Crypto Academy Week 15 , Homework Post for [ @yousafharoonkhan ]... Exchange order book and its Use and How to place different orders?

What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy paste or from other source copy will be not accepted)

No trading pair system is seen. Instead a single currency is used to buy or sell things in our local markets.

The local market order books are not accessible to every buyer /seller. instead they are accessibe to owners of markets or a particular seller/buyer can only see their own details only . It is not in public domain unlike crypto order books that are maintained on blockchain which is a decentralized public ledger accessible to anyone, amywhere and anytime.

In local markets, there is not much scope for price negotiation because there is no significant price volatility.

There is no automatic filling of orders on predefined prices unlike crypto order book.

No such features like stop limit orders and OCO orders are possible locally.

No technical analysis can be done in local markets like price predictions. Because local markets don't determine price, instead prices are driven by increase or decrease in supply/demand nationally or internationally or by chamge in government policiies. Such things can't be predicted from local order book.

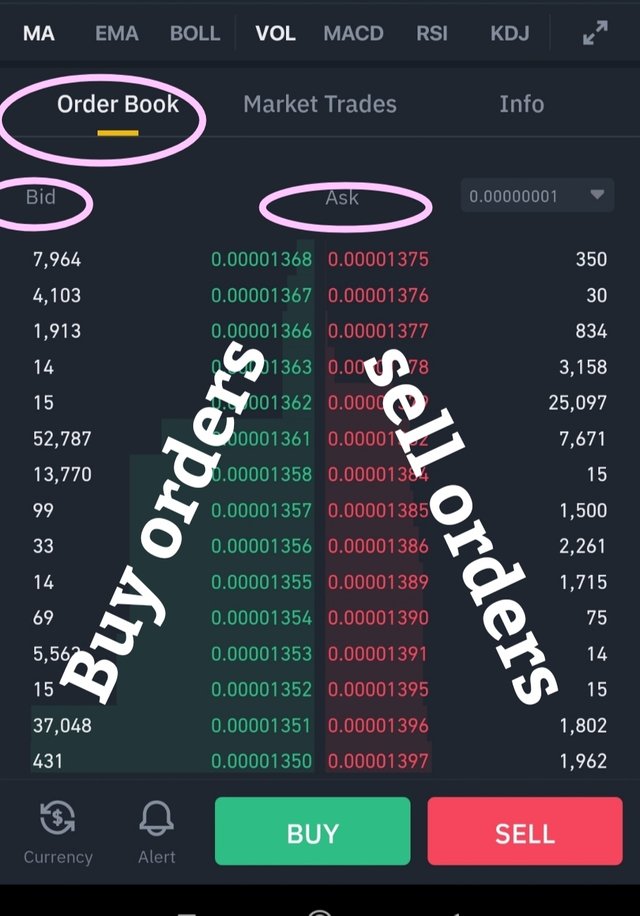

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

- Pairs

- Support and Resistance

- Limit Order

- market order

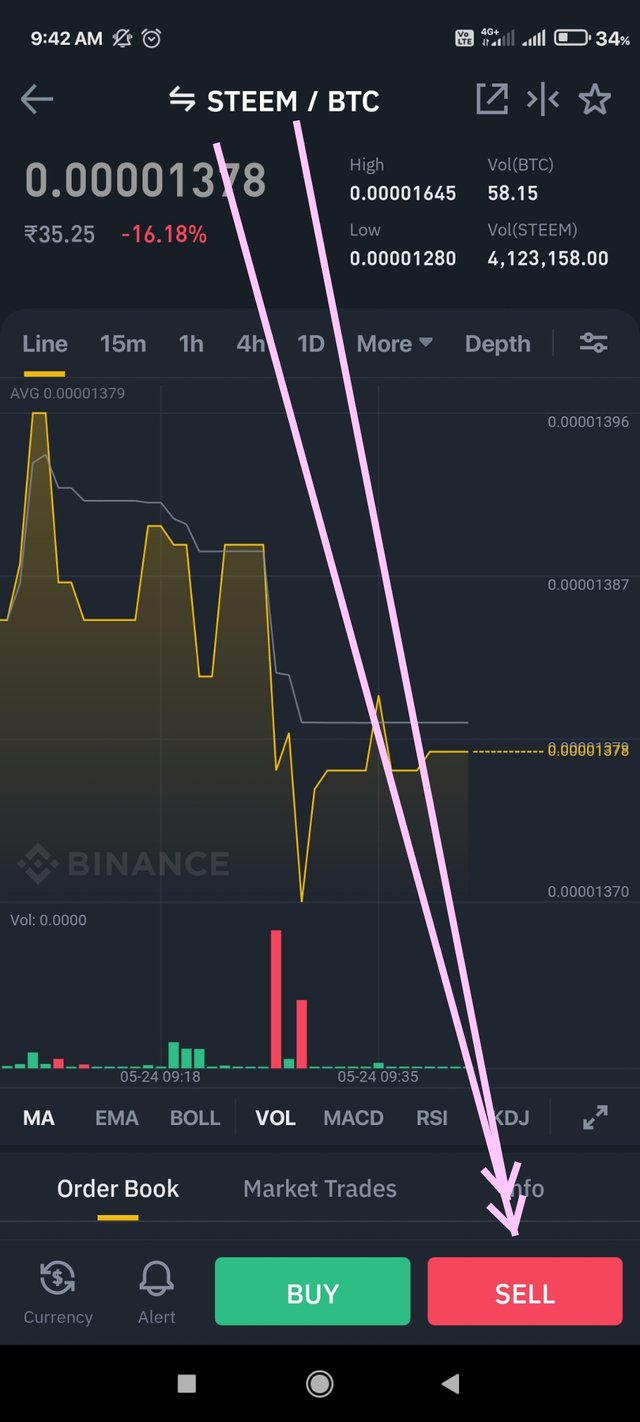

Log in to your Binance app.

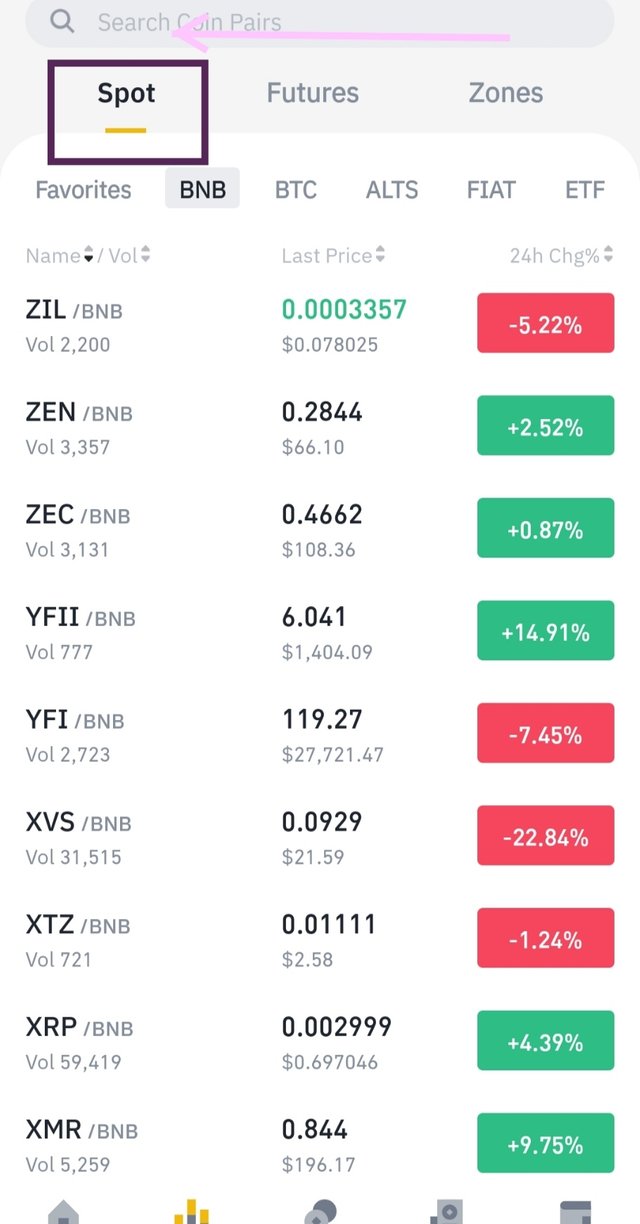

At the bottom panel of the main page , we have option Market. Click on it and the next page with

