Steemit Crypto Academy Contest / S21W5 [SUMMARY] : Advanced Strategies Using On-Chain Data and Sentiment Indicators

Introduction

Dear Steemians,

Welcome to the fifth week of Season 21 of the Steemit Crypto Academy's "Advanced Strategies Using On-Chain Data and Sentiment Indicators" competition. From November 25 to December 1, 2024, we explored the fascinating world of market sentiment analysis. By combining on-chain data and sentiment indicators, traders can gain deeper insights into market psychology, helping to anticipate bullish or bearish trends and optimize trading strategies during a bull run.

Sentiment indicators, such as the Fear & Greed Index, and on-chain metrics, like wallet activity and token flow, provide critical data points for understanding how participants view the market. These tools, when integrated, can uncover valuable signals to strengthen decision-making in the highly dynamic STEEM/USDT market.

This competition invited participants to delve into these advanced techniques, analyze market sentiment, and create actionable trading strategies. Our community rose to the challenge, showcasing impressive analytical skills and a deep understanding of market dynamics. Their contributions reflect the core values of the Steemit Crypto Academy: continuous learning, strategic thinking, and a commitment to excellence.

In this report, we will highlight key aspects of this week's competition, present the most innovative ideas shared by participants, and reflect on the overall quality of the submissions.

Participation Statistics

This week, we are pleased to report a strong level of engagement, with a total of 10 valid entries submitted. The sustained interest and enthusiasm within our crypto trading community are evident, and we are delighted to see participants embracing advanced trading concepts.

Here is the detailed breakdown:

| Total Number of Entries | Valid Entries | Invalid Entries | Plagiarized Content |

|---|---|---|---|

| 10 | 10 | 0 | 0 |

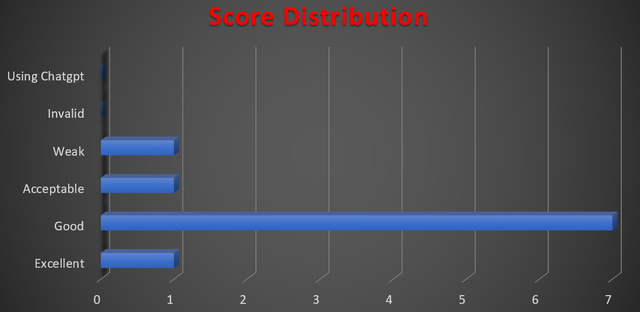

Out of the 10 entries:

- 1 entry was rated Excellent, demonstrating outstanding understanding and application of the competition's concepts.

- 7 entries were rated Good, showcasing solid knowledge and practical application, with room for further enhancement.

- 1 entry was rated Acceptable, meeting the minimum requirements but with significant scope for improvement.

- 1 entry was rated Needs Improvement, indicating a need for deeper analysis and better presentation.

- 0 entries were invalid or off-topic.

- 0 entries contained plagiarized content.

The absence of invalid or plagiarized submissions is commendable and reflects the participants' dedication to producing original, high-quality content. The commitment to academic integrity and the production of thoughtful, well-researched work is highly appreciated.

Performance Evaluation

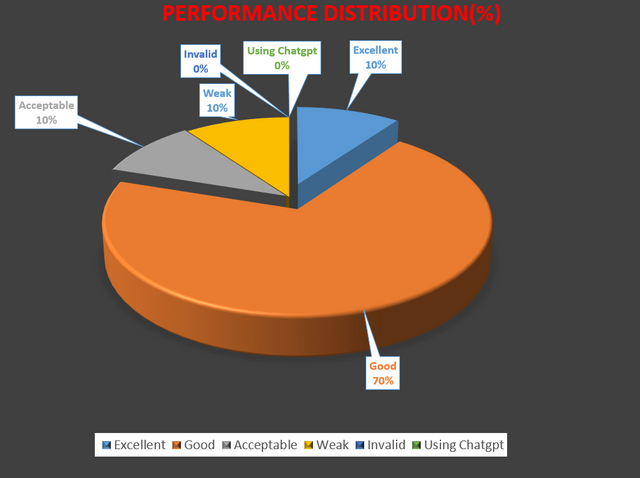

The overall quality of the submissions this week was impressive. Participants displayed a strong grasp of on-chain data and sentiment indicators, effectively applying these tools to analyze the STEEM market and develop actionable trading strategies. Here's the distribution of performance evaluations:

