Steemit Crypto Academy Contest / S4W2 - Decentralized Finance by @cryptsam

Welcome to week 2 of this season's crypto academy contest. This week's topic is about DeFi, short form for Decentralized Finance. A new and innovative form of banking brought about by the emergence of blockchain.

Here's my take on it:

Explain in your own words the DeFi world Why is it important? Let's talk about it.

DeFi stands for Decentralized Finance. It is a new wave of technology brought about by the emergence of cryptocurrencies and the blockchain, where you can perform all your financial activities without the need of centralized authorities like Banks.

In DeFi you are able to perform transactions that includes: Lending, burrowing, staking, yield farming, trading assets etc. Basically most of the services Banks do offer, now happening in a completely decentralized manner with no one serving as a third-party. You transact directly with other peers and there's no one serving as a central figure or in control of anything.

Importance of DeFi

In DeFi there's no centralized authority everyone has to obey.

DeFi is more reliable as transactions are duly recorded on the blockchain and can't be manipulated.

There's no need for office buildings and the logistics that comes with it, as everyone can perform transactions from home.

DeFi Vs Centralized Finance. Advantages and disadvantages, let's talk about them.

DeFi is a new form of banking without any need of a centralized authority. Transactions are relatively peer-to-peer, from one user directly to another. Popular DeFi dapps include: Pancakeswap, Uniswap, Bakeryswap.

| Advantages of DeFi | Disadvantages of Defi. |

|---|---|

| It is decentralized, transactions are peer-to-peer without any need for a third-party. | Some defi swap pools have low liquidity (money readily to be exchanged) which can lead to sudden spike or drop in an asset price. |

| Staking on DeFi offer higher yields than traditional investments. | To take a loan in DeFi you have to put sometimes a much greater amount at stake |

| Transactions are performed in real time (super-fast). | Most defi dapps aren't linked to each other, which makes them just stand alone |

| Transactions are transparent and are recorded on the blockchain. | Making a mistake in DeFi is completely your responsibility as you have no one to complain to. |

Centralized Finance (CeFi) is the form of banking that as a central authority in control. In CeFi a central authority is needed to handle transactions and everyone has to abide by rules and regulations. They include centralized exchanges e.g Binance, Kucoin etc.

| Advantages of CeFi. | Disadvantages of CeFi |

|---|---|

| You have someone to hold accountable if anything goes wrong. | The system is centralized and user funds are under the control of the organisation. |

| CeFi has regulations which helps to prevent scams. | Personal information is needed to get started |

| They are more flexible and convenient to use. | Lack of transparency. |

Have you used decentralized Exchange? Tell your experience and explain a Decentralized Exchange. Show screenshots.

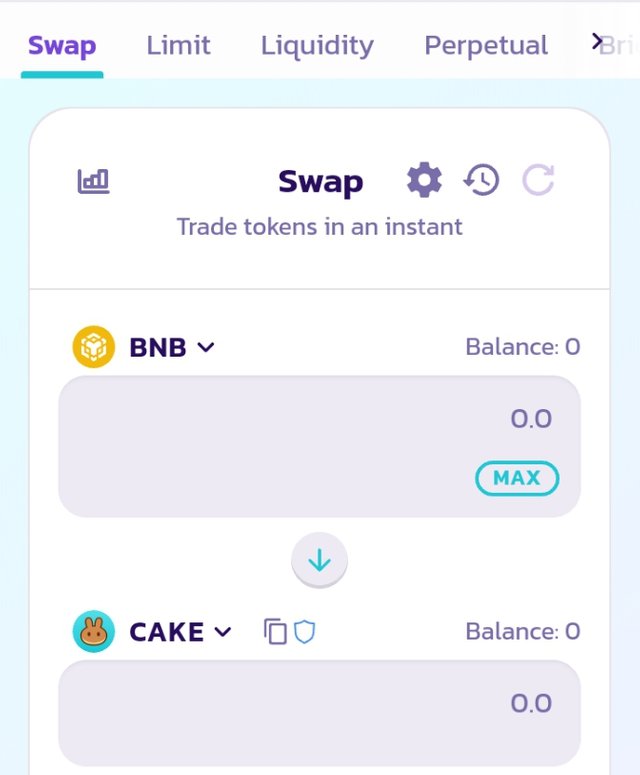

Yes, I've used Pancakeswap a decentralized exchange for swapping tokens built on the Binance smart chain (BSC tokens) .