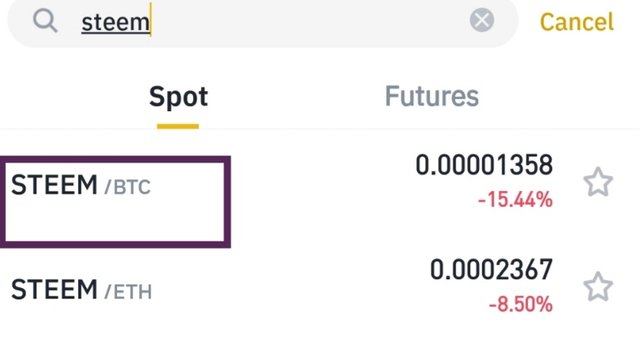

multiple trading pairs and different markets like spot, futures will load. Select any trading pair you wish to look for. You can also search for desired pair. I searched for STEEM/BTC.

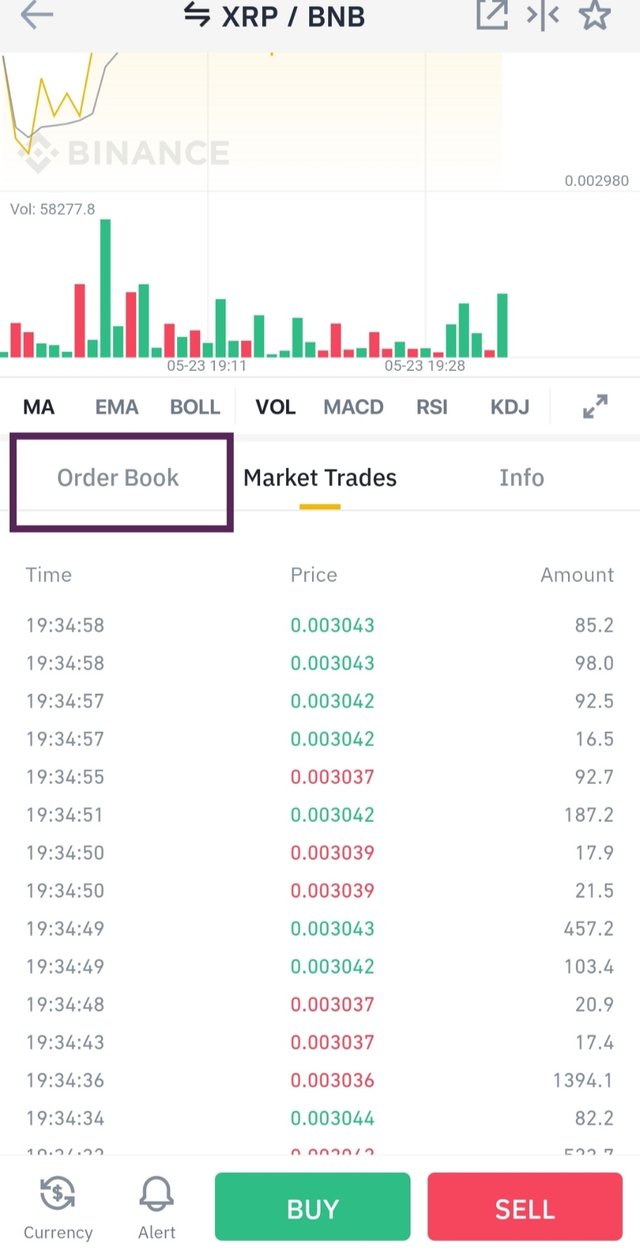

- Click on target pair and next page with details will be loaded. Just below the price chart of the pair, we got to see "order book". Below order book different orders are listed.

Trading pair

Support and Resistance.

