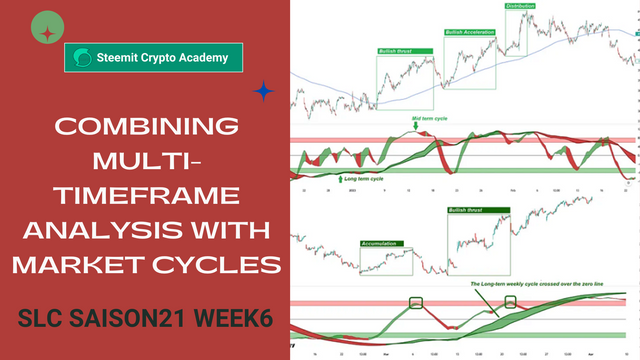

(ENG/ESP) Steemit Crypto Academy Contest / SLC S21W6 : Combining Multi-Timeframe Analysis with Market Cycles || Combinación del análisis de múltiples marcos temporales con los ciclos del mercado

Introduction

Dear Steemians,

For the sixth and final week of Season 21 of the Steemit Learning Challenge, running from December 2 to December 8, 2024, we bring you an advanced trading topic: Combining Multi-Timeframe Analysis with Market Cycles. Understanding how different timeframes interact with broader market cycles is essential for creating refined trading strategies and improving decision-making.

Market cycles, such as accumulation, expansion, distribution, and contraction phases, often repeat themselves across varying timeframes. By aligning multi-timeframe analysis with these cycles, traders can identify high-probability setups and avoid common pitfalls during volatile periods, particularly in the Steem/USDT market.

This competition invites you to analyze the current market cycle, apply multi-timeframe techniques, and develop actionable strategies tailored to the unique dynamics of cryptocurrency trading. Join us in this final challenge to showcase your expertise and compete for exciting rewards!

Background

Market Cycles are recurring patterns that represent shifts in market sentiment and behavior. They typically include:

- Accumulation Phase: Prices stabilize after a decline, marked by increased interest from smart money.

- Expansion Phase: A rapid increase in prices driven by heightened demand and strong bullish sentiment.

- Distribution Phase: Prices peak and volatility increases as traders begin to take profits.

- Contraction Phase: A sharp decline as market sentiment turns bearish.

Multi-Timeframe Analysis allows traders to view the market from multiple perspectives, such as combining weekly, daily, and hourly charts to identify trends, reversals, and entry points. When integrated with market cycle insights, this approach provides a powerful framework for making informed decisions.

What We Expect from the Competition

Question 1: Understanding Market Cycles

- Explain the four key phases of market cycles (accumulation, expansion, distribution, and contraction) and their significance in cryptocurrency trading.

Question 2: Applying Multi-Timeframe Analysis

- Demonstrate how multi-timeframe analysis can be used to identify trends and reversals during different market cycle phases. Use examples from Steem/USDT charts.

Question 3: Combining Market Cycles with Multi-Timeframe Analysis

- Show how to align multi-timeframe analysis with market cycles to refine your trading strategies. Highlight how these tools complement each other in volatile markets.

Question 4: Developing an Advanced Trading Strategy

- Create a trading strategy for Steem/USDT that integrates market cycle phases and multi-timeframe analysis. Specify your entry, exit, and risk management criteria.

Question 5: Mitigating Risks in a Volatile Market

- Discuss how to manage risks and avoid false signals when trading across multiple timeframes during different market cycle phases.

Contest Guidelines

- Timeline: The competition runs from December 2 to December 8, 2024.

- Word Count: Your article must be at least 1000 words and free from plagiarism.

- Article Title: Use the title "Advanced Trading: Multi-Timeframe Analysis and Market Cycles".

- Tags: Include the tag #cryptoacademy-s21w6 and other relevant tags.

- Visuals: Provide annotated charts and examples that demonstrate market cycle phases and multi-timeframe setups for Steem/USDT.

Rewards

- SC01 and SC02 upvotes will reward outstanding contributions from all participating communities and teaching teams.

- The top 5 participants will receive additional rewards and upvotes based on the quality of their insights, strategies, and presentation.

Key Takeaways

This competition challenges participants to:

- Understand Market Cycles: Learn to identify and trade effectively during accumulation, expansion, distribution, and contraction phases.

- Master Multi-Timeframe Analysis: Combine insights from weekly, daily, and hourly charts to optimize trading decisions.

- Integrate Tools: Align market cycle knowledge with multi-timeframe analysis for advanced trading strategies.

- Develop Risk Management Skills: Create strategies to navigate volatility while managing risks effectively.

