Crypto Academy / Season 3 / Week 1 - Homework Post for @kouba01 | Trading Crypto With Ichimoku-kinko-hyo Indicator - Part 1 by @dabeerahmed

Hy steemians hope that you all are good so in this post I am going to share with you guys about " Ichimoku Kinko Hyo" indicator we will persuasively learn in detail about this indicator. So lets start the diagnosis.

1- What is the Ichimoku Kinko Hyo indicator? What are the different lines that make it up?

The "Ichimoku-kinko-hyo" is developed by Japanese journalist "Goichi Hosado". The journalist worked for this platform almost 30 years and he released that indicator in 1960, howbiet still not popular in Europe. When it gets famous people know the value of this asset and do immediate translating of this golden gem.

The aim of Ichimoku-kinko-hyo to attains the control if market by just one look the trader just look the market and get into it then enjoy juicy trades. The ultimate vision of this indicator is all about balance, the journalist gives analogy of this indicator from human lifes and just manage to gain same consents that human behaviour exercises. The indicator also defines you the speed and momentum of market through support and resistance levels and the traders can easily interpret about the future trading of market easily.

The Ichimoku-kinko-hyo consists of five components. Lets view and interpret them in detail.

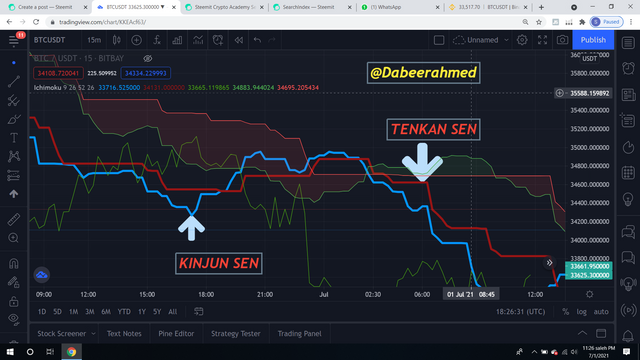

Tenkan and Kiju sen: These two lines indicates the user about the price momentum volatility of an asset. The Tenkan Sen is the conversion line its indicates you the fast up and downs of the market trend. Howbiet Kiju sen line is base line means the line first set his base and create heavy base importance in market when ever tenkan sen break and crosses the kiju thus you will get the signal that market is going upward means bullish whilst when ever kiju break tenkan sen from base way it means the market changing its trend to downwards means bearish.

You can compare this lines to moving average to but its not that at all just for clarification though when we take moving average of small and big time frames when ever the show cross over the bearish and bullish moment can just similar patterns are seen over here too. You can also called tenkan sen line as trigger line so whenever the cross over seen thus indicate us that there will be change and triggered position can occur in market

The Tenkan sen base line (9 periods) while kiju sen is calculated over (26 periods). The formula for both are this (Highest High + Lower low)/2. This is also shown in chart below.

Kumo cloud Senkan A and B:

Senkou span A: The Senkou span A broadly shown by the help of TENKAN SEN line and the Kiju Sen line.

The Tenkan Sen and the Kiju Sen are added and then divide them by 2 nd thus they makes a arrangements in 26 periods futures.

Both lines A used and B Senkou spans can give you the potential area of resistance. The formula is given below.

Senkou span A = period of 26(Tenkan-Sen + Kijun-Sen/2)

Senkou Span B: The Senkou span B is used to identify the future areas of support and resistance. The Senkou span B is calculated by adding the highest and the lowest price in the period of 52 divided by 2.

Senkou span B = Period of 52(Highest price + lowest price/2)

The cloud formation by the Senkou A and B are called Kumo clouds which is colored and helps the user to identify the trend in market through this chart pattern making easy for trader to analyse the market chart pattern. Although This area represents the support and the resistance levels. If the market is above the 'cloud' it indicates the support level. If the market is below the cloud, it indicates the resistance level.

Chikou Span: This line represents the user about the closing points of an asset according to price with the previous 26 periods and seems to be a lagging Span.

