March 2021) by a Seoul firm "Terraform Lab" with offerings of high and stable savings schemes by allowing investors to tender their Terra base assets with high yield and low volatile prone rates in return. During governance, a quorum of the ANC token holders is expected to set the Anchor rate which is the target and expected rate due to depositors of stakes.

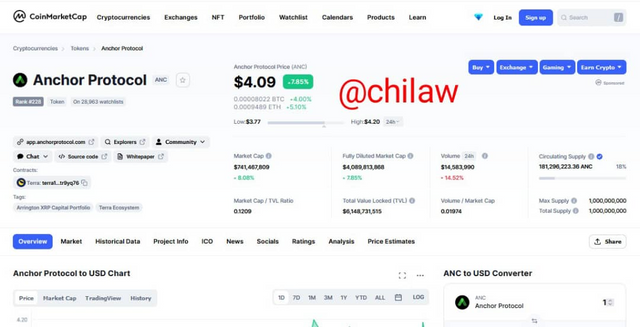

(Images from CoinmarketCap site)

The price of the native token of Anchor Protocol at the time of this post is $4.09 with a Market ca of $741,467,809 and a circulating supply of 181,296,223.36 ANC.

Exploring the Anchor Protocol & Connecting to Terra Station

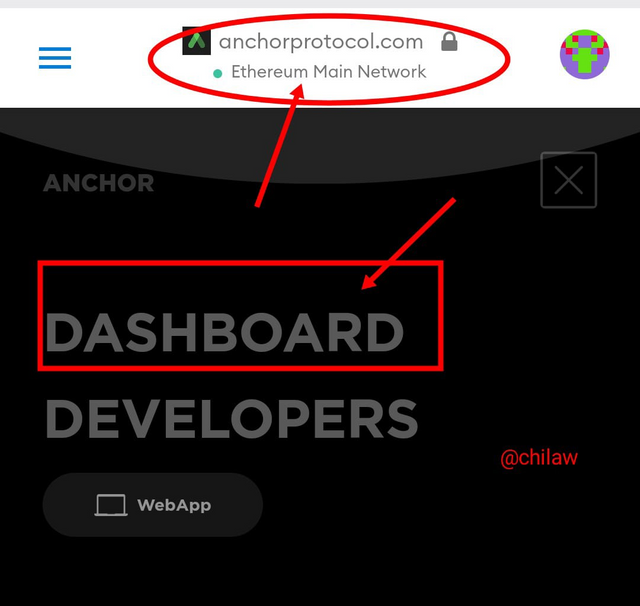

- To have access to the page, log in with https://www.anchorprotocol.com

- This brings us to the landing interface. Click on the menu button by your top right screen

- Then click on the dashboard option

- Click on the menu button to explore some of the available options;

a. Dashboard:

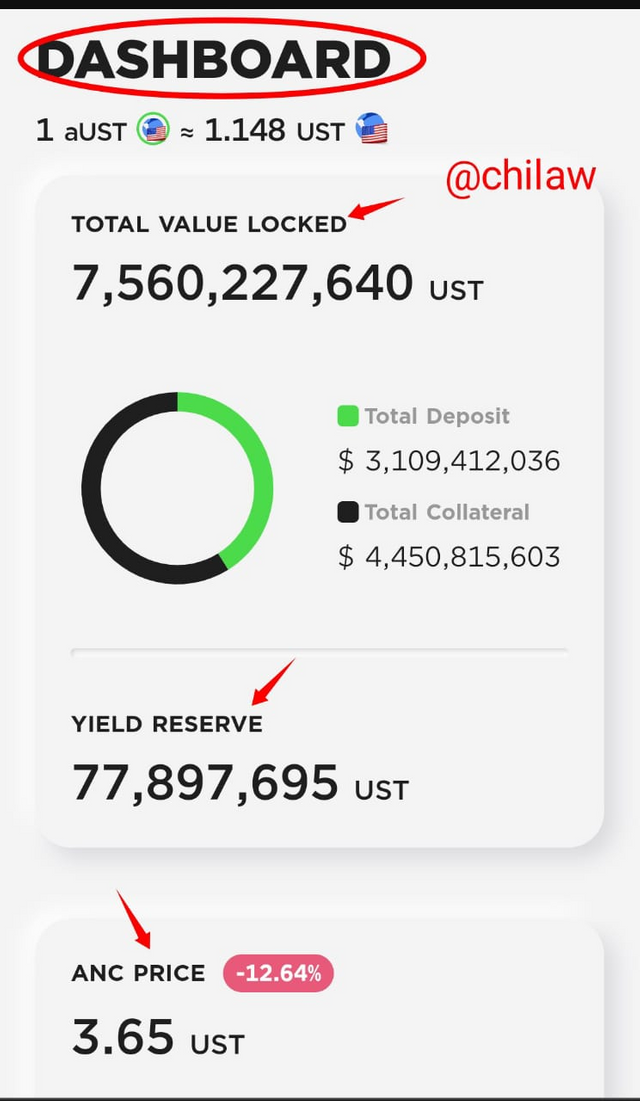

This gives an overview of the ANC at a glance. It shows the Total Value locked (7,547,731,575 UST), Yield RFeserve of 77,959,490 UST, Current ANC price of 3.651UST (with circulating supply and market Cap displayed). Also displayed are the total deposits and borrowed in the protocol, collateral value, etc.

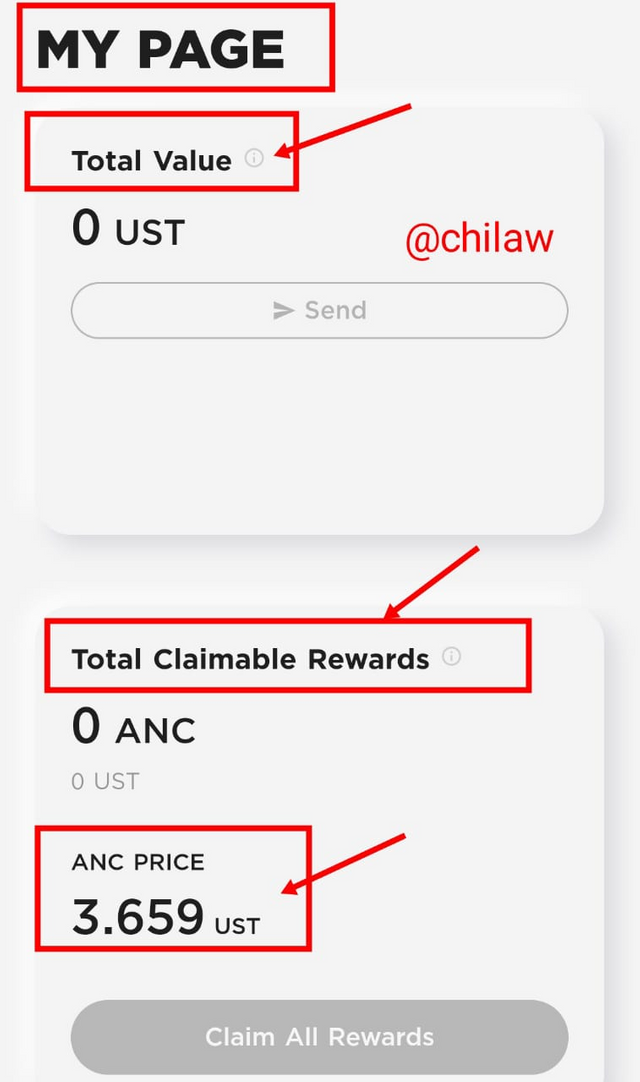

b. Mypage:

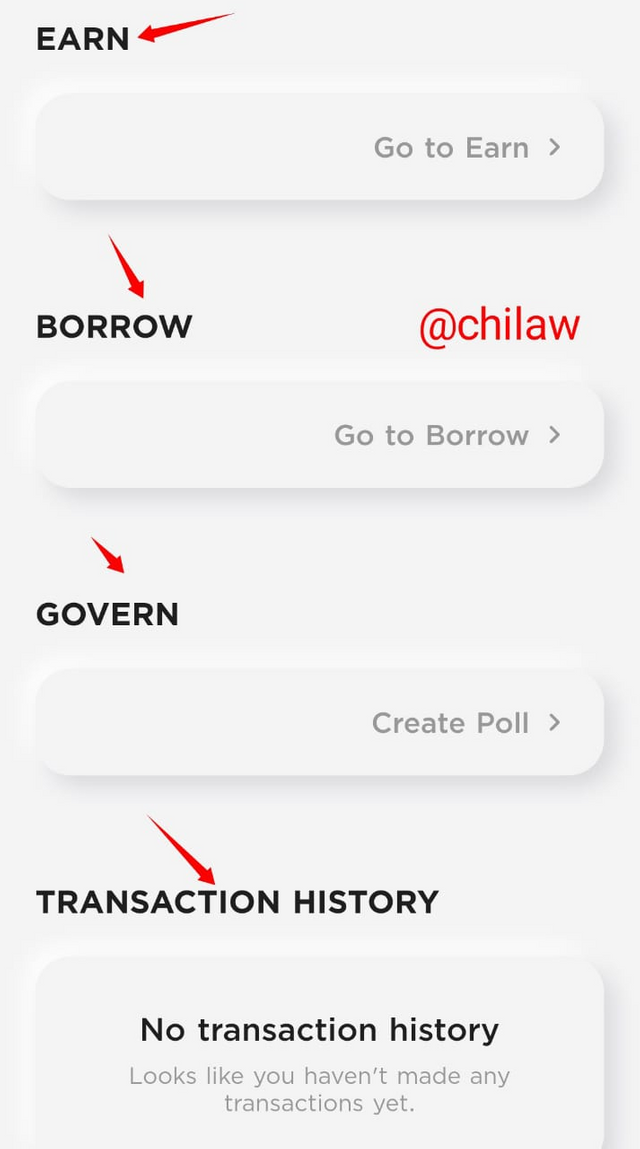

This is an overview of the user account. It shows total value in the wallet, rewards claimable, Rewards, Earn, Borrow, Govern, and transaction history.

