Terra (LUNA) Blockchain - Crypto Academy / S5W4 - Homework post for pelon53

Good day Beautiful Steemians, I am @hadassah26, welcome to another week of the Steemit Crypto Academy season 5. Today I will be treating the topic: Terra (LUNA) Blockchain by professor @pelon53.

"1.- What is Terra Station? Browse Terra Station on the web, download the wallet and connect the wallet to Terra Station. Screenshots required."

Decentralized Finance (DeFi) is an emerging financial system composed of decentralized software running on public blockchain networks for the development of financial products. With no more need for government-issued IDs, bank account numbers, or proof of address when you use Decentralized Financial tools because each transaction is peer to peer. DeFi software can be used by buyers, sellers, lenders or borrowers.

Terra is a blockchain protocol for decentralized finance, which enables users to spend, save, trade, and exchange Terra stablecoins instantly. Terra consists of two main cryptocurrency tokens: Terra and Luna, each with a specific purpose (with the Terra used to create stable coins pegged to other fiat currencies, and the Luna burnt to create a stable Terra coin and for other governance and administrative functions).

The Terra Station is a decentralized channel under the Terra blockchain which allows individuals to connect and use decentralized applications on the Terra blockchain platform from staking, NFTs, swaps, Goverenance and contracts under the Terra blockchain through seamless transactions by connecting to the Terra Station wallet.

Downloading the Terra station wallet and connecting to the Terra stations is very easy, to do so:

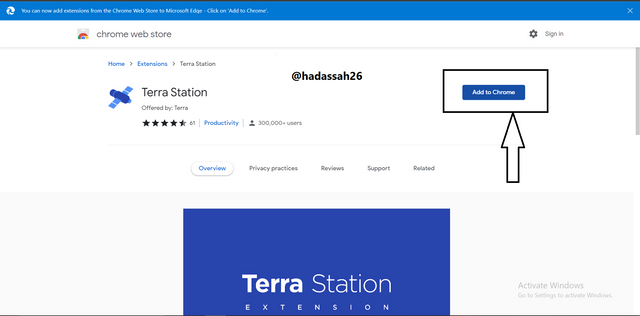

First I download the Terra wallet extension via Terra extension

.png)

Then I click on "add wallet". (screenshot shown below), and the wallet is added to my browser as an extension.

.png)

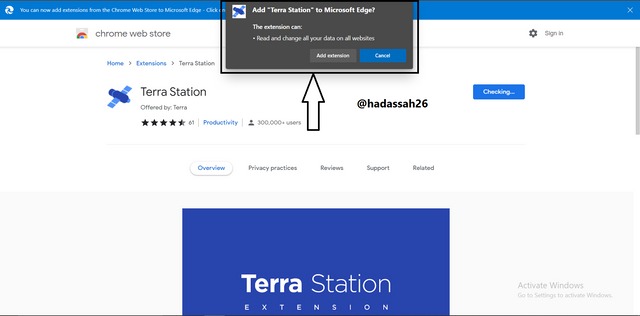

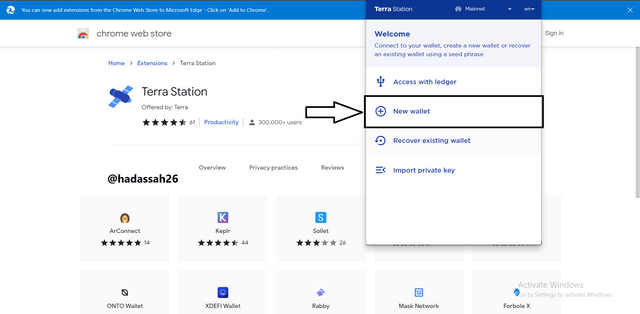

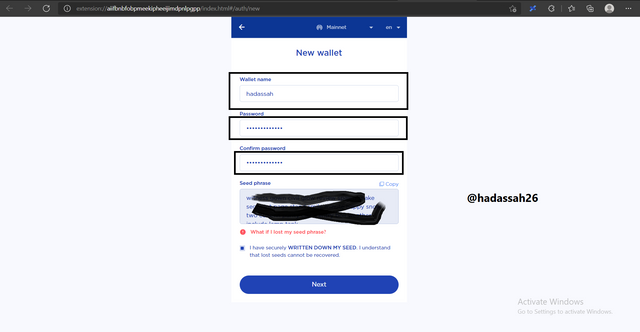

Opening the wallet, I click on create a "New wallet", then I fill in the required information and then copy my seed phrase.