This is the 5th and last line of the Ichimoku-kinko-hyo. The closing price of an asset that I illustrate you helps the user to Due to understand the relation between the last and the current market trend.

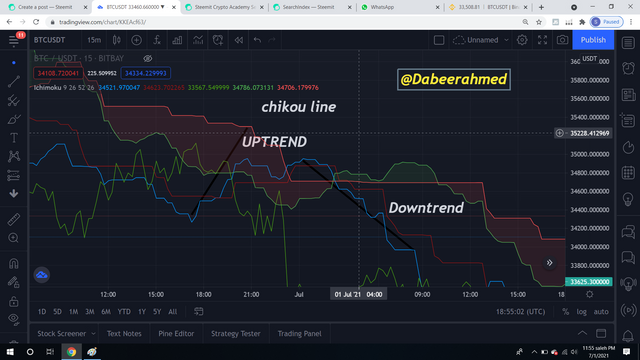

If the Chikou Span is above the market, it indicates an upward trend bullish, and if it's below the market, it indicates a downward trend bearish.

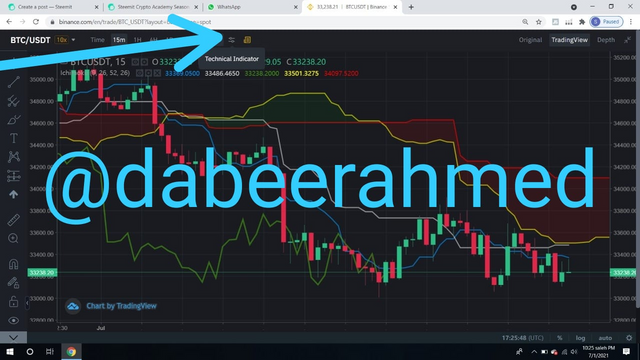

2- How to add the Ichimoku indicator to the chart? What are its default settings? And should it be changed or not?

ADDING ICHIMOKU-KINKO-HYO TO CHART

In this section I will show the process of adding ICHIMOKU-KINKO-HYO to the chart in a simple and fast way.

1: In the screen top left corner you can se indicators, click on the indicators option as shown in the screenshot below.

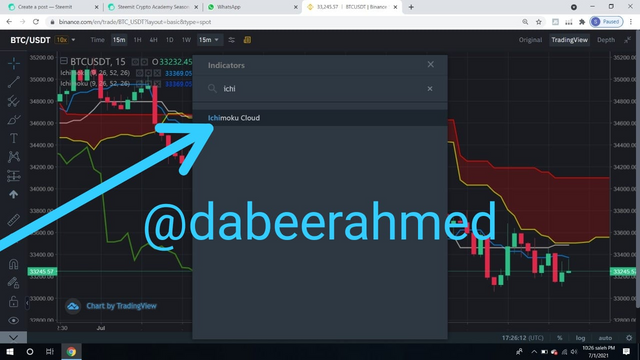

2: Write Ichimoku-kinko-hyo Indicator in search bar as shown in the screenshot below.

3: Click on the setting options of the indicator as shown in the screenshot below.

4: After that you can see the input option and do sett your formation according to your trades as shown in the screen below and you can sett the styles with different and broad colors that ain't make confusions.

As per our professor advice us to use the default setting or he also update us to use the setting which 9 26 52 26 in sequence I also prefer you guys to use the same settings.

But some traders says that this setting is for stock market as per crypto trading my mentors suggest me 20 60 120 30 though I also use them gives me best trading.

3- How to use the Tenkan Sen line? How to use the Kijun Sen line? And How to use them simultaneously?

Tenkan Sen Line

Its conversion line, The main clarification I will break with you guys that it is absolutely do work like moving average but aint moving average. It will work on strategies but won't be a moving average at all. It will show you the average point 60candles high and low of that where it stays and gives you the average of both high and low and divide by 2 which I illustrated you in screen shot.

