Crypto Academy Week 10 Homework post for professor @kouba01 Cryptocurrency Contracts For Difference (CFDs) Trading homework by @chinella

link

Learning from CryptoAcademy has always been educative and exciting as well. This week’s lecture is focused on Cryptocurrency Contracts for Difference by our amiable Prof. @kouba01.

I will be exploring more on Cryptocurrency Contracts for Difference.

Introduction.

With the exponential increase of usage of the internet in the world. The cryptocurrency market is also seeing an increase globally as more people are getting informed about the benefits and potentials of the market.

In the course of this article, we will be looking into an aspect of the Cryptocurrency market called Contracts for Difference (CFD).

1. What is CFD?

Contracts for Difference is a flexible alternative to the traditional trading methods known over the world. In traditional trading, you can only trade or exchange only what you have.

In contrast to traditional trading, CFDs allow the trader to trade the derivatives derived from the price of an asset which could be commodities, forex, cryptocurrency, etc without having the worries of owning the underlying asset.

Trading CFD means you are agreeing to the terms that you will exchange the difference in the price of a commodity from the point at which the contract is opened to when it is closed using trading instruments which include forex, shares, and commodities.

1.1 What is Cryptocurrency CFD?

Cryptocurrency CFDs are the derivatives that enable you to predict cryptocurrency price fluctuations without taking ownership of the underlying coins. Two parties are usually involved in the contract, the investor and the CFD provider.

Certain conditions are met for a successful cryptocurrency CFD transaction to occur. The conditions are explained through the following steps.

One:

The trader selects a trading instrument offered by the broker as a contract for the difference to the trader.

Two:

The trader opens a position to trade the instrument selected, specifies the following matters(the amount he wants to invest, the amount of leverage to use, the duration of the position entered whether long or short term.

Three:

An agreement is made between the trader and broker. Both parties agree on the opening price of the established positions and the fees involved.

Four:

The position is open and remains open until the following occurs

The trader decides to close end the trade.

The trade reaches a specific point such as a loss point, or at the expiration of the agreed contract.

Five:

The trader or the broker makes a profit or loss. If the contract is closed on the profit, the broker pays the trader but if the contract is closed on a loss, the broker takes the money from the trader on the closing differences.

1.2 Profit and Loss.

To calculate the profit/loss incurred during a trade, you multiply the deal size of the position (i.e the total number of contracts) by the value of each contract(expressed per point movement).

This value is then multiplied by the difference in points between the closing price and the opening price.

This is evaluated as profit or loss = (number of contracts * value of each contract) * (closing price – opening price).

To further explain this, let’s look at this example.

Mr. Bassey wants to take a position on Bitcoin with the intention that it will depreciate.

Mr. Bassey buys 1 btc CFD contract $1(each point is equivalent to $1) at an opening price of $54,137.50. After a while, Bassey decides to close the contract when the price move to $60,000 against his intentions. What is the profit or loss incurred by Mr. Bassey?

Loss = (number of contracts * value of each contract) * (closing price – opening price).

Number of contracts = 1btc.

Value of each contract = $1 at each point or movement.

Closing price = $60,000.

Opening price = $54,137.5

loss = (1 multiply 1) multiply ($60,000 – $54,137.5)

loss = 1multiply 5864.3

Mr. Bassey incurred a loss of $5864.3

1.2 Main features of Cryptocurrency Contracts of Difference

Going Short and Long

Leveraging

Margin

Hedging

Spread and Commission

1.2.1 Going Short and Long

Cryptocurrency CFD trading enables you to predict price movements in either direction.

A cryptocurrency trade made when a CFD position is opened that will profit as the underlying instrument increases in price, is referred to as “buying long” or “buying”.

Also, trade is referred to as “selling short” or “selling” when the CFD position opened that will profit as the underlying instrument decreases in price.

With both long and short trades, profits/losses will be attained once the position is closed.

1.2.2 Leverage

Let’s consider this illustration, say you want to open a position of 0.05 btc. In normal traditional trades, you can only make this position when you have 0.05 btc in your wallet. In cryptocurrency CFDs, a fraction of this fund could be used used to open this position instead of the whole fund.

Leveraging is simply using a fraction of the funds available to enter a position of a large sum of asset without having to commit the full cost of the asset.