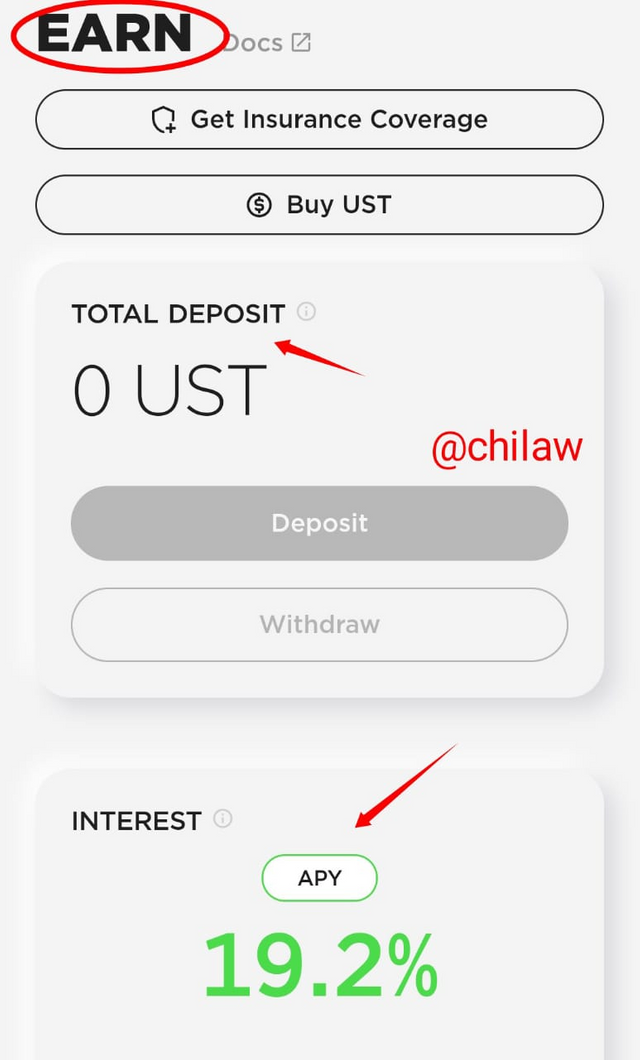

c. Earn:

The earn feature gives us details of the Total deposit in the account relative to the APY rate which is observed to be 19.2% as of the time of this post.

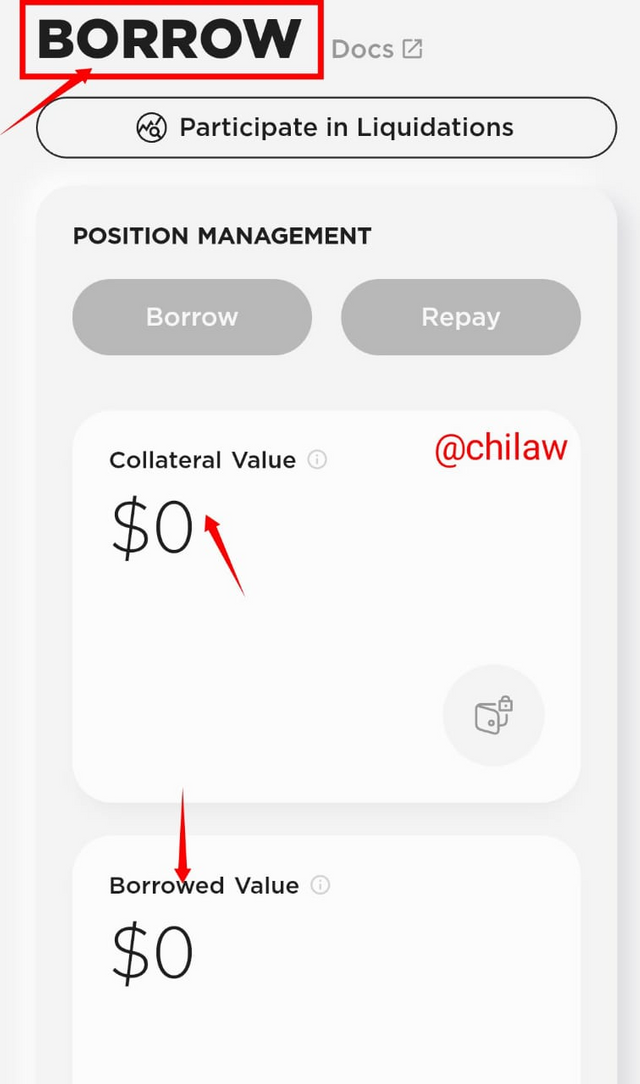

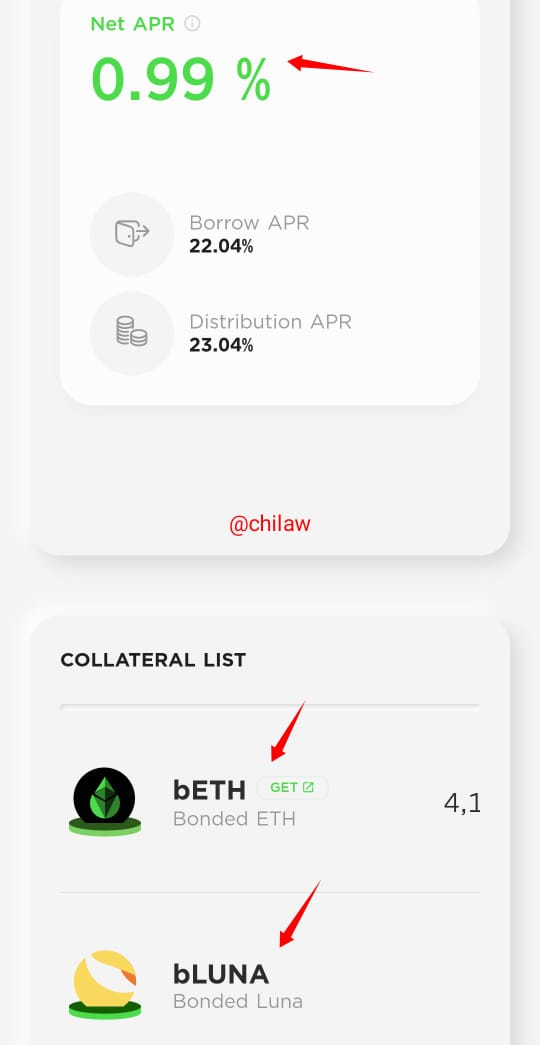

d. Borrow:

The Borrow feature gives is a breakdown of our collateral value vis-a-vis borrowed value. This can be referred to as position management . Net APR stands at 0.99% with borrowers' APR at 22.04% and Distribution APR at 23.04% as at the time of this post. We also have the bETH and bLUNA in the collateral list.

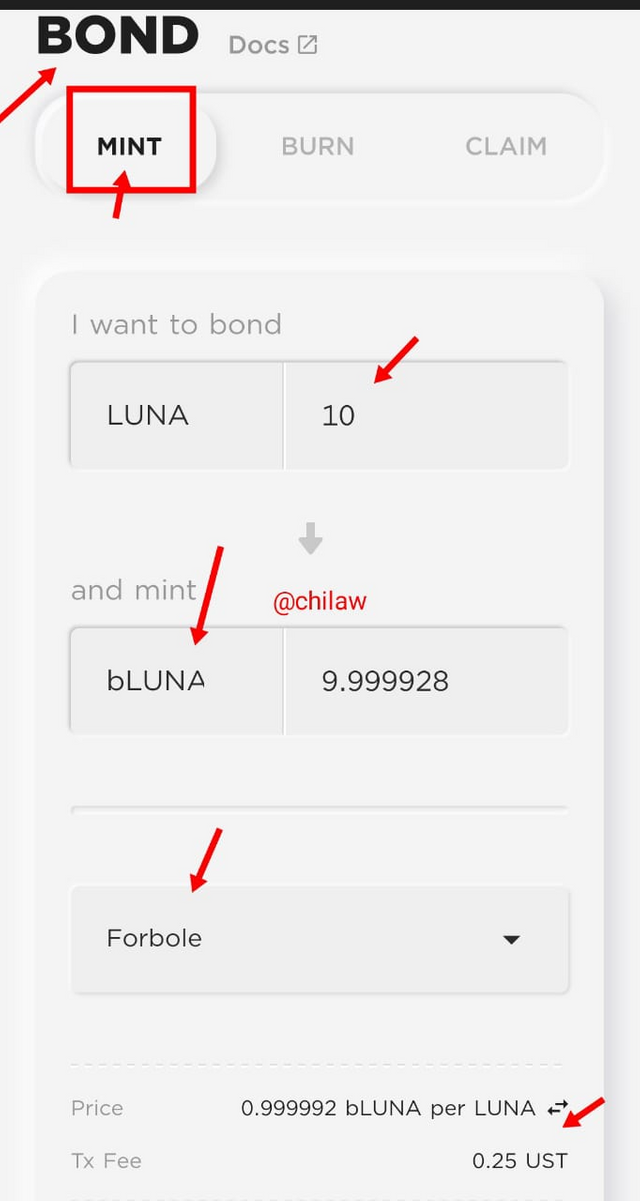

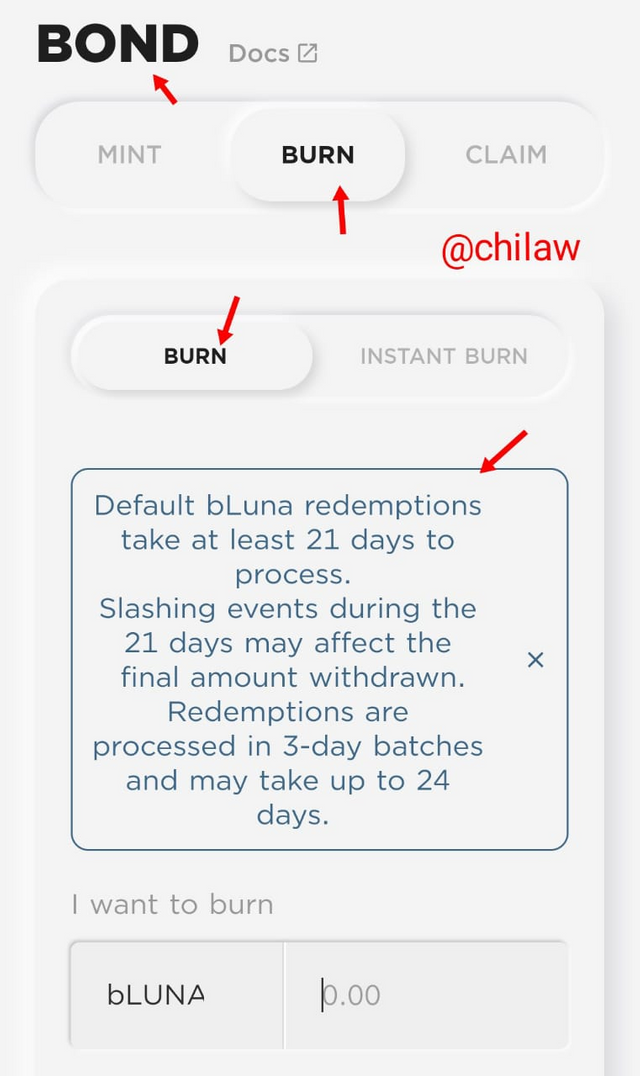

e. Bond:

In this feature, it comprises the Mint, Burn, and Claim. For the mint option we are expected to enter the amount of LUNA coin to be minted to bLUNA and as well choose a validator. This would attract a fee of 0.25UST for bonding 10LUNA I order to mint 9.999928 bLUNA.

