Crypto Academy Season 03 - Week 08 | Advanced Course - Trading Sharkfin Pattern

Steemit Crypto Academy Season 03 is providing an excellent opportunity to new steemians who want to start their journey in Crypto world and advanced steemians who want to take their crypto journey to another level. If you are taking part for the first time in this season, you must check the previous weeks lectures to get some great knowledge.

Last week, I have explained Trading Liquidity Levels strategy that will help you to identify potential levels where fakeouts can happen and you will avoid them using this strategy and make better decisions. This week I am going to share another price action strategy that is called Trading Sharkfin Pattern which will help you to get in great reversal trades at time of high volatility. I will explain different aspects of trading sharkfin pattern and students will be able to understand the following from this lecture;

- The Concept of sharkfin pattern

- Application of RSI indicator to spot sharkfins

- Trade Entry and Exit Criteria for Sharkfin Pattern

- Examples of Sharkfin Pattern Trades on Crypto Assets

The concept of Sharkfin Pattern

You might have seen the market moving fastly and then reversing quickly as well. This reversal pattern can be seen in the form of V shape pattern in case of downtrend shift and it will be seen as Inverted V shape pattern in case of uptrend shift. This reversal pattern is also known as Sharkfin Pattern and it is very useful to spot potential reversal at early stage of the trend change.

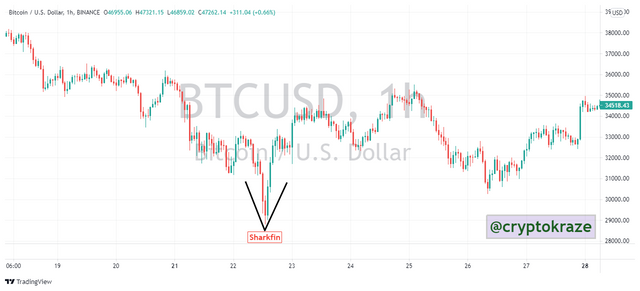

Example of Sharkfin on Chart

Have a look at this Bitcoin chart on 1hour time frame to understand how sharkfin pattern looks like a V shape pattern. You can see the price was moving down quickly and the reversal to upside was also the quick one.

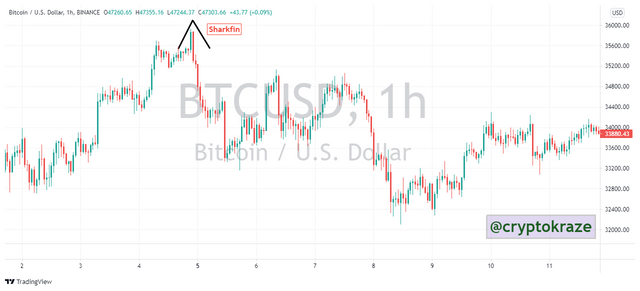

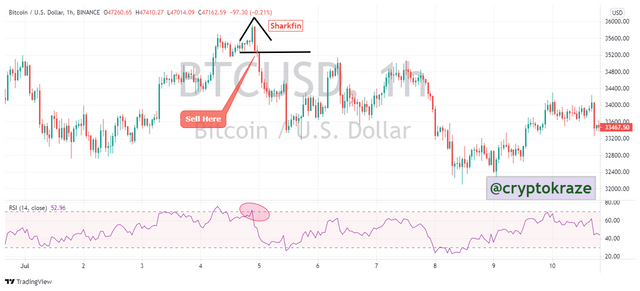

In this chart, you can see the sharkfin pattern formed as an Inverted V shape on Bitcoin 1 hour chart. You can see the price was moving up quickly and the reversal to the downside was also quick.

Application of RSI indicator to spot sharkfins

It looks easy to trade the sharkfin from the above charts I have shown but you need to add a confirmation tool to spot the good sharkfin patterns so that you don't get caught up in the middle of the market.

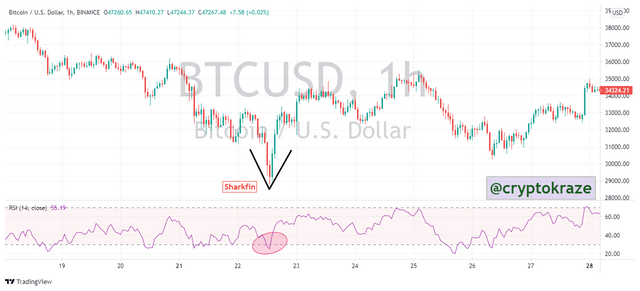

I am recommending using RSI indicator to sport the sharkfin pattern. You need to set RSI on your charts at default settings. The length of RSI should be 14 and the bands should be at 30 and 70.