ETH/USDT pair from my wazirx account

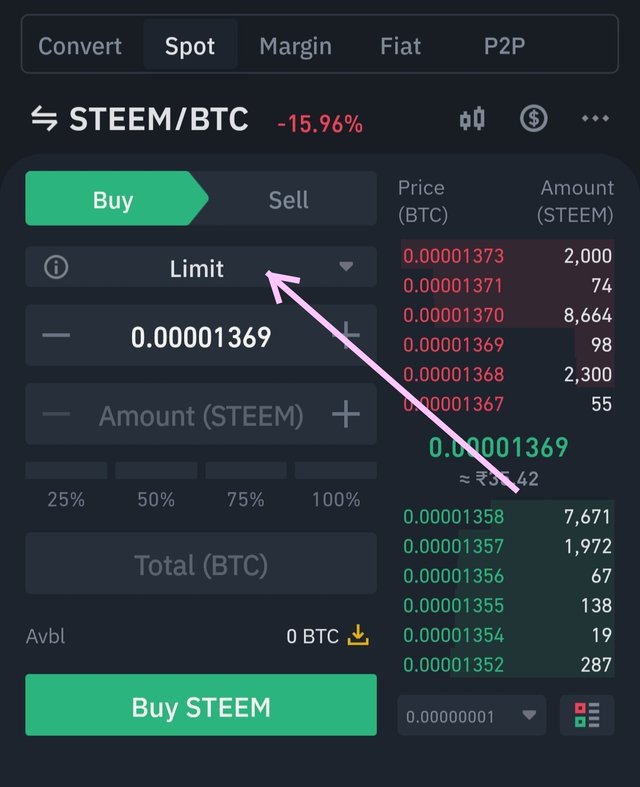

Limit order.

Market order.

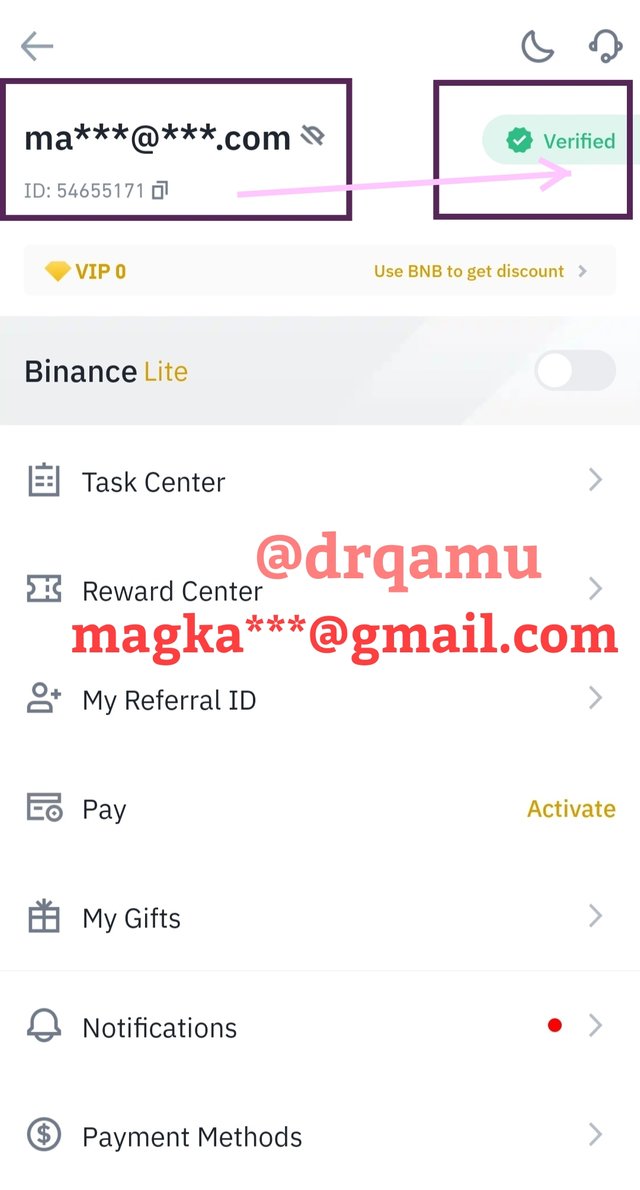

Explain the important future of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words)

)

Screenshot o my f verified binance

)

Screenshot o my f verified binance

Features of order book

Buy order.