- Present Actionable Strategies: Propose clear and actionable trading plans for the Steem/USDT pair.

Conclusion & Perspectives

This final competition provides a unique opportunity to master market cycles and multi-timeframe analysis, two essential tools for advanced trading. By participating, you will enhance your ability to identify trends, navigate volatility, and create robust strategies tailored to crypto markets.

We look forward to seeing your detailed analyses and innovative strategies. Best of luck, and may your trading insights guide you to success!

Queridos Steemians,

Para la sexta y última semana de la Temporada 21 del Desafío de Aprendizaje de Steemit, que tendrá lugar del 2 al 8 de diciembre de 2024, les traemos un tema avanzado de trading: Combinando el Análisis Multitemporal con los Ciclos del Mercado. Comprender cómo interactúan los diferentes marcos temporales con los ciclos del mercado es esencial para crear estrategias de trading refinadas y mejorar la toma de decisiones.

Los ciclos del mercado, como las fases de acumulación, expansión, distribución y contracción, suelen repetirse en diferentes marcos temporales. Al alinear el análisis multitemporal con estos ciclos, los traders pueden identificar configuraciones de alta probabilidad y evitar errores comunes durante períodos de alta volatilidad, particularmente en el mercado de Steem/USDT.

Este concurso les invita a analizar el ciclo del mercado actual, aplicar técnicas multitemporales y desarrollar estrategias accionables adaptadas a las dinámicas únicas del trading de criptomonedas. ¡Únanse a este último desafío para demostrar su experiencia y competir por emocionantes recompensas!

Contexto

Los Ciclos del Mercado son patrones recurrentes que representan cambios en el sentimiento y comportamiento del mercado. Generalmente incluyen:

- Fase de Acumulación: Los precios se estabilizan tras una caída, marcada por un mayor interés de los grandes inversores.

- Fase de Expansión: Un aumento rápido de los precios impulsado por una mayor demanda y un fuerte sentimiento alcista.

- Fase de Distribución: Los precios alcanzan su punto máximo y la volatilidad aumenta mientras los traders comienzan a tomar ganancias.

- Fase de Contracción: Una caída pronunciada a medida que el sentimiento del mercado se torna bajista.

El Análisis Multitemporal permite a los traders observar el mercado desde múltiples perspectivas, como combinar gráficos semanales, diarios y horarios para identificar tendencias, reversiones y puntos de entrada. Cuando se integra con el conocimiento de los ciclos del mercado, este enfoque proporciona un marco poderoso para tomar decisiones informadas.

¿Qué esperamos de la competencia?

Pregunta 1: Comprender los Ciclos del Mercado

- Explica las cuatro fases clave de los ciclos del mercado (acumulación, expansión, distribución y contracción) y su importancia en el trading de criptomonedas.

Pregunta 2: Aplicación del Análisis Multitemporal

- Demuestra cómo el análisis multitemporal puede usarse para identificar tendencias y reversiones durante las diferentes fases del ciclo del mercado. Usa ejemplos de gráficos de Steem/USDT.

Pregunta 3: Combinando Ciclos del Mercado con el Análisis Multitemporal

- Muestra cómo alinear el análisis multitemporal con los ciclos del mercado para refinar tus estrategias de trading. Destaca cómo estas herramientas se complementan en mercados volátiles.

Pregunta 4: Desarrollo de una Estrategia Avanzada de Trading

- Crea una estrategia de trading para Steem/USDT que integre las fases del ciclo del mercado y el análisis multitemporal. Especifica tus criterios de entrada, salida y gestión de riesgos.

Pregunta 5: Mitigación de Riesgos en un Mercado Volátil

- Discute cómo gestionar los riesgos y evitar señales falsas al operar en múltiples marcos temporales durante diferentes fases del ciclo del mercado.

Guía de la Competencia

- Duración: La competencia se llevará a cabo del 2 al 8 de diciembre de 2024.

- Cantidad de palabras: Tu artículo debe tener al menos 1000 palabras y estar libre de plagio.

- Título del artículo: Utiliza el título "Trading Avanzado: Análisis Multitemporal y Ciclos del Mercado".

- Etiquetas: Incluye la etiqueta #cryptoacademy-s21w6 y otras etiquetas relevantes.

- Visuales: Proporciona gráficos anotados y ejemplos que demuestren las fases del ciclo del mercado y las configuraciones multitemporales para Steem/USDT.

Recompensas

- Votos de SC01 y SC02 reconocerán las contribuciones destacadas de todas las comunidades participantes y equipos de enseñanza.

- Los 5 mejores participantes recibirán recompensas adicionales y votos en función de la calidad de sus análisis, estrategias y presentación.