This means that Mr. Asiwaju does not need to have 0.05 btc to open this position. All he needs is only 0.0025 btc.

Using leverage in CFD is very risky in the sense that if Mr.Asiwaju’s prediction goes wrong, he does not only lose the 0.0025 btc invested but will also pay the broker as though he opened the position with 0.05btc.

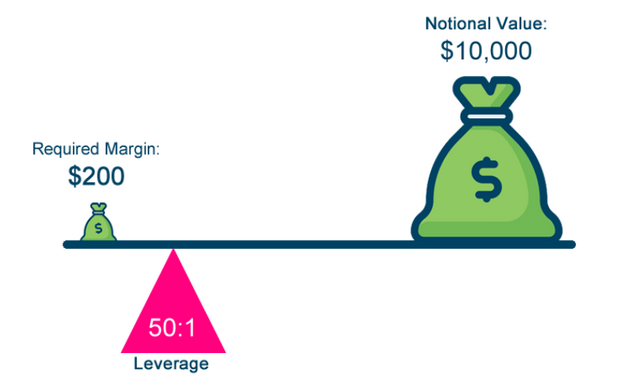

1.2.3 Margin

Buying on margin in cryptocurrency CFDs is the act of taking a loan from the broker to enter a position. Margin trading is also referred to as leverage because the funds required to open and maintain a position is a fraction of the required asset needed initially.

There two types of margin in cryptocurrency CFDs.

1.Deposit margin.

2.Maintenance margin

Deposit margin is the margin required to open a position while a maintenance margin is required to keep or maintain a position in an opened trade due to incurring loses.

Relationships between Margin and Leverage

Leverage is the ratio of the assets traded to the fraction of the asset traded to open a position.

It is usually expressed with an “x:1” format.

Using this case scenario, Mr. Emeka enters a position with a leverage of 5% worth of 0.05btc.

Sum needed by Mr.Emeka to enter a position using 5% leverage of 0.05btc.

=> 5/100 * 0.05 = 0.0025btc.

This shows that he only had to open his position with 0.0025btc to match up 0.05btc.

Mr. Emeka’s margin = x : 1

ie 5% of x = 1

x = 1/0.05

x = 20.

Thus, Mr.Emeka’s margin is 20:1

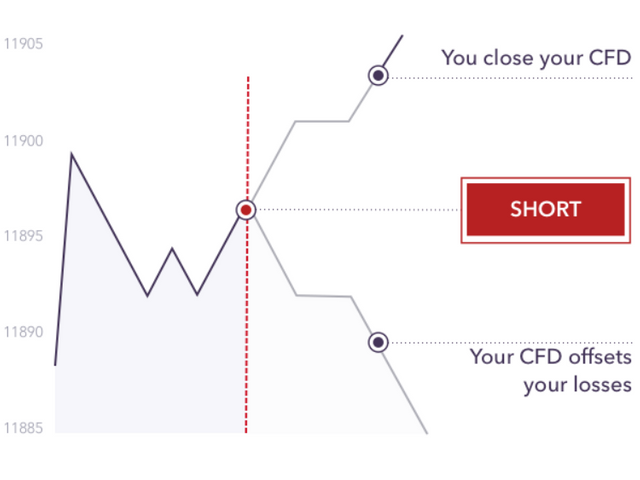

1.2.4 Hedging.

Hedging is like an insurance that protects you from losses in investment by taking the opposite position in an opening.

Hedging is used to offset the number of losses.

Cryptocurrency CFDs can also be used to hedge against losses in an existing position.

There are lots of strategies that you can implement using derivatives but direct hedging is one of the most popular. This is achieved by taking two positions on the same cryptocurrency at the opening of the trade but in different directions.

1.2.5 Spreads and Commission.

Cryptocurrency CFDs prices are quoted in two prices:

The buy price and the sell price.

The buy price (is the price at which you can open a long cryptocurrency CFD. It is also called offer price).

The selling price (or bid price) is the price at which you can open a short cryptocurrency CFD.

Spreads

The selling price will always be slightly lower than the current market price and the buy price is slightly higher than the market price. The distinction among the two costs is known as spread.

This difference the brokers profit.

Commissions

The commission is the money paid to the broker by the trader at the opening of each position. Most stockbrokers offer no commission but high spreads.