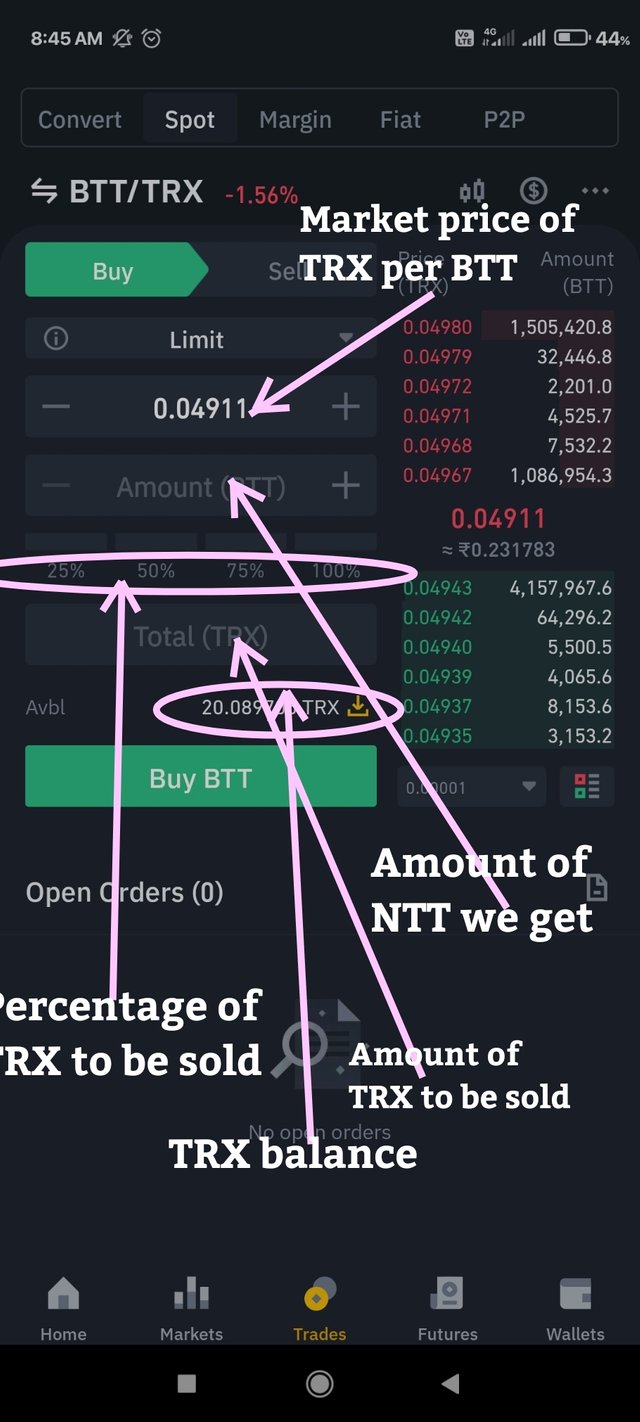

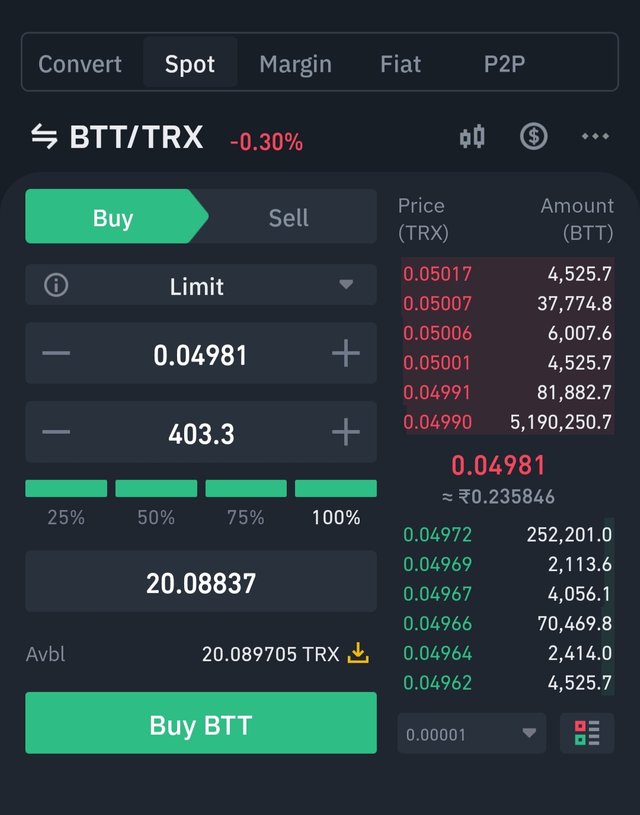

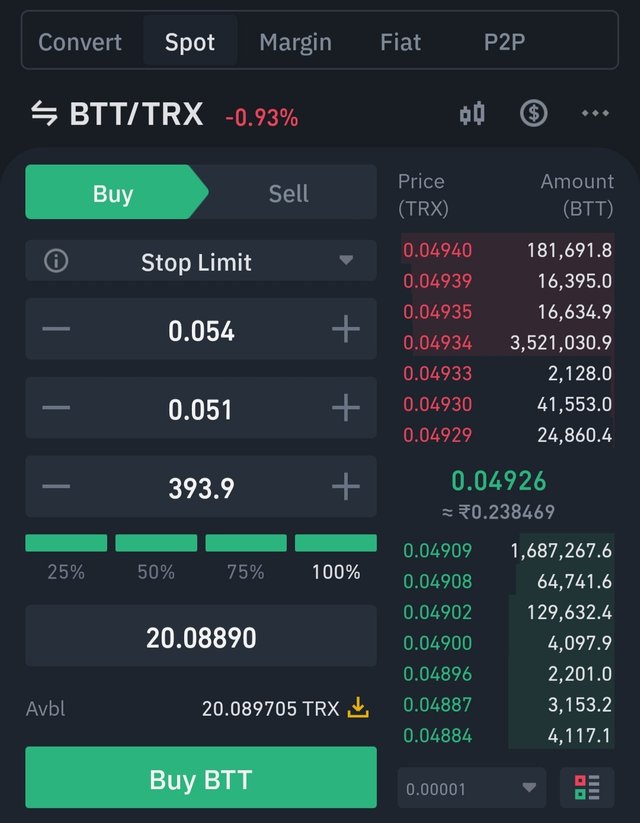

- Next we click on Buy.

- On the next page, fill details like amount of TRX to be sold. We can also select the percentage of total TRX to be sold from the amount that we have . For