.png)

.png)

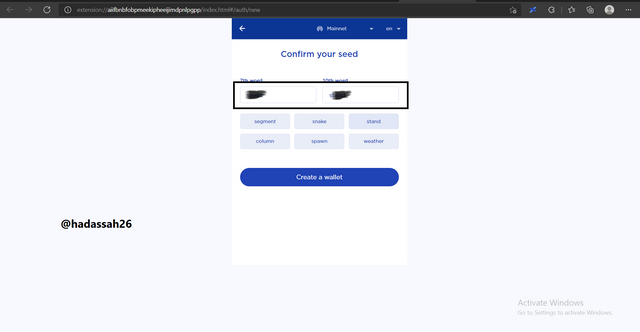

I put the required part of the seed phrase on the next page and then, boom my Terra statoin wallet is ready.

.png)

.png)

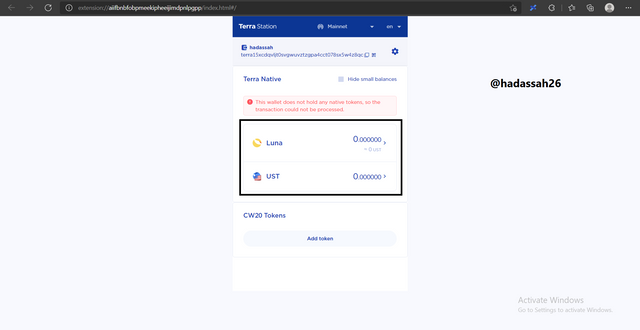

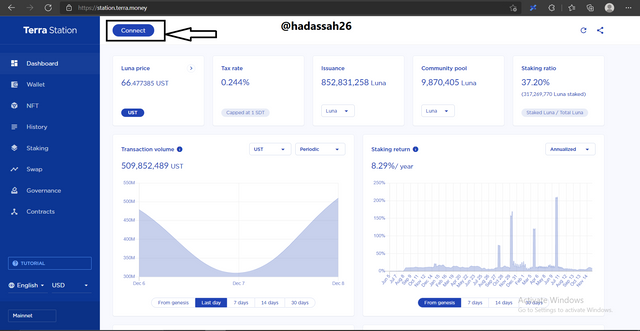

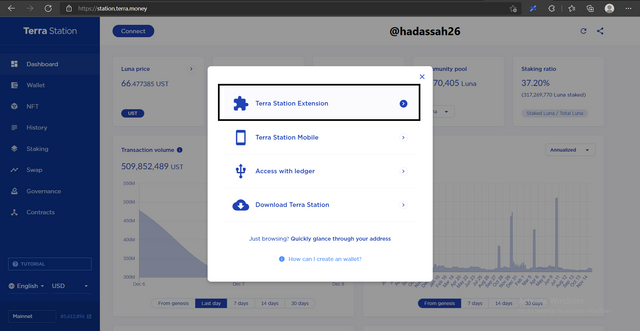

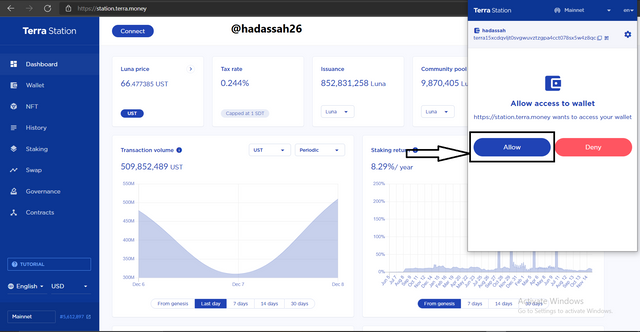

Connecting to the Terra Station website

To connect my Terra station wallet to the website, I first go to the website via Terra station

I click on "connect", and my Terra station wallet notifies me on "allowing" the connection.

.png)

.png)

.png)

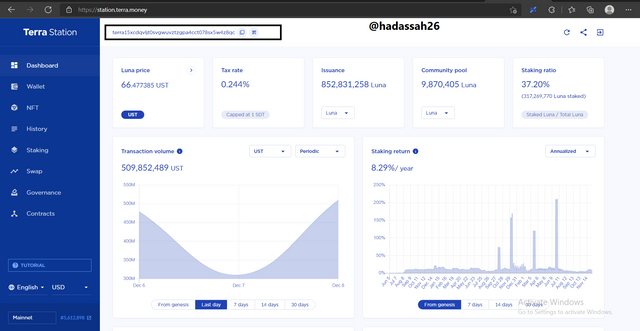

My Terra station is now connected to the Terra website.