1.3 How do I know if Cryptocurrency CFDs are suitable for my trading strategy?

Trading cryptocurrency contracts for difference as we have discussed is a way of making speculations on cryptocurrency markets that don’t require the buying and selling of any underlying assets.

This alone reduces the stress and worries of owning and storing your cryptocurrency assets.

Trading Cryptocurrency CFDs can be your best fit if these options listed below fall under your likes.

You enjoy risk-taking and find it fun trading in a stressful and volatile environment.

You prefer trading via a regulated CFD broker that provides certain protections for investors.

You possess a short term trading policy

Trading on a margin to get profit with relatively initial low capital.

Don’t have the time or energy to buy and store cryptocurrencies for trading.

1.4 Is trading Cryptocurrency Contracts for Difference Risky?

There are various risks involved in cryptocurrencies CFDs. In this section, we take a look into the major risk factors involved.

Market Risk.

Cryptocurrency contracts for differences are derivative assets that an investor uses to predict the directions of the underlying assets. If he believes the value of the crypto asset will appreciate, a long position is chosen and vice-versa.

He believes the market will favor him, but this is not always the case in reality. Even the best traders are proven wrong. Sudden change in government policies, climatic conditions, news outbreak, change in market conditions can trigger a drastic change in the price of the underlying crypto asset in question. Due to the nature of cryptocurrency, a little change results in a drastic impact on the returns.

An adverse effect on the value of the underlying asset may cause the CFD provider to request a second deposit payment. If the margin requirements cannot be met, the provider may close the position and the trader will sell at a loss.

Liquidity

market situations have a great impact on many economic transactions and may increase the risk of losses. When there aren’t sufficient trades being made in the market for an underlying cryptocurrency being traded, your present agreement can become illiquid. At this point, the broker can require extra margin bills or close contracts at inferior prices.

Gapping

With the volatile nature of cryptocurrency CFDs, the value of the underlying cryptocurrency can depreciate before the trade can be executed at the previously agreed-upon price. This is known as gapping. When this occurs, the trader will have to cover up for his losses and probably a reduction in profit if it was a winning trade.

With these few cases, I have been able to show that trading cryptocurrency CFDs is a risky endeavor and one should tread with care and caution.

1.5 Do all Brokers offering Cryptocurrency CFDs?

Not all brokers offer cryptocurrencies trading through Contract for Difference.

1.6 Why Trade on a Demo Account?

Trading Cryptocurrency Contract for Difference involves a huge amount of risk, it is advisable to start with a practice sandbox usually called a Demo Account because of a few reasons:

You experience the real marketplace volatility using a demo account.

Trading with a demo account is free.

It is very easy to get on board with a demo account.

In this section, we will be going through the steps in creating a demo account, opening and closing your first position on IG broker.

1.6.1 Setting up your Demo Trading Account on IG.

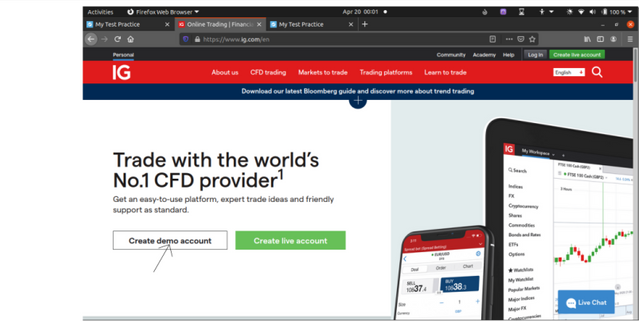

1.Log on to “https://www.ig.com/en”, click on the Create Demo Account

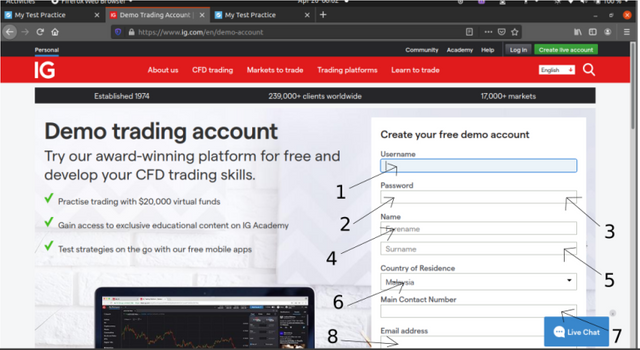

2.Enter your credentials in the form, starting with your username, password, name, country of residence, main contact number, and email address.