market order , price of TRX has to be same. However, we can alter it too than it will become limit order.

- At the market price, i selected to sell 100% of TRX ( 20.08) and for which i would get 403.3 BTT. Then hit the "Buy BTT" Button. Order is placed.

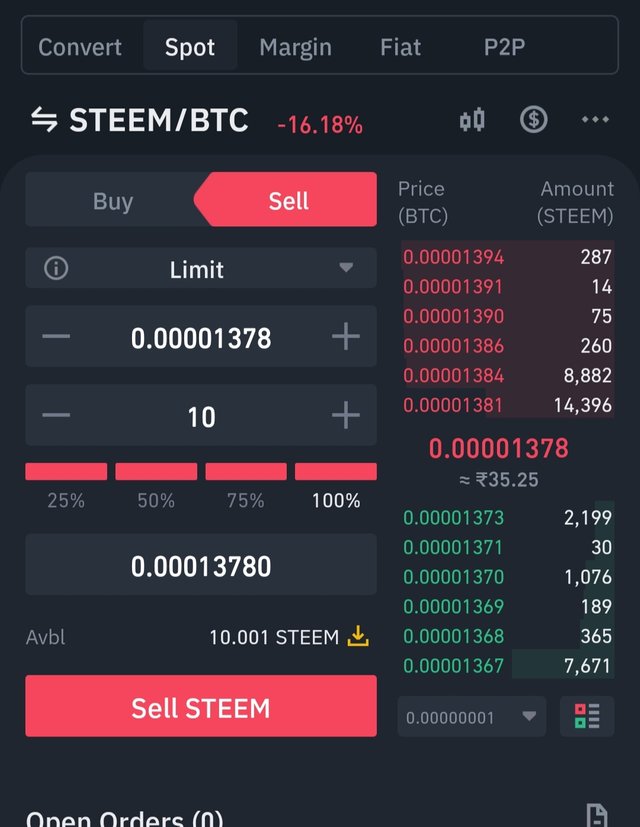

Sell order.