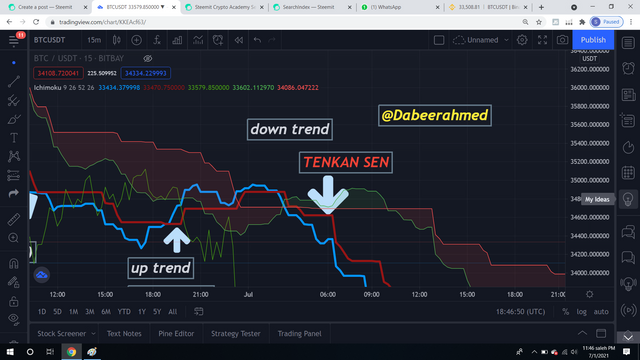

The Tenkan-Sen line is used for short period of time. The prediction done through the Tenkan-Sen line is over the period of 9. When the market trend is above the Tenkan-Sen line, an uptrend bullish trend and when the market is below the Tenkan-Sen line, it wil show us downtrend bearish trend

Kiju- Sen

Its a base line of 26periods just tenkan sen kiju sen is also same but here we will see the average of 26 candles are shown. Same as the previous high and low of candles would be divide by 2 to know the exact point of price and points you the screen shot below.

The Kijun-Sen line show you movement of the market in medium trends. It makes the high and loe of 26 periods.

How to use the Tenkan Sen line and Kijun Sen line together?

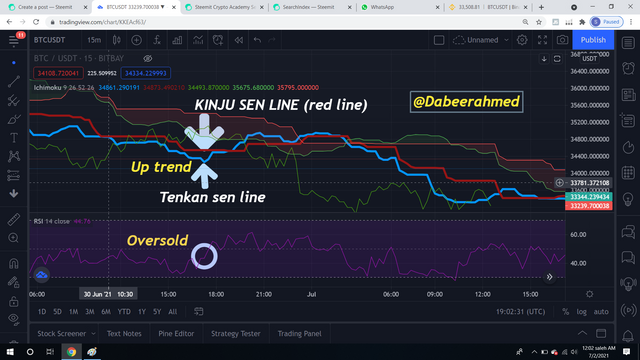

When the traders use Ichimoku lines in parallel with each other makes the trading easier. It will gives you the absolute and broad indication. When ever the trend is in a position where the Tenkan Sen line is above the Kijun Sen line gives the trader a bullish signal in the market and where you can easily place you trading executions some time executory positions might be seen but the indicator manage the market in best motions so the position of bullish season where the bull run seems to be ahead in market.

Vice versa position can bee seen in Kiju Sen line when its above the Tenkan Sen line it is considered that bearish market is ahead. The chart illustrate the positions might every trader uses lets see.

4- What is the chikou span line? And how to use it? And Why is it often neglected?

The Chikou Span line this line is the artifacts of all lines thus it gives the trader the constructive and positive relation between current and previous market trends. The analogy of this line is based on 26 periods following the high and low of previous opening and closing of candles.

Usages of chikou span line

The chikou span indicator the most essential line of

ichimoku indicator, the relationship between the past and current trend of market is analysis by this line and show you the reversal of candles too. The line also develops the bullish and bearish trends in market making more easy for you guys when the line crosses the price in upward direction though indicates you that there is a bullish season ahead when cross from downward direction seems to be a bearish trend and all you now what to do in bearish and bullish circumstances.

Why Chikou Span is often Neglected?

The behaviour of this indicator is quite different from other so there is a reason why the trader might neglect so lets discuss them in detail.

Chikou span line measure the closing of an assets in 26 period but aint gaves the trader the forecast of price when the candles often seems to be in closing position the other indicators alwasy show you such trend some times lagging cam be seen but not all the time.

It also neglects the cross overs in positive way and trader might seems difficulty thus no clear indication is observed

The indicator is not quite effective and efficient enough to make trading on the basis of this indicator so the trader always seems to be using only one indicator through using more indicators in a row traders might not use and they neglect it.