.png)

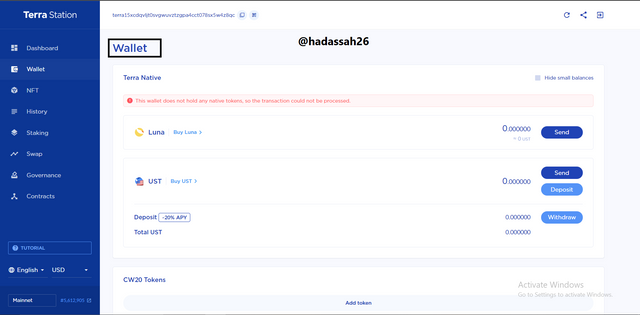

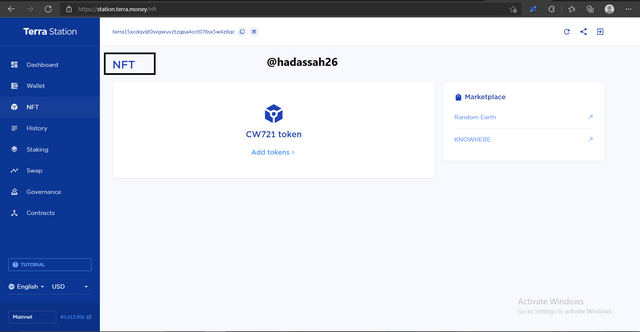

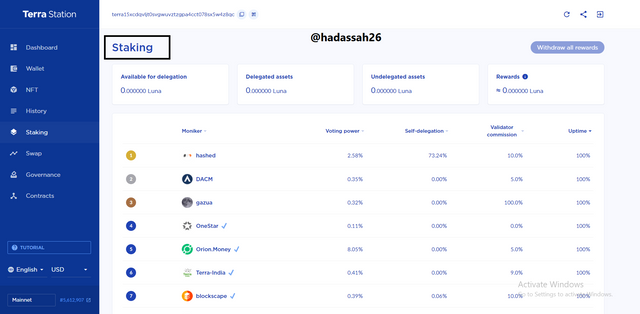

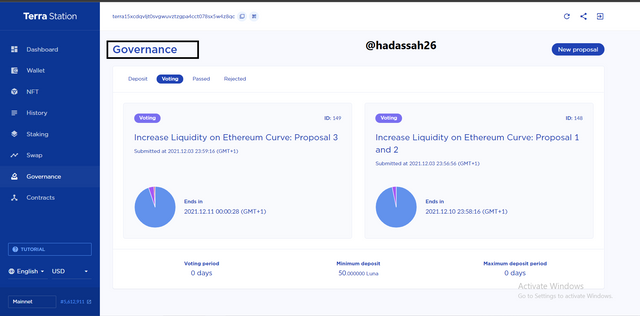

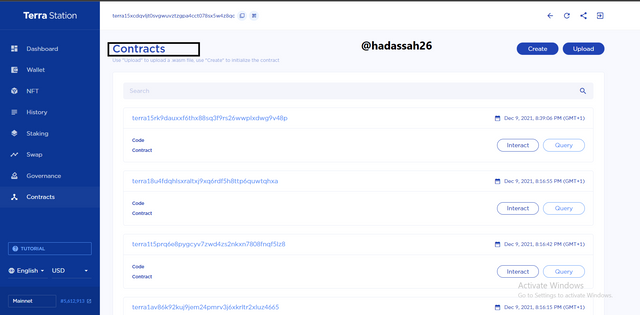

With my Terra station wallet connected to the site, I can now participate in either of the NFTs, Staking, Swap, Governance or Contracts as shown below:

.png)

.png)

.png)

.png)

.png)

.png)

"2. Explain Anchor Protocol, explore the application and connect the Terra Station wallet. Show screenshots."

Anchor is a DeFi protocol that provides an innovative strategy for giving out interest through saving products and making borrowing via loans easy with reasonable interests.

Interests are paid based on the Anchor platform's stablecoins, which are tokens that anchor their price to that of the U.S. Dollar with an assurance guaranteed of one USD per member token.

Through the Anchor protocol, lenders and borrowers can engage in a money market. Lenders looking to earn stable yields on their stablecoins can lend them to borrowers, who convert it back to fiat and pay the lender upon completion of the contract. This system allows for increased yielding and lower risk for both parties: rates are lower than traditional loans and loans cannot be defaulted on because collateralized asssets retain their value even if the loan is not paid back; borrowers get access to low interest, low risk

With this second generation decentralized banking, the Anchor Protocol doesn’t need a third party intermediary due to its smart contract infrastructure. If you want to loan or borrow from another individual when using the platform, then the protocol will ensure the transaction becomes automatically processed without a middleman beating most traditional savings accounts.