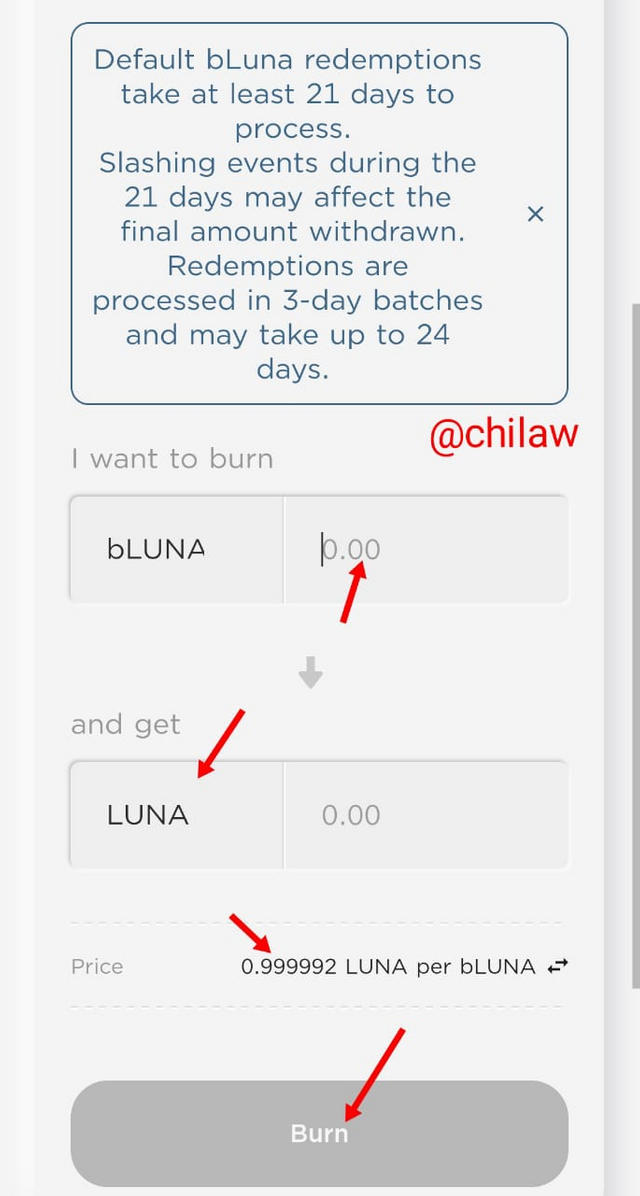

We can see that bLUNA redemption takes 21 days. Input the amount of bLUNA so as to get back your LUNA then click on the Burn button.

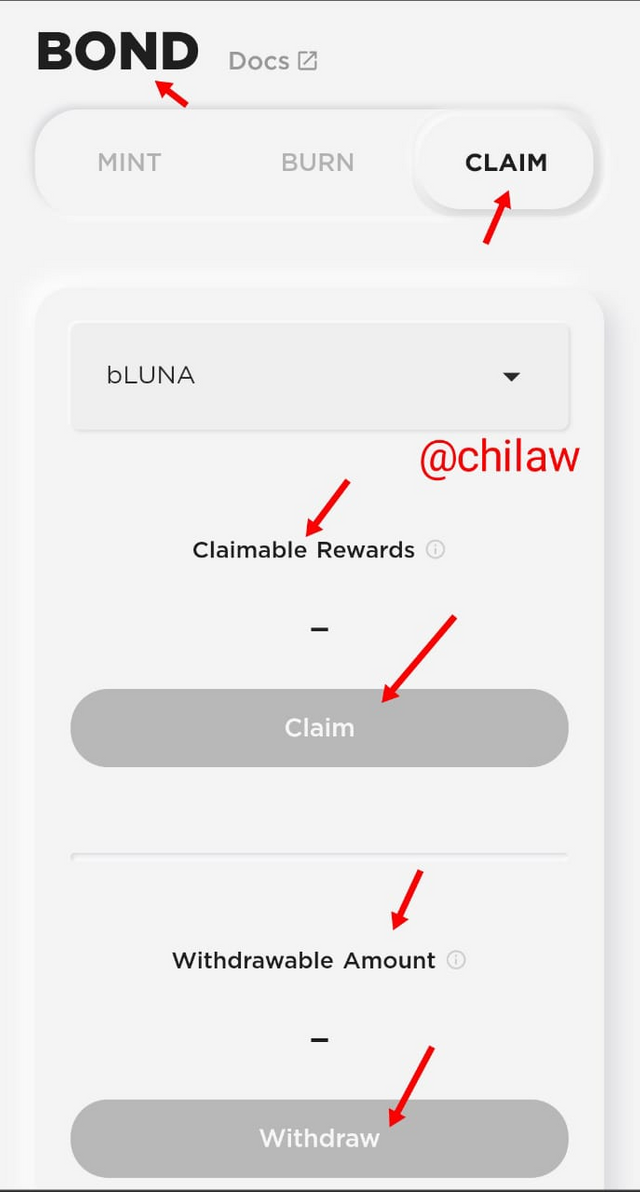

This is also the same for the Claim option. The user is to select the coin staked (bLUNA/bETH) which rewards are expected.

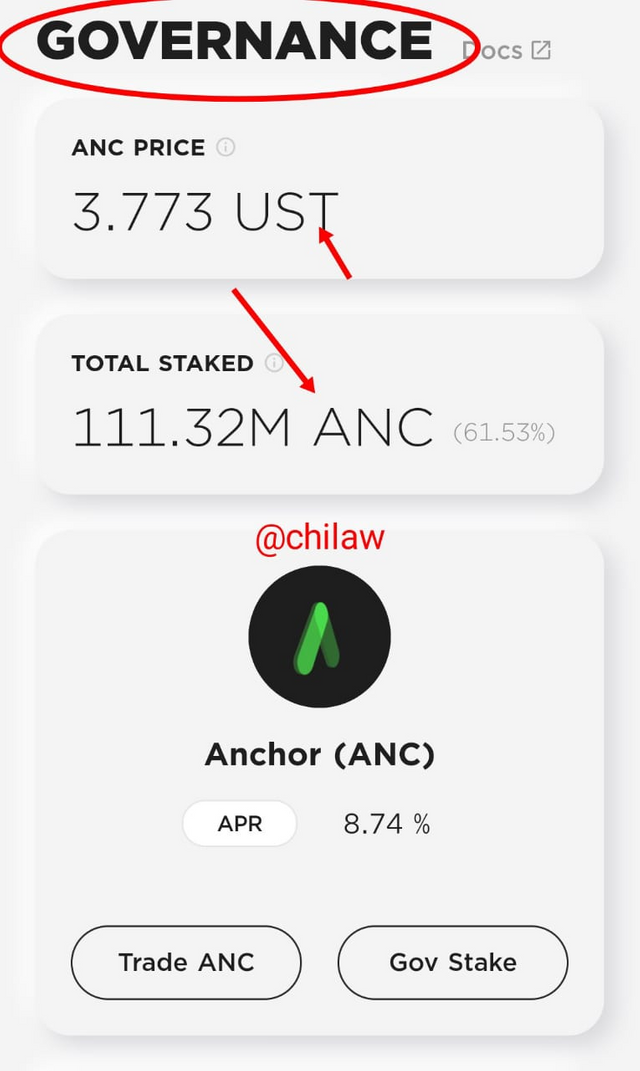

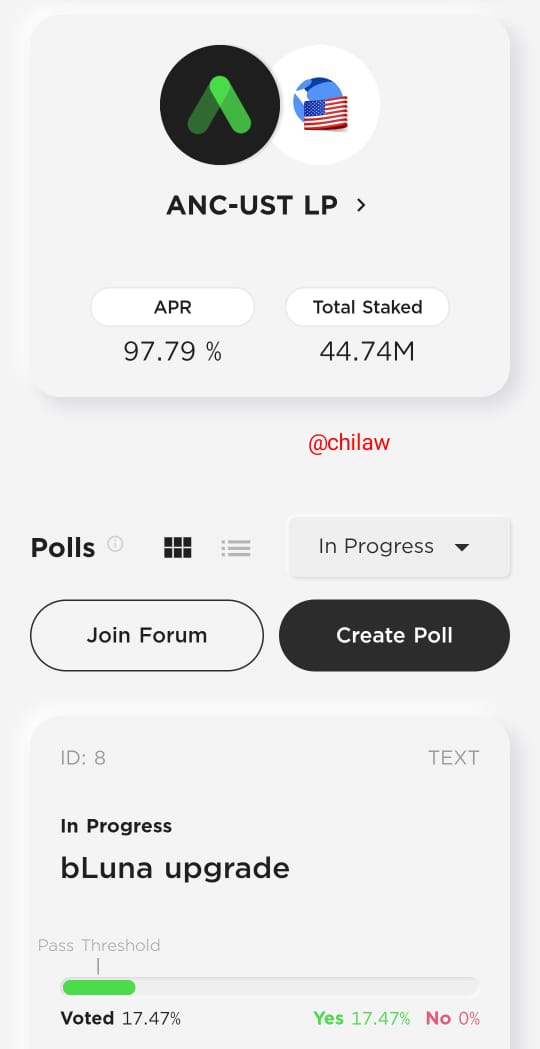

f. Govern:

As we know, only users who staked their ANC assets participate in the governance of the Anchor protocol system. Total Staked stands at 11.32M ANC which represents 63.53% of available ANC assets.