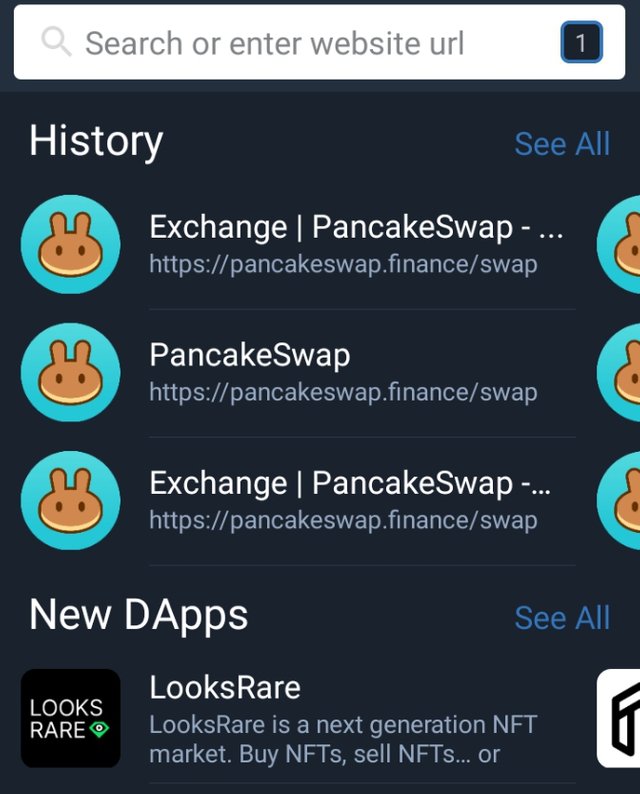

To use a Dex like Pancakeswap, you would need a crypto wallet to get started I mostly use Trust wallet.

Entering Trust wallet, I click on dapps then select Pancakeswap or type the website's name in the url column: https://www.pancakeswap.finance

On Pancakeswap you can easily swap between any two tokens so far they are listed and are on the BSC network, you just need to have a little amount of BNB for gas fees.