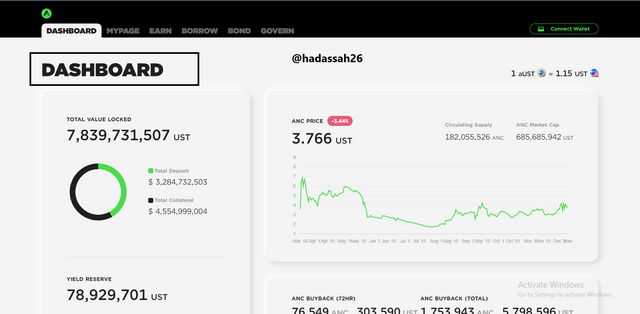

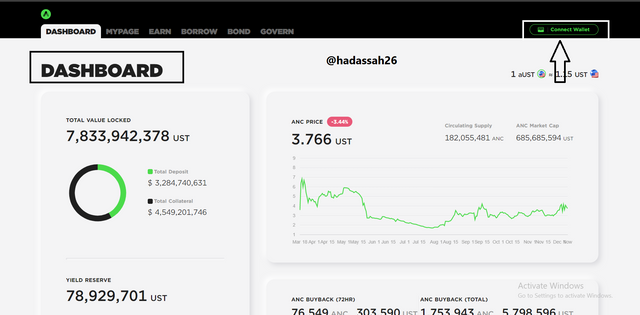

Exploring the Anchor Defi Protocol, we go to the Anchor website, and then click on "Dashboard"

.png)

I click on Dashboard and I am taken to a new page where I can now explore the Decentralized finance activities on Anchor protocol.

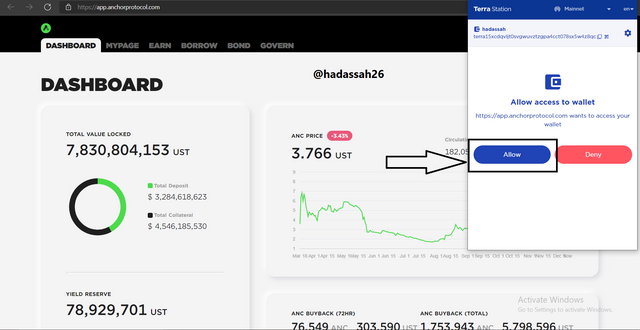

On the dashboard page, we can see the total value locked and total yield reserve.

.png)

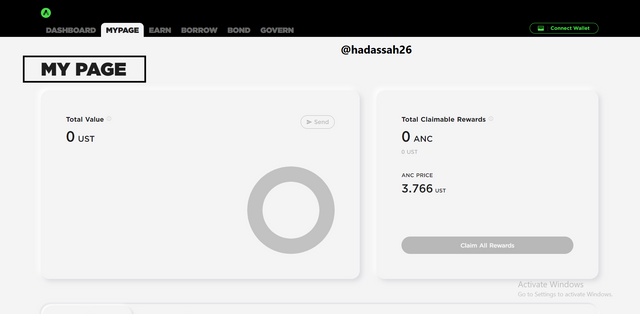

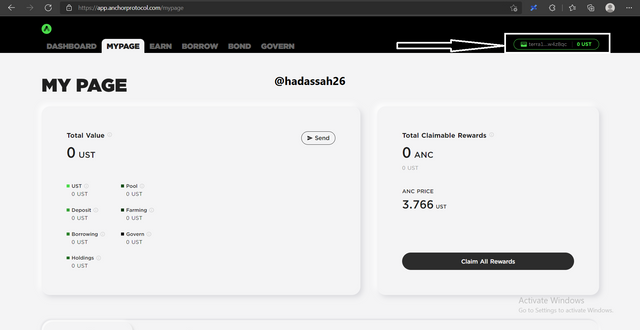

Next we have the MY Page where we can see our total value of UST in our wallet, and also send to Anchor.

.png)

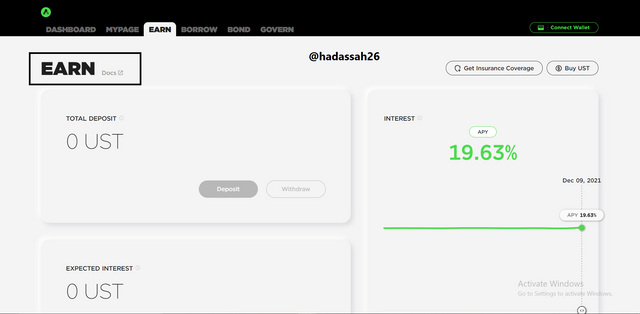

Next we have the "Earn" page where one can stake Anchor tokens for APY.