For an ideal sharkfin in case of downtrend reversal, the RSI should go below 30 level and make a quick reversal by going up the 30 level. This will give us a spike looking like V shape pattern which will confirm the sharkfin pattern.

For an ideal sharkfin in case of uptrend reversal, the RSI should go above 70 level and make a quick reversal by going down the 70 level. This will give us a spike looking like an Inverted V shape pattern which will confirm the sharkfin pattern.

Trade Entry Criteria

I will be explaining the trade entry criteria for both Buy positions and Sell positions. It is important to note that you can only place Buy trades in spot trading available on crypto exchanges. You can also sell crypto assets on margin trading or other platforms like Metatrader4.

Entry Criteria for Buy Position

1- You need to add RSI indicator with default settings on your chart.

2 - Wait for the price to make a clear a quick move and then started to reverse quickly for a V shape pattern.

3 - Confirm that RSI has gone below 30 level and then reverse back above 30 level quickly making a spike looking like V shape pattern.

4 - Place your Buy order when RSI has gone above 30 level clearly.

Note: You must wait for a clear move above 30 level because the price can go further down before RSI goes above 30 level and then give a better sharkfin pattern.

Entry Criteria for Sell Position

1- You need to add RSI indicator with default settings on your chart.

2 - Wait for the price to make a clear a quick move and then started to reverse quickly for an Inverted V shape pattern.

3 - Confirm that RSI has gone above 70 level and then reverse back below 70 level quickly making a spike looking like an Inverted V shape pattern.

4 - Place your Sell order when RSI has gone below 70 level clearly.

Note: You must wait for a clear move below 70 level because the price can go further up before RSI goes below 70 level and then give a better sharkfin pattern.

Trade Exit Criteria

I am explaining the trade exit criteria for both Buy and Sell Positions. You should also set Stop Loss levels and Take Profit levels for both scenarios i.e. Profit or Loss.

Exit Criteria for Buy Position

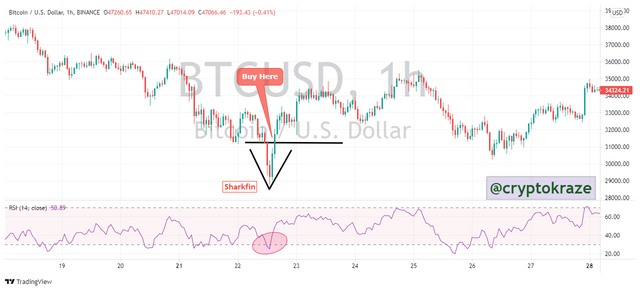

1 - We should set a Stop Loss Level in case our trade goes in the wrong direction after entry.

2 - This Stop Loss level should be below the swing low point of the sharkfin pattern.

3 - If the price crosses the stop loss levels, it means the trade setup is invalidated and we should exit the trade and wait for another setup.

4 - We Should Set Take Profit level in case our trade goes in the desired direction.

5 - Take profit level should be 1:1 RR (Risk:Reward) at least which means it should be equal to our stop loss level.

6 - I will recommend everyone to use 1:1 RR until they get good practice with this strategy.

7 - When price hits your take profit levels, you can book the profits ar exit from trade.

Exit Criteria for Sell Position

1 - We should set a Stop Loss Level in case our trade goes in the wrong direction after entry.

2 - This Stop Loss level should be above the swing high point of the sharkfin pattern.

3 - If the price crosses the stop loss levels, it means the trade setup is invalidated and we should exit the trade and wait for another setup.

4 - We Should Set Take Profit level in case our trade goes in the desired direction.

5 - Take profit level should be 1:1 RR (Risk:Reward) at least which means it should be equal to our stop loss level.

6 - I will recommend everyone to use 1:1 RR until they get good practice with this strategy.

7 - When price hits your take profit levels, you can book the profits ar exit from trade.

Example of Trading Sharkfin Pattern on Crypto Assets

I hope you have understood Trading sharkfin pattern strategy along with its entry and exit criteria. This is a very simple strategy, especially for intraday and scalping trades. I am showing you some examples on crypto charts where the strategy has worked well.