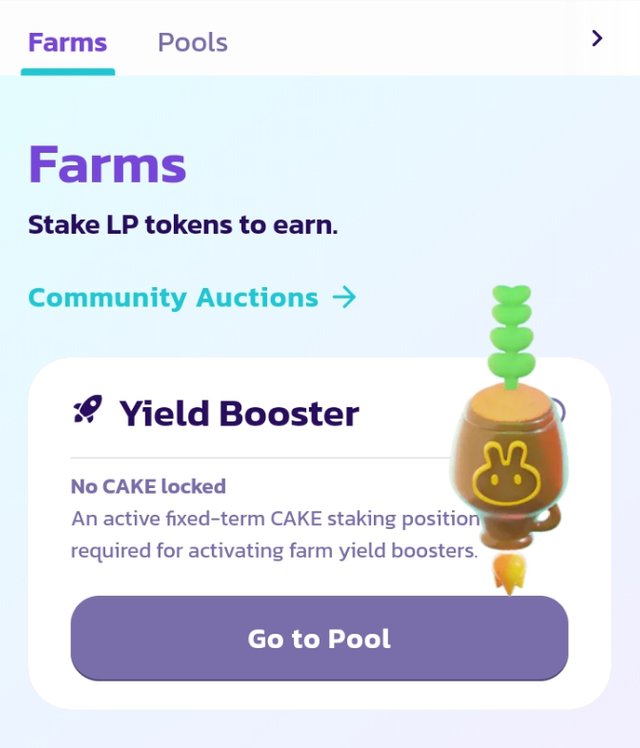

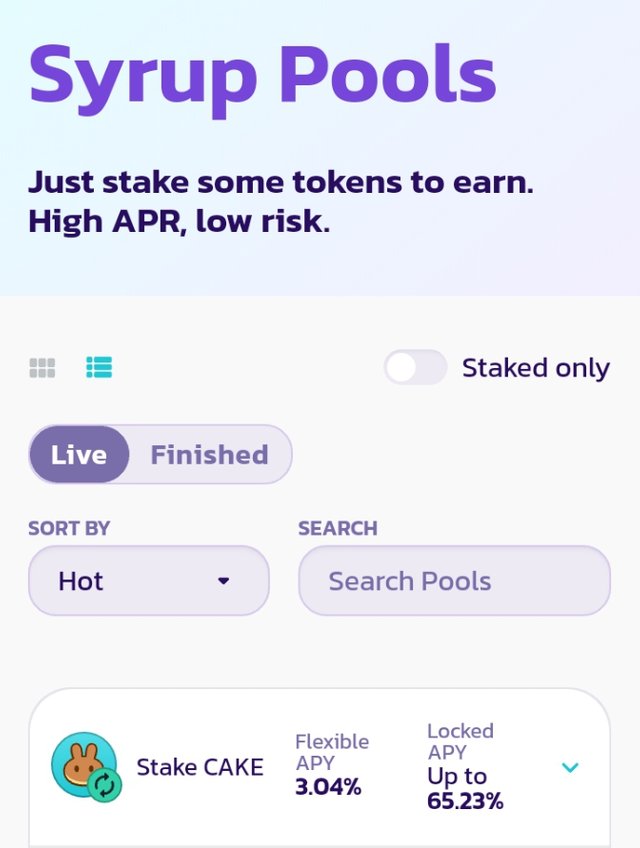

You are can consider yield farming

And also provide liquidity in liquidity pools. Just select the particular token you have and wish to stake thereby providing liquidity.

You earn a certain annual percent return for doing so.

Give us your opinion about the future of DeFi.

DeFi is here and is revolutionalising the banking industry as we know it. A lot of services that we could only have gotten from Banks are now made available with no one in central control, breaking the monopoly held by centralized institutions.

But with a current total market capitalization of $47.9 billion compared to that of the traditional banking industry which is about $8 trillion DeFi still has a long way to go. There's still room for a lot of innovations and growth for DeFi to completely take over the current banking system. There's also need for all dapps to be connected to each other making it easier for users to interact with.

The future of DeFi is limitless as it is ever growing and more innovations are surely on the way.

Pancake swap has been famous for its awesome features, it has been so so reliable and trustworthy for some years now.

Please also try justify your content so it will look more organized, do this by using some markdowns.

Thank you very much for sharing.

Wishing you success

Good opinion, kindly let him know, if he don't.

Thanks for this feedback 🔥

How do I use Justify?..

Review the achievement 4 guidelines because if I write it here won't show

You shared good article in which you added detailed writing for DeFi, it's explanation, as well as advantages and disadvantages of CeFi and DeFi in a new table form. It's looking awesome. Uniswap, pancakeswap, SushiSwap. I like these all. Good to see you have an experience with pancakeswap. I share SushiSwap in my post which I experienced.

Wishing you Success.

Thanks for your feedback 🔥

How do I find your posts

There's a lot to do in DeFi, from borrowing to trading assets. I tend to prefer DeFi over CeFi. Because CeFi is still controlled by a third party.

I also shared a post about DeFi, if you have time please see it and I am very happy.

The importance of DeFi that you stated is good as well as the advantages and disadvantages. With DeFi all transactions can be done anywhere and at any time, unlike CeFi where one has to go to their offices within their working hour or wait for some time to get it processed on centralized exchanges so that some transactions can be done. Thank you for sharing.