.png)

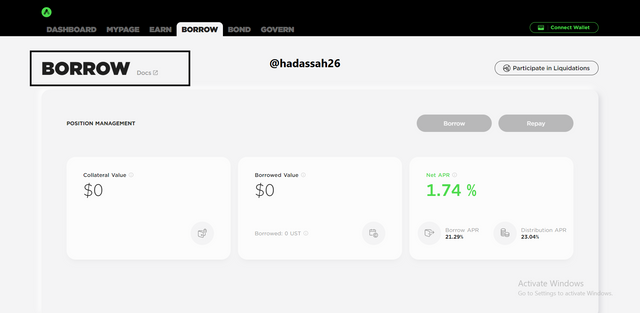

Next we have the "Borrow" page where one can bring collateral to borrow from the Achor platform.

.png)

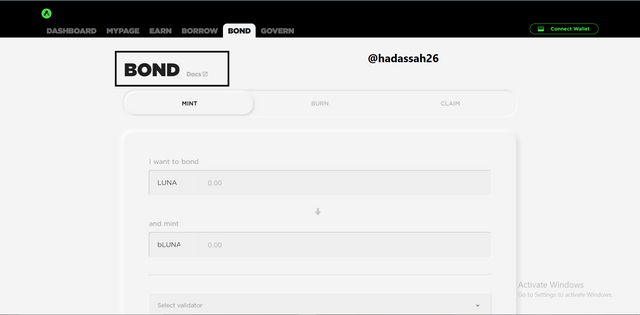

Next we have the Bond Page, where we can bond our tokens for other tokens

.png)

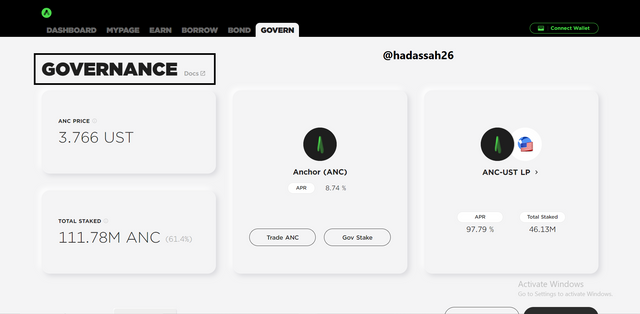

Then lastly we have the Governance page, where we can input our voting power with Anchor ANC.

.png)

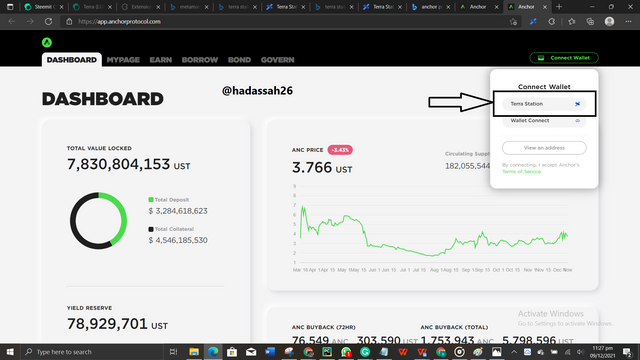

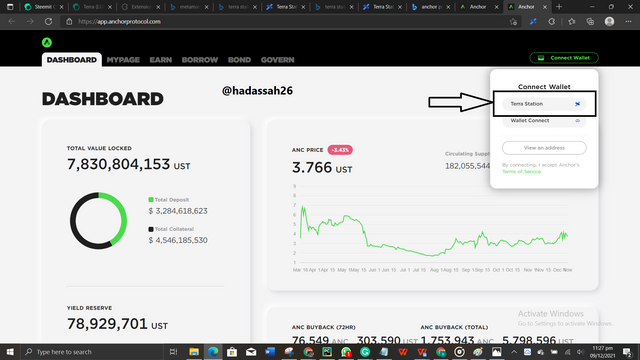

Connecting to the Anchor protocol, we first click on "connect wallet":

.png)

Then we click on Terra station on our Achor page:

.png)

Then connect via our Terra station wallet by allowing as shown below:

.png)

.png)

.png)

"3. Expand Mirror Protocol, connect Terra Station and explore the Mirror Protocol application. Show screenshots."