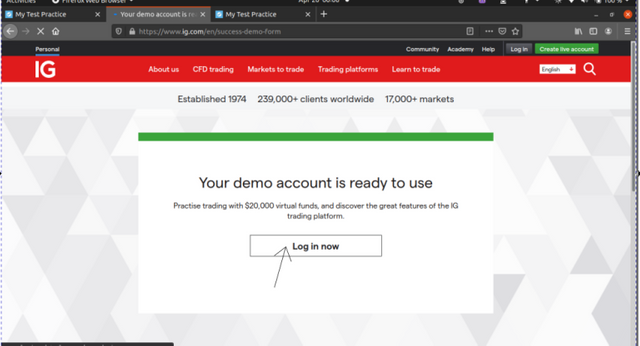

3.Click on the “Try Our Demo” button. After this, it redirects you to a new page titled “Your demo account is ready to use”.

4.Click on “Login now”

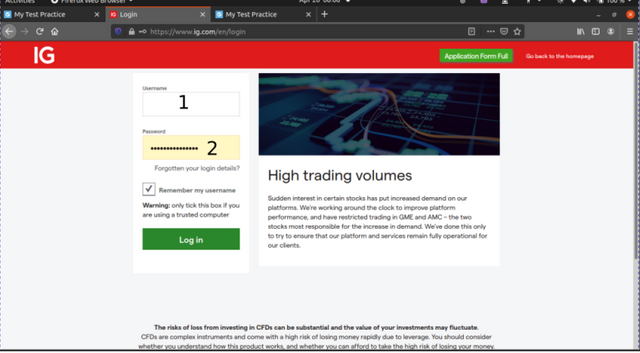

5.Enter your username and password, it is optional to click on the “Remember my username checkbox”.

6.Click on Log in.

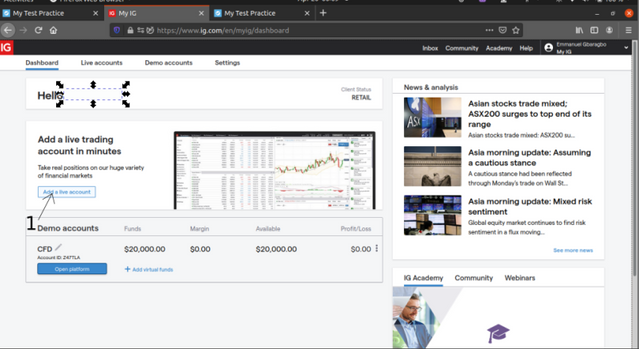

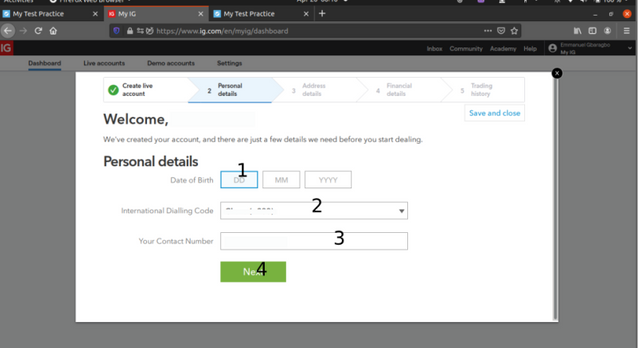

1.6.2 Creating a Live Account

1.Click on “Add a live Account”.

2.Enter your country of residence, your name and email are automatically filled in. The account type should be CFD.

3.Click on Next

4.Enter your details and click next.

5.Enter your address details, employment details and click next.

6.Select your appropriate experience/expertise in cryptocurrency CFD trading.

7.Select professional and Educational experience should be filled. Click next

2.Click on the “Accept I agree to all, you can click on yes if you want marketing preference.