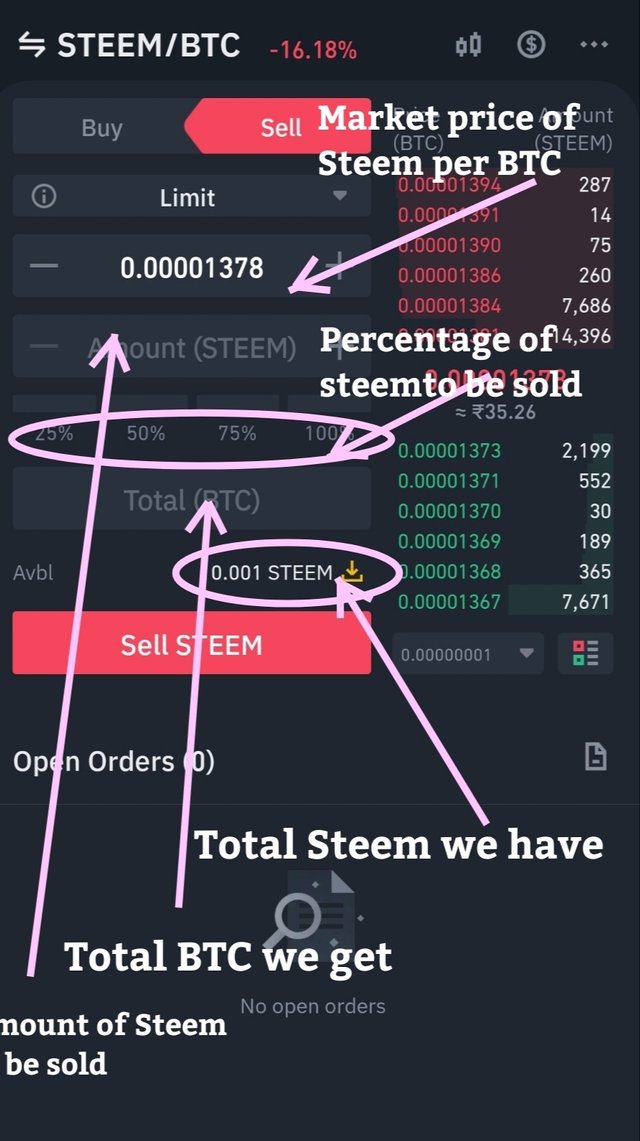

On the next page, fill details like amount of STEEM to be sold. We can also select the percentage of total STEEM to be sold from the amount that we have . For market order , price of STEEM has to be same. However, we can alter it too than it will become limit order.

At the market price, i selected to sell 100% of STEEM ( 10 ) and for which i would get 0.00013780 BTC. Then hit the "Sell Steem" Button. Order is placed.