Mirror Protocol offers Synthetic tokens to give investors exposure to real-world assets without needing the actual real-world asset. The Mirror Protocol consists of two layers: a programmatic layer, which issues synthetic tokens, and an on-chain layer that records the pricing logic for these synthetic tokens. This DeFi platform produces reliable tokens with low trading volumes that are cheaper to issue, manage, and use than existing solutions.

Built on a similar technology stack as that of Augur. Assets on Mirror Protocol are called mAssets. To mint a mAsset, a user must deposit collateral in excess of 150% of its real-world value equivalent. Once the collateralized position is created, holders need not be concerned with day-to-day fluctuations to their real world asset so long as it remains within this collateralization ratio - monitors ensure the solvency of the protocol for this purpose.

With the Mirror Protocol, users will create a profile for themselves inside ethereum's blockchain by linking their addresses to third parties. This allows for over-collateralization of assets to a max of 150% that promotes stability and functions as a side chain which is accessed through Terra Net.

Staking of your mAssets can be executed in both the Tera and Ethereum blockchains. Thanks to this dual range of staking, there can be additional staking of tokens by using the Mirror Protocol–even if you didn’t have access due to government policies or lack of funds. This fit can be achieved through minting synthetic assets which is a typical example that explains how traders will access equities outside the US market place.

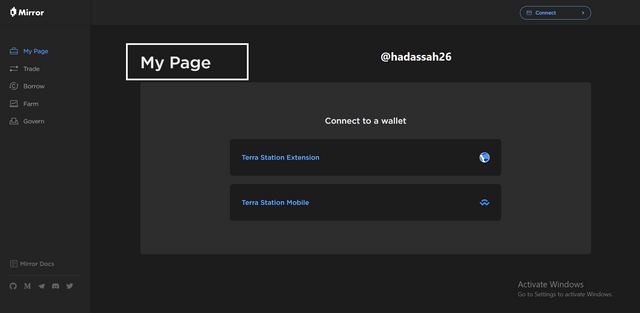

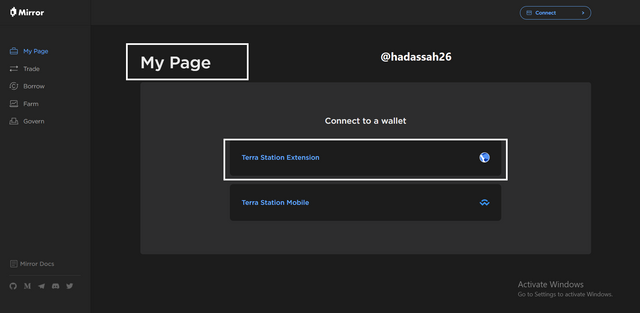

With the Mirror Wallet making cryptocurrency Defi management simple with its connectable website, connecting your wallet is easy with the Connect button in the upper-left corner - when you connect your account, cryptocurrency management instantly becomes automatic.

Next in the "My Page" section, we can see statistics about our assets (e.g., total assets and total claimable rewards), as seen in the screenshot above.

.png)

Under the "My Page" section, we can now connect to our Terra Station wallet and make transfers from it

.png)

.png)

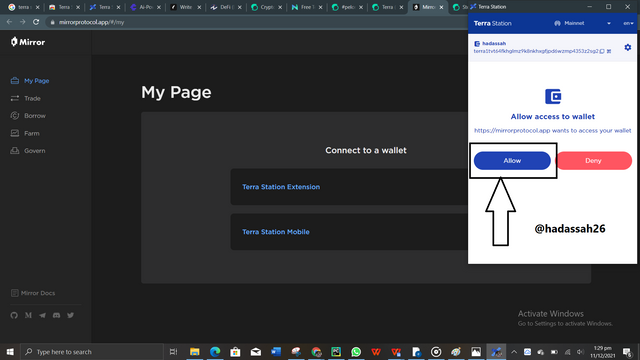

Next the "Trade" section of the interface displays rates across trading networks, here we can buy shares pegged from reputable companies.