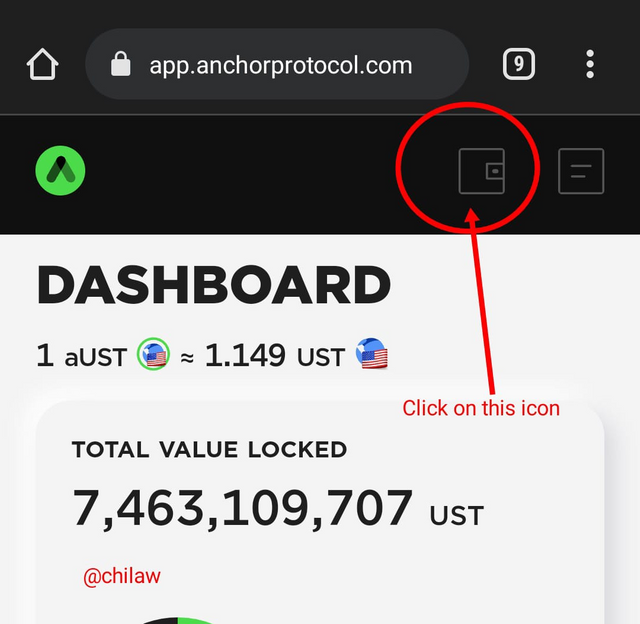

Connecting the Anchor Protocol to the Terra Station

- In connecting the Anchor Protocol to the Terra Station, Click on the button seen on the top right screen

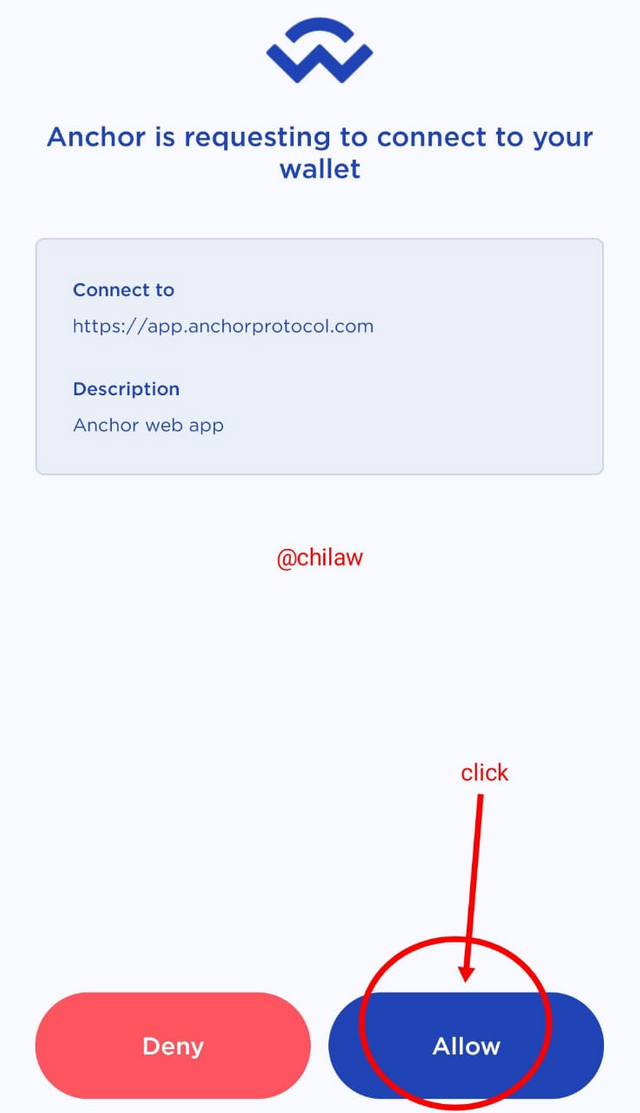

- Since I already have the Terra Station installed on my device. This would ask for permission.

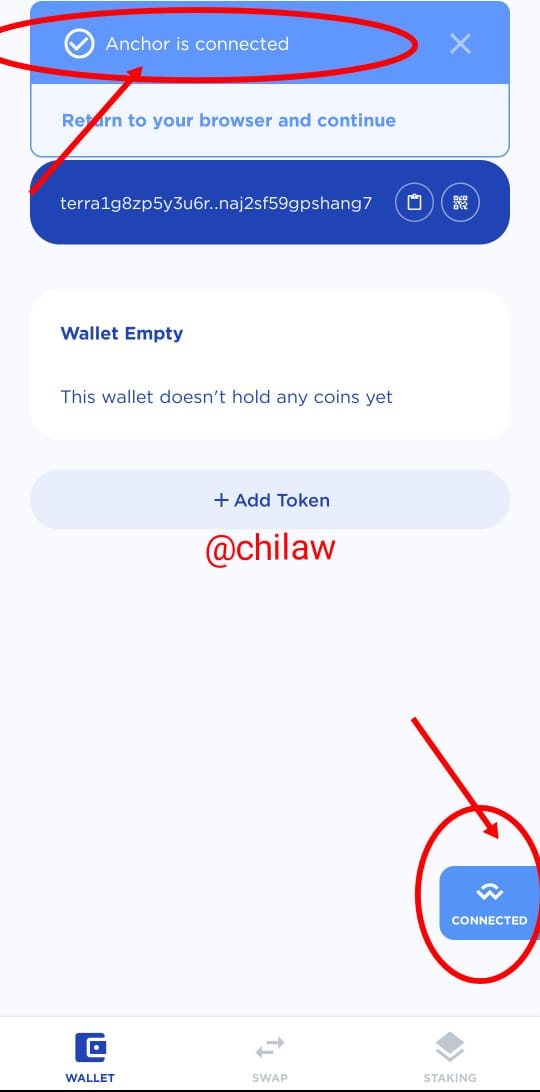

- Click on the allow button

- The Anchor Protocol is observed to be connected with the Terra Station

Question 3: Explain Mirror Protocol, connect Terra Station and explore the Mirror Protocol app. Show screenshots.

The Mirror protocol

This is a completely decentralized protocol whose entrance has expanded the synthetic asset space. It is a project built on the Terra network and is an extension available in the Ethereum blockchain through its shuttle bridge. It allows a full representation of all assets on the blockchain, synthesis and management of assets. Assets found in the Mirror Protocol are tagged as mAssets and the system allows for over-collateralization of assets to a max of 150% which hitherto promotes stable operation. Just the beauty of the system, when there are shortfalls below the required threshold, the Liquidation engine cashes them out.

This is a project since its launch that has not reserved any pre-mines tokens for the team or raised any funding to support its project rather it runs on community-driven ideology. Its native token is the Mirror token (MIR) which serves as its main utility token in the protocol. Hence it helps facilitate governance, staking and rewards execution done in its network. There are 370M total supply of this token which after four years is expected to drop by halving. Unlike the ANC, the MIR is inflationary in its nature.

Staking of mAssets and MIR tokens can be executed in both the Tera and Ethereum blockchains. Due to this dual range of staking, there can be further staking of tokens using the liquidity pool for more rewards in the blockchain. Users can now have the opportunity to participate in markets they ordinarily would not have had access to due to government policies or insufficient/no capital using the Mirror Protocol. This fit can be achieved through the minting of synthetic assets which is a typical example of trading on equities is the US equities where Mirror users can access anywhere in the world.

Synthetic in this context means a representation of the real-world asset. Every asset can be represented in a synthetic form using the Mirror project.

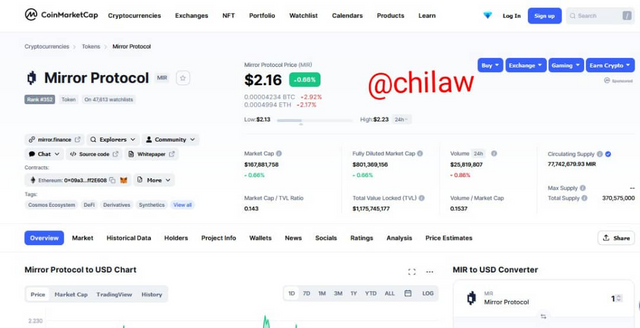

(Images from CoinmarketCap site)

As of the time of this post, the price value of the native token of the Mirror Protocol is $2.16 with a Market Cap of $167,881,758 and a circulating supply of 77,742,679.93 MIR.