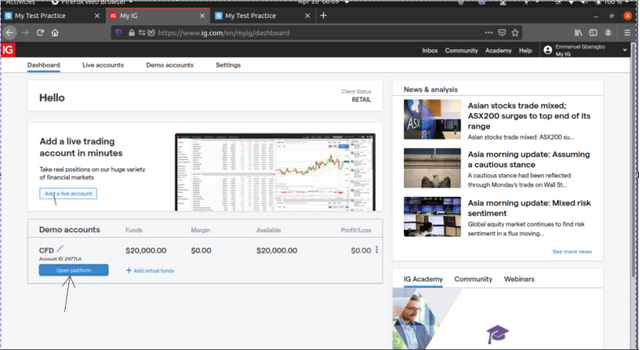

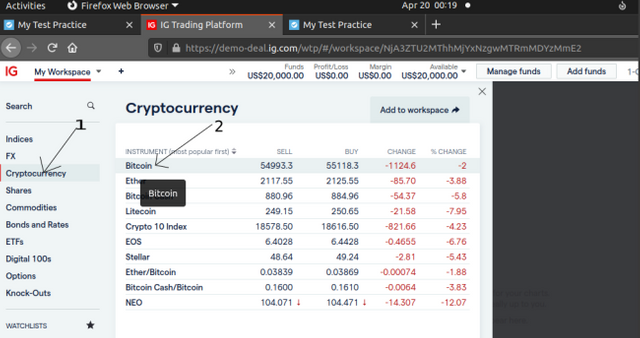

1.6.3 Setting up your trading Environment

1.Under the CFD Demo, click on “Open platform”

2.Click on cryptocurrency(i)

3.Select your preferred cryptocurrency. I selected bitcoin.

4.To buy long, click on Buy(i)

5.Input 1 as the size, the number of the contract you want. Input one.(ii)

6.Stop loss, the stop loss refers to the point at which the contract closes(iii).

7.Limit→ refers to the point at which you want the trade to close, but in this case, the limit at which you want to stop profiting before the trade moves against your favor(iv)

8.Click on force open. This reduces the occurrence of gapping(v).

9.Click on place deal to Open your position,(vi)

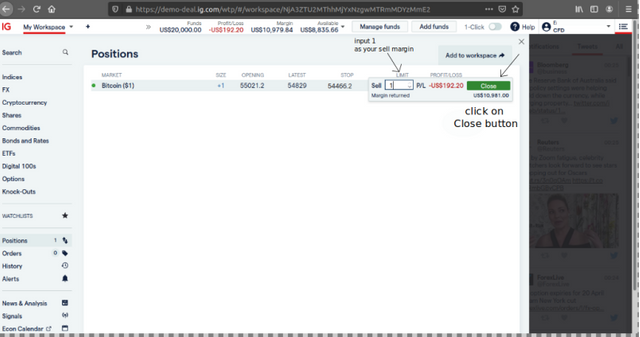

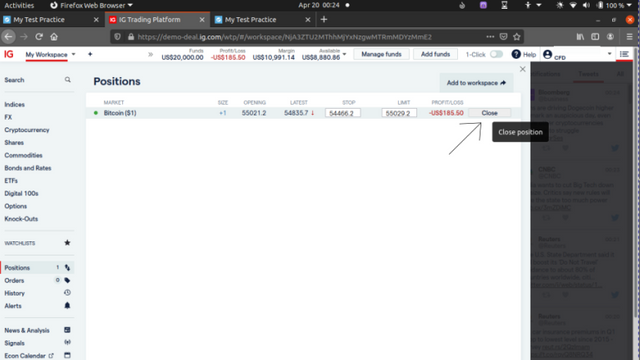

1.6.4 Closing a trade

1.Click on positions

2.Click on the close button

3.Enter a sell margin, input 1

4.Click on close.

Conclusion

Contracts for Difference is a flexible alternative to the traditional trading methods known over the world. In traditional trading, you can only trade or exchange only what you have.

In contrast to traditional trading, CFDs allow the trader to trade the derivatives derived from the price of an asset which could be commodities, forex, cryptocurrency, etc without having the worries of owning the underlying asset.

Cryptocurrency CFDs are the derivatives that enable you to predict cryptocurrency price fluctuations without taking ownership of the underlying coins. Two parties are usually involved in the contract, the investor and the CFD provider.

Cryptocurrency CFDs is volatile and risky. Before venturing into this type of trade, you should carefully examine yourself if your personality fits into this type of trade.

Hello @chinella,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 7/10 rating, according to the following scale:

My review :

A good article, what is missing is expressing your opinion on each question, especially the second question, as your role was limited to reformulating information from websites, which caused the article to lose its analytical dimension. Thank you for sharing your experience of trading CFDs on the IG platform.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Thank you sir @kouba01