- Excellent (10%): 1 post delivered exceptional content, showcasing both theoretical understanding and practical application of advanced sentiment analysis strategies.

- Good (70%): 7 posts exhibited solid understanding and practical application, with thoughtful analyses and reflections.

- Acceptable (10%): 1 post met the basic requirements but could benefit from further refinement and deeper analysis.

- Needs Improvement (10%): 1 post required significant enhancement in content quality and depth of analysis.

- Invalid (0%): No entries were invalid or off-topic.

The entry rated Excellent stood out for its depth of analysis, clarity of explanation, and effective integration of on-chain data with sentiment indicators. The majority of participants fell into the Good category, indicating a strong overall performance and a solid understanding of the subject matter.

The performance distribution suggests that while participants are producing strong and well-structured submissions, there is potential for further enhancement. Encouraging participants to delve deeper into the nuances of on-chain data and sentiment analysis, explore advanced strategies, and provide more detailed analyses will help elevate their work to the 'Excellent' level in future contests.

Top 5 Contributors

We are pleased to recognize the participants who delivered outstanding submissions this week. These users demonstrated technical proficiency, creativity, and insightful analysis in their work. Here are the top performers:

| Ranking | Username | Article | Score |

|---|---|---|---|

| 1 | @mohammadfaisal | Link | 8.9/10 |

| 2 | @hamzayousafzai | Link | 8.8/10 |

| 3 | @artist1111 | Link | 8.7/10 |

| 4 | @luxalok | Link | 8.7/10 |

@mohammadfaisal achieved the highest score this week with 8.9/10, standing out for his detailed analysis and effective application of on-chain data and sentiment indicators in the STEEM market. His submission demonstrated a high level of understanding and practical insight, serving as an excellent example for others.

@hamzayousafzai, @artist1111, and @luxalok also delivered high-quality work, showcasing their ability to interpret market sentiment, utilize advanced tools effectively, and develop robust trading strategies.

We encourage all participants to review these top submissions to gain insights into how to enhance their analyses and presentations in future contests.

Conclusion

The fifth week of Season 21 has been both enlightening and inspiring. Participants embraced the challenge of exploring advanced strategies using on-chain data and sentiment indicators, delving into complex concepts with enthusiasm and intellectual rigor. Their efforts have contributed significantly to the collective knowledge of the Steemit community and have showcased the high level of talent within our ranks.

The strong performance across the board reflects a deepening understanding of market sentiment analysis within our community. As participants continue to refine their skills, we anticipate even more exceptional work in the coming weeks.

We are particularly pleased with the collaborative spirit and mutual support demonstrated within the community. By sharing insights and constructive feedback, participants are not only enhancing their own expertise but also fostering a culture of continuous learning and improvement.

Moving forward, we encourage participants to:

- Delve Deeper: Explore the intricacies of on-chain data and sentiment indicators, seeking to understand both the theoretical foundations and practical applications.

- Enhance Analytical Rigor: Provide detailed analyses, supported by empirical data and real-world examples, to strengthen the credibility and impact of your submissions.

- Embrace Creativity: Innovate and think outside the box, developing unique strategies and perspectives that contribute to the advancement of trading knowledge.

We extend our heartfelt thanks to all participants for their dedication and hard work this week. Your contributions enrich the Steemit Crypto Academy and inspire others to pursue excellence.

Stay tuned for more exciting competitions!

Thanks for considering me

Thank you 😊

☀️ ☀️

Дякую!