Among trading indicators chikou might seems to be a strongest and completable indicator although when it does not touch or cross over any the prior candles or ain't show good interaction with market price so the traders often not use it for big rounds.

5. Best time-frame to use the Ichimoku Indicator?

The time frames matter with individual and person to person that how the traders strategy is going. The trading patterns and strategy of each individual is depend upon his ability and experience thus they look forward and contingent on their experience for taking different time frames honestly speaking I an average trader with good skills in few indicators as per my mentors guide me about this so I will share with you guys too.

First we will talk about for short term trading for scalpers If you are a day trader or a scalper, then you can use on shorter time frames from 1-minute chart to 6-hour you can extend the essentials of indicator and their means by your experience and sentiments also. For long term it is suggest that you should use the daily and weekly for more manifestation of your trading depend upon you and you past experience.

More implementation of time frames in given screen shots below

Best Indicator to use with Ichimoku:

The best of this assignment is now came a cross that professor deploys us that should the traders will multiple indicators through which you can examine the market more clear and each pro and cons will be more clear and definite.

The Ichimoku indicator is an independent indicator through which the experience indicator resultant their profitable trades and help the beginners to analysis the resistance and support and by multiple trading sections gaves you the appropriate support and resistance levels we can also predict the market trend using this indicator further more traders can compare the current market trend with the previous.

Now lets use the indicators in parallel in a way to look the market more dominant. I am using RSI AND MACD which is most accurate and constructive trading management of market.

MACD AND ICHIMOKU

In this above screen shots showing the nature of RSI so you can view the crystal clear crosses of line that is Tenkan sen line crosses the kijun Sen line in the upward direction. There after the MACD shows good overlapping in his medium and indicates us the moving above the signal line which observed the bearish moment and buyers are potentially charge

RSI AND ICHIMOKU

Above screen shot show us the RSI movement with Ichimoku lines so from the there is an oversold signal which is more clear though RSU shoeing the reversal pattern in the chart through which bullish divergence took place and the price charges in manner of great volatility. The market pretends to bullish before the ichimoku indicator exposed it, RSI shoe great moves showing appropriate signal so thats why the use of multiple indicators helps traders to take more efficient and effective trades to achieve the goal.

Conclusion:

The summary satisfy us that I myself learn 50% of this indicator through different medium and from that I understand, it will really helps us in future for trading the indicator generates multiple gems in it and origins each sub origin plays a vital role for trading and the trend support resistance price movements helps the trader to do trades in more appropriate and easy. The most beautiful thing in this indicator is that it aint having alienations in working in this indicator and boredom period is not often seen here. The components Tenkan Sen, Kijun Sen, Senkou Span A, Senkou Span B and Chikou Span, providing the trader to do more purposeful and appropriate trades thus every individual and trader should do practice of this indicator through which helps every trader to take trades in a organise manner.

Perhaps the ICHIMOKU indicator is a revolutionary indicator in this trading platform mainly in crypto because of the volatility of market is so fast hence each and every mechanism of this indicator will be shown definite manner. So our professor also extracts such a good and knowledgeable indicators which I honestly not aware of this.

Thanks professor @kouba for this knowledgeable lecture thanks to all who are engaged with him as partner too.

Regards;

@dabeerahmed

#cryptoacademy #kouba-s3week1 #ichimoku #indicator #cryptocurrency #trading

Dear @dabeerahmed

Thank you for participating in Steemit Crypto Academy Season 03 and making efforts to complete the homework task. You got 8/10 Grade Points according to the following Scale;

Key Notes:

You should have explained why your mentor uses these settings to get the best trading results.

We appreciate your efforts in Crypto Academy and look forward to your next homework tasks.

Regards

@cryptokraze

Thanks professor for reviewing my post.

I will make sure to do less mistakes in the next upcoming homework posts.

These are not mistakes but areas for improvement.

We are mentoring the students to improve so that they can become the better version of themselves.

Regards

@cryptokraze

Well explained brother keep it up.

IYKYK