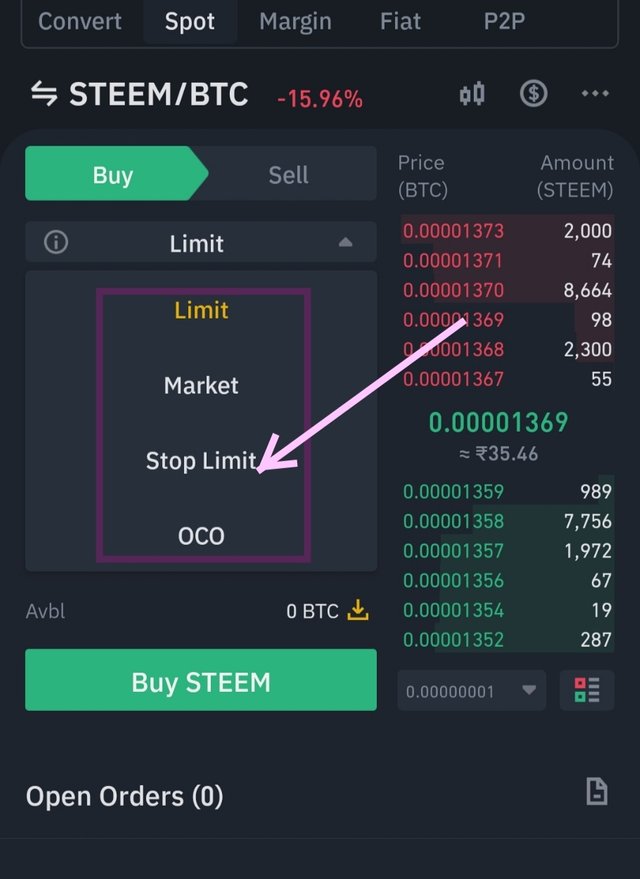

How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

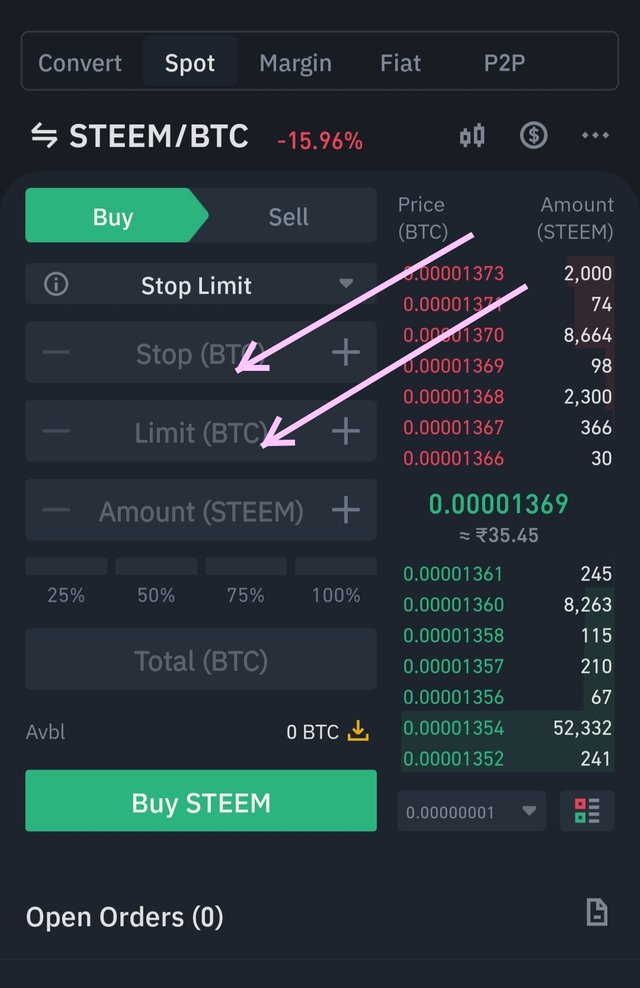

STOP LIMIT ORDER

Stop price : The start of target price. At this price, the stop limit order becomes limit order.

Limit price: The lower limit of target price . At rhis price the limit order is likely to get executed.

How to place stop - limit orders.

Buy stop limit order.

Let me try to place buy stop limit order for BTT.

Sell stop - limit order.

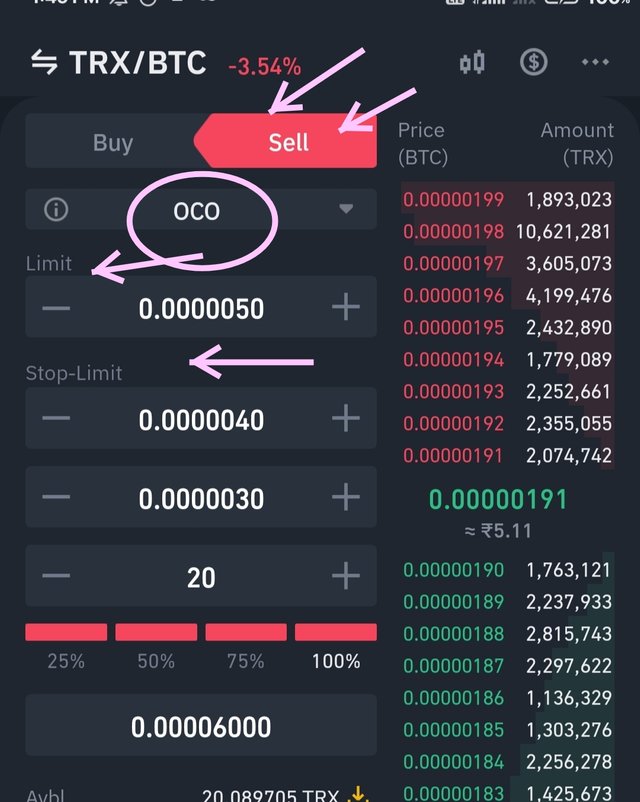

How to place buy sell order in OCO.

Buy OCO order.

Sell OCO order

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

thank you very much for participating in this class

Grade; 9.6

Sir thank you very much for taking time to verify my task.

#affable