Conclusiones Clave

Este concurso desafía a los participantes a:

- Comprender los Ciclos del Mercado: Aprende a identificar y operar de manera efectiva durante las fases de acumulación, expansión, distribución y contracción.

- Dominar el Análisis Multitemporal: Combina ideas de gráficos semanales, diarios y horarios para optimizar tus decisiones de trading.

- Integrar Herramientas: Alinea el conocimiento de los ciclos del mercado con el análisis multitemporal para estrategias de trading avanzadas.

- Desarrollar Habilidades de Gestión de Riesgos: Crea estrategias para navegar la volatilidad mientras gestionas los riesgos de manera efectiva.

- Presentar Estrategias Accionables: Propón planes de trading claros y accionables para el par Steem/USDT.

Conclusión y Perspectivas

Este último concurso ofrece una oportunidad única para dominar los ciclos del mercado y el análisis multitemporal, dos herramientas esenciales para el trading avanzado. Al participar, mejorarás tu capacidad para identificar tendencias, navegar la volatilidad y crear estrategias sólidas adaptadas a los mercados de criptomonedas.

Esperamos ver tus análisis detallados y estrategias innovadoras. ¡Buena suerte, y que tus ideas de trading te guíen al éxito!

Greetings, here is my entry.

https://steemit.com/hive-108451/@sahmie/advanced-trading-multi-timeframe-analysis-and-market-cycles

my entry post: https://steemit.com/hive-108451/@hamzayousafzai/advanced-trading-multi-timeframe-analysis-and-market-cycles

My entry

https://steemit.com/hive-108451/@shano49/advanced-trading-multi-timeframe-analysis-and-market-cycles

You may need to correct your tag cryptoacadmey-s21w6 with cryptoacademy-s21w6

@stream4u thank you so much for your correction. I have corrected.

https://steemit.com/hive-108451/@artist1111/steemit-crypto-academy-contest-slc-s21w6-combining-multi-timeframe-analysis-with-market-cycles

my entry post: https://steemit.com/hive-108451/@hamzayousafzai/advanced-trading-multi-timeframe-analysis-and-market-cycles

This is something I need proper time to get a good understanding of your post I mean. I have been trading for a long time but still till this day I have just been loosing a lot of money..

Really? Didn't you learn anything? Anyhoo, beeter luck next times .....

Thank you no of course I picked up on something but eventually I think I am suffering severe ADHD. Sorry I didn't know that this was a contest though quite a lot of reading and research but yes thank you for the opportunity I will be active next time..

Here we learn the theories by doing the assignments given. In the marketplace we put what we learn into action.

I'm not an active trader myself, although in the past I have enjoyed doing trading-related assignments from Crypto Academy.

I think knowing something theoretically is one thing practicing it is another, and gaining wisdom from both is another.

I wish you the best of luck.

Thank you for your help and support I greatly appreciate it I am hosting a a steem power engagement contest maybe you could share some more wisdom consider yourself invited..

Steem power delegation Contest for engagement | Winners announcement ‼️

Maybe I will. You'll make a goood salesperson.

According to my point of view, in the current Crypto extreme bull run many of us may take entry in big coin when they are already at a pick point, no issue in this but the holding is more needed if they fall from their current pick point.

In such bull run we need find those genuine coins which has potential and bull run for that coin not started or just started, like 1 month ago STEEM, Doge, TRX, XRP, BNB.

Before 1 month ago, we published many articles wherein we pointed about STEEM that bull run may expected, according to last 1 month the STEEM 102.3% Up. Similarly , Doge, TRX, XRP, BNB.

Cc: @aneukpineung78

This is one of those happy moments, and SBD is printing again! Yay!!

This is true but but one thing is that of which btc cannot be duplicated and it's going to be extremely valuable however my question to you is do you know of any other coins that could be as special as this? I'm hosting a steem power engagement contest maybe you could share some wisdom with us and support small curators in the ecosystem by following here 👇🏾

Steem power delegation Contest for engagement | Winners announcement ‼️

Consider yourself invited.

https://steemit.com/hive-103393/@aneukpineung78/advanced-trading-multi-timeframe-analysis-and-market-cycles

My participation Link

https://steemit.com/hive-108451/@shahid2030/advanced-trading-multi-timeframe-analysis-and-market-cycles

Here is my entry: https://steemit.com/hive-108451/@mohammadfaisal/advanced-trading-multi-timeframe-analysis-and-market-cycles

https://steemit.com/hive-108451/@simonnwigwe/advanced-trading-multi-timeframe-analysis-and-market-cycles