.png)

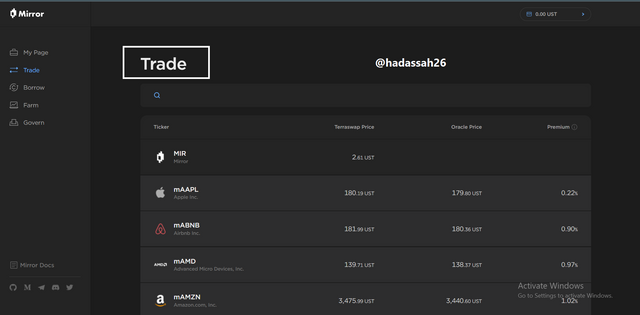

Next we have the "Borrow", here we can put some tokens as collateral and borrow pegged assets hoping to make profit

.png)

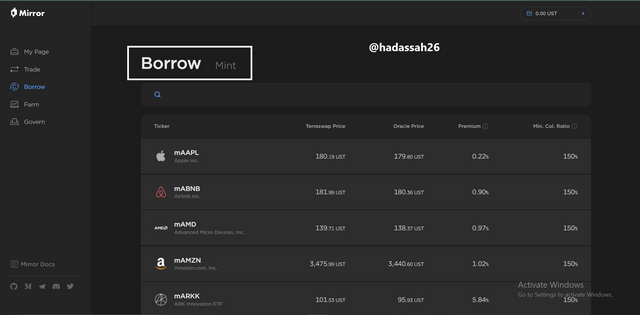

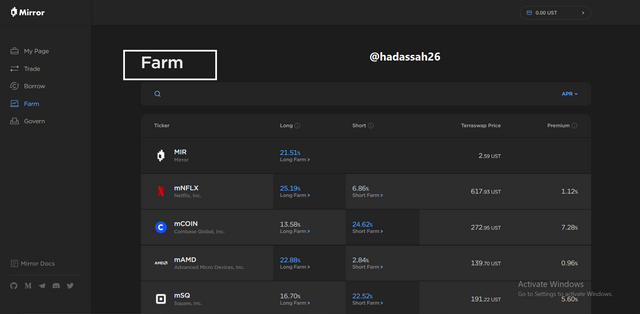

Next we have the "Farm". On the farm, we can stake our UST for assets with hope to make profit on the long run.

.png)

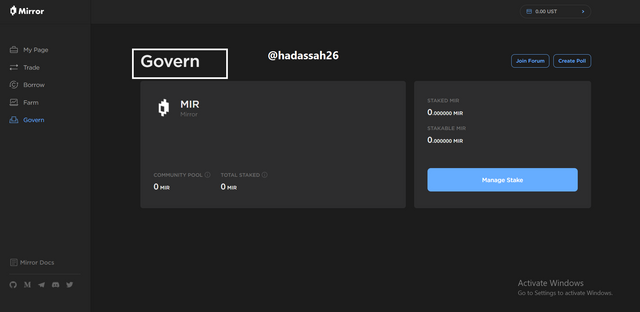

And Finally the Governance system, here we can put in our lot to have a vote in running the system.

.png)

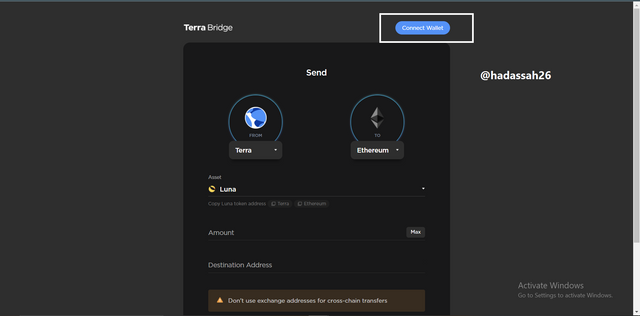

"4. What is the Terra Bridge? Explain, show screenshots."

The Terra Bridge project under the Terra blockchain was built as what will ultimately be the cross-chain transfer channel of all tokens supported by the Terra Shuttle (a Terra to ethereum exclusive transfer channel for whitelisted tokens) , including Terra native tokens, most mAssets and also other token types from Terra ecosystem. This new bridge will allow persistent data uploads to the second contract with better scaling costs provided by snappy compression.

The purpose of Terra Bridge is to connect established blockchain networks to the Terra Network so that they can share liquidity. Individuals may easily send Terra assets to say the Binance Smart Chain ecosystem via the Terra Bridge thanks to the gateway integration.