Exploring the Mirror Protocol

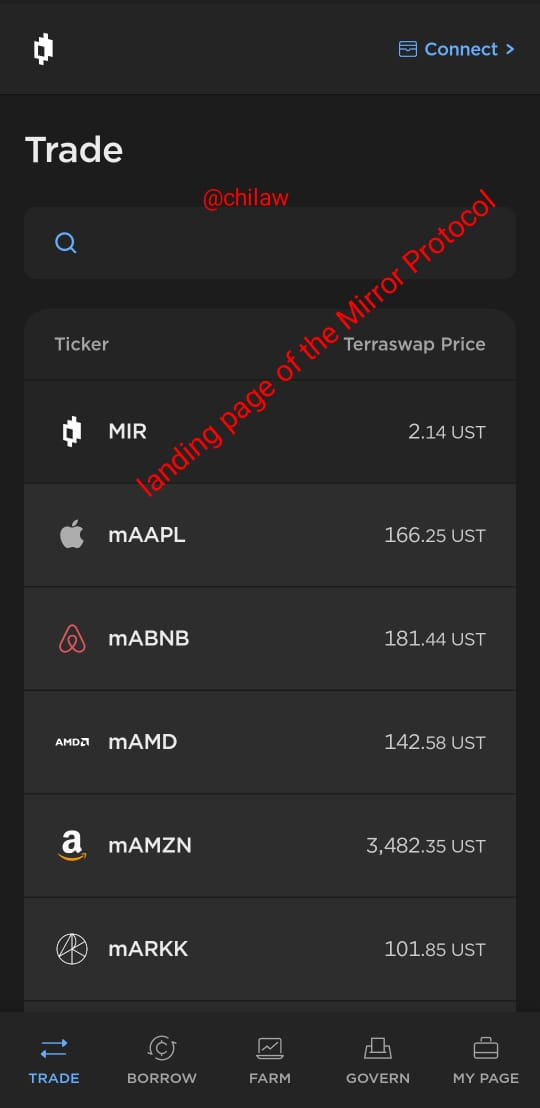

- Login to have access with https://mirrorprotocol.com

- From the two links, choose any of them to access the Mirror protocol

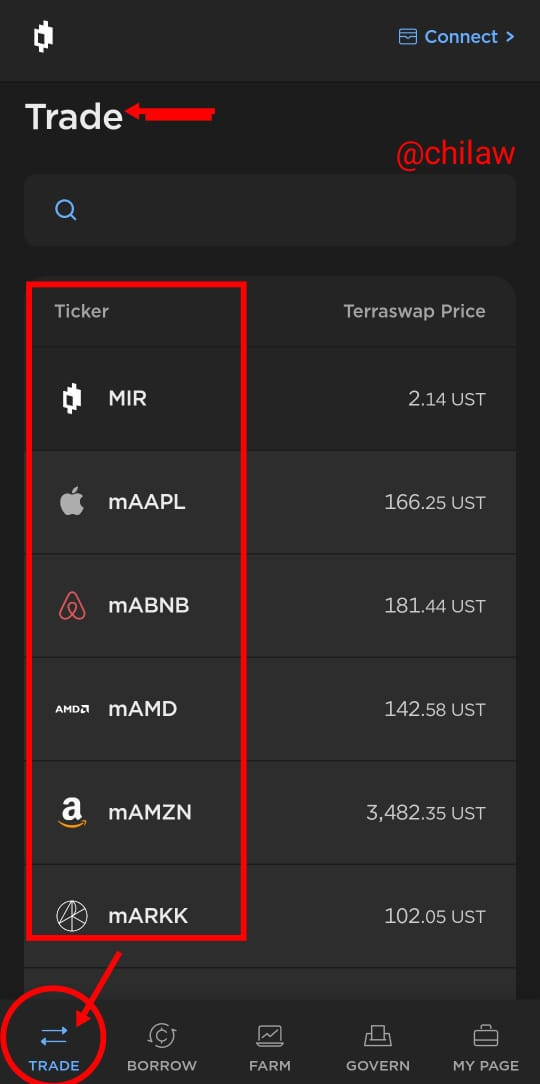

- From the landing page which is on the Trade option, we can find the different listed coins representing the mAssets.

We can also see other features listed below which include the following:

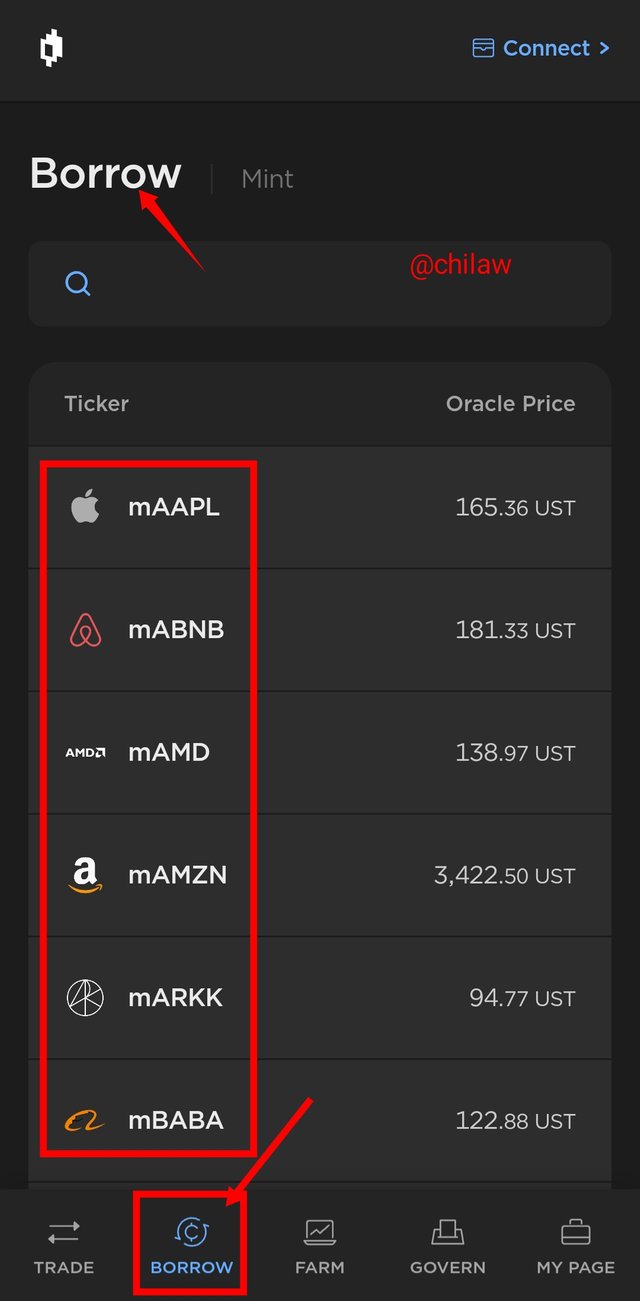

a. Borrow: This feature shows us the different listed assets we can borrow from which include mAPPL, mABNB, mAMD, mAMZN, mARKK, mBABA, etc.

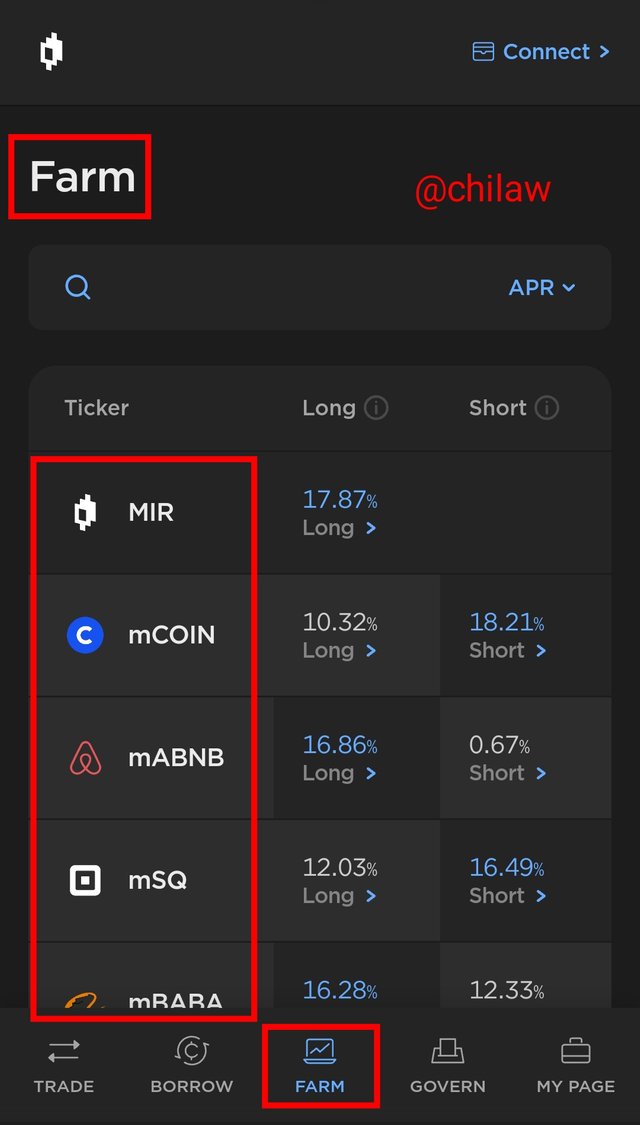

b. Farm:

This is a form of staking with the designated APR displayed for each asset. In this interface, we have with the long or short APR for every asset which varies. The longer the APR term the higher the value.

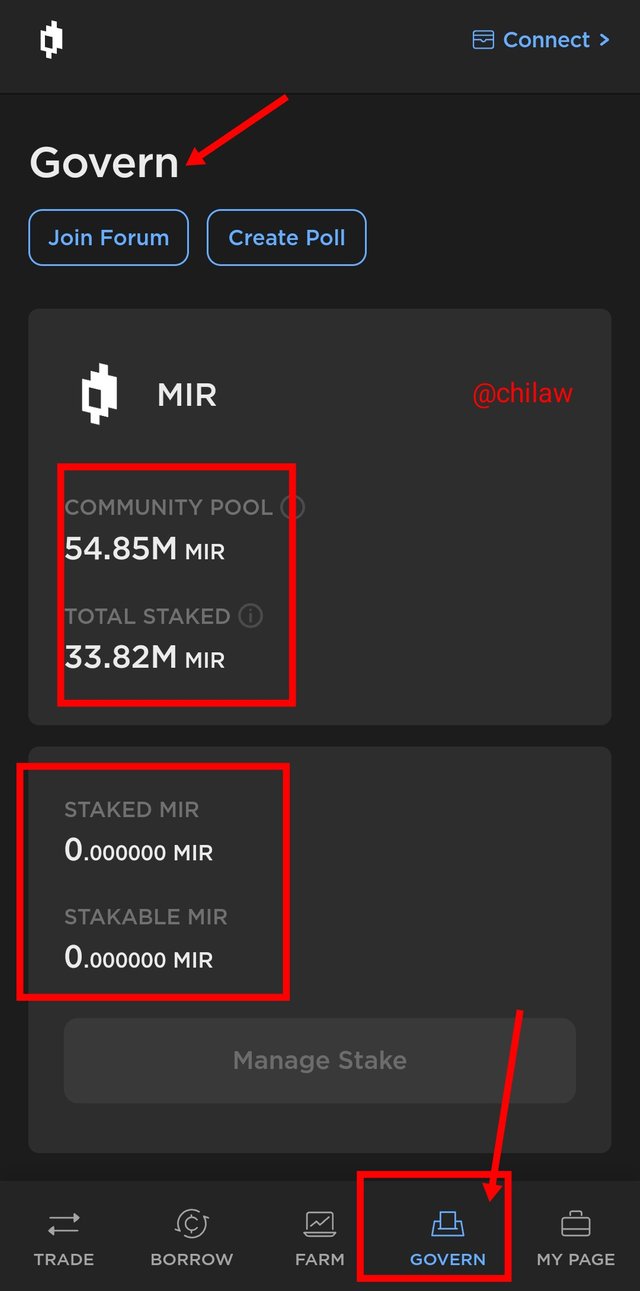

c. Govern:

To participate in governance, users have to own the MIR token and as well stake them. This feature ,it shows the amount of Staked MIR and Stackable MIR in our account as well as the total stated MIR in the community and community pool MIR value.