BNB/USD on 1 Hour Time Frame

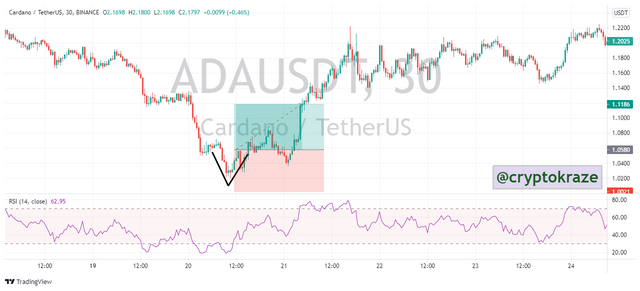

ADAUSD on 30 Minute Time Frame

DOGEUSDT on 15 Minute Time Frame

Homework Task

1 - What is your understanding of Sharkfin Patterns. Give Examples (Clear Charts Needed)

2 - Implement RSI indicator to spot sharkfin patterns. (Clear Charts Needed)

3 - Write the trade entry and exit criteria to trade sharkfin pattern (Clear Charts Needed)

4 - Place at least 2 trades based on sharkfin pattern strategy (Need to actually place trades in demo account along with Clear Charts)

Rules

Your homework post should have at least 300 words. You can write more but I want you to be specific about your answers and do not write super lengthy paragraphs.

You must give more importance to make great and clear charts instead of making your task extra lengthy.

I want to see your clear understanding of the strategy and not a super lengthy essay.

You must post your homework post in SteemitCryptoAcademy Community.

Plagiarism of any kind will not be tolerated and result in severe actions against the offenders.

Create your own charts and use only copyright-free images/charts with proper reference if you have to use them.

You can submit your homework post by 21st August 23:59 UTC. Any post submitted after the deadline will not be entertained.

You must include Trading sharkfin Pattern in your title of homework post.

You must include #cryptokraze-s3week8 and #cryptoacademy among the first 5 tags.

Members who are doing power down will not be considered for evaluation and grading.

To be eligible for participating in Advanced Tasks, you must have 60 reputation and minimum 500 SP.

Discords : FxKraze#2451

@steemitblog

@steemcurator01

@steemcurator02

Hello profesor. My homework link:

https://steemit.com/hive-108451/@adamsmoke/crypto-academy-season-03-week-08-or-homework-post-for-cryptokraze-trading-sharkfin-pattern

Thanks for the great lecture professor @cryptokraze. Here is my homework: https://steemit.com/hive-108451/@chinma/crypto-academy-season-03-week-08-or-homework-post-for-cryptokraze-or-advanced-course-trading-sharkfin-pattern

Thanks for the lectures prof. Your explanation is easy to understand. More grace, much appreciation. 💓

Professor in question 4 what we have to do Demo trade or real trade?

Trade can be placed in demo account or real. You need to place the trades in the market.

Ok... thank you so much professor

Can you, Sir @cryptokraze, suggest me good platform or MT4 on which all pairs of crypto assets can be traded.

Hugo's way and Icmarkets are good for crypto trading.

Hey professor @cryptokraze, again a very nice, knowledgeable and understandable lecture from you.

But I have a doubt regarding 4th question, do we have to to place actual or demo trade??

Actual trade might cost us a loss as we are not that much familiar to this strategy .

Waiting for your reply

Thank you!!

By actual I mean, you need to place the trade in the market on your demo account.

Some students only give charts only. I need you to place the demo trades in market and provide chart of that placed trades.

Thank you professor for clearing my doubt!!

I will be doing this homework as it looks informative and important for trading.

Thank you.

Respected Professor, I have submitted my homework post. Please review it and oblige. Thanks

https://steemit.com/hive-108451/@mawattoo8/crypto-academy-season-3-week-8-homework-post-for-professor-cryptokraze

Hello prof. In question 4, what if a situation doesn't appear for this strategy to be used? This is the major problem I have with placing trades with a strategy. A good situation for the strategy doesn't always present itself at a given time. Just like in your illustrations, the examples are not given in real time.

Hello professor @cryptokraze ! Here is my entry 😇

https://steemit.com/hive-108451/@shahidchoudary/crypto-academy-season-03-week-08-or-or-homework-post-for-cryptokraze-advanced-course-trading-sharkfin-pattern

Hello professor @cryptokraze, this is my homework assignment. Thank You.

https://steemit.com/hive-108451/@zology69/crypto-academy-season-03-week-08-or-or-homework-post-for-cryptokraze-advanced-course-trading-sharkfin-pattern