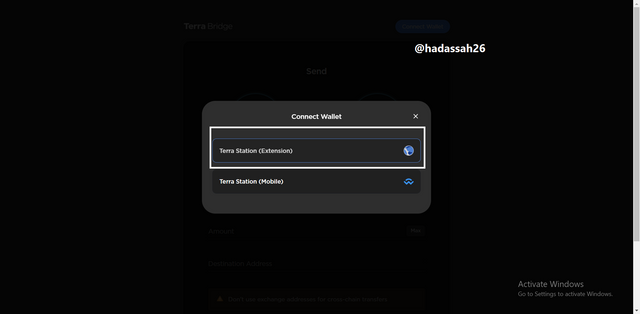

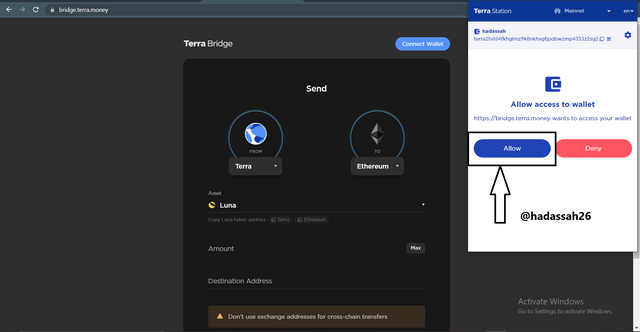

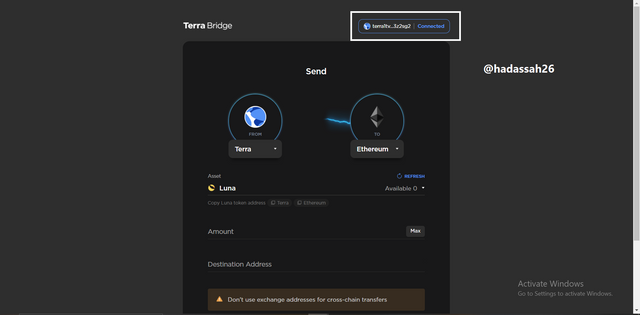

Opening the Terra Bridge via its site Terra bridge, we can easily connect to our wallet and then try make transactions easily. (Screenshots below):

.png)

.png)

.png)

.png)

"5. Explain how Terra's Stablecoin works."

When prices come up or go down, the decision about which cryptocurrency to use is tough.

In realizing the volatility of many cryptocurrency markets, Terra has introduced a new form of digital currencies that is pegged to the local currencies.

Called the Terra Stablecoins, it has the goal of remaining a stable investment for those looking to enter into a crypto market without affecting need to change from ones local currencies.

Terra Stable Coins are currencies pegged to a country's currency. These been pegged to the USD, Korean Won, Mongolian Tugric, etc. Anyone can propose new stable currencies as well as the Terra Stable Coins themselves. In addition to lower fees and no bank limits, Terra Stable Coins can be sent anywhere instantly without hassle

Luna: Luna is the Terra Stable coin’s minning token. Luna will typically not possess the volatility of Terra's stable coins, but it will allow for Governance and administrative transactions within the network.

"6. You have 1,500 USD and want to transform them into UST. Explain in detail and take the price of the updated LUNA token."

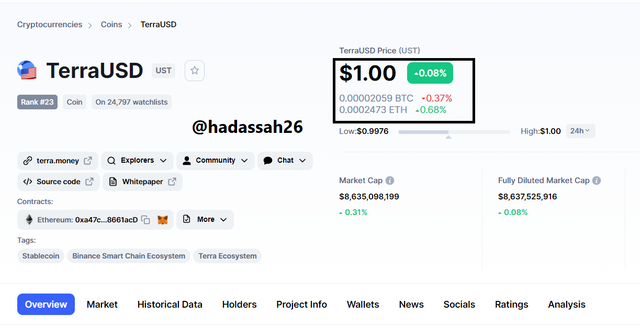

The cost is UST Value equaled $ 1, from coinmarket cap data as of updated today,

$68.44 is the current luna price

So say we invest 1500 USD into this opportunity, it will give us a return of:

1500 USD = 1500 UST (1: 1 ratio)

That means, 1500 UST will give us

1500 / 68.44 = 21.97 LUNA coinsSo we get 23.58 LUNA coins.

"7. Now you have that 1,500 USD and you want to make a profit, since 1 UST = 1.07 USD. Explain in detail and take the price of the updated LUNA token."

Calculating the Terra arbitrage following our 1 USD = 1.07 UST rate,

Having 1500 USD to convert, we should have a Profit of : 0.7 * 1500 UST = 105 UST,

Adding the 1:1 ratio, we have a total of 1500 UST + 105 UST = 1605 UST.

Converting our UST to LUNA at a current rate of $68.44, for 1500 UST we have = 21.91 Luna coins.

and for the 105 UST, we have a profit of 1.53 Luna coins.

In Conclusion, the Terra blockchain is a sound blockchain as it provides its users almost every service they need when it comes to decentralized finance.

What I love most about the Terra project is the Mirror protocol where one can now buy asset pegged crypto and make real stock trades with UST.

Thanks to professor @pelon53 for opening us to this great course.