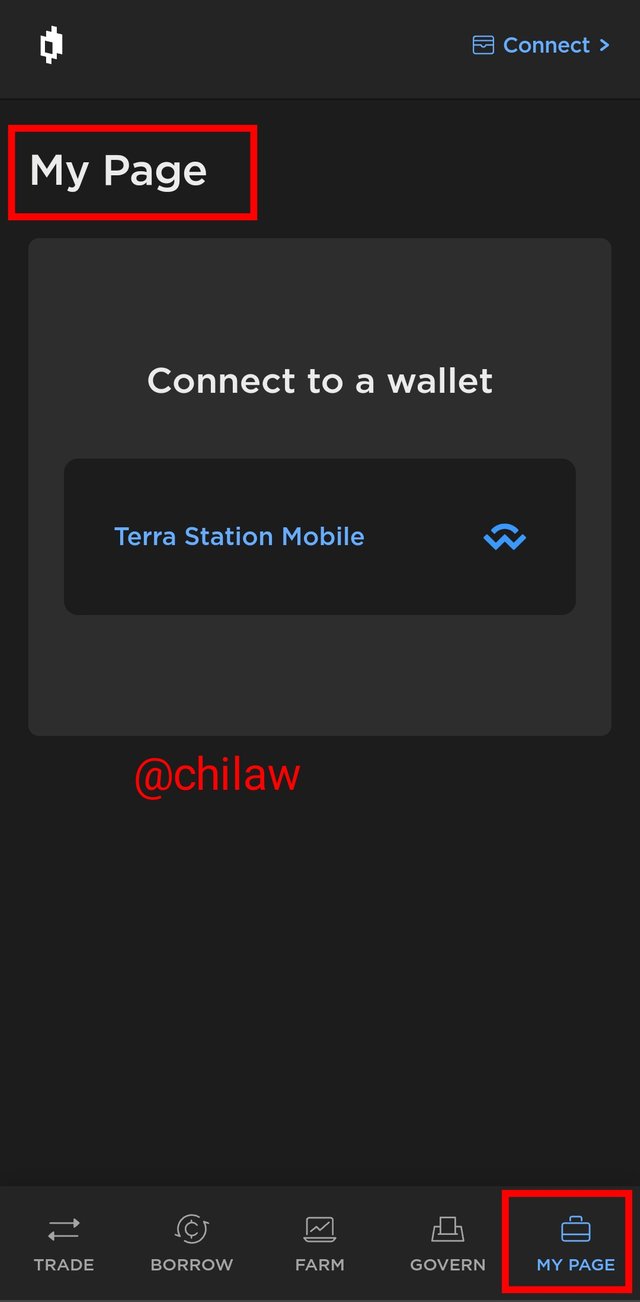

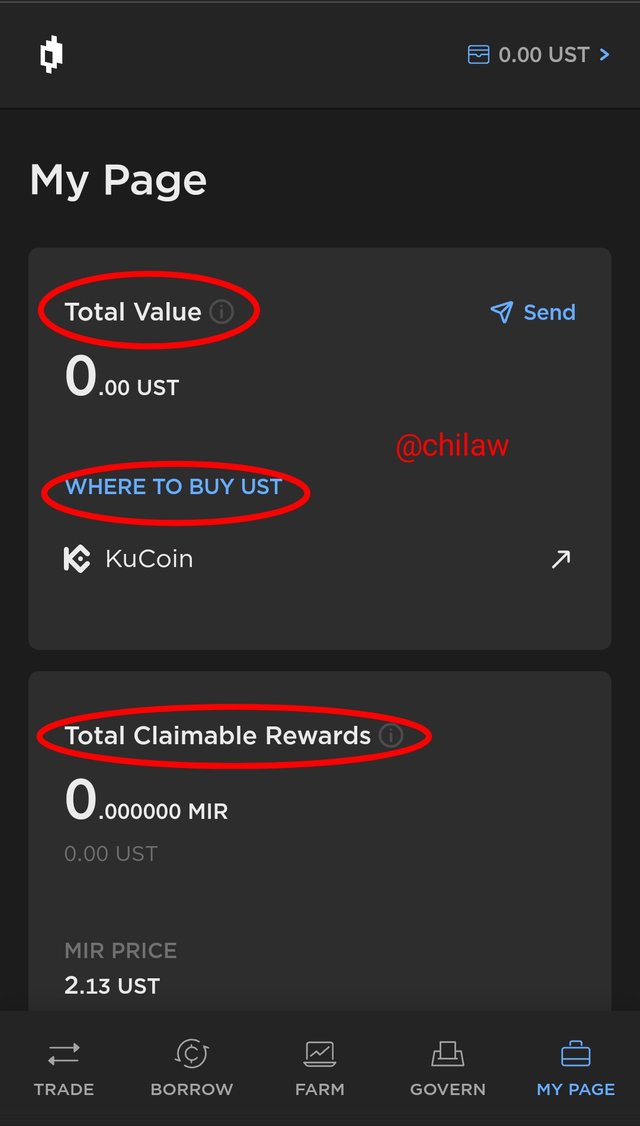

d. MyPage:

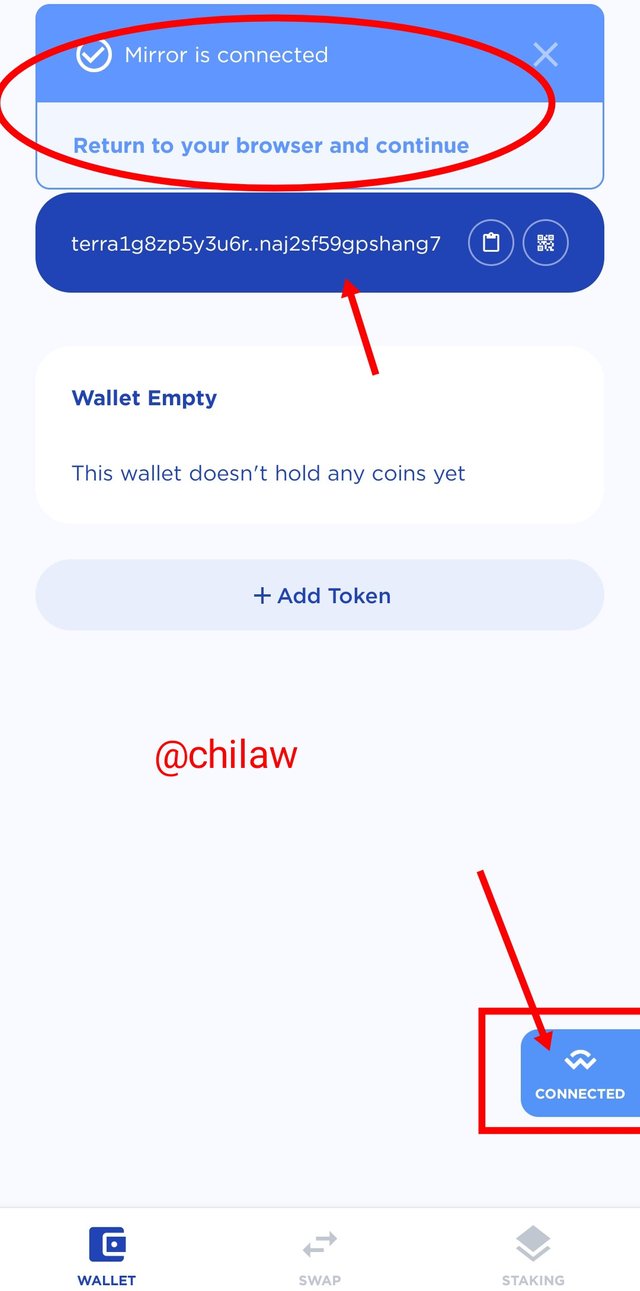

To have access to this page, one has to be connected to a wallet account. But I will connect and show us the details therein. We have Total Claimable Rewards, Total account value etc.

(Before connecting wallet)

(After connecting wallet)

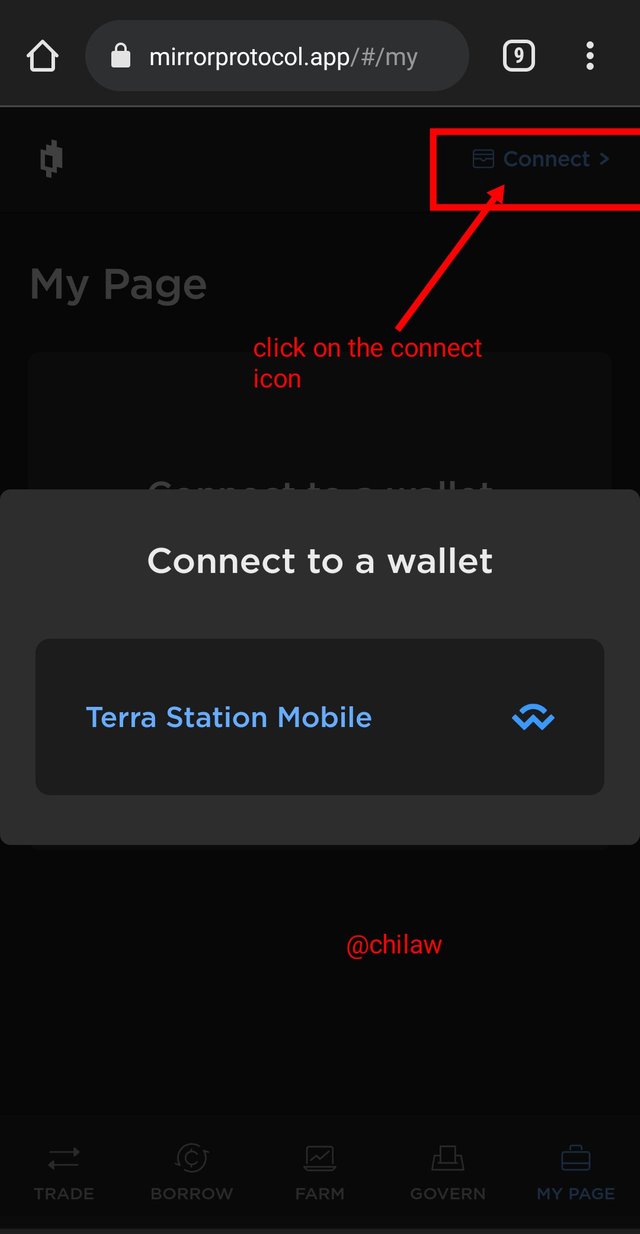

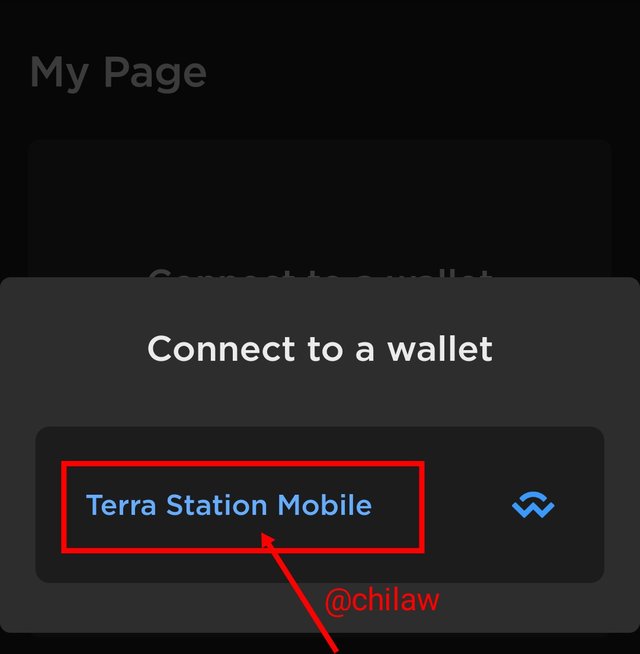

Connecting the Mirror Protocol to the Terra Station

- Click on the connect icon on the top-right screen

- Click on the Terra Station Mobile icon

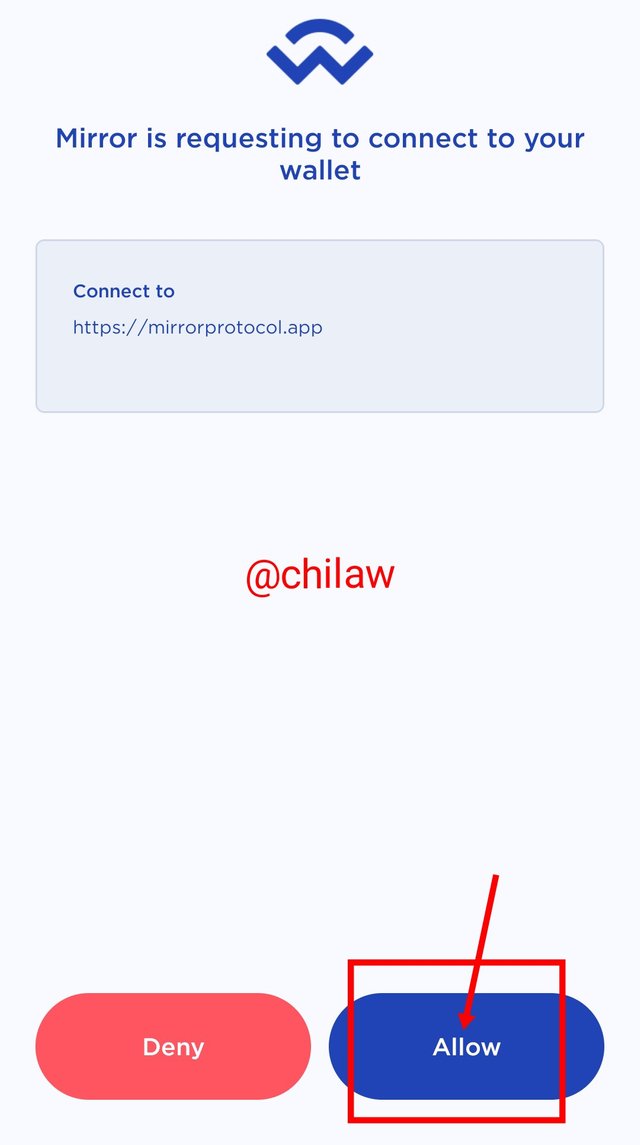

- Click on the below button to grant access

- Then this connects your Mirror Protocol to the Terra Station

Question 4: What is the Terra bridge? Explain, show screenshots.

The Terra Bridge

The Terra Bridge is simply an intermediary that enables users of the Terra Network to easily transact Terra assets across the chain. That is , this frontend mechanism allows inter Blockchain asset transfer amongst all supported Terra enabled Blockchains like the Ethereum and Binance Smart Chain.

The unified interface which allows token movement from chain to chain is the Terra Bridge. Though there are current updates to completely integrate the wormhole into the Terra Bridge which would end the Shuttle transfers originally seen in the Terra Network.

The wormhole network is systems put in place whose specialty is to build bridges that would seamlessly connect Blockchain Networks. Hence this wormhole integration would see a seamless flow of synergy between the Terra Network and the Solana ecosystem. Therefore the Terra assets can be used on Solana's DeFi.

With the Terra Network now having a bridge amongst the four biggest Blockchains in the space, it makes for wider adoption and user friendly. This Blockchain include; Ethereum, Binance Smart Chain (BSC), Solana and Harmony Blockchains.

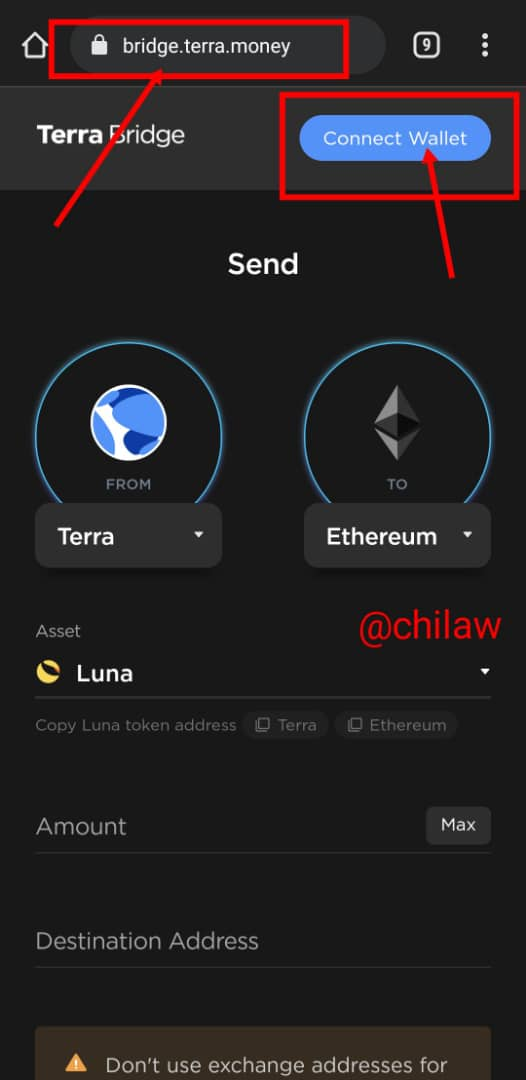

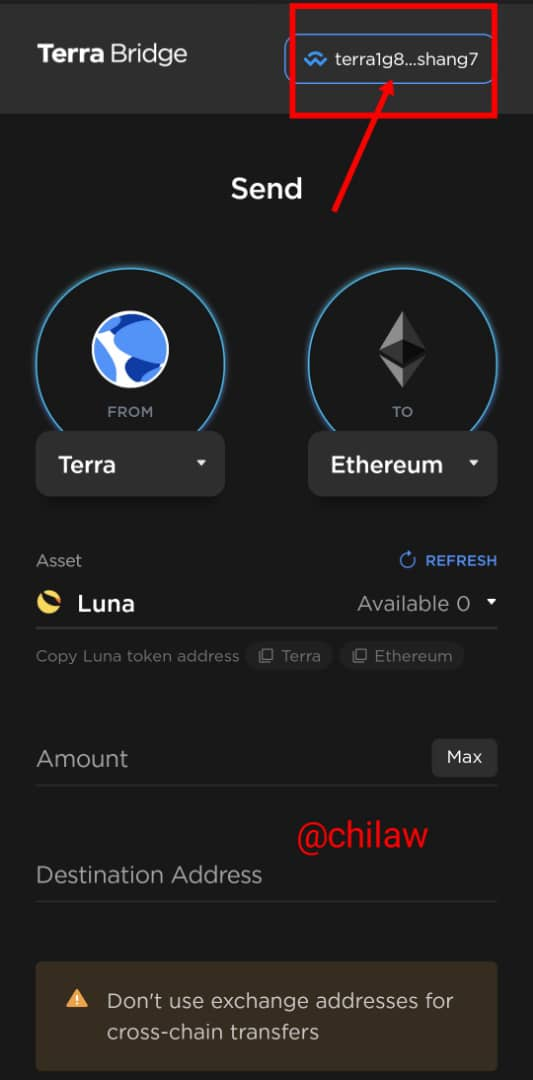

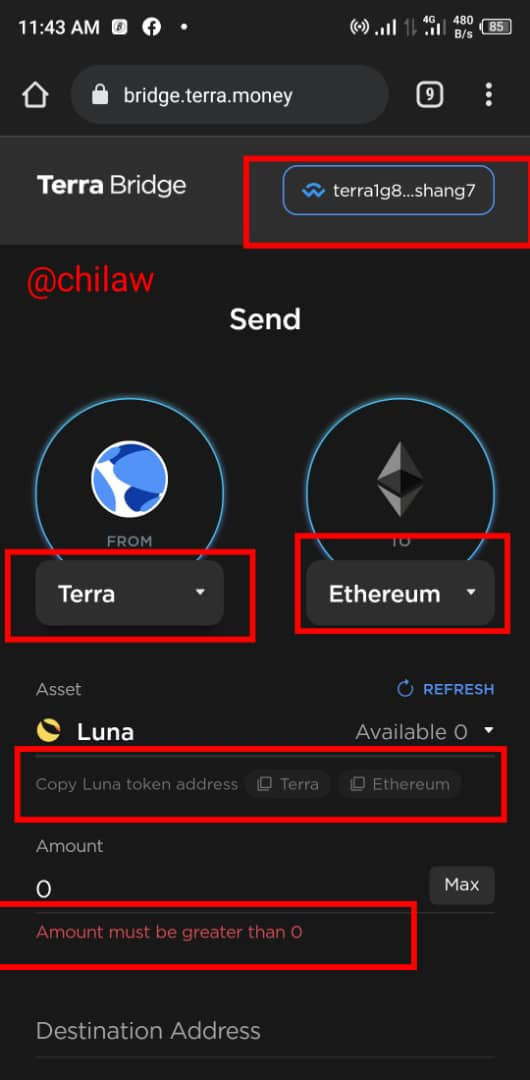

Connecting and Using the Terra Bridge

- In doing this, log in with https://bridge.terra.money

- From the landing page, you will see the "Connect Wallet" icon on your top right screen. Click on it

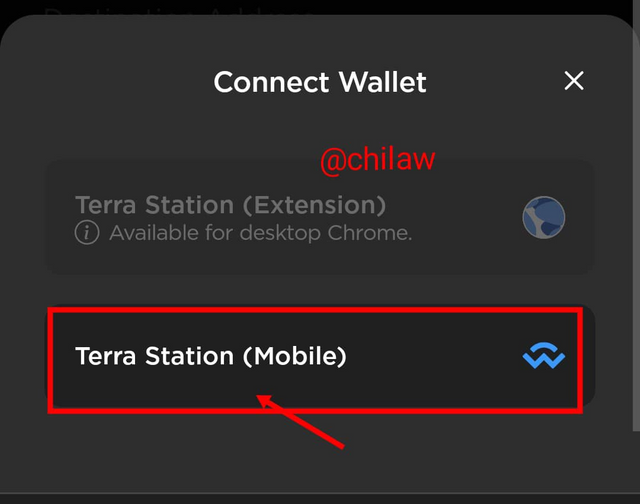

- Click on the Terra Station (mobile) icon

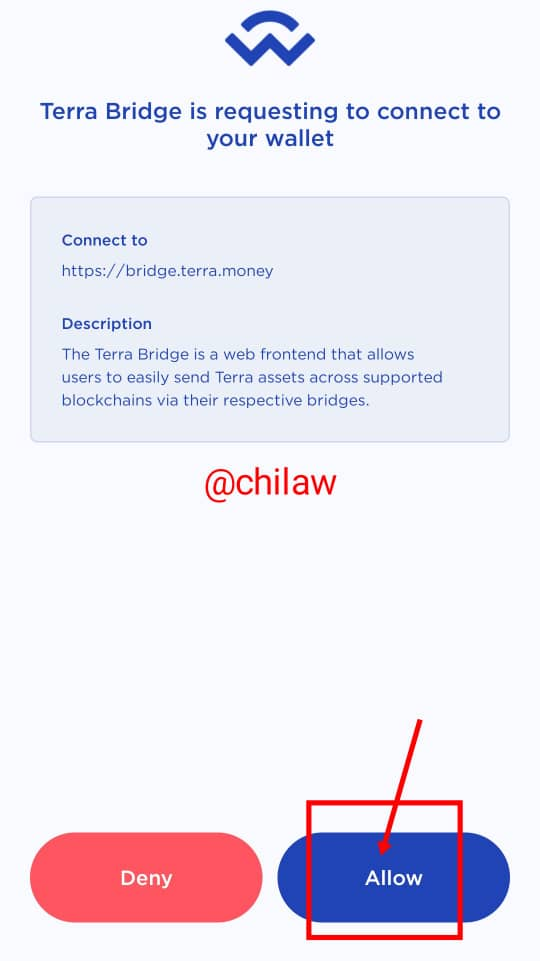

- Click on the Allow button to continue

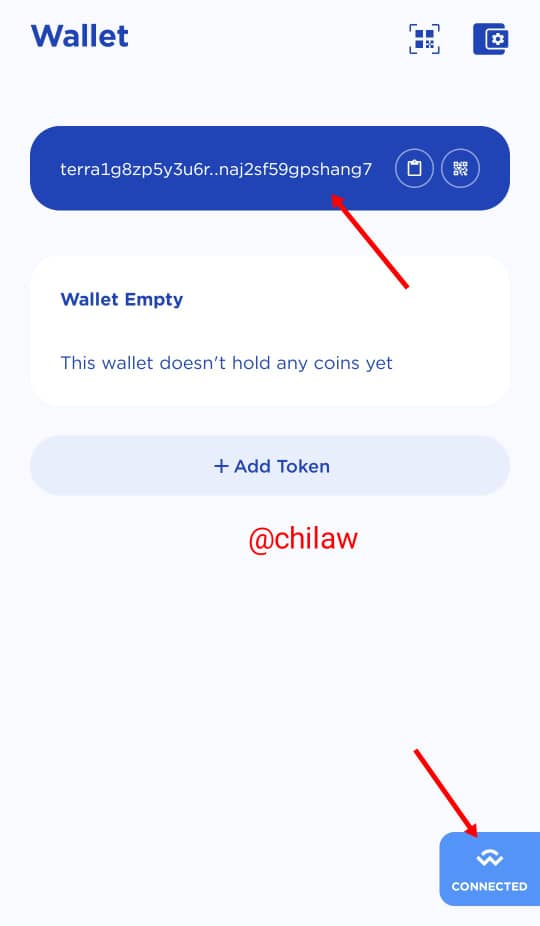

- The bridge account is now connected to the Terra Station

From the connected interface, this simply shows that I can now transfer Terra to Ethereum which is a different blockchain network from the sender Terra network. All I need to do is to select the required token from the listed token and as well Input the amount of token to be sent.

There is a disclaimer which we all have to take good note of, which is to avoid using addresses that are associated with exchanges while transferring from one blockchain network to another (Cross-Chain transactions).

Question 5 - Explain how it works and what Terra Stablecoins are

Stable coins are basically known to derive their value from the given FIAT. They are pegged to the currency which makes their value relatively stable and hence assumes the value of the currency at every point in time. We have a number of them like the Tether, USDT, BUSD, etc. Therefore using stablecoins in the cryptocurrency space where there are high market volatility, helps to retain the value of token over a period of time.

Therefore the Terra Stablecoin isn't an exception in the token structure of a typical stablecoin, as values of all traded assets in the Terra Network are relatively observed to maintain value stability. There is relatively low volatility in the use of Terra Stablecoin even with the activities buy and sell transactions does not alter its derived value. That is, the forces of demand and supply do not determine the value of a given stable coin rather other tokens can be swapped into stable coins to salvage assets for unprecedented value depreciation.

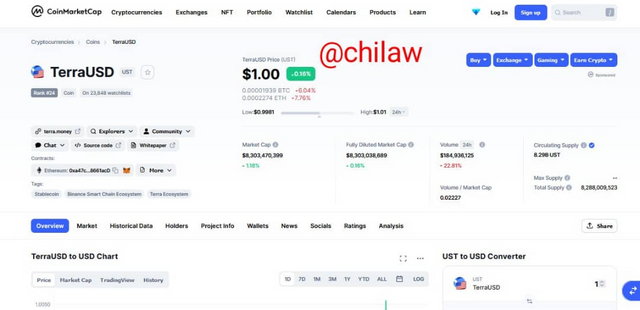

(Image from CoinMarketCap Site)

For the Terra Stablecoin, we have the LUNA and the Terra USD (UST). The current price value of Terra USTR still remains $1 given to its derived value from the FIAT currency. This comes with a Market Cap of $8,303,470,399 and a circulating supply of 8,298UST.

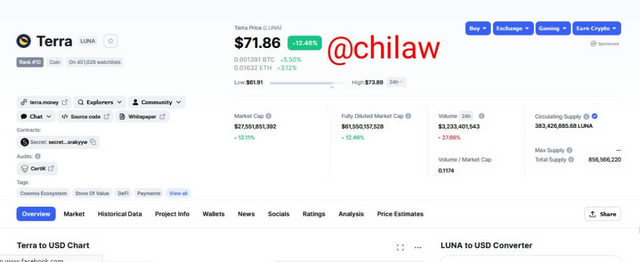

(Image from CoinMarketCap Site)

But on the other hand, the price of Terra (LUNA) which is the native token of the Terra Network is derived from the demand and supply indexes. As at the time of the report, the price of Terra _LUNA is $71.86 with a Market Cap of $27,551,851,392 and a circulating supply of 383,426,885.68 LUNA.

Question 6 - You have 1,500 USD and you want to transform it into UST. Explain in detail and take the price of the updated LUNA token.

From the already captured screenshots showing the price value for TerraUSD and LUNA token, this can be demonstrated as required.

UST Value = $1

LUNA value = $71.86

Since 1 USD = 1 UST

therefore 1500 USD = 1500 UST

But we already have the price of LUNA token at $71.86

That is, for every one UST = $71.86

therefore 1500 UST will give us; 1500/71.86 = 20.8739 LUNA token

1500 UST investment would give us 20.8739 LUNA tokens.

Question 7 - Now you have that 1,500 USD and you want to make a profit, since 1 UST = 1.07 USD. Explain in detail and take the price of the updated LUNA token

If 1 UST = 1.07 USD

Therefore Investing 1500 USD assets would give us a relatively higher value than what was initially derived for the 1:1 ratio.

Hence $1500 x $1.07 = 1,605 UST

This gives me an additional 105UST

Initial investment = 1500 USD or 1500 UST

But since 1.07USD = 1UST (an additional value is observed on the initial investment)

Converting this value back would give me 1605 USD, hence 105USD profit.

But let us look at converting this to the LUNA token

Since the LUNA token is valued at $71.86,

1605 UST = (1605 UST/71.86) = 22.3351 LUNA

We can observe that I would make an extra 1.4612 LUNA token relative to the initial USD: UST rate

Where 1.4612 LUNA = USD105.001

Conclusion

The Terra Network is an all-important project that has brought cross-chain interaction among some top blockchains that include the Solana, Harmony, Ethereum, etc with the partnership of the Anchor and Mirror protocols to its advantage. The Terra station has remained a central gateway that provides wallet services to all built projects on its network. Also, the Terra bridge which serves as a cross-chain link between the Terra network and another blockchain whereby Terra assets can now be traded in them.

Thanks, Prof @pelon53 for your lessons.

All images used are from the Terra Sites which are screenshots from my mobile device.